Are you gearing up for a career in Payroll Technician? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Payroll Technician and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

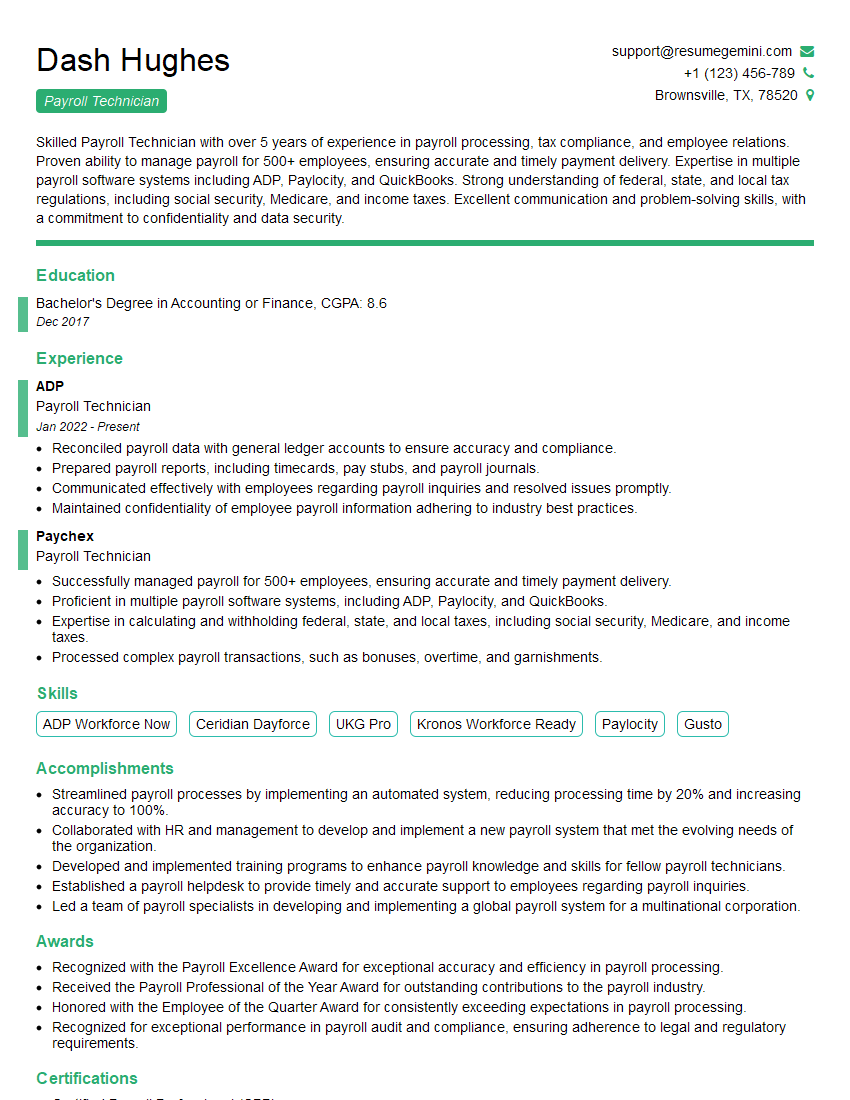

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Payroll Technician

1. What are the key responsibilities of a Payroll Technician?

As a Payroll Technician, my responsibilities include:

- Processing payroll accurately and on time, ensuring that employees are paid correctly.

- Calculating and withholding taxes, deductions, and insurance premiums.

- Maintaining employee payroll records.

- Filing payroll tax returns.

- Responding to employee inquiries and resolving payroll issues.

2. What are the most important qualities of a successful Payroll Technician?

Attention to detail

- Checking for errors in calculations and ensuring accuracy is crucial.

- Verifying information and following procedures thoroughly is essential.

Strong mathematical skills

- Calculating payroll correctly requires proficiency in math.

- Understanding formulas and applying them accurately is important.

Excellent communication skills

- Communicating clearly with employees, managers, and accounting staff is important.

- Explaining complex payroll concepts and resolving issues requires effective communication.

Knowledge of payroll laws and regulations

- Staying up-to-date with federal and state payroll laws is crucial.

- Understanding compliance requirements ensures accurate payroll processing.

3. What are the different types of payroll systems?

The different types of payroll systems include:

- Manual payroll systems: These systems involve manual calculations and record-keeping.

- Semi-automated payroll systems: These systems use software to automate some tasks, but still require manual input.

- Fully automated payroll systems: These systems automate most or all payroll tasks, including calculations, withholding, and reporting.

- In-house payroll systems: These systems are managed and operated by the company itself.

- Outsourced payroll systems: These systems are managed and operated by a third-party provider.

4. Which type of payroll system do you have experience with?

In my previous role at [Company Name], I used [Payroll System Name], a fully automated payroll system that streamlined payroll processing, ensured accuracy, and simplified compliance.

5. What are the most common errors that you have encountered in payroll processing?

The most common errors that I have encountered in payroll processing include:

- Input errors, such as incorrect employee information or hours worked.

- Calculation errors, such as incorrect tax withholding or deduction amounts.

- Compliance errors, such as missing or incorrect tax filings.

6. How do you ensure the accuracy and confidentiality of payroll information?

- I verify all input data carefully before processing payroll.

- I use secure systems and procedures to protect sensitive payroll information.

- I limit access to payroll information to authorized personnel only.

7. What is your experience with payroll reporting and compliance?

I am proficient in preparing and filing federal and state payroll tax returns, including Form 941, Form 940, and state unemployment insurance reports.

I also have experience with electronic tax filing, which ensures timely and accurate reporting.

8. What is your experience with payroll accounting?

In my previous role, I was responsible for reconciling payroll expenses with general ledger accounts.

I also prepared payroll accruals and journal entries to ensure accurate financial reporting.

9. What is your experience with handling payroll inquiries and resolving issues?

I have experience handling a variety of payroll inquiries, including:

- Questions about paychecks

- Changes to employee information

- Resolving payroll errors

I am able to communicate clearly and effectively with employees to resolve issues and ensure their satisfaction.

10. What are your career goals and how does this position align with them?

My career goal is to become a Payroll Manager. This position would provide me with the opportunity to expand my knowledge and skills in payroll processing, compliance, and management.

I am confident that my experience and qualifications align well with the requirements of this role and I am eager to contribute to the success of your organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Payroll Technician.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Payroll Technician‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Payroll Technicians perform a variety of duties related to the processing and administration of payroll. These responsibilities may include:Calculating and Processing Payroll

- Calculating employee pay based on hours worked, overtime, bonuses, and other factors

- Processing payroll transactions, including direct deposits, checks, and deductions

Maintaining Payroll Records

- Maintaining accurate records of employee payroll information, including time sheets, pay stubs, and tax documents

- Filing and maintaining payroll-related documents, such as tax returns and W-2 forms

Complying with Payroll Regulations

- Ensuring compliance with federal, state, and local payroll regulations, including wage and hour laws, overtime rules, and tax withholding requirements

- Filing and paying payroll taxes on time and in accordance with regulations

Resolving Payroll Issues

- Responding to employee inquiries and resolving payroll-related issues

- Investigating and correcting payroll errors, including overpayments and underpayments

Other Duties

- Preparing and distributing payroll reports, such as payroll summaries and cost breakdowns

- Assisting with payroll audits and other payroll-related projects

- Working with other departments, such as Human Resources and Accounting, to ensure accurate and timely payroll processing

Interview Tips

To prepare for a Payroll Technician interview, candidates should consider the following tips:Research the Company and Position

- Visit the company’s website and social media pages to learn about their culture, values, and business practices.

- Review the job description carefully to understand the specific responsibilities and requirements of the position.

Practice Answering Common Interview Questions

- Prepare for questions about your payroll experience, skills, and knowledge of payroll regulations.

- Consider using the STAR method (Situation, Task, Action, Result) to answer questions about your accomplishments.

Quantify Your Accomplishments

- When describing your payroll experience, be sure to quantify your accomplishments using specific numbers and metrics.

- For example, instead of saying “I processed payroll for a large number of employees,” you could say, “I processed payroll for over 2,000 employees, ensuring that they were paid accurately and on time.”

Highlight Your Attention to Detail

- Payroll Technicians must be highly detail-oriented to ensure accuracy and compliance.

- Highlight your attention to detail in your resume and during the interview by providing specific examples of your work.

Demonstrate Your Problem-Solving Skills

- Payroll Technicians often encounter problems that need to be resolved quickly and efficiently.

- Share examples of how you have solved payroll problems in the past, demonstrating your analytical and decision-making skills.

Showcase Your Teamwork and Communication Skills

- Payroll Technicians often work as part of a team and must be able to communicate effectively with employees, supervisors, and other departments.

- Provide examples of how you have worked successfully in a team environment and communicated effectively with others.

Dress Professionally and Arrive on Time

- First impressions matter, so be sure to dress professionally for your interview.

- Plan to arrive on time, or even a few minutes early, to show that you respect the interviewer’s time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Payroll Technician interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.