Are you gearing up for a career in Peer Financial Counselor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Peer Financial Counselor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

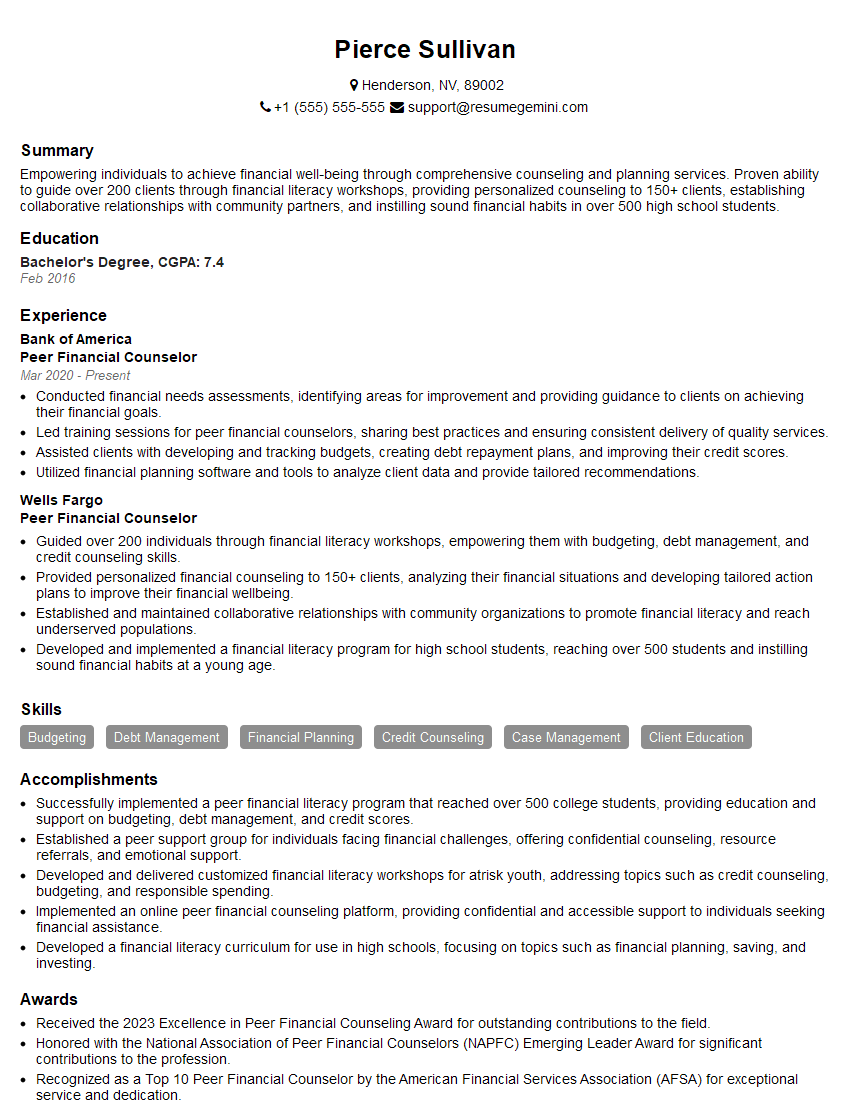

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Peer Financial Counselor

1. How do you assess a client’s financial situation during an intake session?

* Gather personal and financial information through interviews and review of documents. * Analyze income, expenses, assets, and debts to determine financial stability. * Identify financial goals, concerns, and areas for improvement. * Discuss credit history, budgeting habits, and spending patterns.

2. What are the key principles of behavioral economics, and how do you apply them in your counseling sessions?

Understanding Biases

- Acknowledge cognitive biases that influence financial decisions.

- Provide information in a way that reduces bias and promotes rational thinking.

Nudging Techniques

- Use simplified language and visuals to make financial concepts accessible.

- Set up default options and provide reminders to encourage positive behaviors.

Framing and Goal Setting

- Present financial choices in a way that highlights benefits and minimizes perceived losses.

- Help clients set realistic goals and track progress to maintain motivation.

3. How do you develop and implement a personalized financial plan for a client?

- Collaborate with the client to identify financial goals, values, and risk tolerance.

- Create a comprehensive plan that outlines strategies for budgeting, debt management, saving, and investing.

- Prioritize immediate financial needs and address long-term financial objectives.

- Provide ongoing support and guidance as the client implements the plan.

4. How do you stay up-to-date on the latest financial trends and regulations?

- Attend industry conferences, workshops, and training programs.

- Read professional journals, articles, and news sources covering financial topics.

- Network with other financial professionals and share knowledge and best practices.

- Obtain certifications or designations to demonstrate expertise and credibility.

5. What is your approach to working with clients from diverse backgrounds and with varying levels of financial literacy?

- Respect cultural differences and tailor counseling to individual needs.

- Use plain language and avoid financial jargon to ensure understanding.

- Provide relatable examples and use visuals to illustrate concepts clearly.

- Be patient, empathetic, and build rapport to create a comfortable and supportive environment.

6. How do you handle clients who are resistant to making changes to their financial situation?

- Explore underlying reasons for resistance and address concerns empathetically.

- Provide evidence-based information and share success stories to demonstrate benefits of change.

- Set realistic goals and focus on gradual improvements rather than overwhelming changes.

- Collaborate with the client to identify small, achievable steps that will build momentum and motivation.

7. How do you evaluate the effectiveness of your financial counseling services?

- Track client progress towards financial goals and objectives.

- Conduct client satisfaction surveys to gather feedback on services provided.

- Seek input from supervisors and colleagues to identify areas for improvement.

- Review industry best practices and research to ensure alignment with effective counseling techniques.

8. Describe a challenging situation you faced while working as a Peer Financial Counselor and how you overcame it.

- Provide specific details about the situation, including client challenges and obstacles encountered.

- Explain the strategies and interventions used to address the situation effectively.

- Highlight the positive outcomes and lessons learned from the experience.

9. What ethical considerations guide your work as a Peer Financial Counselor?

- Maintain confidentiality and protect client information.

- Avoid conflicts of interest and disclose any potential biases.

- Act in the best interests of clients and prioritize their financial well-being.

- Follow professional guidelines and adhere to ethical codes of conduct.

10. What are your strengths and weaknesses as a Peer Financial Counselor?

Strengths

- Excellent communication and interpersonal skills.

- Strong understanding of financial concepts and principles.

- Ability to build rapport and establish trust with clients.

- Experience in developing and implementing personalized financial plans.

Weakness

- Limited experience in managing complex financial situations.

- Still developing knowledge in specialized areas of finance.

- Working on improving time management skills to handle a heavy caseload.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Peer Financial Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Peer Financial Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Peer Financial Counselor plays an essential role in providing support and guidance to individuals experiencing financial hardship. Their primary responsibilities include:

1. Provide One-on-One Financial Counseling

Conduct confidential financial counseling sessions with clients to assess their financial situation, identify areas of concern, and develop personalized action plans to improve their financial well-being.

- Establish rapport with clients, building trust and understanding.

- Review clients’ income, expenses, and assets to create a comprehensive financial picture.

- Identify financial challenges and develop strategies to address them, such as budgeting, debt management, and credit repair.

2. Conduct Financial Education Workshops

Facilitate group workshops on various financial topics, such as budgeting, saving, investing, and credit management.

- Prepare and deliver engaging presentations on financial concepts.

- Answer questions from participants and provide practical advice.

- Develop and distribute educational materials to reinforce workshop content.

3. Provide Referrals to Community Resources

Connect clients with external organizations and resources that can provide additional support, such as housing assistance, food banks, and mental health services.

- Establish partnerships with community agencies and service providers.

- Conduct outreach to identify and refer clients to appropriate resources.

- Monitor client progress and provide ongoing support as needed.

4. Maintain Case Records and Track Progress

Document all client interactions, financial counseling sessions, and referrals in detailed case files.

- Track client progress and identify areas for improvement

- Provide regular reports to supervisors and stakeholders.

- Ensure confidentiality and privacy of client information.

Interview Tips

To ace an interview for a Peer Financial Counselor position, it is essential to prepare thoroughly and demonstrate your passion for helping others. Here are some tips to help you succeed:

1. Research the Organization and Position

Take time to learn about the organization’s mission, services, and target population. This will help you understand the role of the Peer Financial Counselor within the context of the organization.

- Visit the organization’s website and social media pages.

- Read articles or news stories about the organization.

- Contact the hiring manager or recruiter to ask specific questions about the position.

2. Highlight Your Skills and Experience

Emphasize your transferable skills and experience that are relevant to the role of a Peer Financial Counselor. This may include:

- Prior experience in financial counseling or a related field.

- Strong interpersonal and communication skills.

- Knowledge of financial concepts and principles.

- Empathy, compassion, and a non-judgmental approach.

3. Prepare Examples of Your Work

When answering interview questions, provide specific examples of your work that demonstrate your skills and abilities. For instance, you could describe a successful financial counseling session or a workshop you facilitated.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Focus on quantifying your results whenever possible.

- Be prepared to discuss your strengths and areas for improvement.

4. Demonstrate Your Passion for Helping Others

Interviews are not just about showcasing your skills and experience; they are also an opportunity to demonstrate your passion for helping others. Share stories that illustrate your commitment to making a difference in people’s lives.

- Explain why you are interested in working as a Peer Financial Counselor.

- Describe a time when you helped someone overcome a financial challenge.

- Discuss your goals for making a positive impact in the community.

5. Dress Professionally and Be Punctual

First impressions matter, so it is important to dress professionally for your interview. Arrive on time and be prepared to start the interview promptly.

- Choose attire that is appropriate for a business setting.

- Be mindful of your body language and maintain eye contact.

- Be respectful of the interviewer’s time and answer questions honestly and concisely.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Peer Financial Counselor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Peer Financial Counselor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.