Are you gearing up for an interview for a Pension Administrator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Pension Administrator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

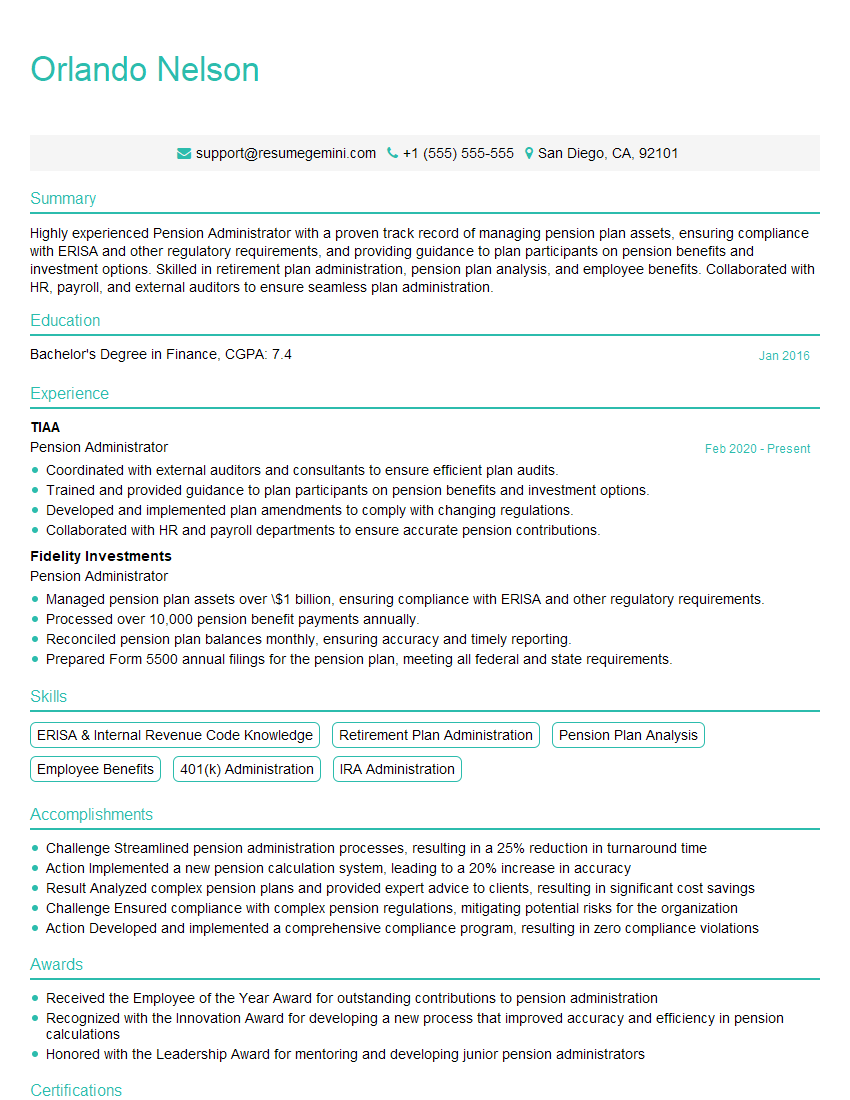

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Pension Administrator

1. What are the key responsibilities of a Pension Administrator?

- Processing pension applications and calculating benefits

- Maintaining pension records and ensuring compliance with regulations

- Providing customer service and support to pension scheme members

- Working with investment managers to ensure the pension fund is invested appropriately

- Monitoring pension fund performance and reporting to stakeholders

2. What are the different types of pension schemes?

Defined Benefit (DB) Schemes

- Provide a guaranteed level of pension based on your salary and years of service

- The employer bears the investment risk

- Less common than they used to be

Defined Contribution (DC) Schemes

- Provide a pension based on the value of your pension pot at retirement

- The employee bears the investment risk

- More common than DB schemes

3. What are the key factors to consider when calculating pension benefits?

- Age

- Years of service

- Salary

- Investment performance

- Pension scheme rules

4. What are the different types of pension investments?

- Equities (stocks)

- Bonds

- Property

- Cash

- Alternative investments (e.g. hedge funds, private equity)

5. What are the key risks associated with pension investments?

- Investment risk: the value of investments can go down as well as up

- Inflation risk: the value of your pension pot could be eroded by inflation over time

- Longevity risk: you could live longer than expected, which could mean your pension pot runs out

6. What are the key regulations that govern pension schemes?

- The Pensions Act 2008

- The Occupational Pension Schemes (Investment) Regulations 2005

- The Pensions Regulator Code of Practice

7. What is the role of the Pensions Regulator?

- To regulate occupational pension schemes in the UK

- To protect the interests of pension scheme members

- To promote good governance and administration of pension schemes

8. What are the key trends in the pension industry?

- The shift from DB to DC schemes

- The increasing use of auto-enrolment

- The development of new pension products and services

- The increasing use of technology

- The growing focus on environmental, social and governance (ESG) investing

9. What are the challenges facing the pension industry?

- The ageing population

- The low interest rate environment

- The increasing cost of living

- The regulatory burden

- The need for greater financial literacy among pension scheme members

10. What are your strengths and weaknesses as a Pension Administrator?

- Strong technical knowledge of pension regulations and schemes

- Excellent customer service skills

- Proven ability to manage complex pension calculations

- Experience in working with investment managers

- Excellent communication and interpersonal skills

- Limited experience in a large pension scheme

- Not yet qualified as a Fellow of the Society of Pension Professionals

Strengths

Weaknesses

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Pension Administrator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Pension Administrator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Pension Administrators play a crucial role in managing and administering pension plans, ensuring the smooth functioning of these plans and the well-being of plan participants.

1. Plan Administration

Pension Administrators oversee the day-to-day operations of pension plans, including enrolling new participants, processing contributions and withdrawals, and maintaining plan records.

- Manage plan records and ensure compliance with regulations and plan documents.

- Process contributions from both employees and employers.

- Process withdrawals and distribute benefits to participants and beneficiaries.

2. Investment Management

Pension Administrators may assist with the management of plan investments, ensuring that funds are invested prudently and in accordance with plan objectives.

- Monitor and evaluate investment performance.

- Work with investment managers to make investment decisions.

- Advise plan participants on investment options.

3. Customer Service

Pension Administrators provide support and assistance to plan participants and beneficiaries, answering their questions and resolving any issues.

- Provide information about plan benefits and eligibility.

- Assist participants with enrollment and withdrawal processes.

- Resolve any discrepancies or errors in plan records.

4. Compliance and Reporting

Pension Administrators ensure that pension plans comply with applicable laws and regulations, and that required reports are filed accurately and on time.

- Stay up-to-date on regulatory changes.

- Prepare and file required reports to government agencies.

- Review and approve plan amendments to ensure compliance.

Interview Tips

Preparing for a Pension Administrator interview requires thorough research and thoughtful consideration of your skills and experiences.

1. Research the Company and Role

Spend time researching the specific company, its pension plan, and the industry. Understand the key responsibilities of the Pension Administrator role and how it aligns with your background.

2. Highlight Your Experience and Skills

Tailor your resume and cover letter to the specific requirements of the role. Quantify your experience whenever possible, using specific metrics and results to demonstrate your impact.

3. Be Prepared to Discuss Your Knowledge

Be prepared to discuss your understanding of pension law, regulations, and best practices. The interviewer may ask you questions about specific topics, such as ERISA, Form 5500, or investment strategies.

4. Emphasize Your Communication and Interpersonal Skills

Pension Administrators interact with a variety of stakeholders, including plan participants, beneficiaries, employers, and regulators. Strong communication and interpersonal skills are essential.

5. Practice Your Answers

Practice answering common interview questions to improve your confidence and delivery. Consider using the STAR method (Situation, Task, Action, Result) to structure your answers.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Pension Administrator role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.