Feeling lost in a sea of interview questions? Landed that dream interview for Pension Adviser but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Pension Adviser interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

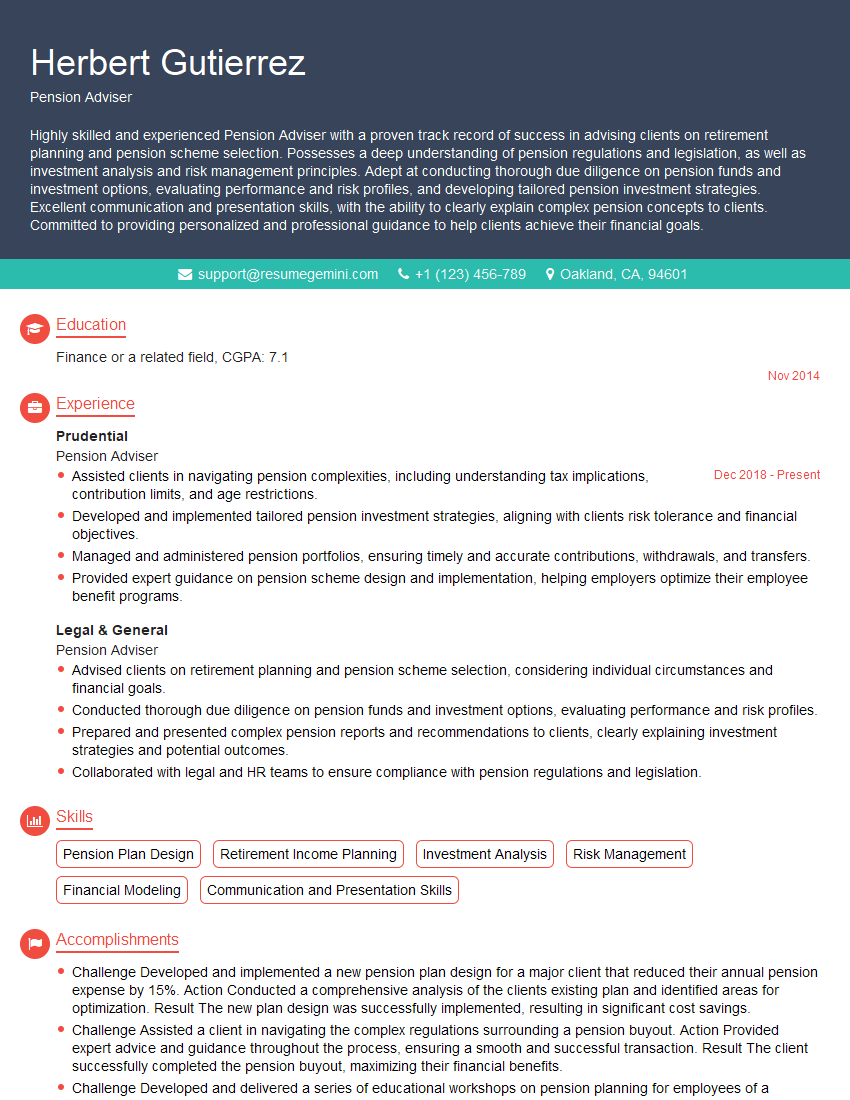

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Pension Adviser

1. Describe the key factors to consider when determining an appropriate retirement age for a client?

- Health and life expectancy

- Financial situation and retirement goals

- Investment portfolio and risk tolerance

- Social security benefits and other sources of income

- Personal preferences and lifestyle

2. Explain the difference between defined benefit and defined contribution pension plans.

Defined Benefit Plan:

- Employer bears the investment risk

- Employee receives a fixed benefit upon retirement

- Benefits are not affected by market fluctuations

Defined Contribution Plan:

- Employee bears the investment risk

- Employee contributes to an account, which is invested

- Benefits vary based on investment performance

3. What are the tax implications of different retirement savings vehicles?

- Traditional IRA: Contributions are tax-deductible, but withdrawals in retirement are taxed.

- Roth IRA: Contributions are made after-tax, but qualified withdrawals in retirement are tax-free.

- 401(k) Plan: Contributions are made pre-tax, but withdrawals in retirement are taxed.

- 403(b) Plan: Similar to 401(k) plans, but only available to employees of public schools and certain non-profit organizations.

4. How do you assess a client’s risk tolerance?

- Use questionnaires and surveys

- Conduct interviews to discuss investment goals and financial situation

- Review investment history and experience

- Consider age, time horizon, and financial resources

5. What are the key considerations when recommending investment options to clients?

- Risk tolerance and investment goals

- Time horizon and investment strategy

- Tax implications and investment fees

- Diversification and asset allocation

- Client’s knowledge and experience

6. How do you stay up-to-date on the latest pension regulations and industry best practices?

- Attend industry conferences and seminars

- Read professional journals and publications

- Participate in online forums and discussion groups

- Network with other professionals

- Take continuing education courses

7. How do you handle ethical dilemmas that may arise in your work as a Pension Adviser?

- Adhere to ethical codes and industry standards

- Prioritize client interests and avoid conflicts of interest

- Seek guidance from supervisors or professional organizations

- Document all decisions and recommendations

- Stay informed about legal and regulatory requirements

8. What are the key differences between providing pension advice to individuals and employers?

Individuals:

- Focus on personal financial goals and retirement planning

- Consider individual risk tolerance and investment strategies

Employers:

- Advise on pension plan design and management

- Consider legal and regulatory compliance

- Communicate with employees about pension benefits

9. How do you build and maintain strong relationships with clients?

- Provide personalized advice and tailored solutions

- Communicate regularly and respond promptly to inquiries

- Build trust and earn clients’ respect

- Network with other professionals and refer clients

- Attend industry events and participate in community activities

10. What are your thoughts on the future of the pension industry and the challenges it faces?

- Demographic changes and aging population

- Volatile economic conditions and investment risks

- Technological advancements and digitalization

- Increased regulatory scrutiny

- Need for financial literacy and retirement planning support

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Pension Adviser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Pension Adviser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Pension Adviser, you will be responsible for providing expert financial guidance and support to clients on all aspects of retirement planning and pension provision. Your key responsibilities will include:

1. Client Management

Identifying and qualifying potential clients, developing and maintaining strong relationships, and providing ongoing advice and support throughout their retirement journey.

- Conducting thorough financial needs analyses and risk assessments to determine clients’ retirement goals and objectives.

- Developing personalized retirement plans that take into account clients’ individual circumstances and aspirations.

2. Investment Planning and Management

Developing and implementing investment strategies that align with clients’ risk tolerance and retirement goals, including:

- Providing guidance on asset allocation and diversification strategies.

- Monitoring and reviewing investment performance regularly and making adjustments as needed.

3. Retirement Income Planning

Advising clients on maximizing their retirement income, including:

- Developing strategies for drawing down pension funds in a tax-efficient manner.

- Exploring and recommending various retirement income options, such as annuities and structured products.

4. Tax Planning and Optimization

Providing guidance on how to mitigate taxes and maximize retirement savings by:

- Advising clients on tax-advantaged saving schemes and pension contributions.

- Helping clients navigate complex tax regulations and legislation.

Interview Tips

To excel in a Pension Adviser interview, it is crucial to showcase your technical expertise, analytical skills, and ability to build strong client relationships. Here are some tips to help you ace the interview:

1. Prepare for Technical Questions

Be well-versed in pension regulations, investment strategies, tax laws, and retirement planning concepts. Practice answering technical questions related to these areas, such as:

- “Explain the different types of pension schemes available in the market and their key features.”

- “Discuss the factors to consider when developing an investment strategy for a retired client.”

2. Demonstrate Analytical and Problem-Solving Skills

Show that you can analyze complex financial data and provide informed recommendations. Use examples from your past experience where you have successfully solved client problems. For instance, you could say:

- “I recently helped a client maximize their retirement income by identifying underutilized tax-advantaged savings schemes.”

3. Highlight Your Communication and Client Management Skills

Emphasize your ability to clearly explain complex financial concepts to clients and build strong relationships with them. Provide examples of successful client interactions and explain how you exceeded their expectations. For example:

- “I always prioritize building trust with my clients by actively listening to their concerns and tailoring my advice to their individual needs.”

4. Research the Company and Industry Trends

Show that you have researched the company and are aware of current industry trends. This demonstrates your interest in the role and the organization. For instance, you could mention:

- “I am particularly impressed by your company’s commitment to providing holistic retirement planning solutions.”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Pension Adviser interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!