Are you gearing up for a career in Pension Agent? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Pension Agent and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

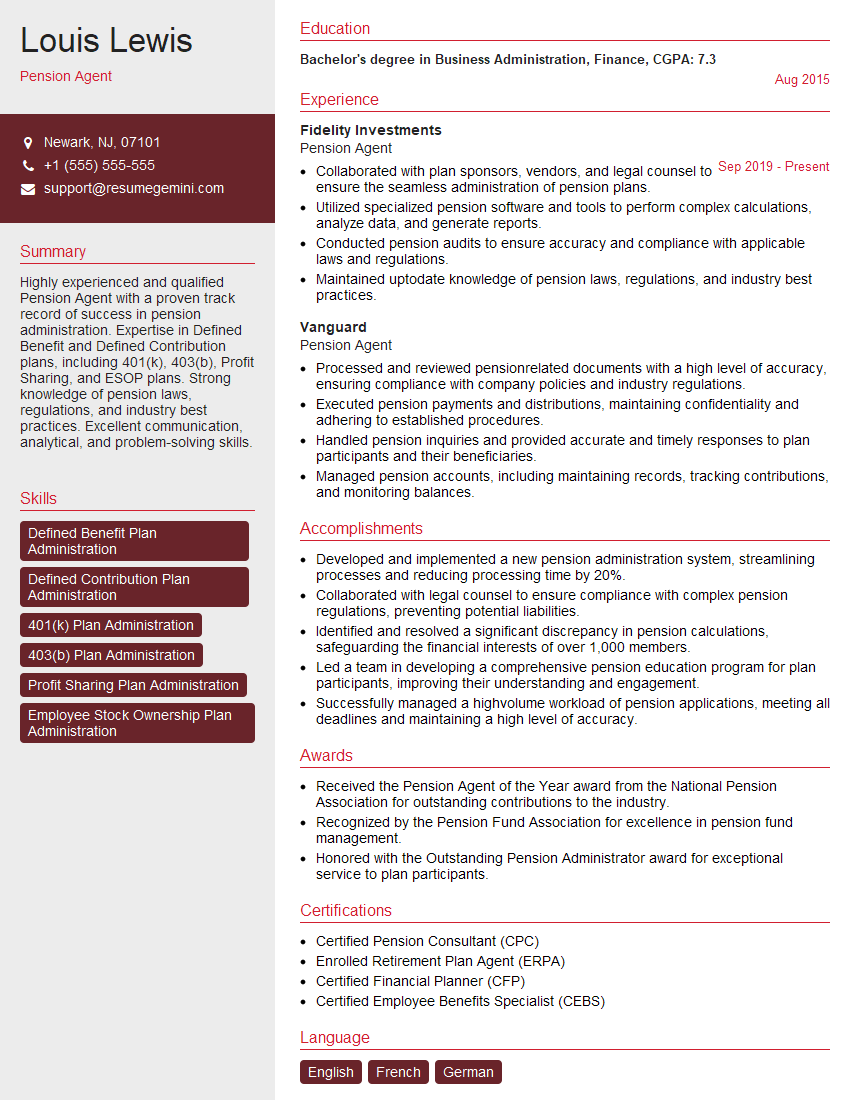

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Pension Agent

1. What are the key responsibilities of a Pension Agent?

- Providing advice and guidance to clients on pension planning.

- Calculating and administering pension schemes.

- Liaising with trustees and employers on pension matters.

- Preparing and submitting pension scheme accounts and returns.

- Managing pension scheme investments.

2. What are the different types of pension schemes available in the UK?

Defined Benefit Schemes

- Provide a guaranteed level of income in retirement.

- The employer bears the investment risk.

Defined Contribution Schemes

- Provide a pot of money at retirement that can be used to purchase an annuity or drawdown income.

- The employee bears the investment risk.

3. What are the key considerations when choosing a pension scheme?

- The level of risk you are willing to take.

- The length of time you have until retirement.

- Your retirement income goals.

- The tax implications of different pension schemes.

4. How do you calculate the value of a pension scheme?

The value of a pension scheme is calculated using a variety of factors, including the scheme’s assets, liabilities, and the expected rate of return on investments.

5. What are the key risks associated with pension schemes?

- Investment risk

- Longevity risk

- Inflation risk

- Interest rate risk

6. What are the legal and regulatory requirements for pension schemes?

- The Pensions Act 2004

- The Occupational Pension Schemes (Investment) Regulations 2005

- The Pensions Regulator

7. What are the ethical considerations when investing pension scheme assets?

- Environmental, social, and governance (ESG) factors

- The United Nations Principles for Responsible Investment (UNPRI)

8. What are the future trends in pension provision?

- The increasing use of defined contribution schemes

- The rise of auto-enrolment

- The impact of longevity on pension costs

9. What are the key challenges facing the pension industry?

- The low interest rate environment

- The increasing cost of providing defined benefit pensions

- The need to improve financial literacy among members

10. What are your strengths and weaknesses as a Pension Agent?

- Strengths: I am a qualified pension professional with over 10 years of experience in the industry. I have a strong understanding of the legal and regulatory requirements for pension schemes and I am up-to-date on the latest trends and developments in pension provision. I am also a good communicator and I am able to build strong relationships with clients and colleagues.

- Weaknesses: I can sometimes be a bit too detail-oriented and I can be slow to make decisions. I am also not always comfortable with public speaking.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Pension Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Pension Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Pension Agents are vital in the financial industry, providing expertise and guidance in pension matters. Key responsibilities encompass:

1. Pension Administration

Handling pension contributions, member enrollments, and account maintenance.

- Processing contributions from employers and members

- Enrolling new members and updating member profiles

- Maintaining accurate and up-to-date pension records

2. Compliance and Reporting

Ensuring compliance with pension regulations and providing regular reports.

- Monitor and ensure compliance with relevant laws and regulations

- Prepare and submit regulatory reports, such as Form 5500

- Respond to inquiries from regulators and auditors

3. Investment Management

Collaborating with investment managers to oversee pension fund investments.

- Review and evaluate investment performance

- Make recommendations for changes to investment strategy

- Monitor market trends and economic conditions

4. Member Communication

Communicating with pension plan members and providing information and assistance.

- Develop and distribute educational materials and presentations

- Answer member inquiries and provide personalized advice

- Conduct workshops and seminars on pension-related topics

Interview Tips

Preparing for a Pension Agent interview requires a combination of technical knowledge and soft skills. Here are some tips to ace the interview:

1. Technical Expertise

Thoroughly review the job description and research the company’s pension plan. Highlight your knowledge of:

- Pension accounting principles (e.g., GAAP, GASB)

- ERISA and other pension regulations

- Investment strategies and portfolio management

2. Communication and Interpersonal Skills

Pension Agents need excellent communication skills to convey complex information clearly. Demonstrate your:

- Ability to articulate technical concepts in a straightforward manner

- Patience and empathy when dealing with diverse stakeholders (e.g., members, retirees, employers)

- Strong listening skills to understand and address concerns

3. Attention to Detail

Pension administration requires meticulous attention to detail. Highlight your:

- Ability to manage multiple tasks accurately and efficiently

- Strong organizational skills to keep track of complex data

- Experience using specialized pension software or databases

4. Example Outline

Prepare a concise and well-structured outline that includes:

- Your qualifications and experience that align with the job requirements

- Specific examples that demonstrate your skills and abilities

- Questions you may have for the interviewer to show your interest and engagement

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Pension Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!