Are you gearing up for a career in Pension Consultant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Pension Consultant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

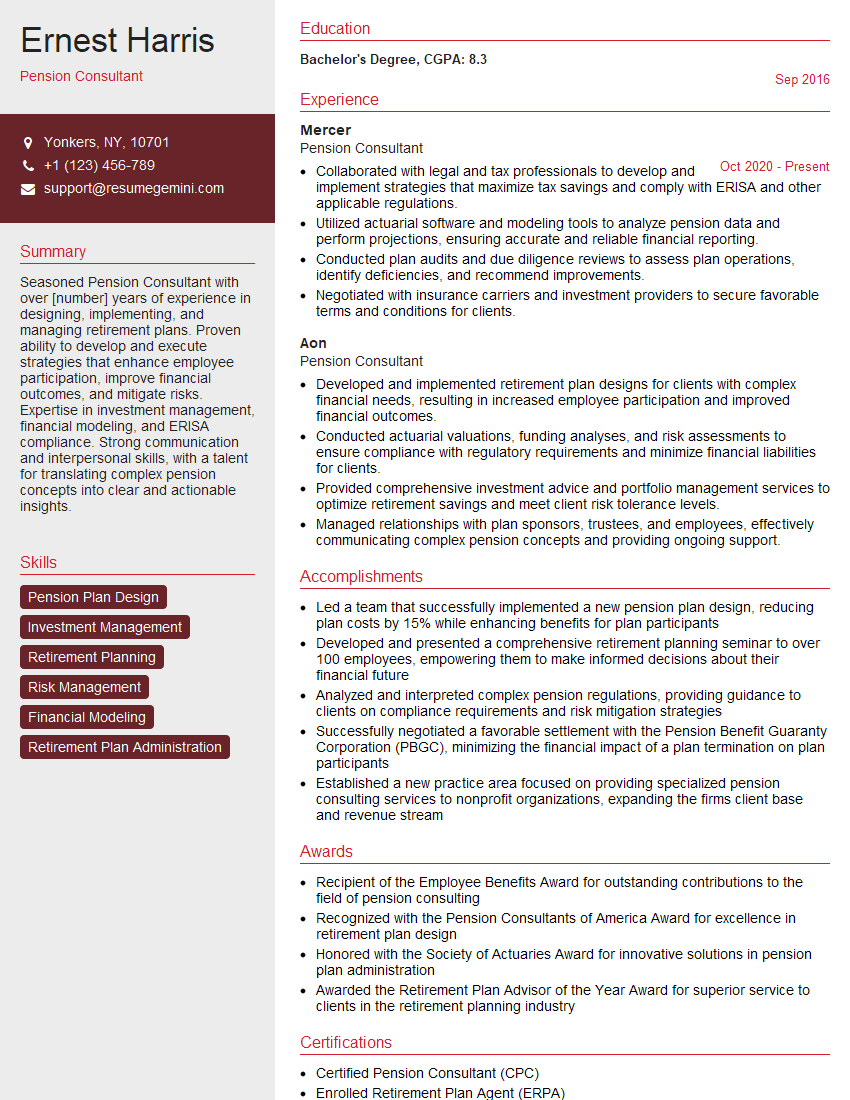

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Pension Consultant

1. Can you give an example of a time when you successfully implemented a new investment strategy for one of your clients?

In my previous role, I was responsible for managing the pension assets of a large corporate client. The client’s investment portfolio was heavily invested in traditional asset classes such as stocks and bonds. I recommended that the client consider adding alternative investments such as private equity and real estate to their portfolio to improve diversification and enhance returns. After careful analysis and due diligence, the client agreed to my recommendation. I worked with the client to develop an appropriate investment strategy and implemented it. The new investment strategy resulted in a significant improvement in the client’s investment performance over the following three years.

2. What are the key considerations when designing a pension plan for a large multinational company?

Legal and regulatory considerations

- The plan must comply with all applicable laws and regulations in each country where the company operates.

- This includes laws and regulations governing the funding, investment, and administration of pension plans.

Tax considerations

- The plan must be structured in a way that minimizes the tax burden on the company and its employees.

- This includes considering the tax implications of different investment strategies and plan design features.

Investment considerations

- The plan must be invested in a way that meets the long-term funding needs of the company and its employees.

- This includes considering the risk tolerance of the plan participants and the expected return on investments.

Administrative considerations

- The plan must be administered in a cost-effective and efficient manner.

- This includes considering the use of technology and outsourcing solutions.

3. What are the different types of pension plans available to employers?

- Defined benefit plans

- In a defined benefit plan, the employer promises to pay a fixed benefit to employees at retirement.

- The employer bears the investment risk under a defined benefit plan.

- Defined contribution plans

- In a defined contribution plan, the employer contributes a fixed amount of money to each employee’s account.

- The employee bears the investment risk under a defined contribution plan.

- Hybrid plans

- Hybrid plans combine features of both defined benefit and defined contribution plans.

4. What are the advantages and disadvantages of each type of pension plan?

Defined benefit plans

Advantages

- Employees know how much they will receive in retirement.

- Employers can use defined benefit plans to attract and retain employees.

Disadvantages

- Employers bear the investment risk under defined benefit plans.

- Defined benefit plans can be more expensive to administer than defined contribution plans.

Defined contribution plans

Advantages

- Employees bear the investment risk under defined contribution plans.

- Defined contribution plans are less expensive to administer than defined benefit plans.

Disadvantages

- Employees may not have enough money saved for retirement under a defined contribution plan.

- Defined contribution plans can be less attractive to employees than defined benefit plans.

Hybrid plans

Advantages

- Hybrid plans offer some of the advantages of both defined benefit and defined contribution plans.

Disadvantages

- Hybrid plans can be more complex to administer than defined benefit or defined contribution plans.

5. What are the key trends in pension plan design?

- The increasing popularity of defined contribution plans

- The use of target-date funds

- The use of annuities

- The use of technology to administer pension plans

6. What are the challenges facing the pension industry?

- The increasing cost of providing retirement benefits

- The decline in interest rates

- The increasing longevity of retirees

- The globalization of the workforce

7. What are the opportunities for the pension industry?

- The development of new investment strategies

- The use of technology to improve efficiency and reduce costs

- The expansion of the global pension market

8. What are your thoughts on the future of the pension industry?

I believe that the pension industry is facing a number of challenges, but I also believe that there are a number of opportunities for the industry. I expect that the industry will continue to evolve in the years to come. I believe that the industry will become more globalized and that there will be a greater focus on providing retirement benefits to employees in developing countries. I also believe that the industry will continue to adopt new technologies to improve efficiency and reduce costs. I believe that the pension industry has a bright future and that it will continue to play an important role in providing retirement security for employees around the world.

9. What are the most important qualities for a successful pension consultant?

- Strong analytical skills

- Excellent communication skills

- In-depth knowledge of the pension industry

- Experience in providing consulting services to clients

- Ability to work independently and as part of a team

10. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to providing retirement security for employees. I believe that your company is a leader in the pension industry and I would like to contribute to your continued success. I am confident that I have the skills and experience that you need to be a successful pension consultant. I am eager to learn more about your company and I look forward to discussing how I can contribute to your success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Pension Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Pension Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Pension Consultants play a crucial role in managing and advising on complex pension schemes. They collaborate with clients to design, implement, and monitor strategies that meet their retirement saving and benefit goals.

1. Client Relationship Management

Building and maintaining strong client relationships is paramount. Pension Consultants regularly meet with clients to understand their objectives, financial situations, and risk tolerance.

- Counsel clients on investment strategies, benefit design, and regulatory compliance.

- Provide personalized advice tailored to each client’s unique circumstances.

2. Pension Scheme Design and Implementation

Consultants are responsible for designing and implementing pension schemes that adhere to legal and regulatory requirements. They work closely with clients to determine the most appropriate schemes for their specific needs.

- Develop and present proposals for new pension schemes or modifications to existing schemes.

- Ensure compliance with relevant legislation and regulations.

3. Investment and Risk Management

Pension Consultants provide guidance on investment strategies and risk management. They assess clients’ investment portfolios, recommend suitable options, and monitor performance regularly.

- Conduct investment analysis and advise clients on asset allocation and diversification.

- Manage financial risks associated with pension schemes.

4. Reporting and Communication

Consultants regularly prepare reports for clients, providing updates on scheme performance, investment returns, and any regulatory changes. They also communicate complex technical information to clients in a clear and understandable manner.

- Generate regular reports on pension scheme performance and investment results.

- Effectively communicate with clients and stakeholders.

Interview Tips

Preparing for a Pension Consultant interview requires a thorough understanding of the role and industry. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company’s services, clientele, and industry reputation. Read industry publications, attend webinars, and connect with professionals in the field to gain insights.

- Identify recent developments and trends in the pension industry.

- Research the specific pension schemes offered by the company.

2. Practice Answering Common Interview Questions

Prepare for common interview questions related to your skills, experience, and knowledge of the pension industry. Practice your answers to anticipate questions and respond confidently.

- Example Outline:

- Tell me about your experience in designing and implementing pension schemes.

- Describe your approach to investment management and risk mitigation in pension plans.

3. Highlight Your Technical Skills

Pension Consultants require a solid understanding of financial concepts, actuarial principles, and investment strategies. Emphasize your proficiency in these areas and provide specific examples of your work.

- Demonstrate your ability to interpret financial statements and pension legislation.

- Quantify your contributions through performance metrics or case studies.

4. Emphasize Communication and Relationship-Building Skills

Effective communication and relationship-building are crucial in this role. Highlight your ability to present complex technical information clearly, build rapport with clients, and maintain long-term partnerships.

- Share examples where you successfully resolved client concerns or negotiated complex contracts.

- Discuss your strategies for building and maintaining strong client relationships.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Pension Consultant, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Pension Consultant positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.