Are you gearing up for an interview for a Pension Examiner position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Pension Examiner and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

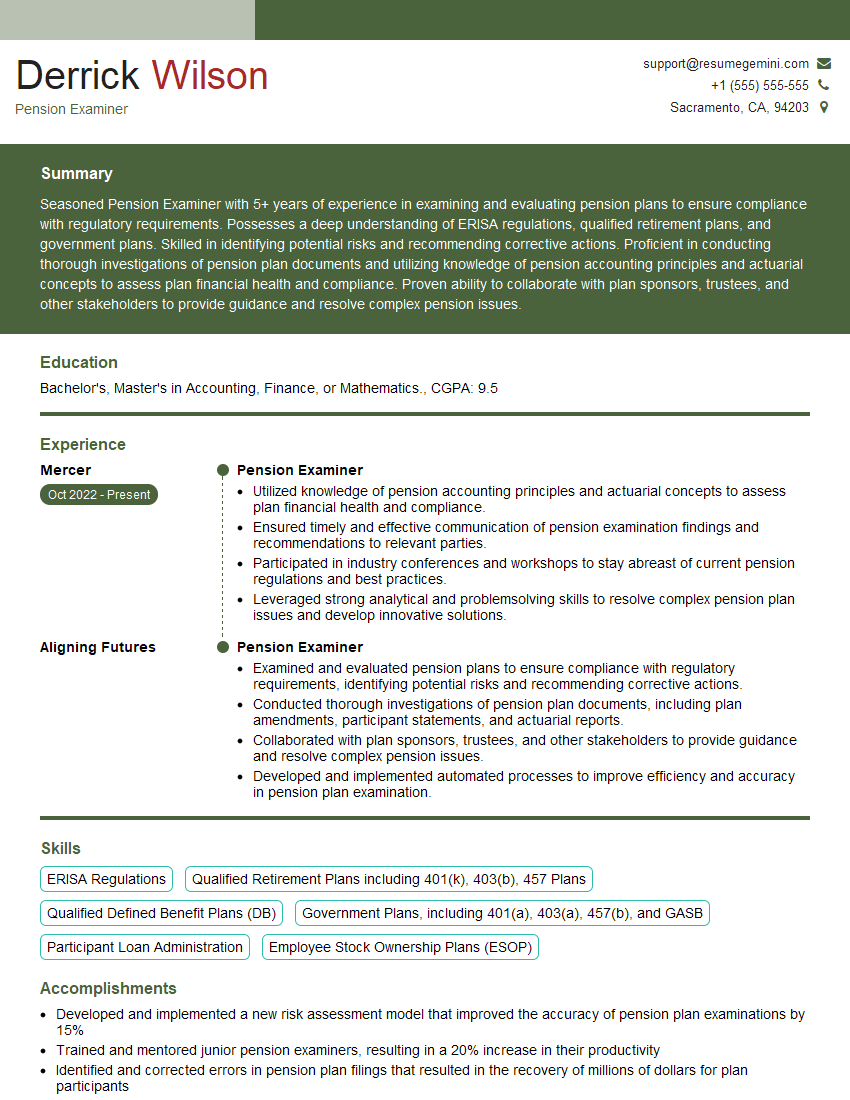

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Pension Examiner

1. Explain the process of reviewing pension applications.

The process of reviewing pension applications typically involves the following steps:

- Receiving the application and checking for completeness.

- Verifying the applicant’s eligibility for pension benefits.

- Calculating the applicant’s benefit amount.

- Determining the payment method and frequency.

- Notifying the applicant of the decision.

2. What are some of the common errors that you encounter when reviewing pension applications?

Some of the most common errors that I encounter when reviewing pension applications include:

- Incomplete or missing information.

- Inaccurate or outdated information.

- Miscalculations.

- Lack of supporting documentation.

- Unclear or ambiguous language.

3. How do you handle cases where the applicant’s eligibility for pension benefits is unclear?

In cases where the applicant’s eligibility for pension benefits is unclear, I will typically take the following steps:

- Request additional information from the applicant.

- Consult with other members of the pension team.

- Review relevant laws and regulations.

- Make a decision based on the best available evidence.

4. What are some of the ethical challenges that you face as a pension examiner?

Some of the ethical challenges that I face as a pension examiner include:

- Ensuring that I am making decisions that are fair and impartial.

- Maintaining confidentiality of applicant information.

- Avoiding conflicts of interest.

- Upholding the integrity of the pension system.

5. What are some of the best practices for conducting a pension examination?

Some of the best practices for conducting a pension examination include:

- Being thorough and organized.

- Asking clarifying questions.

- Documenting all findings.

- Communicating clearly and concisely with the applicant.

- Seeking peer review when necessary.

6. What are some of the emerging trends in pension administration?

Some of the emerging trends in pension administration include:

- The use of technology to automate processes.

- The increasing popularity of defined contribution plans.

- The growing importance of financial literacy.

- The need for greater transparency and accountability.

7. What are some of the challenges facing the pension industry?

Some of the challenges facing the pension industry include:

- Low interest rates.

- Increasing longevity.

- Rising healthcare costs.

- Political and regulatory uncertainty.

8. What are your thoughts on the future of the pension system?

The future of the pension system is uncertain, but there are a number of trends that could shape its future:

- The increasing popularity of defined contribution plans.

- The growing importance of financial literacy.

- The need for greater transparency and accountability.

- The impact of technology on pension administration.

9. What are your strengths and weaknesses as a pension examiner?

My strengths as a pension examiner include:

- My attention to detail.

- My ability to analyze complex information.

- My strong communication skills.

- My commitment to accuracy and fairness.

My weaknesses as a pension examiner include:

- My lack of experience in some areas of pension administration.

- My tendency to be conservative in my decision-making.

- My occasional difficulty in meeting deadlines.

10. Why are you interested in this position?

I am interested in this position because I am passionate about helping people plan for their retirement. I believe that everyone deserves to have a secure retirement, and I am committed to using my skills and experience to help make that happen. I am also attracted to this position because of the opportunity to work with a team of dedicated professionals. I am confident that I can make a valuable contribution to your team and help you achieve your goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Pension Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Pension Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Pension Examiners are responsible for ensuring that pension plans comply with federal and state laws and regulations. They examine pension plan documents, such as trust agreements, plan descriptions, and financial statements, to ensure that they are in compliance. They also conduct audits of pension plans to verify that they are operating in accordance with their governing documents and that they are meeting their fiduciary responsibilities.

1. Examine pension plan documents

Pension Examiners review pension plan documents to ensure that they comply with federal and state laws and regulations. They also review plan amendments to ensure that they are properly drafted and that they do not violate any applicable laws or regulations.

2. Conduct audits of pension plans

Pension Examiners conduct audits of pension plans to verify that they are operating in accordance with their governing documents and that they are meeting their fiduciary responsibilities. They also review plan investments to ensure that they are prudent and that they are meeting the plan’s investment objectives.

3. Investigate complaints about pension plans

Pension Examiners investigate complaints about pension plans. They may also investigate potential violations of federal or state laws or regulations. They may also investigate potential violations of fiduciary duties.

4. Issue reports on their findings

Pension Examiners issue reports on their findings. They may also make recommendations for corrective action. They may also refer cases to the appropriate enforcement agency.

Interview Tips

Preparing for an interview for a Pension Examiner position can be a daunting task, but by following these tips, you can increase your chances of success.

1. Research the position and the company

Before you go on an interview, it is important to research the position and the company. This will help you to understand the company’s culture and what they are looking for in a Pension Examiner. Knowing more about the position and company will help you to answer questions intelligently and show that you are interested in the position.

2. Practice answering common interview questions

There are a number of common interview questions that you can expect to be asked during an interview for a Pension Examiner position. By practicing answering these questions beforehand, you can increase your confidence and deliver more polished responses. Some common questions you may be asked include:

- Tell me about your experience with pension plans.

- What are the most important qualities of a successful Pension Examiner?

- Why are you interested in working for our company?

- What are your strengths and weaknesses?

- What are your salary expectations?

3. Dress appropriately

First impressions matter, so it is important to dress appropriately for your interview. For a Pension Examiner position, it is best to dress in business attire.

4. Be on time

Punctuality is important, so be sure to arrive for your interview on time. If you are running late, call the interviewer to let them know.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Pension Examiner interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.