Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Personal Banking Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

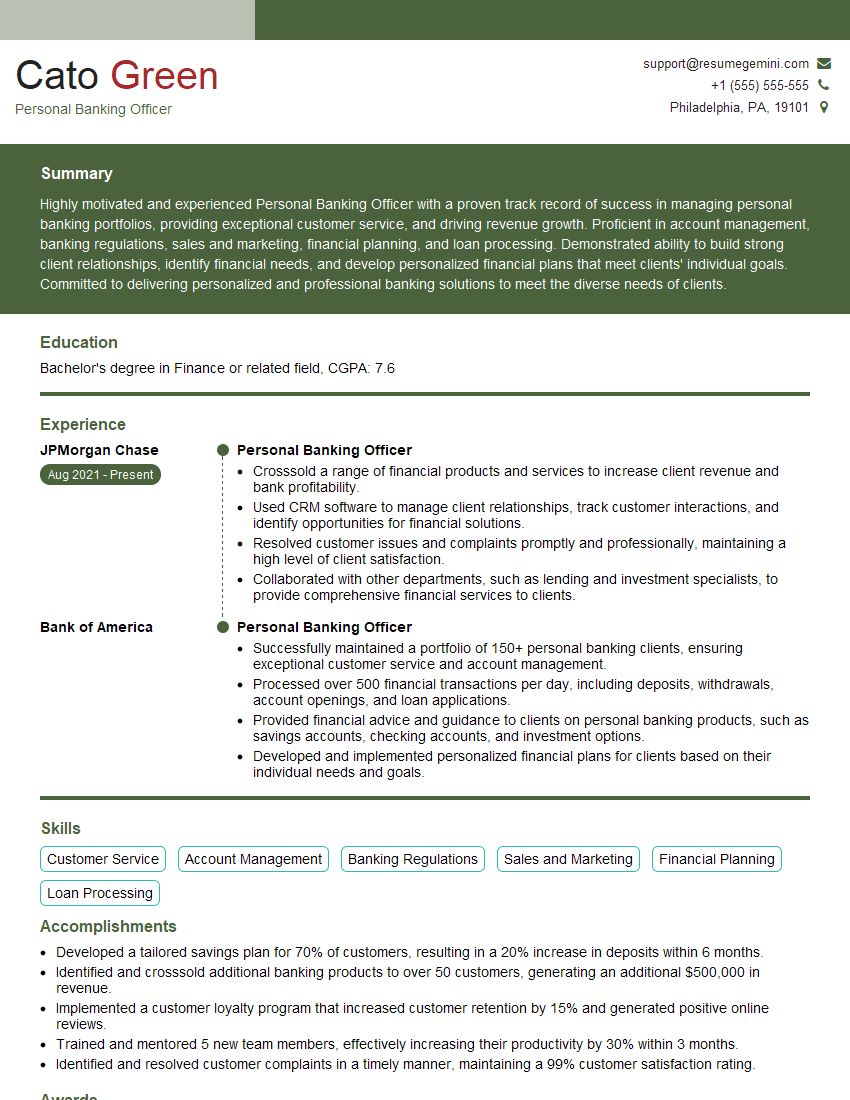

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Banking Officer

1. Explain the process of opening a new checking account for a customer?

- Greet the customer and establish their identity.

- Explain the different types of checking accounts available.

- Help the customer choose the right account based on their needs.

- Collect the necessary documentation.

- Open the account and provide the customer with their account information.

2. How would you handle a customer who is upset about a recent transaction?

- Listen to the customer’s concerns without interrupting.

- Apologize for the inconvenience.

- Investigate the transaction to determine the cause of the problem.

- Resolve the issue and explain the resolution to the customer.

- Follow up with the customer to ensure their satisfaction.

3. What are the different types of loans that you offer?

- Personal loans

- Auto loans

- Home equity loans

- Business loans

- Credit cards

4. What are the qualifications for obtaining a loan?

- Good credit score

- Stable employment

- Sufficient income

- Collateral (for some types of loans)

5. What are the different ways to make a deposit into an account?

- In person at a branch

- By mail

- Online

- Mobile deposit

6. What are the different ways to withdraw money from an account?

- In person at a branch

- By mail

- Online

- ATM

- Debit card

7. What are the different types of fees that may be associated with a checking account?

- Monthly maintenance fee

- Overdraft fee

- ATM fee

- Insufficient funds fee

- Wire transfer fee

8. What are the different types of investments that you offer?

- Certificates of deposit

- Money market accounts

- Mutual funds

- Stocks

- Bonds

9. What are the different ways to apply for a loan?

- In person at a branch

- By mail

- Online

- Over the phone

10. What are the different types of insurance that you offer?

- Life insurance

- Health insurance

- Car insurance

- Home insurance

- Business insurance

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Banking Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Banking Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Personal Banking Officers (PBOs) are responsible for providing excellent customer service and support to individuals and families, assisting them with their banking needs. They work in retail bank branches and are the face of the bank for many customers.

1. Customer Service

PBOs must be friendly, courteous, and helpful, and be able to build rapport with customers. They must be able to answer questions about bank products and services, and provide guidance to customers on how to manage their finances.

- Greet customers, answer their questions and resolve their issues.

- Process transactions, such as deposits, withdrawals, and loan payments.

2. Sales

PBOs are also responsible for selling bank products and services, such as checking accounts, savings accounts, loans, and credit cards. They must be able to identify customer needs and recommend products and services that meet those needs.

- Identify customer needs and recommend products and services that meet those needs.

- Explain the features and benefits of products and services.

3. Operations

In addition to providing customer service and sales, PBOs also perform a variety of operational tasks, such as opening and closing accounts, processing checks, and maintaining customer records.

- Open and close accounts.

- Process checks.

- Maintain customer records.

4. Compliance

PBOs must be familiar with all applicable banking regulations and comply with them at all times. They must also be able to identify and report suspicious activity.

- Comply with all applicable banking regulations.

- Identify and report suspicious activity.

Interview Tips

To ace your interview for a Personal Banking Officer position, you should prepare for the following:

1. Research the bank and the position

Before your interview, take some time to research the bank and the specific position you are applying for. This will help you understand the bank’s culture and the specific requirements of the job.

- Visit the bank’s website.

- Read the job description carefully.

- Talk to people you know who work in the banking industry.

2. Practice answering common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why do you want to work for this bank?” You can prepare for these questions by practicing your answers in advance.

- Practice answering common interview questions out loud.

- Get feedback from a friend or family member.

- Use the STAR method to answer questions.

3. Dress professionally

First impressions matter, so dress professionally for your interview. This means wearing a suit or dress pants and a button-down shirt. You should also make sure your shoes are clean and your hair is neatly styled.

- Wear a suit or dress pants and a button-down shirt.

- Make sure your shoes are clean and your hair is neatly styled.

- Avoid wearing casual clothing, such as jeans or t-shirts.

4. Be confident and enthusiastic

Interviewers want to see that you are confident and enthusiastic about the position. Make sure you maintain eye contact, speak clearly, and be positive. You should also be prepared to talk about your skills and experience, and how they relate to the job requirements.

- Maintain eye contact.

- Speak clearly and confidently.

- Be positive and enthusiastic.

Next Step:

Now that you’re armed with the knowledge of Personal Banking Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Personal Banking Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini