Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Personal Investment Adviser interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Personal Investment Adviser so you can tailor your answers to impress potential employers.

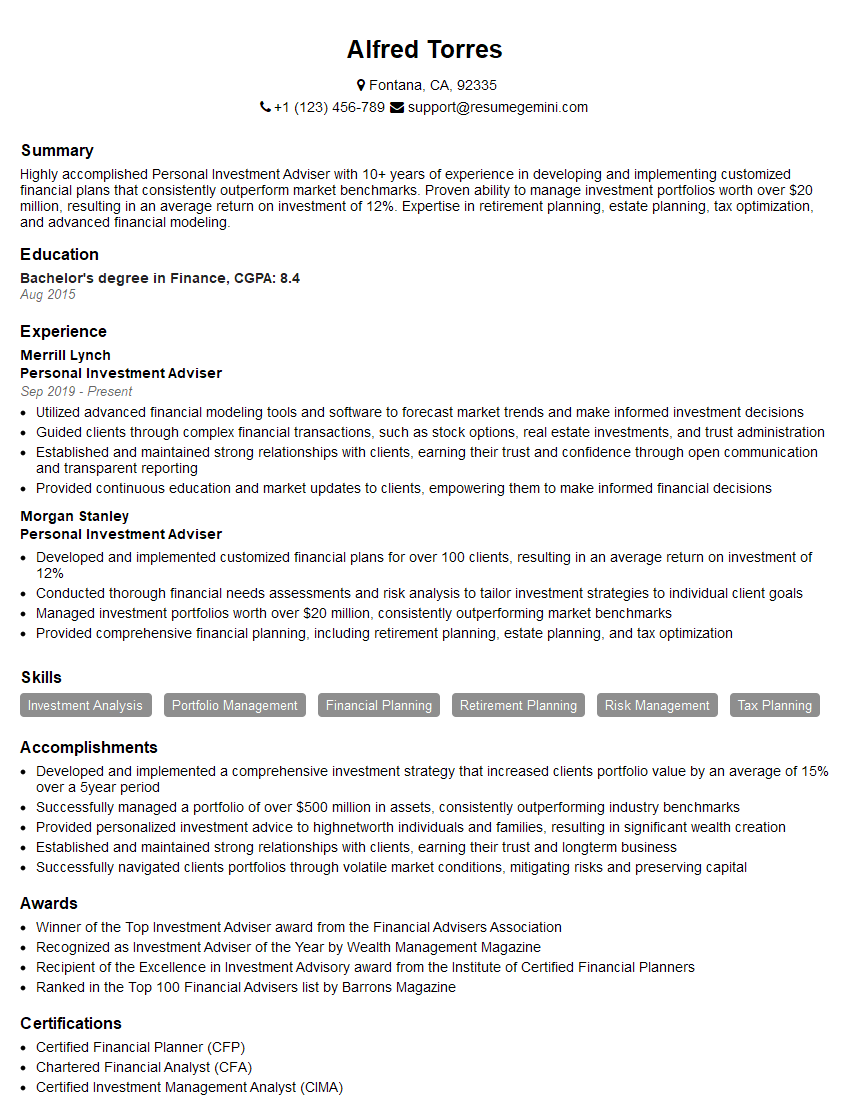

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Investment Adviser

1. How do you assess a client’s risk tolerance and investment objectives?

- Conduct comprehensive risk assessment questionnaires to determine client’s financial situation, investment knowledge, goals, and time horizon.

- Engage in in-depth discussions with clients to understand their risk appetite, return expectations, and investment philosophy.

- Utilize psychometric tools and simulations to gauge clients’ emotional responses to market volatility and potential losses.

2. Describe your approach to creating and managing personalized investment portfolios for clients.

Asset Allocation

- Analyze market conditions, economic trends, and client objectives to determine optimal asset allocation.

- Diversify portfolios across asset classes, sectors, and regions to mitigate risk and enhance returns.

Portfolio Rebalancing

- Monitor portfolios regularly and rebalance them as needed to maintain desired risk-return profile.

- Sell assets that have outperformed and buy assets that have underperformed to maintain desired allocations.

Performance Measurement

- Track portfolio performance against benchmarks and client objectives using Sharpe ratio, Sortino ratio, and other metrics.

- Provide clients with regular performance reports and discuss deviations from expected returns.

3. How do you stay up-to-date on market trends and investment strategies?

- Attend industry conferences, seminars, and webinars to gain insights from experts.

- Read financial publications, research reports, and analyst recommendations to stay informed about market developments.

- Utilize online platforms and social media to connect with thought leaders and discuss investment strategies.

4. Discuss your experience in managing investments in various market conditions, including bull and bear markets.

- In bull markets: Actively participate in market rallies, maintaining a balanced approach to avoid overexposure to risk.

- In bear markets: Implement defensive strategies, such as increasing cash positions, reducing volatility, and hedging against market downturns.

5. Describe a complex financial problem you have solved for a client, and the steps you took to resolve it.

- Assessed the client’s financial situation, risk tolerance, and investment objectives.

- Analyzed market conditions and explored various investment options to identify potential solutions.

- Developed a comprehensive plan, implementing a combination of asset allocation, portfolio diversification, and hedging strategies.

6. How do you handle client concerns or objections regarding investment decisions?

- Listen attentively to client concerns and provide clear and rationale explanations.

- Address client objections with factual information, risk-return analysis, and market data.

- Be patient and empathetic, understanding that clients may have emotional attachments to their investments.

7. Describe your understanding of ethical and regulatory responsibilities in the investment advisory profession.

- Adhere to all applicable laws, regulations, and industry standards, such as the Investment Advisers Act of 1940.

- Maintain the highest standards of confidentiality and privacy with client information.

- Avoid conflicts of interest and conduct all transactions in the best interests of clients.

8. How do you communicate complex financial concepts to clients in a clear and understandable manner?

- Use plain language, avoiding jargon and technical terms to simplify complex concepts.

- Provide visual aids, such as charts and graphs, to illustrate market trends and investment strategies.

- Tailor communication to the client’s level of financial knowledge and understanding.

9. What are your strengths and weaknesses as a Personal Investment Adviser?

Strengths

- Strong understanding of financial markets and investment strategies.

- Proven ability to create and manage personalized investment portfolios for clients.

- Excellent communication and interpersonal skills.

Weaknesses

- Limited experience in managing complex financial products, such as hedge funds and private equity.

- Still developing expertise in international markets and emerging economies.

10. What are your career goals and how does this role align with them?

- To become a leading Personal Investment Adviser, providing exceptional financial guidance to clients.

- To develop a deep understanding of investment strategies and market dynamics.

- To make a positive impact on the lives of my clients, helping them achieve their financial goals.

- This role aligns with my career goals as it provides a platform to utilize my skills, expand my knowledge, and contribute to the success of clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Investment Adviser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Investment Adviser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Personal Investment Advisers provide expert financial advice to individuals and families, helping them plan and manage their investments to achieve their financial goals. Key responsibilities include:

1. Client Relationship Management

Building and maintaining strong relationships with clients, understanding their unique financial needs and risk tolerance.

- Conducting initial consultations and ongoing reviews.

- Establishing investment objectives and developing personalized financial plans.

2. Investment Research and Analysis

Conducting thorough research and analysis of financial markets, investment opportunities, and economic trends.

- Monitoring market conditions and economic indicators.

- Identifying and evaluating potential investments for clients.

3. Portfolio Management

Managing and monitoring client investment portfolios according to agreed-upon financial plans.

- Allocating assets strategically to meet client objectives and risk profiles.

- Executing trades and managing portfolio performance.

4. Financial Planning and Advisory

Providing comprehensive financial planning advice beyond investment management, addressing clients’ financial goals and concerns.

- Assisting with retirement planning, tax optimization, and estate planning.

- Conducting financial projections and risk assessments.

Interview Tips

To ace your interview for a Personal Investment Adviser role, consider the following tips:

1. Research the Firm and Industry

Demonstrate your knowledge and interest in the financial services industry and the specific firm you’re applying to.

- Review their website, press releases, and financial reports.

- Research their investment philosophy, products, and services.

2. Highlight Your Expertise and Experience

Showcase your skills in financial planning, investment analysis, and portfolio management.

- Quantify your accomplishments with specific examples.

- Emphasize your ability to build strong client relationships.

3. Prepare for Common Interview Questions

Anticipate questions related to your investment philosophy, risk management strategies, and experience in specific investment areas.

- Prepare answers to scenario-based questions that demonstrate your problem-solving abilities.

- Review ethical guidelines and regulations relevant to financial advising.

4. Ask Thoughtful Questions

Demonstrate your interest and engagement by asking insightful questions about the firm, the position, and the industry.

- Inquire about the firm’s investment process and client management approach.

- Ask about growth opportunities and professional development within the organization.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Personal Investment Adviser interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!