Are you gearing up for a career in Personal Lines Account Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Personal Lines Account Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

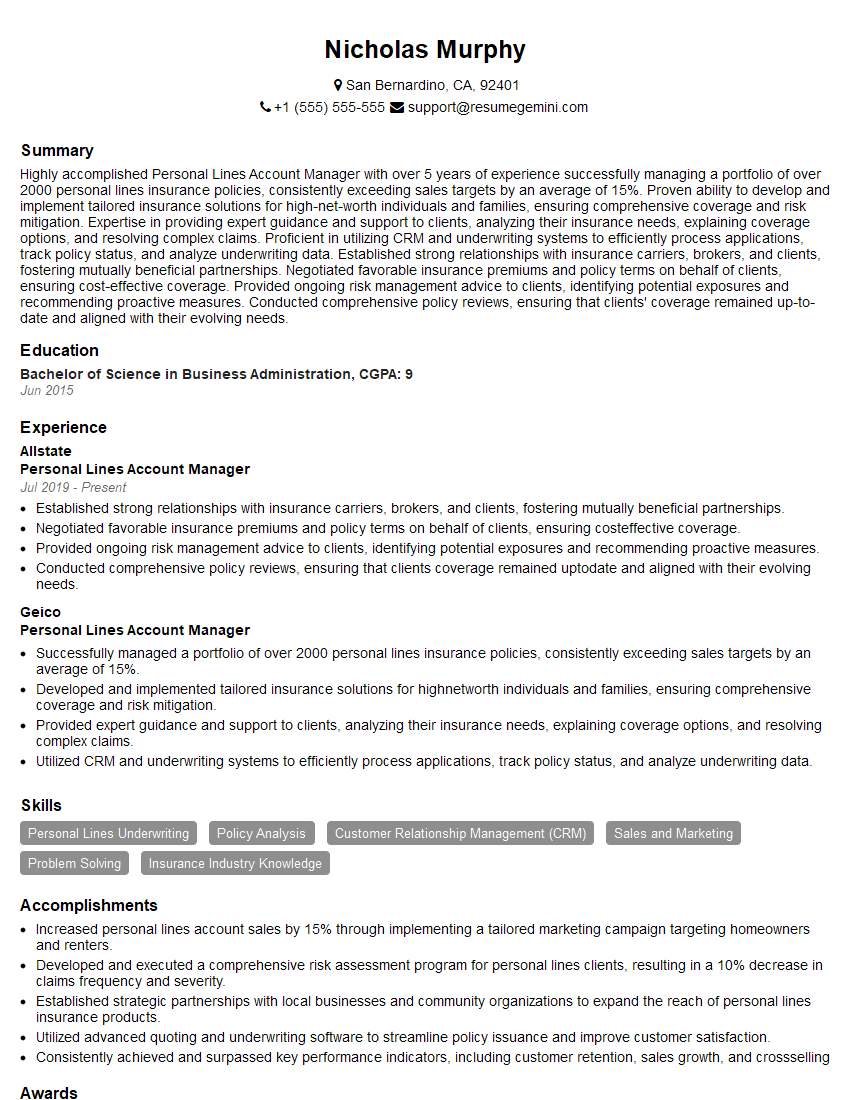

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Lines Account Manager

1. Describe the key responsibilities of a Personal Lines Account Manager.

As a Personal Lines Account Manager, I am responsible for developing, maintaining, and servicing a portfolio of personal lines insurance policies for individuals and families. Key responsibilities include:

- Prospecting for new clients and developing strategies to drive sales.

- Providing expert advice and guidance to clients on their insurance needs.

- Underwriting and pricing policies, ensuring adherence to company guidelines.

- Processing policy changes, issuing policies, and handling claims.

- Maintaining strong relationships with clients, building trust and loyalty.

2. How do you prioritize and manage your workload effectively?

Time Management Techniques

- I utilize time management techniques such as the Eisenhower Matrix and Pomodoro Technique to prioritize tasks.

- I break down large projects into smaller, manageable tasks.

Communication and Collaboration

- I communicate regularly with clients and colleagues to keep them updated on progress and manage expectations.

- I leverage technology such as project management software to track progress and collaborate with team members.

Delegation and Automation

- I delegate tasks to team members when appropriate to optimize efficiency.

- I use automation tools to streamline processes and save time.

3. Describe your experience in underwriting personal lines insurance policies.

In my previous role as an Underwriter, I was responsible for assessing and evaluating risks associated with personal lines insurance policies. This involved:

- Analyzing applications, financial statements, and other relevant documents.

- Evaluating property and liability risks, including using underwriting manuals and industry best practices.

- Determining appropriate premiums and coverage limits based on risk assessment.

- Deciding on policy acceptance or denial, ensuring compliance with company guidelines.

4. How do you handle objections and concerns from clients?

When dealing with objections and concerns from clients, I follow a structured approach:

- Acknowledge and Listen: I acknowledge the client’s concerns and actively listen to their perspective.

- Empathize and Understand: I try to understand the underlying reasons for their objections and empathize with their situation.

- Provide Solutions: I present clear and well-reasoned solutions that address their concerns and meet their needs.

- Negotiate and Compromise: I am willing to negotiate and compromise within company guidelines to find mutually acceptable solutions.

- Follow Up: I follow up with clients to ensure their concerns have been resolved and to build a strong relationship.

5. How do you stay up-to-date on industry trends and regulations?

To stay current on industry trends and regulations, I engage in the following practices:

- Attending industry conferences, seminars, and webinars.

- Reading industry publications and white papers.

- Participating in professional development courses and workshops.

- Actively networking with industry professionals.

- Monitoring government websites and regulatory updates.

6. Describe a challenging situation you faced in your previous role and how you overcame it.

In my previous role, I faced a challenging situation when a major storm caused significant damage to a client’s property. The client was extremely distressed and concerned about the extent of their coverage.

- Empathy and Communication: I empathized with the client and communicated regularly, providing updates and reassurance.

- Assessment and Evaluation: I visited the property, inspected the damage, and evaluated the coverage under the client’s policy.

- Negotiation and Resolution: I negotiated with the insurance carrier to maximize the settlement amount and ensure fair compensation for the client.

- Follow-up and Support: I provided ongoing support to the client throughout the claims process, ensuring their needs were met.

7. How do you build strong relationships with clients?

Building strong relationships with clients is crucial to my success as an Account Manager. I employ various strategies to foster these relationships:

- Active Listening and Communication: I actively listen to clients’ needs and concerns, communicating regularly to keep them informed.

- Personalized Service: I tailor my approach to each client, providing customized solutions and recommendations based on their unique circumstances.

- Trust and Transparency: I build trust by being transparent, providing clear and honest advice, and always acting in the client’s best interests.

- Proactive Outreach: I proactively reach out to clients to offer support, review coverage, and address any concerns.

- Follow Up and Appreciation: I follow up with clients after each interaction and express my appreciation for their business.

8. How do you measure your success as an Account Manager?

- Client Retention: I track client retention rates to measure my ability to maintain and grow my client base.

- Revenue Generation: I monitor sales figures to assess my contribution to the company’s revenue goals.

- Customer Satisfaction: I collect feedback from clients through surveys and testimonials to evaluate their satisfaction levels.

- Industry Recognition: I seek industry recognition, such as awards or certifications, to demonstrate my expertise and credibility.

- Professional Development: I continuously strive to improve my skills and knowledge through professional development opportunities.

9. What is your understanding of the principles of insurance?

The principles of insurance are fundamental to my role as an Account Manager. I have a deep understanding of the following principles:

- Risk Sharing: Insurance is a mechanism for spreading risk among a large group of policyholders.

- Indemnity: Insurance policies aim to restore the insured to their pre-loss financial position in the event of a covered event.

- Insurable Interest: Individuals and businesses must have an insurable interest in the property or assets insured.

- Utmost Good Faith: Both the insurer and the insured have a duty to disclose all material facts.

- Subrogation: Insurers have the right to pursue recovery from responsible third parties after paying a claim.

10. How do you leverage technology to enhance your role as an Account Manager?

Technology plays a vital role in my work as an Account Manager. I leverage various tools and platforms to:

- Customer Relationship Management (CRM): I use CRM systems to track client interactions, manage policies, and provide personalized communication.

- Underwriting Tools: I utilize underwriting software to streamline the risk assessment process and ensure accurate pricing.

- Policy Management Systems: I rely on policy management systems to issue and maintain policies, track claims, and provide customer service.

- Data Analytics: I analyze data to identify trends, optimize processes, and make informed decisions.

- Collaboration Tools: I leverage video conferencing, instant messaging, and project management tools to collaborate with colleagues and clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Lines Account Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Lines Account Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Personal Lines Account Manager is responsible for managing a portfolio of personal lines insurance policies, including homeowners, renters, auto, and umbrella policies. Key job responsibilities include:1. Sales and Marketing

Develop and implement sales and marketing strategies to generate new business.

- Prospect and qualify potential clients.

- Develop and deliver sales presentations.

- Negotiate and close deals.

- Maintain relationships with existing clients.

2. Account Management

Manage a portfolio of personal lines insurance policies.

- Underwrite and issue policies.

- Provide customer service and support.

- Renew and cancel policies.

- Process claims.

3. Risk Management

Assess and manage risks associated with personal lines insurance policies.

- Identify and evaluate potential risks.

- Develop and implement risk management strategies.

- Monitor and report on risk exposures.

4. Compliance

Ensure compliance with all applicable laws and regulations.

- Stay abreast of changes in insurance laws and regulations.

- Develop and implement compliance policies and procedures.

- Monitor and report on compliance activities.

Interview Tips

To prepare for an interview for a Personal Lines Account Manager position, you should focus on your skills in sales, account management, risk management, and compliance. You should also be prepared to discuss your experience with personal lines insurance products. Here are some tips to help you ace the interview:1. Research the company and the position

Before the interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture, values, and goals, and tailor your answers to the interviewer’s questions.

2. Practice your answers to common interview questions

There are some common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” Practice your answers to these questions so that you can deliver them confidently and concisely.

3. Be prepared to discuss your skills and experience

The interviewer will want to know about your skills and experience in sales, account management, risk management, and compliance. Be prepared to discuss your accomplishments in these areas, and how they have contributed to your success.

4. Ask questions

At the end of the interview, the interviewer will likely ask if you have any questions. This is your opportunity to learn more about the company and the position, and to show the interviewer that you are interested and engaged.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Personal Lines Account Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.