Are you gearing up for a career in Personal Lines Insurance Customer Service Representative (Personal Lines Insurance CSR)? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Personal Lines Insurance Customer Service Representative (Personal Lines Insurance CSR) and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

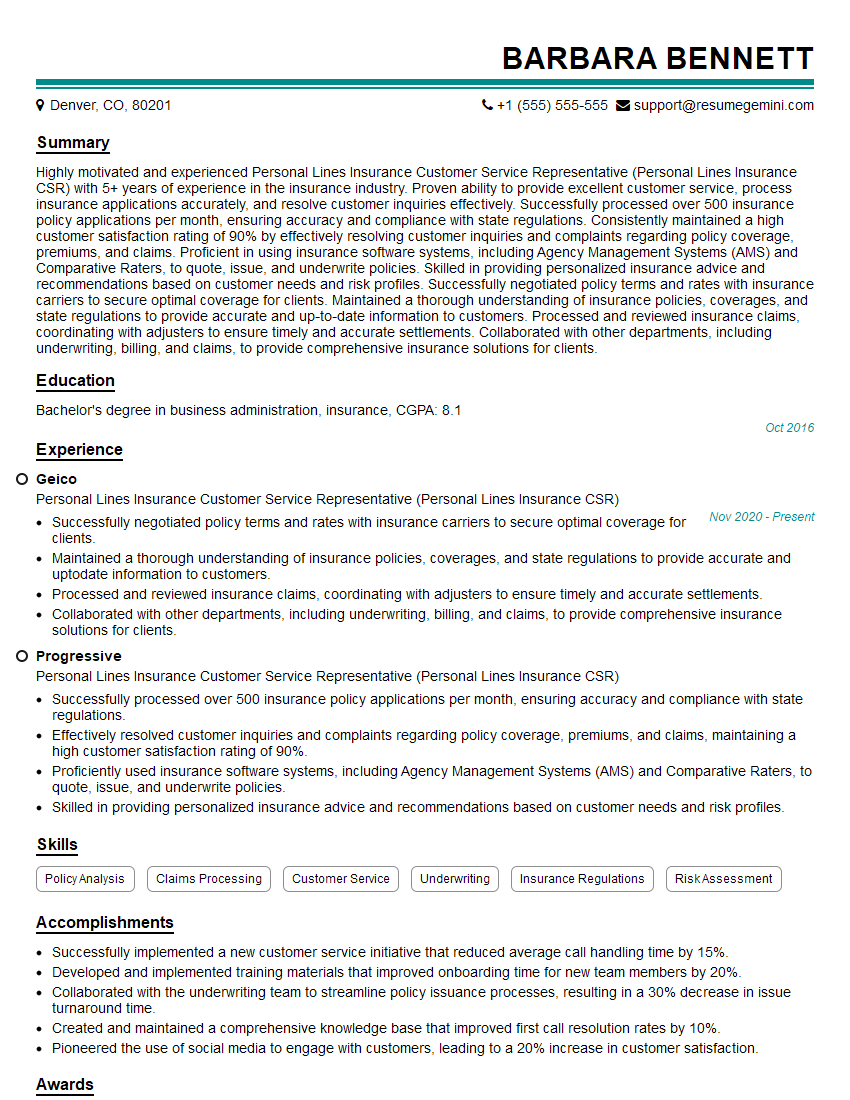

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Lines Insurance Customer Service Representative (Personal Lines Insurance CSR)

1. Describe the different types of personal lines insurance policies you have handled in the past?

In my previous role, I handled a wide range of personal lines insurance policies, including:

- Auto insurance

- Homeowners insurance

- Renters insurance

- Personal liability insurance

- Umbrella insurance

2. What is your process for resolving customer inquiries and complaints?

Understanding the customer’s needs

- Listen attentively to the customer’s concerns and ask clarifying questions to fully understand their situation.

- Identify the root cause of the issue by gathering relevant information and reviewing account details.

Providing solutions

- Research and analyze the policy terms and conditions to determine coverage and eligibility.

- Offer clear and concise explanations of the policy and relevant laws.

- Explore multiple options and recommend the most appropriate solution to meet the customer’s needs.

Follow-up and documentation

- Summarize the resolution and provide documentation or resources as needed.

- Follow up with the customer to ensure their satisfaction and address any additional concerns.

3. What are the key elements of a comprehensive auto insurance policy?

A comprehensive auto insurance policy typically includes the following key elements:

- Liability coverage: Protects against bodily injury and property damage caused to others.

- Collision coverage: Covers damage to the insured vehicle in an accident with another vehicle or object.

- Comprehensive coverage: Provides coverage for non-collision events, such as theft, vandalism, and weather-related damage.

- Uninsured/Underinsured motorist coverage: Protects against financial losses caused by drivers who do not have adequate insurance coverage.

- Medical payments coverage: Pays for medical expenses for the policyholder and passengers, regardless of fault.

4. How would you handle a customer who is angry or upset?

To handle an angry or upset customer, I would follow these steps:

- Remain calm and empathetic, acknowledging the customer’s emotions without becoming defensive.

- Allow the customer to vent their frustrations and express their concerns fully.

- Use active listening techniques to demonstrate that I am paying attention and understanding their perspective.

- Focus on finding a solution that addresses the customer’s needs and concerns.

- Communicate clearly and respectfully, explaining the situation and available options.

5. What is your experience with using insurance software and systems?

I am proficient in using various insurance software and systems, including:

- Policy management systems (PMS)

- Claims processing systems

- Customer relationship management (CRM) software

- Underwriting tools

- Rating calculators

I am comfortable navigating these systems to access and update customer information, process transactions, and generate reports.

6. What are the ethical considerations you keep in mind when dealing with customers’ personal information?

When dealing with customers’ personal information, I adhere to the following ethical considerations:

- Maintain confidentiality: I understand the importance of protecting sensitive customer data and keep it confidential.

- Use data responsibly: I only access and use customer information for authorized purposes and in accordance with privacy regulations.

- Respect customer privacy: I treat customer information with respect and avoid sharing it with unauthorized parties.

- Comply with laws and regulations: I am familiar with and comply with all applicable data protection laws and regulations.

- Report any breaches: I promptly report any suspected or actual breaches of customer data security.

7. How do you stay up-to-date on the latest insurance regulations and industry best practices?

To stay up-to-date on the latest insurance regulations and industry best practices, I engage in the following activities:

- Attend industry conferences and webinars

- Read insurance publications and trade journals

- Participate in professional development courses

- Network with colleagues and industry experts

- Stay informed about regulatory updates and legislative changes

8. What are your strengths and weaknesses as a Personal Lines Insurance CSR?

Strengths:

- Excellent communication and interpersonal skills

- Strong understanding of personal lines insurance products and policies

- Ability to resolve customer inquiries and complaints effectively

- Proficient in using insurance software and systems

- Commitment to providing exceptional customer service

Weaknesses:

- Limited experience with handling complex insurance claims

- Not fluent in any languages other than English

However, I am actively working on improving my weaknesses and developing my skills in these areas.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to customer satisfaction and your reputation for providing innovative insurance solutions.

I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to the success of your organization.

10. What are your salary expectations?

My salary expectations are in line with the industry standard for a Personal Lines Insurance CSR with my level of experience and qualifications.

I am also open to discussing a competitive benefits package that includes health insurance, paid time off, and professional development opportunities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Lines Insurance Customer Service Representative (Personal Lines Insurance CSR).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Lines Insurance Customer Service Representative (Personal Lines Insurance CSR)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Personal Lines Insurance Customer Service Representative (CSR) is the first point of contact for customers seeking insurance policies, billing inquiries, policy changes, or claims processing. They provide excellent customer service, resolve inquiries, and process transactions while maintaining compliance with company policies and regulations.

1. Customer Service and Communication

Respond to customer inquiries via phone, email, and in-person interactions.

- Provide clear and accurate information about insurance products and services.

- Resolve customer concerns and complaints promptly and effectively.

2. Policy Management

Process and issue insurance policies.

- Review and analyze customer applications.

- Calculate premiums and determine coverage options.

3. Billing and Transactions

Handle billing inquiries and process payments.

- Explain billing statements and payment options.

- Resolve billing disputes and process refunds.

4. Claims Processing

Assist customers with claims filing and processing.

- Gather and review relevant documentation.

- Determine coverage and calculate settlement amounts.

Interview Tips

Preparing thoroughly for an interview can make a significant impact on your chances of success. Here are some key tips and hacks to help you ace your interview for a Personal Lines Insurance CSR position:

1. Research the Company and Role

Take time to research the insurance company and the specific role you’re applying for. Understand their products, services, and company culture.

- Review the company’s website, social media pages, and recent news articles.

- Read the job description carefully and identify the key skills and responsibilities required.

2. Practice Your Answers

Common interview questions for Personal Lines Insurance CSRs include those related to customer service, insurance knowledge, and problem-solving. Practice answering these questions in a clear and concise manner.

- Example Outline: Tell me about a time you went above and beyond to help a customer.

- Example Outline: What are your strengths and weaknesses as they relate to this role?

– Start by briefly describing the situation and the customer’s need.

– Explain the specific actions you took to assist the customer.

– Emphasize the positive outcome and how your efforts exceeded expectations.

– Identify your top strengths that align with the job requirements, such as excellent communication skills, attention to detail, and a strong work ethic.

– Acknowledge a relevant weakness, but frame it as an opportunity for growth and development.

– Explain how you are actively working to improve in that area.

3. Highlight Your Skills and Experience

Emphasize your relevant skills and experience during the interview. Quantify your accomplishments whenever possible using specific metrics or percentages.

- For example, instead of saying “I provided excellent customer service,” you could say, “I consistently exceeded customer satisfaction targets by an average of 15%.”

4. Ask Thoughtful Questions

Asking well-thought-out questions at the end of the interview shows that you are engaged and interested in the role. Prepare questions that demonstrate your understanding of the industry and the company.

- For example, you could ask about the company’s approach to customer experience, recent industry trends, or opportunities for professional development.

5. Follow Up Professionally

After the interview, send a brief thank-you note to the interviewer. Summarize your key strengths and how you believe you can contribute to the team. Reaffirm your interest in the role and reiterate your availability for any further discussions.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Personal Lines Insurance Customer Service Representative (Personal Lines Insurance CSR) interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!