Are you gearing up for a career in Personal Lines Underwriter? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Personal Lines Underwriter and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

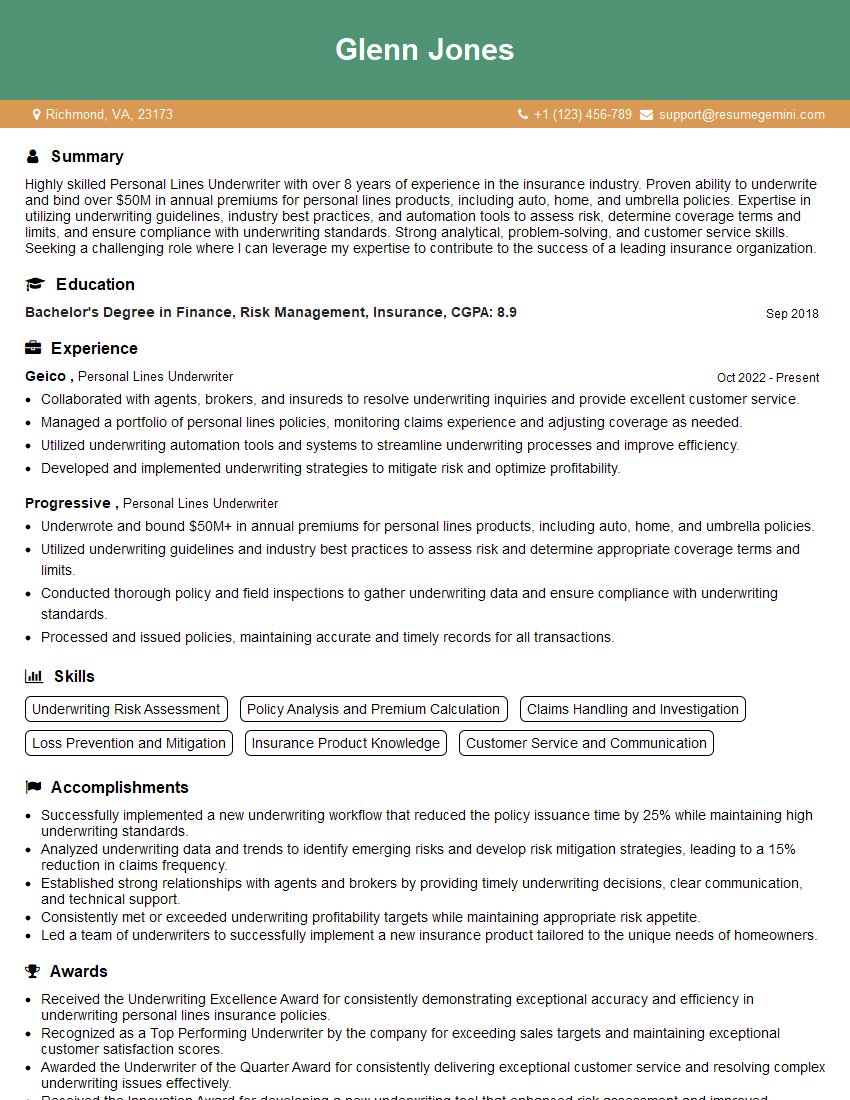

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Lines Underwriter

1. What are the key underwriting factors you consider when evaluating a personal auto insurance policy?

- Age, driving history, and claims experience of the driver(s)

- Type, make, and model of the vehicle(s) being insured

- Location where the vehicle(s) will be primarily driven

- Intended use of the vehicle(s)

- Any modifications or accessories that have been made to the vehicle(s)

2. How do you determine the appropriate insurance limits for a personal auto insurance policy?

Consideration of Assets

- Assess the policyholder’s financial situation

- Review their assets, income, and potential liabilities

- Ensure adequate coverage to protect their assets in case of an accident

Assessment of Risk

- Evaluate the policyholder’s driving history

- Consider the type of vehicle being insured

- Analyze the frequency and severity of accidents in the policyholder’s area

3. What are the different types of coverage available under a personal auto insurance policy, and what do they cover?

- Liability Coverage: Bodily injury and property damage caused to others in an accident

- Collision Coverage: Damage to the policyholder’s vehicle in an accident

- Comprehensive Coverage: Damage to the policyholder’s vehicle from non-collision events (e.g., theft, vandalism, fire)

- Uninsured/Underinsured Motorist Coverage: Protection if the policyholder is involved in an accident with a driver who is uninsured or underinsured

- Medical Payments Coverage: Medical expenses for the policyholder and passengers in case of an accident

4. What are the main factors that affect the cost of a personal auto insurance policy?

- Driving history and experience

- Age of the driver(s)

- Type and value of the vehicle(s) being insured

- Location where the vehicle(s) will be primarily driven

- Insurance coverage limits and deductibles

5. How do you assess the risk of a potential insured?

- Reviewing their insurance history and driving record

- Analyzing their claims history

- Assessing their credit score

- Interviewing the potential insured to understand their driving habits and lifestyle

6. What are some of the common underwriting challenges you face when evaluating personal auto insurance risks?

- Drivers with poor driving records

- High-risk vehicles (e.g., sports cars, motorcycles)

- Applicants with multiple claims

- Fraudulent insurance claims

7. How do you stay up-to-date on changes in the personal auto insurance industry?

- Attending industry conferences and workshops

- Reading insurance industry publications and newsletters

- Maintaining professional certifications

- Networking with other insurance professionals

8. What are the ethical considerations that you must adhere to in your role as an underwriter?

- Treating all applicants fairly and without discrimination

- Maintaining confidentiality of applicant information

- Avoiding conflicts of interest

- Acting in the best interests of the insurance company and its policyholders

9. How do you handle situations where you have to deny coverage to an applicant?

- Explaining the reasons for the denial clearly and concisely

- Providing the applicant with an opportunity to appeal the decision

- Offering alternative insurance options if possible

- Maintaining a professional and empathetic demeanor

10. What are your strengths and weaknesses as an underwriter?

Strengths

- Strong analytical skills

- Excellent communication and interpersonal skills

- Up-to-date knowledge of the personal auto insurance industry

- Commitment to ethical underwriting practices

Weaknesses

- Limited experience in underwriting high-risk vehicles

- Need to improve time management skills

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Lines Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Lines Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Personal Lines Underwriters play a vital role in the insurance industry by evaluating and assessing risks associated with personal insurance policies, such as homeowners, renters, and auto insurance. Their responsibilities include:

1. Risk Assessment

Underwriters thoroughly examine applications and supporting documentation to determine the level of risk associated with insuring a particular individual or property. They analyze factors such as claims history, age, location, and lifestyle to assess the likelihood and potential severity of future claims.

- Review applications for new policies or policy renewals.

- Assess property values, construction types, and potential hazards.

- Analyze driving records and other relevant information for auto insurance.

2. Policy Issuance and Pricing

Based on their risk assessment, underwriters determine whether to accept or decline coverage, and if approved, they establish appropriate policy terms and premiums. They ensure that policies adhere to company guidelines and regulatory requirements.

- Issue policies for accepted risks.

- Calculate premiums based on risk factors and company guidelines.

- Set policy limits and coverage amounts.

3. Claims Management

Underwriters play a key role in claims handling by reviewing and investigating claims to determine coverage and liability. They work closely with policyholders, adjusters, and other stakeholders to ensure fair and equitable claim settlements.

- Review claims submissions and documentation.

- Determine coverage and liability based on policy terms.

- Negotiate and approve claim settlements.

4. Market Analysis and Product Development

Underwriters stay abreast of industry trends and market conditions to identify potential risks and opportunities. They provide insights to management and product development teams to enhance existing products or develop new insurance solutions.

- Monitor market trends and analyze data.

- Identify emerging risks and recommend underwriting strategies.

- Contribute to product development and policy design.

Interview Preparation Tips

To prepare for a Personal Lines Underwriter interview, consider the following tips:

1. Research the Company and Industry

Demonstrate your knowledge of the insurance industry, the specific company you’re applying to, and their competitors. Familiarize yourself with their products, underwriting guidelines, and market position.

- Visit the company website and review their annual reports.

- Read industry publications and news articles.

- Network with professionals in the insurance field.

2. Practice Common Interview Questions

Prepare for common interview questions related to underwriting, risk assessment, claims handling, and insurance products. Practice answering these questions in a clear and concise manner, highlighting your skills and experience.

- Tell me about your experience in assessing and pricing personal lines risks.

- Describe a complex claim you handled and the steps you took to resolve it.

- How do you stay up-to-date on industry trends and regulatory changes?

3. Prepare Questions to Ask the Interviewer

Asking thoughtful questions during the interview shows your interest in the position and the company. Prepare questions that demonstrate your understanding of the role and industry, and seek clarification on specific aspects of the job or company culture.

- What is the company’s underwriting philosophy and approach to risk management?

- How does the company handle claims and what is the average claims settlement time?

- What are the opportunities for professional development and career growth within the company?

4. Dress Professionally and Be Punctual

First impressions matter. Dress professionally and arrive for your interview on time. Your attire and punctuality reflect your respect for the interviewer and the company.

- Choose business attire that is clean and pressed.

- Plan your route and allow ample time for any unexpected delays.

- Be polite and respectful to everyone you encounter.

5. Be Confident and Enthusiastic

Confidence and enthusiasm are contagious. Believe in yourself and your abilities. Show the interviewer that you are passionate about the insurance industry and eager to contribute to their team.

- Maintain eye contact, speak clearly, and project your voice.

- Be positive and enthusiastic about your experience and skills.

- Express your interest in the position and the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Personal Lines Underwriter interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!