Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Personal Property Assessor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

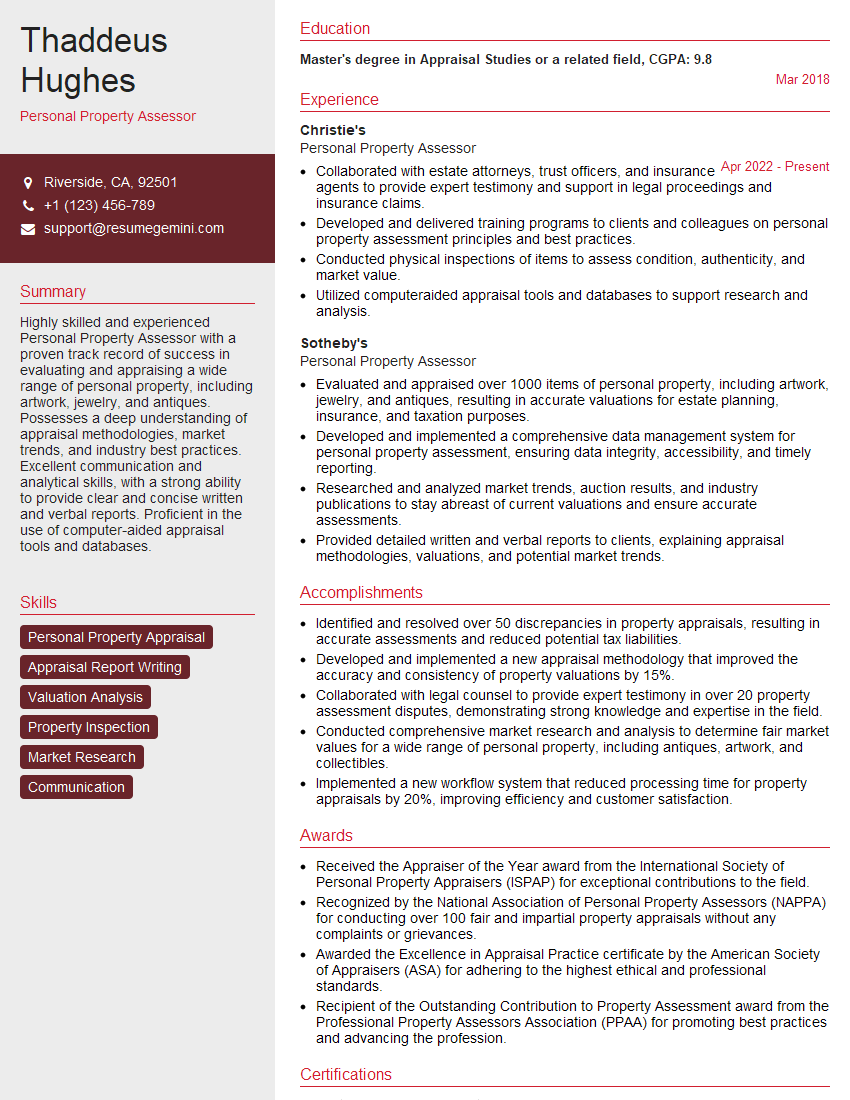

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Property Assessor

1. What are the key principles of assessing personal property?

When assessing personal property, the following principles should be considered:

- Uniformity: Personal property should be assessed fairly and consistently across different taxpayers.

- Equity: The assessment process should ensure that all taxpayers contribute their fair share of property taxes.

- Accuracy: Personal property assessments should be based on accurate and up-to-date information.

- Objectivity: Assessments should be based on objective criteria, not subjective factors.

2. What are the different methods used to assess personal property?

Cost Approach

- New replacement cost

- Depreciated replacement cost

Income Approach

- Capitalization of income

- Gross rent multiplier

Market Approach

- Comparable sales

- Cost to cure

3. How do you determine the fair market value of personal property?

- Consider the property’s condition, age, and location.

- Research comparable sales of similar properties.

- Use the appropriate assessment method based on the type of property.

- Consult with experts as needed.

4. What are the most common challenges in assessing personal property?

- Lack of accurate and complete information

- Determining the value of highly specialized or unique items

- Dealing with uncooperative or evasive taxpayers

- Keeping up with changes in the market and appraisal techniques

5. How do you handle appeals or disputes related to property assessments?

- Meet with the taxpayer to discuss their concerns.

- Gather evidence and documentation to support the assessment.

- Explain the assessment process and valuation methods used.

- Make adjustments to the assessment if necessary.

- Provide the taxpayer with a written explanation of the appeal decision.

6. What software or tools do you use for personal property assessment?

- Computer-assisted mass appraisal systems (CAMA)

- Geographic information systems (GIS)

- Property valuation databases

- Spreadsheet and statistical software

7. How do you stay up-to-date on industry best practices and legal changes?

- Attend conferences and workshops

- Read professional journals and publications

- Network with other assessors

- Consult with legal counsel as needed

8. Describe a situation where you had to use your negotiation skills to resolve a conflict with a taxpayer.

In one instance, a taxpayer disputed the assessed value of their commercial property. I met with the taxpayer to discuss their concerns. I presented evidence and documentation to support the assessment, but the taxpayer remained unconvinced. I listened to their viewpoint and tried to understand their perspective. After some negotiation, we agreed on an adjusted assessment that was fair to both parties.

9. What is your approach to ensuring that personal property assessments are accurate and compliant with state and local laws?

- Follow established appraisal standards and guidelines.

- Use reliable data and research to support assessments.

- Maintain a high level of professionalism and integrity.

- Attend training and continuing education to stay current with legal and regulatory changes.

10. How do you prioritize your workload and manage multiple projects simultaneously?

- Establish clear goals and deadlines.

- Break down large projects into smaller tasks.

- Delegate tasks to team members when appropriate.

- Use project management software or tools.

- Stay organized and keep track of progress regularly.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Property Assessor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Property Assessor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Personal Property Assessor is a vital role in establishing fair property taxes. Their responsibilities encompass a range of tasks related to property assessment and tax administration:

1. Property Inspection and Appraisal

Assesses the value of personal property, including machinery, equipment, inventory, and business assets.

- Conducts physical inspections of properties to determine their size, condition, and characteristics.

- Employs various valuation methods, such as cost, market, and income approaches, to estimate fair market value.

2. Research and Data Management

Gathers and analyzes relevant data to support property assessments.

- Researches property sales, market trends, and economic indicators to determine property values.

- Maintains accurate records of property assessments and other related data.

3. Tax Assessment and Billing

Determines the amount of property taxes owed by property owners.

- Calculates property taxes based on assessed values and applicable tax rates.

- Generates and distributes tax bills to property owners.

4. Taxpayer Assistance and Appeals

Provides information and assistance to property owners regarding property assessments and taxes.

- Responds to taxpayer inquiries and complaints.

- Reviews and resolves property assessment appeals filed by taxpayers.

5. Adherence to Laws and Regulations

Ensures compliance with all applicable laws and regulations governing property assessment and taxation.

- Stays updated with changes in laws and regulations.

- Participates in training and professional development to enhance knowledge and skills.

Interview Preparation Tips

1. Research the Role and Company

Thoroughly research the Personal Property Assessor role and the specific organization you’re applying to.

- Review the job description to identify key responsibilities and qualifications.

- Visit the company’s website to learn about their mission, values, and industry.

2. Highlight Relevant Skills and Experience

Emphasize your skills and experience that are directly relevant to the job responsibilities.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Prepare examples of your work that showcase your problem-solving, analytical, and communication skills.

3. Practice Common Interview Questions

Anticipate and prepare responses to common interview questions.

- Practice answering questions about your motivation for applying, your strengths and weaknesses, and your experience in property assessment.

- Prepare questions to ask the interviewer, which demonstrates your interest and enthusiasm for the role.

4. Dress Professionally and Arrive On Time

First impressions matter. Dress professionally and arrive at the interview on time.

- Choose attire that is appropriate for the office environment.

- Arrive at the interview venue a few minutes early to show respect for the interviewer’s time.

5. Be Confident and Enthusiastic

Confidence and enthusiasm can make a positive impact on the interviewer.

- Maintain eye contact and speak clearly and confidently during the interview.

- Demonstrate a genuine interest in the role and express your excitement about the opportunity.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Personal Property Assessor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.