Are you gearing up for an interview for a Physical Damage Appraiser position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Physical Damage Appraiser and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

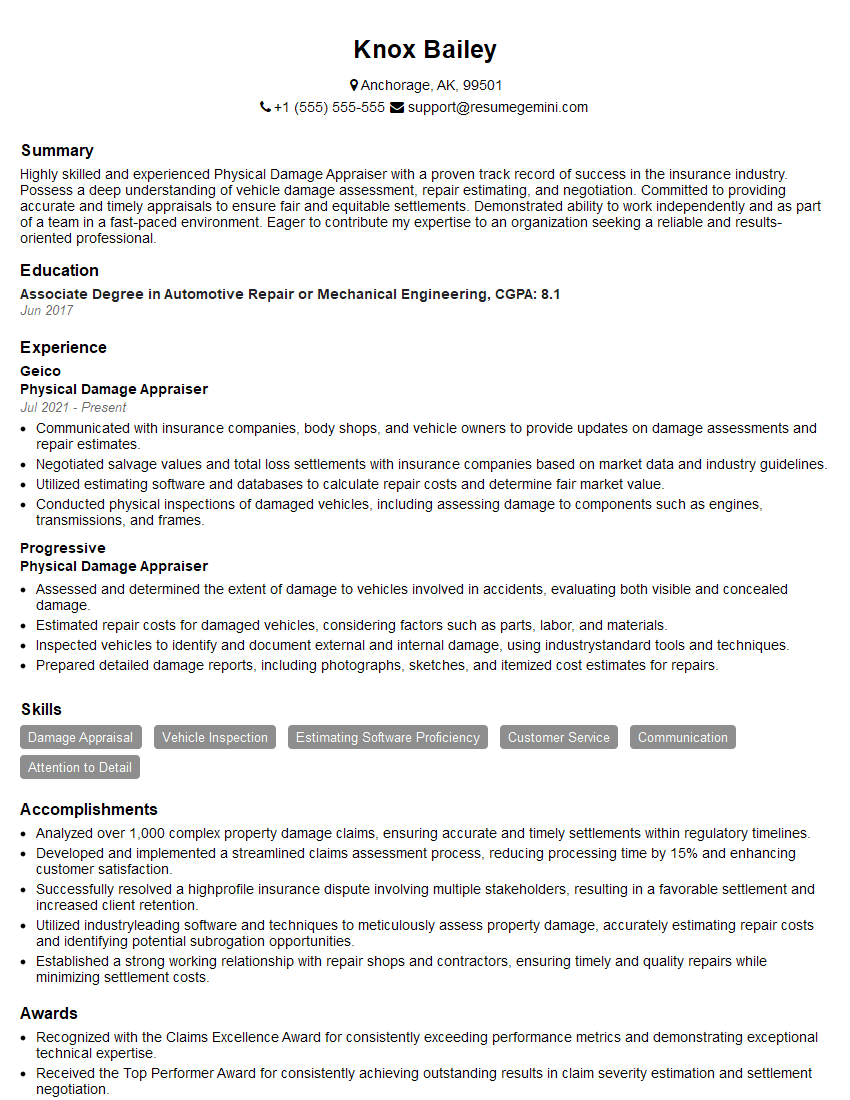

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Physical Damage Appraiser

1. Describe the main steps involved in the physical damage appraisal process?

- Gather and review relevant information, such as the insurance policy, police report, and repair estimates.

- Inspect the damaged vehicle to assess the extent of damage and determine the cause.

- Estimate the cost of repairs based on industry standards and guidelines.

- Prepare a detailed appraisal report that includes photographs, measurements, and a description of the damage.

- Discuss the findings with the insurance company and policyholder and negotiate a settlement.

2. How do you determine the fair market value of a damaged vehicle?

Consideration of factors

- The vehicle’s make, model, year, and mileage.

- The condition of the vehicle prior to the damage.

- The extent of the damage.

- The cost of repairs.

- Comparable sales data for similar vehicles.

Research and analysis

- Research sales data from reputable sources.

- Analyze the data to determine the range of values for comparable vehicles.

- Adjust the value based on the condition of the damaged vehicle and the cost of repairs.

3. What techniques do you use to assess the severity of vehicle damage?

- Visual inspection: Examining the vehicle for dents, scratches, broken parts, and other visible damage.

- Diagnostic tools: Using diagnostic tools to identify hidden damage, such as frame damage or electrical issues.

- Paint thickness gauges: Measuring the thickness of the paint to determine if it has been repainted or repaired.

- Mechanical inspection: Inspecting the vehicle’s engine, transmission, and other mechanical components to assess their condition.

4. How do you handle situations where there is disagreement with the repair shop’s estimate?

- Review the repair estimate carefully and identify any discrepancies or errors.

- Contact the repair shop to discuss the estimate and provide your own assessment.

- Request additional documentation or a second opinion from another repair shop.

- Negotiate with the repair shop to reach a fair and reasonable settlement.

5. What is your experience with using estimating software?

- Proficient in using industry-standard estimating software, such as CCC ONE or Mitchell.

- Experience in creating detailed repair estimates that accurately reflect the cost of repairs.

- Ability to use the software to generate reports, track progress, and manage claims.

6. How do you stay up-to-date on industry trends and best practices in vehicle appraisal?

- Attend industry conferences and webinars.

- Read industry publications and online resources.

- Participate in continuing education courses.

- Network with other professionals in the field.

7. What is your approach to customer service?

- Providing excellent customer service is a top priority.

- Communicating clearly and effectively with policyholders and insurance companies.

- Being responsive and available to answer questions and provide updates.

- Treating customers with respect and empathy.

8. How do you handle conflicts or disagreements with policyholders?

- Maintain a professional and respectful demeanor.

- Listen attentively to the policyholder’s concerns.

- Explain the appraisal process and the basis for the estimate.

- Be willing to compromise and negotiate when appropriate.

- Document all discussions and agreements.

9. What is your experience with total loss appraisals?

- Experience in determining the total loss value of vehicles.

- Understanding of the factors that contribute to a total loss, such as the cost of repairs, the fair market value of the vehicle, and salvage value.

- Ability to prepare detailed total loss reports that justify the decision.

10. Describe a challenging appraisal case that you have handled and how you resolved it.

Provide a detailed description of the case, including the specific challenges and how you overcame them. Highlight your problem-solving skills, technical expertise, and ability to negotiate a fair settlement.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Physical Damage Appraiser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Physical Damage Appraiser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Physical Damage Appraisers function as expert evaluators who play a critical role in determining the extent of damage to various types of property. They excel at analyzing complex issues and utilizing a broad knowledge of construction practices, materials, and repair techniques.

1. Comprehensive Property Damage Assessment

Conduct thorough inspections to assess the extent and nature of damage to properties, including buildings, homes, vehicles, and other structures.

- Identify and document the cause and extent of damage using industry-standard methods and equipment.

- Prepare detailed reports summarizing findings, including estimated repair or replacement costs.

2. Accurate Damage Estimation

Develop precise estimates for repair or replacement costs based on thorough analysis of damage.

- Utilize knowledge of construction practices, materials, and labor costs to calculate accurate estimates.

- Consider depreciation, salvage value, and other factors impacting the final estimation.

3. Effective Communication and Report Writing

Effectively communicate findings and recommendations to clients, insurance companies, and other stakeholders.

- Prepare clear and concise reports that detail the damage assessment and repair recommendations.

- Communicate effectively with clients to explain findings and answer queries.

4. Expert Testimony and Support

Provide expert testimony in legal proceedings as required.

- Support clients in legal disputes by providing expert opinions on the cause and extent of damage.

- Assist attorneys in preparing for trials and hearings.

Interview Tips

Preparing for an interview for a Physical Damage Appraiser position requires a strategic approach. Here are some valuable tips to help you excel:

1. Research the Company and Industry

Familiarize yourself with the company’s history, services, and target market.

- Research the physical damage appraisal industry, key trends, and best practices.

- Understanding the company’s values and align your skills and experience accordingly.

2. Showcase Your Technical Expertise

Highlight your knowledge of construction practices, materials, and repair techniques.

- Quantify your experience in estimating repair costs and providing accurate assessments.

- Discuss specific techniques or technologies you have employed to enhance your work.

3. Emphasize Communication and Client Service Skills

Demonstrate your ability to communicate effectively and build relationships with clients.

- Share examples of how you have effectively communicated complex technical information to non-technical audiences.

- Highlight your ability to build rapport and maintain positive relationships with clients.

4. Prepare for Industry-Specific Questions

Anticipate questions about your understanding of insurance policies, depreciation, and legal proceedings.

- Review common insurance terms and concepts to demonstrate your knowledge.

- Prepare to discuss your experience with depreciation calculations and salvage value assessments.

5. Seek Feedback and Practice

Conduct mock interviews with friends, family, or a career counselor to gain feedback on your presentation and answers.

- Record and review your practice interviews to identify areas for improvement.

- Seek constructive criticism to refine your communication style and enhance your confidence.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Physical Damage Appraiser role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.