Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Portfolio Analyst interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Portfolio Analyst so you can tailor your answers to impress potential employers.

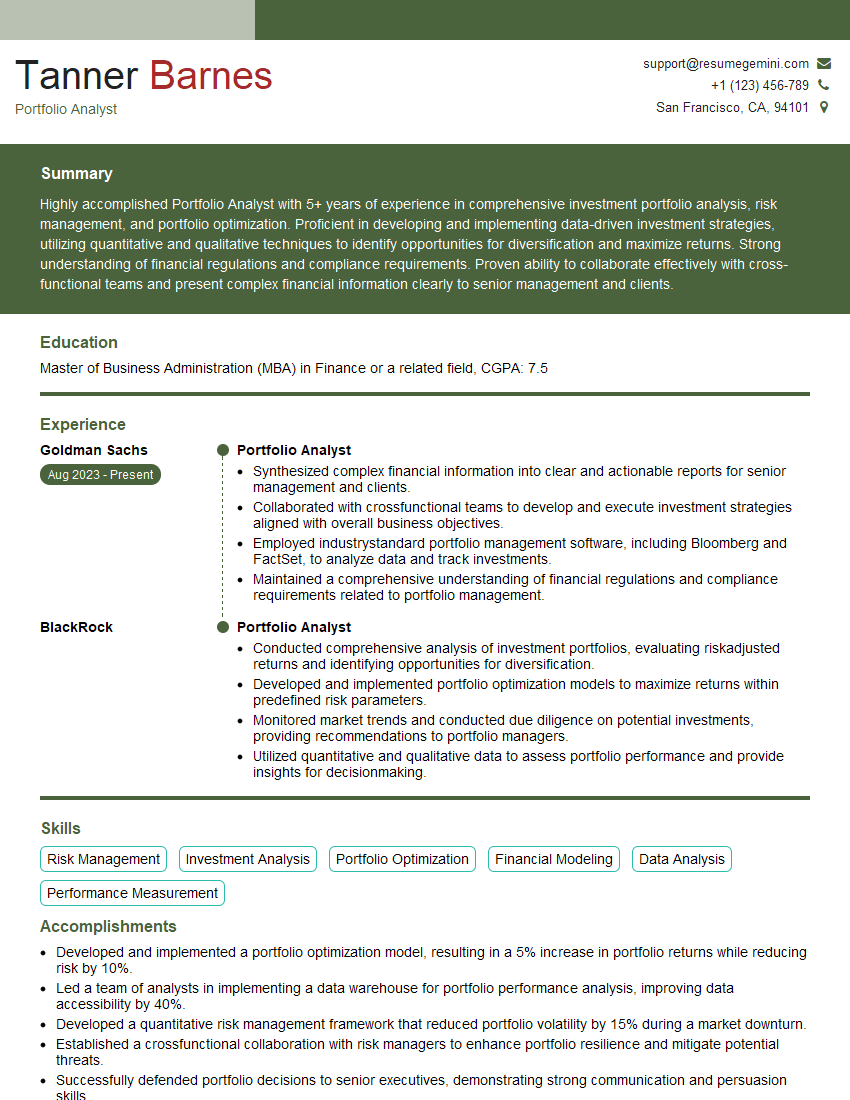

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Portfolio Analyst

1: What are the key responsibilities of a Portfolio Analyst?

As a Portfolio Analyst, my responsibilities encompass:

- Conducting in-depth financial analysis of investment portfolios to assess their performance and risk profiles.

- Developing and implementing investment strategies aligned with clients’ objectives and risk tolerance.

2: How do you evaluate the performance of an investment portfolio?

Risk Assessment

- Calculate risk metrics such as standard deviation, beta, and correlation to quantify portfolio risk.

- Analyze historical returns and volatility to assess the consistency and stability of performance.

Return Analysis

- Track portfolio returns against benchmarks and peer groups to assess relative performance.

- Evaluate the contribution of individual assets and asset classes to overall portfolio returns.

3: What are the different types of investment analysis techniques?

Investment analysis techniques include:

- Fundamental analysis: Examining a company’s financial statements, industry trends, and management to assess its intrinsic value.

- Technical analysis: Analyzing historical price data and patterns to identify trading opportunities.

- Quantitative analysis: Using statistical models and algorithms to predict future market behavior and optimize portfolio performance.

4: How do you incorporate ESG factors into your investment analysis?

Incorporating ESG (Environmental, Social, and Governance) factors into my analysis involves:

- Assessing the potential impact of ESG factors on company performance and valuation.

- Utilizing ESG data and ratings to identify companies with strong ESG practices and sustainable business models.

- Developing investment strategies that align with clients’ ESG preferences and values.

5: What is your approach to managing risk in an investment portfolio?

My approach to risk management includes:

- Identifying and quantifying different types of portfolio risks, such as market risk, credit risk, and liquidity risk.

- Implementing risk mitigation strategies, such as diversification, asset allocation, and hedging.

- Regularly monitoring portfolio performance and adjusting strategies as needed to manage risk.

6: How do you stay up-to-date with the latest investment trends and market developments?

To stay informed, I:

- Read industry publications and attend conferences.

- Network with other investment professionals and experts.

- Utilize market data and analytical tools to track market trends and identify opportunities.

7: What are the key challenges facing Portfolio Analysts in the current market environment?

Current market challenges for Portfolio Analysts include:

- Volatility and uncertainty created by geopolitical events and economic headwinds.

- Rising interest rates and inflation eroding portfolio returns.

- Increasing regulatory scrutiny and compliance requirements.

8: How do you handle working under pressure and meeting tight deadlines?

In a fast-paced environment, I:

- Prioritize tasks and manage my time effectively.

- Communicate clearly and collaborate with team members to ensure smooth execution.

- Stay focused and composed under pressure to deliver high-quality work.

9: What makes you a strong candidate for this Portfolio Analyst role?

My qualifications and experience align well with the requirements of this role:

- Strong analytical and problem-solving skills.

- Expertise in investment analysis and portfolio management.

- Excellent communication and presentation skills.

10: Where do you see yourself in your career in 5 years?

Within the next five years, my career goals are to:

- Advance my knowledge and skills in portfolio management and investment analysis.

- Take on leadership responsibilities within a team.

- Contribute to the success and growth of a reputable investment firm.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Portfolio Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Portfolio Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Portfolio Analyst is responsible for managing and evaluating investment portfolios, conducting financial analysis, and making recommendations to clients. The key job responsibilities of a Portfolio Analyst include:

1. Investment Analysis

Analyze financial data, market trends, and economic conditions to identify investment opportunities and make recommendations to clients.

- Conduct due diligence on potential investments

- Develop and maintain investment models

2. Portfolio Management

Manage investment portfolios according to client objectives and risk tolerance, including asset allocation, diversification, and rebalancing.

- Monitor portfolio performance and make adjustments as needed

- Provide regular reporting to clients

3. Client Relations

Build and maintain relationships with clients, understand their investment goals, and provide tailored advice.

- Meet with clients to discuss investment strategies

- Respond to client inquiries and provide guidance

4. Risk Management

Identify and mitigate investment risks, including market risk, credit risk, and operational risk.

- Develop and implement risk management strategies

- Monitor portfolio risk and take corrective action

Interview Tips

To prepare for an interview for a Portfolio Analyst position, it is essential to:

1. Research the company and the role

Familiarize yourself with the company’s investment philosophy, portfolio management strategies, and client base. Understand the specific responsibilities and expectations for the Portfolio Analyst role.

- Visit the company’s website and read its financial reports and press releases

- Connect with current and former employees on LinkedIn to gather insights

2. Practice your technical skills

Be prepared to demonstrate your proficiency in financial analysis, portfolio management, and risk management. Review concepts such as asset allocation, diversification, and risk assessment.

- Solve practice problems and case studies to test your analytical abilities

- Prepare examples of your investment analysis and portfolio management experience

3. Highlight your client-facing skills

Portfolio Analysts often interact with clients, so it is essential to showcase your communication, interpersonal, and relationship-building skills. Emphasize your ability to understand client goals, provide clear investment advice, and build rapport.

- Describe experiences where you have successfully managed client relationships

- Role-play mock client interactions to demonstrate your communication skills

4. Prepare for behavioral questions

Behavioral interview questions are common in Portfolio Analyst interviews. Prepare by reflecting on your past experiences and identifying examples that demonstrate your analytical skills, problem-solving abilities, and work ethic.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

- Quantify your accomplishments and highlight the impact of your work

5. Practice your presentation skills

You may be asked to present your investment analysis or portfolio management recommendations during the interview. Practice delivering a clear and concise presentation that effectively communicates your insights and recommendations.

- Prepare a brief presentation on a current investment topic

- Practice presenting your ideas to a mock audience

Next Step:

Now that you’re armed with the knowledge of Portfolio Analyst interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Portfolio Analyst positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini