Are you gearing up for a career in Principal Associate? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Principal Associate and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

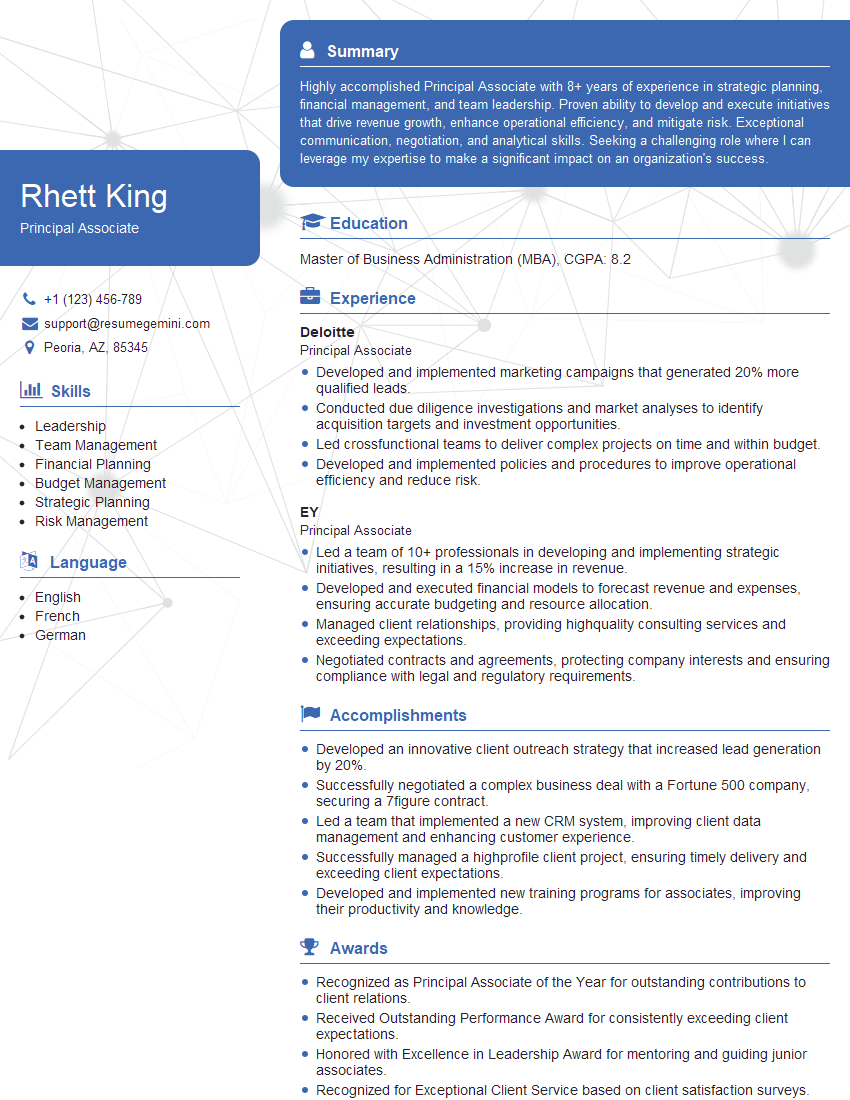

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Principal Associate

1. What are your key responsibilities as a Principal Associate?

As a Principal Associate, I would be responsible for:

- Leading and managing a team of associates and analysts

- Developing and executing investment strategies

- Conducting due diligence on potential investments

- Monitoring and managing portfolio investments

- Providing investment advice to clients

2. Can you describe your experience in developing and executing investment strategies?

Experience in Developing Investment Strategies

- Developed investment strategies for a variety of clients, including individuals, families, and institutions

- Used a variety of investment strategies, including fundamental analysis, technical analysis, and quantitative analysis

- Traced and monitored economic trends, market conditions, and industry developments to make informed investment decisions

Experience in Executing Investment Strategies

- Executed investment strategies across a variety of asset classes, including equities, bonds, and alternative investments

- Used a variety of investment vehicles, including mutual funds, ETFs, and hedge funds

- Monitored and managed portfolio investments to ensure they aligned with the client’s objectives

3. What are your key strengths as a Principal Associate?

My key strengths as a Principal Associate include:

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- A deep understanding of the financial markets

- A proven track record of success in developing and executing investment strategies

- A commitment to providing exceptional client service

4. What are your areas of expertise within the financial industry?

My areas of expertise within the financial industry include:

- Investment strategy development and execution

- Portfolio management

- Financial analysis

- Risk management

- Client relationship management

5. What are your career goals for the next 5 years?

My career goals for the next 5 years are to:

- Continue to develop my skills and knowledge in the financial industry

- Take on increasingly challenging roles and responsibilities

- Become a recognized expert in my field

- Make a significant contribution to the firm and its clients

- Build a successful and fulfilling career in the financial industry

6. What are your thoughts on the current state of the financial markets?

The current state of the financial markets is complex and uncertain. There are a number of factors that are contributing to this uncertainty, including the COVID-19 pandemic, the war in Ukraine, and rising inflation. However, there are also a number of positive factors that could support the markets in the long term, such as strong economic growth and low interest rates. Overall, I believe that the financial markets are still in a period of transition, and it is difficult to predict what will happen in the short term. However, I am optimistic about the long-term prospects for the markets.

7. What are your favorite technical indicators and why?

I use a variety of technical indicators in my investment analysis. Some of my favorites include:

- Moving averages

- Support and resistance levels

- Relative strength index (RSI)

- Moving average convergence divergence (MACD)

- Fibonacci retracements

I find these indicators to be particularly helpful in identifying trends, momentum, and potential trading opportunities.

8. How do you stay up-to-date on the latest developments in the financial industry?

I stay up-to-date on the latest developments in the financial industry by reading a variety of sources, including:

- Financial news websites and publications

- Industry research reports

- Company press releases

- SEC filings

- Attending industry conferences and webinars

I also follow a number of financial experts on social media and subscribe to their newsletters.

9. What are your thoughts on the future of the financial industry?

I believe that the future of the financial industry is bright. There are a number of trends that are driving innovation and growth in the industry, including:

- The rise of fintech

- The increasing popularity of passive investing

- The globalization of the financial markets

- The growing demand for financial advice

I believe that these trends will continue to shape the industry in the years to come, and I am excited to be a part of it.

10. Do you have any questions for me?

I do have a few questions for you:

- What is the firm’s investment philosophy?

- What are the firm’s growth plans for the future?

- What are the firm’s expectations for a Principal Associate?

- What is the firm’s culture like?

- What is the next step in the interview process?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Principal Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Principal Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Principal Associates are responsible for servicing high-profile clients and generating a substantial book of business. They lead and drive large, complex advisory engagements and provide strategic advice to clients on a range of financial matters. The key job responsibilities include:

1. Client Relationships

Principal Associates are responsible for developing and maintaining strong relationships with high-profile clients. They understand the client’s business, financial goals, and risk tolerance to provide tailored advice and solutions.

2. Business Development

Principal Associates are responsible for generating a substantial book of business. They proactively identify and develop new client opportunities and build relationships with potential clients. They also grow existing client relationships by providing exceptional service and identifying new opportunities to serve their needs.

3. Project Management

Principal Associates lead and drive large, complex advisory engagements. They develop and execute project plans, manage teams, and coordinate with other departments to ensure the successful delivery of client services. They also manage project budgets and timelines to ensure that projects are completed on time and within budget.

4. Financial Advisory Services

Principal Associates provide strategic advice to clients on a range of financial matters, including mergers and acquisitions, capital raising, financial restructuring, and risk management. They use their knowledge and experience to help clients make informed decisions and achieve their financial goals.

Interview Tips

Interviewing for a Principal Associate position can be a challenging but rewarding experience. Here are a few tips to help you prepare and ace your interview:

1. Research the Company

Before you go into your interview, take some time to research the company. This will help you understand the company’s culture, values, and goals. You should also learn about the company’s products, services, and clients. This will help you answer questions about the company and show the interviewer that you are interested in the position.

2. Practice Your Answers

It’s a good idea to practice your answers to common interview questions before you go into your interview. This will help you feel more confident and prepared. You should also prepare questions to ask the interviewer. This will show the interviewer that you are engaged in the conversation and interested in the position.

3. Dress Professionally

First impressions matter. Make sure you dress professionally for your interview. This means wearing a suit or business dress. You should also make sure that your clothes are clean and well-pressed.

4. Be Yourself

The most important thing is to be yourself. The interviewer wants to get to know the real you. Don’t try to be someone you’re not. The interviewer will be able to tell if you’re being fake. Just relax and be yourself.

Next Step:

Now that you’re armed with the knowledge of Principal Associate interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Principal Associate positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini