Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Private Equity Associate interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Private Equity Associate so you can tailor your answers to impress potential employers.

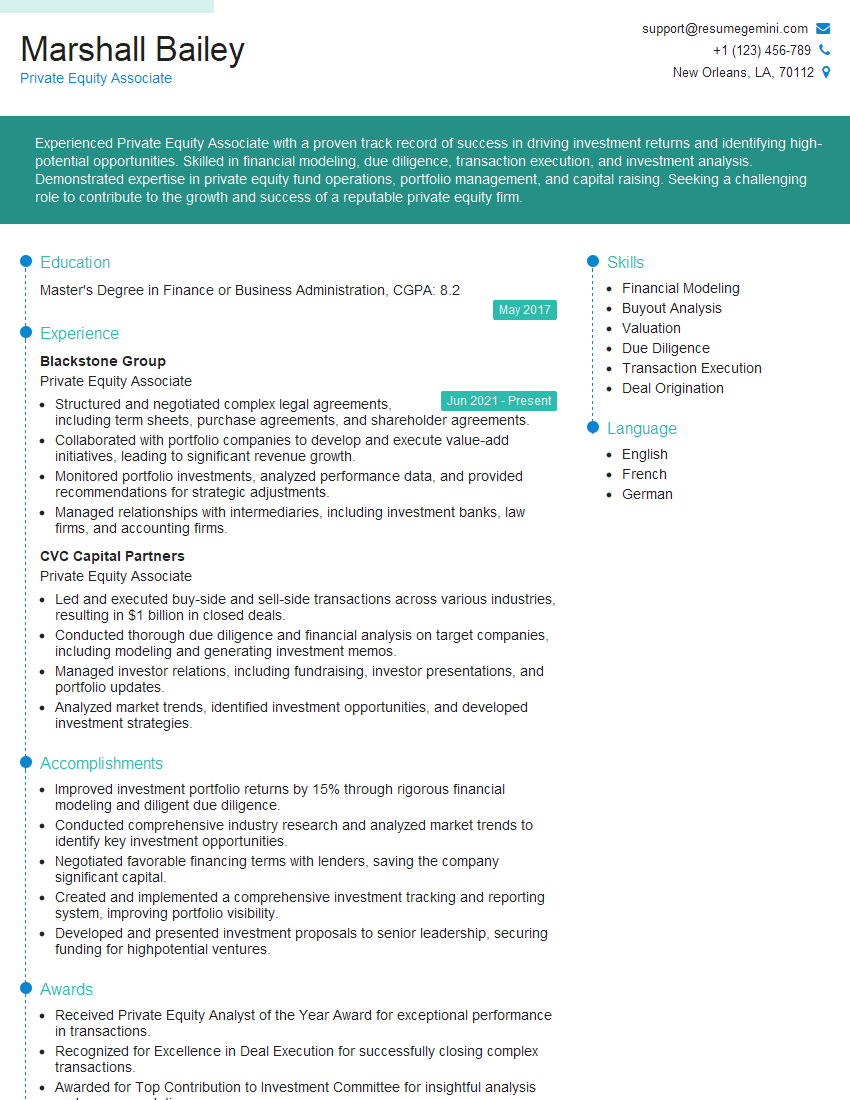

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Private Equity Associate

1. Walk me through your process for evaluating a potential investment opportunity.

- Identify the investment opportunity and gather relevant information.

- Conduct due diligence on the target company, including financial analysis, market research, and management interviews.

- Develop a financial model to project the potential return on investment.

- Assess the risks and rewards of the investment, and make a recommendation to the investment committee.

2. How do you approach valuing a privately held company?

subheading of the answer

- Comparable company analysis: Comparing the target company to similar publicly traded companies.

- Discounted cash flow analysis: Projecting the future cash flows of the target company and discounting them back to the present day.

subheading of the answer

- Transaction precedent analysis: Reviewing recent transactions involving similar companies to determine market pricing.

- Asset-based valuation: Calculating the value of the target company’s assets, such as inventory, property, and equipment.

3. What are the key factors you consider when structuring a private equity deal?

- The investment horizon and return objectives of the fund.

- The risk profile and financial condition of the target company.

- The competitive landscape and industry dynamics.

- The regulatory and legal environment.

4. How do you manage portfolio companies after an investment has been made?

- Regularly monitoring the financial performance and operations of the portfolio company.

- Providing strategic guidance and support to the management team.

- Assisting with fundraising, acquisitions, and other corporate events.

- Working with other stakeholders, such as lenders and co-investors.

5. What are some of the challenges and opportunities in the private equity industry?

- Challenges:

- Intense competition for investment opportunities.

- Volatility in the financial markets.

- Regulatory and compliance risks.

- Opportunities:

- Access to attractive investment opportunities with high return potential.

- Ability to generate alpha through active management.

- Growing demand for private equity investments from institutional investors.

6. How do you stay up-to-date on industry trends and best practices?

- Reading industry publications and attending conferences.

- Networking with other professionals in the industry.

- Conducting research and analysis on industry trends.

- Participating in professional development programs.

7. What are your career goals and how does this role align with them?

- My long-term career goal is to become a partner in a private equity firm.

- This role aligns with my goal because it will provide me with the opportunity to gain experience in all aspects of private equity investing, from deal sourcing and execution to portfolio management and exit.

- I am confident that I have the skills and experience necessary to be successful in this role and to make a significant contribution to the firm.

8. Why are you interested in working for our firm?

- I am attracted to the firm’s reputation as a leading private equity investor.

- I am impressed by the firm’s investment track record and the quality of the team.

- I believe that my skills and experience would be a valuable asset to the firm.

- I am excited about the opportunity to contribute to the firm’s continued success.

9. What are your strengths and weaknesses as they relate to this role?

- Strengths:

- Strong analytical and financial modeling skills.

- Excellent communication and interpersonal skills.

- Experience in deal sourcing and execution.

- Weaknesses:

- Limited experience in portfolio management.

- Not yet a CFA charterholder.

10. Do you have any questions for me?

- What is the firm’s investment strategy?

- What is the firm’s track record?

- What is the culture of the firm like?

- What are the opportunities for professional development?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Private Equity Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Private Equity Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Private Equity Associates play a crucial role in the investment process of private equity firms, assisting Senior Associates and Principals in deal sourcing, due diligence, and portfolio management.

1. Deal Sourcing and Evaluation

Identify and evaluate potential investment opportunities through various channels such as cold calling, attending industry events, and networking.

- Develop a pipeline of potential investment targets and conduct preliminary due diligence.

- Prepare investment summaries and participate in pitch presentations to the investment committee.

2. Due Diligence

Thoroughly examine and analyze potential investments, including financial, operational, legal, and market due diligence.

- Review financial statements, conduct site visits, and interview management teams.

- Identify potential risks, assess growth opportunities, and recommend investment decisions.

3. Transaction Execution

Assist in the execution of investment transactions, including drafting legal agreements, negotiating terms, and coordinating with transaction advisors.

- Prepare term sheets, negotiate key deal points, and finalize transaction documents.

- Coordinate with lawyers, accountants, and other professionals to ensure compliance and maximize investment value.

4. Portfolio Management

Monitor and track the performance of existing portfolio companies, providing support and guidance to management teams.

- Attend board meetings, review financial results, and identify opportunities for growth.

- Assist in the development and implementation of value creation plans.

Interview Tips

Preparing thoroughly for a Private Equity Associate interview is essential to showcase your skills and increase your chances of success.

1. Research the Firm and Industry

Familiarize yourself with the firm’s investment strategy, portfolio, and team. Research key industry trends and recent deals in the sector.

- Visit the firm’s website and social media platforms for insights into their culture and values.

- Read industry publications, attend webinars, and network with professionals to stay up-to-date on market developments.

2. Highlight Your Skills and Experience

Emphasize your analytical, financial modeling, and due diligence Fähigkeiten. Showcase your understanding of private equity investment principles and deal execution processes.

- Quantify your accomplishments whenever possible, providing specific examples of deals you have worked on or projects you have led.

- Explain how your skills and experience align with the key responsibilities of the role.

3. Practice Case Studies and Technical Questions

Most interviews include case studies or technical questions to assess your problem-solving, analytical, and financial modeling abilities.

- Review basic financial modeling concepts and practice building models in Excel or other software.

- Prepare for case studies by analyzing sample cases and developing a structured framework for approaching the analysis.

4. Be Prepared to Discuss Your Motivation

Explain why you are passionate about private equity and how your goals align with the firm’s objectives.

- Share your understanding of the industry and why you believe it is a compelling career path.

- Demonstrate your eagerness to learn and contribute to the team’s success.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Private Equity Associate, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Private Equity Associate positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.