Are you gearing up for a career in Project Accountant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Project Accountant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

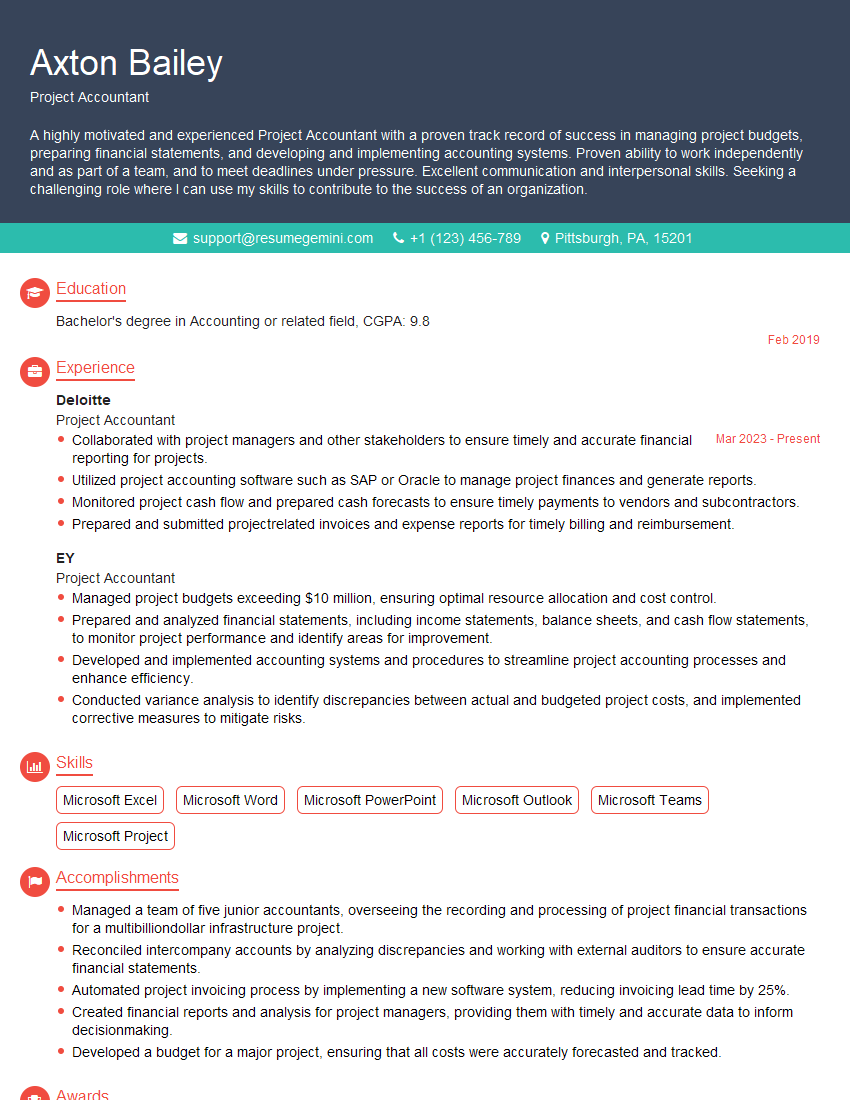

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Project Accountant

1. What are the key responsibilities of a Project Accountant?

- Maintaining project budgets and tracking project costs

- Preparing and analyzing financial reports for project stakeholders

- Ensuring compliance with accounting standards and regulations

- Working with project managers to identify and mitigate financial risks

- Preparing and filing tax returns for projects

2. What are the most important accounting principles that apply to project accounting?

Accrual accounting

- Revenue and expenses are recognized when they are earned or incurred, regardless of when cash is received or paid

- Assets and liabilities are recorded on the balance sheet at their historical cost or fair value

Matching principle

- Expenses are matched to the revenues they generate in the same period

- This ensures that the financial statements accurately reflect the profitability of projects

Consistency principle

- The same accounting methods are used from period to period

- This allows for comparability of financial statements over time

3. What are the different types of project costs?

- Direct costs: These costs are directly related to the project and can be easily traced to it, such as materials, labor, and equipment

- Indirect costs: These costs are not directly related to the project but are necessary for the project to be completed, such as overhead costs and administrative expenses

- Fixed costs: These costs do not change with the level of activity, such as rent and depreciation

- Variable costs: These costs change with the level of activity, such as materials and labor

4. What are the different types of project budgets?

- Operating budget: This budget outlines the expected revenues and expenses of the project

- Capital budget: This budget outlines the expected capital expenditures of the project

- Cash flow budget: This budget outlines the expected cash inflows and outflows of the project

5. What are the different types of project financial reports?

- Project status report: This report provides an overview of the project’s financial performance, including actual costs, budgeted costs, and variances

- Project forecast report: This report provides an estimate of the project’s future financial performance, including expected revenues, expenses, and cash flows

- Project profitability report: This report shows the profitability of the project, including the net income and return on investment

6. What are the different types of project accounting software?

- Enterprise resource planning (ERP) systems: These systems integrate all aspects of a company’s financial operations, including project accounting

- Project management software: These systems help project managers plan, execute, and control projects, and they often include accounting features

- Standalone project accounting software: These systems are designed specifically for project accounting and they offer a wide range of features

7. What are the benefits of using project accounting software?

- Improved accuracy and efficiency

- Increased visibility and control over project costs

- Improved decision-making

- Reduced risk of financial problems

- Improved compliance with accounting standards and regulations

8. What are the challenges of project accounting?

- Tracking and allocating costs accurately

- Dealing with uncertainty and change

- Ensuring compliance with accounting standards and regulations

- Working with different stakeholders with different needs

- Managing risk

9. What are the trends in project accounting?

- Increased use of technology

- Greater focus on data analytics

- Increased collaboration between project accountants and project managers

- Greater emphasis on risk management

- Increased use of cloud-based accounting software

10. What are the qualities of a successful Project Accountant?

- Strong accounting skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Strong attention to detail

- Ability to think critically and solve problems

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Project Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Project Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Project Accountants play a critical role in ensuring the financial success of projects within an organization. Their responsibilities are varied and require a solid understanding of accounting principles, project management methodologies, and industry-specific knowledge. Key responsibilities include:1. Project Budget Management

Project Accountants are responsible for developing and managing project budgets. This involves:

- Estimating project costs, including direct and indirect expenses.

- Monitoring project expenses and identifying potential cost overruns.

- Preparing and presenting budget reports to project managers and stakeholders.

2. Project Billing and Collections

Project Accountants handle the billing and collection process for projects. This includes:

- Creating and issuing invoices to clients.

- Tracking payments and reconciling accounts.

- Managing accounts receivable and following up on overdue payments.

3. Financial Reporting and Analysis

Project Accountants provide financial reporting and analysis to project managers and stakeholders. This may include:

- Preparing profit and loss statements, balance sheets, and cash flow statements.

- Analyzing financial data to identify trends and areas for improvement.

- Making recommendations on how to improve project financial performance.

4. Compliance with Accounting Standards

Project Accountants must ensure that all accounting and financial activities comply with applicable accounting standards. This may include:

- Following Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Maintaining proper documentation and records to support financial transactions.

- Collaborating with external auditors to ensure compliance with regulatory requirements.

Interview Preparation Tips

Preparing thoroughly for a Project Accountant interview is crucial to increase your chances of success. Here are some tips to help you prepare effectively:1. Research the Company and Role

Take the time to research the company’s website, industry, and recent news. Understanding the company’s culture and values will help you tailor your answers to the interviewer’s questions.

Review the job description carefully to identify the key skills and experience required. Highlight any relevant skills and experiences in your resume and cover letter, and be prepared to discuss them in the interview.

2. Practice Common Interview Questions

Prepare for commonly asked interview questions, such as:

- Tell me about your experience in project accounting.

- Describe a time when you successfully managed a project budget.

- How do you ensure compliance with accounting standards?

- What are your strengths and weaknesses as a Project Accountant?

- Why are you interested in this role?

3. Demonstrate Your Skills

Use the STAR method (Situation, Task, Action, Result) to answer behavioral interview questions. For example:

Interviewer: “Tell me about a time when you faced a challenge in managing a project budget.”

Candidate: “In my previous role, I was responsible for managing the budget for a large-scale construction project. During the project, we encountered unforeseen delays and cost overruns. I worked closely with the project manager and other stakeholders to identify cost-saving opportunities and negotiate with vendors. As a result, we were able to complete the project within the revised budget and on time.”

4. Ask Thoughtful Questions

At the end of the interview, ask the interviewer thoughtful questions about the role, team, and company. This shows your interest and enthusiasm for the position.

Example questions:

- Can you tell me more about the typical project lifecycle within the company?

- What is the reporting structure for this role?

- What are the opportunities for professional development within the company?

5. Follow Up

After the interview, send a thank-you note to the interviewer within 24 hours. Thank them for their time and reiterate your interest in the position.

You may also follow up a few days later to inquire about the next steps in the hiring process or to provide additional information that you may have forgotten to mention during the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Project Accountant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!