Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Property Accountant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Property Accountant so you can tailor your answers to impress potential employers.

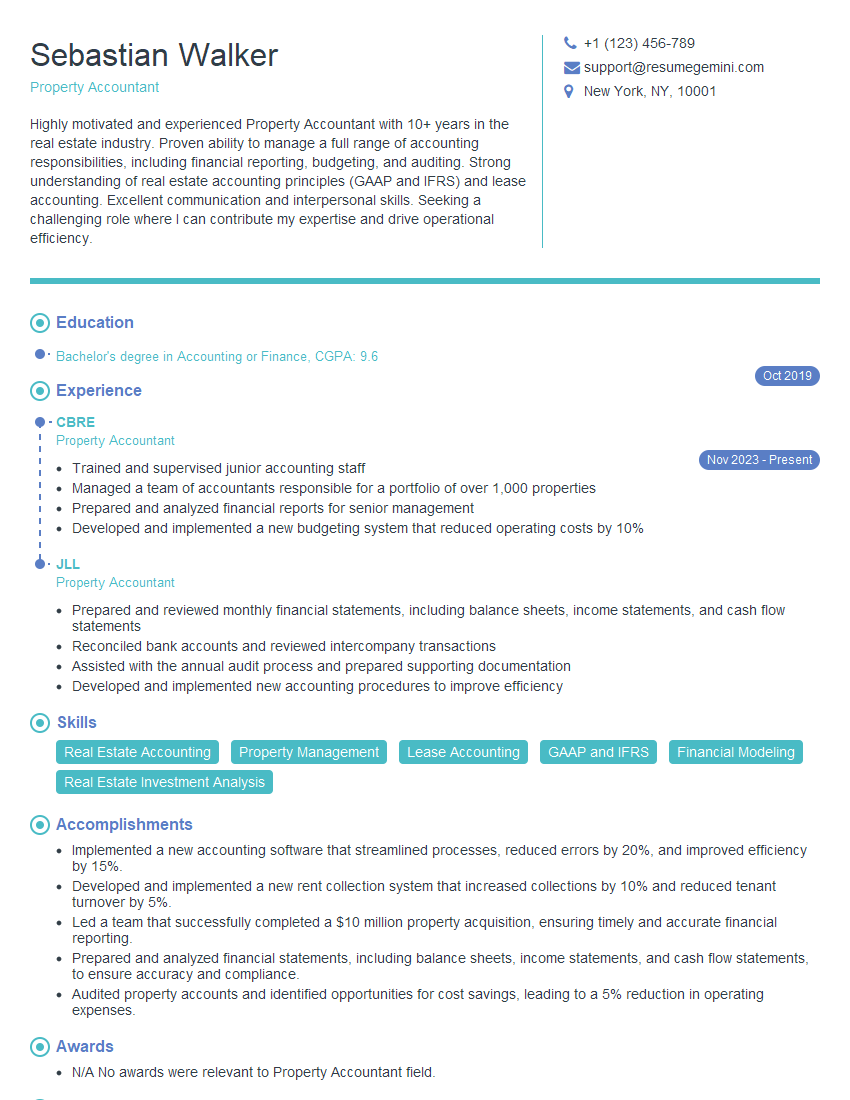

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Property Accountant

1. Explain the accrual accounting method and how it is used in property accounting?

- Accrual accounting recognizes revenue when earned and expenses when incurred, regardless of cash flow.

- In property accounting, accrual method is used to record rent revenue and expenses even if cash has not yet been received or paid.

- This ensures that financial statements accurately reflect the company’s financial performance.

2. What are the key differences between GAAP and IFRS accounting standards for real estate?

GAAP

- Primary focus on protecting investors and creditors

- Rules-based, which provides more specific guidance

- Focuses on historical cost and less on fair value

IFRS

- Focuses on providing relevant information to users

- Principle-based, which provides more flexibility

- Emphasis on fair value and present value

3. Describe the process of reconciling bank statements for a property management company?

- Compare transactions on the bank statement to those recorded in the company’s books.

- Identify and investigate any discrepancies.

- Record any necessary adjustments to the company’s accounts.

- Ensure that the bank statement balance matches the company’s cash balance.

4. What are the common types of lease accounting transactions and how are they recorded?

- Operating Leases: Rent expense is recognized over the lease term. No assets or liabilities are recorded.

- Finance Leases: The asset is capitalized and an obligation is recorded. Interest expense and depreciation are recognized over the lease term.

- Sale-Leasebacks: The sale of a property is recorded as a gain. The leaseback is recorded as an operating lease.

5. How do you calculate and account for depreciation of property assets?

- Determine the depreciable cost of the asset.

- Estimate the useful life of the asset.

- Select an appropriate depreciation method.

- Calculate the annual depreciation expense and record it as an expense.

- Accumulate depreciation in a contra-asset account.

6. What are the challenges of managing cash flow for a real estate investment trust (REIT)?

- REITs rely on rental income, which can be seasonal or cyclical.

- REITs have high capital expenditures for property acquisition and development.

- REITs are subject to debt covenants that restrict cash flow.

- Economic downturns can impact rental demand and property values.

7. How would you implement a new accounting software system for a property management company?

- Conduct a thorough needs assessment.

- Evaluate and select the appropriate software.

- Train staff on the new system.

- Convert data from the old system to the new system.

- Monitor the implementation and make adjustments as needed.

8. What are the accounting implications of environmental regulations on property management?

- Properties may need to be upgraded to meet environmental standards.

- Environmental remediation costs can be significant.

- Non-compliance can result in fines and penalties.

- Properly accounting for environmental liabilities is crucial.

9. How do you ensure that the financial statements of a property management company comply with Generally Accepted Accounting Principles (GAAP)?

- Establish internal controls to prevent and detect errors.

- Perform regular reconciliations and analysis.

- Review financial statements for reasonableness and accuracy.

- Consult with independent auditors as needed.

10. What are the emerging trends in property accounting and how do you stay up-to-date with these trends?

- Increased use of technology, such as cloud-based accounting software.

- Focus on data analytics and business intelligence.

- Adoption of new accounting standards, such as ASC 842.

- Staying up-to-date through continuing education, industry publications, and conferences.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Property Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Property Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Property Accountant is accountable for maintaining the financial records of real estate properties. They ensure the accuracy of financial statements, manage accounts payable and receivable, and prepare tax returns. Their responsibilities include:

1. Financial Reporting

Preparing financial statements such as balance sheets, income statements, and cash flow statements

- Ensuring that financial statements comply with Generally Accepted Accounting Principles (GAAP)

- Analyzing financial data and identifying trends and patterns

2. Accounts Payable and Receivable

Managing accounts payable and receivable, including invoice processing, payment processing, and collection

- Reconciling bank statements and identifying discrepancies

- Preparing and filing tax returns

3. Budgeting and Forecasting

Developing and managing budgets for property operations

- Preparing financial forecasts and projections

- Monitoring actual results against budgets and forecasts

4. Internal Control

Developing and implementing internal controls to ensure the accuracy and reliability of financial information

- Conducting internal audits and reviews

- Identifying and mitigating financial risks

Interview Tips

To ace the Property Accountant interview, it’s essential to prepare thoroughly and showcase your skills and experience. Here are some tips:

1. Research the Company and Industry

Before the interview, research the company’s website, financial statements, and industry trends. This demonstrates your interest and shows the interviewer that you have a basic understanding of their business.

- Look for news articles or industry reports that mention the company or its competitors.

2. Highlight Relevant Skills and Experience

Review the job description and identify the skills and experience that are most relevant to the role. Be prepared to provide specific examples of how you have applied these skills in the past.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide clear and concise examples.

3. Practice Common Interview Questions

Anticipate common interview questions and prepare your answers beforehand. Practice with a friend or family member to gain confidence and refine your delivery.

- Prepare for questions about your accounting knowledge, experience with financial reporting, and budgeting and forecasting.

4. Ask Thoughtful Questions

At the end of the interview, ask thoughtful questions that demonstrate your engagement and interest in the role. This can be an opportunity to clarify any aspects of the job or to ask about the company’s culture and growth plans.

- Ask about the company’s financial performance and any recent acquisitions or expansions.

5. Follow Up

After the interview, send a thank-you email to the interviewer. Reiterate your interest in the role and highlight any additional information that you may have forgotten to mention during the interview.

- In the follow-up email, you can also request feedback on your performance or inquire about the next steps in the hiring process.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Property Accountant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.