Feeling lost in a sea of interview questions? Landed that dream interview for Property Adjuster but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Property Adjuster interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

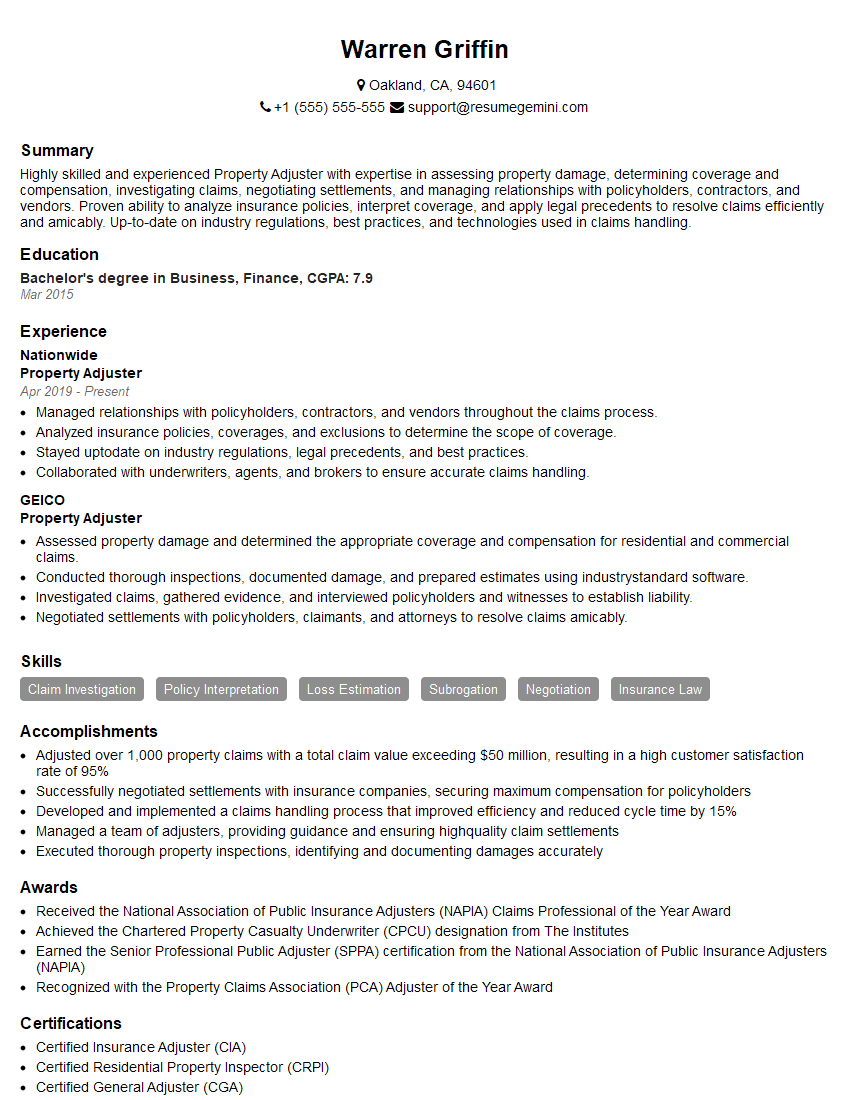

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Property Adjuster

1. How would you handle a situation where the policyholder disagrees with your assessment of the damages?

– Actively listen to the policyholder’s concerns and perspective. – Explain the basis of your assessment clearly and professionally. – Provide supporting documentation and evidence to justify your findings. – Seek additional information or expert opinions if necessary. – Be willing to negotiate and compromise, within the bounds of the policy coverage and industry standards.

2. What is your approach to estimating the replacement cost of damaged items?

Cost Approach

- Determine the current market value of an identical or similar item.

- Consider depreciation and apply applicable factors.

Comparable Sales Approach

- Analyze recent sales of comparable items in the area.

- Adjust for differences in size, features, and condition.

Contractor’s Estimate

- Obtain estimates from qualified contractors or vendors.

- Verify the accuracy and reasonableness of the estimates.

3. Describe your experience in assessing damages caused by complex events, such as natural disasters.

– Share specific examples of handling complex claims, including the types of damages encountered. – Explain how you collaborated with engineers, contractors, or other experts to determine the extent of the damage. – Discuss the challenges you faced and how you overcame them. – Highlight your ability to prioritize and allocate resources effectively in high-stakes situations.

4. How do you determine liability in the case of a disputed property damage claim?

– Review the policy language and relevant legal precedents. – Gather evidence from the policyholder, witnesses, and other sources. – Analyze the facts and circumstances surrounding the incident. – Consult with legal counsel if necessary. – Make a determination based on the preponderance of the evidence.

5. What software and tools do you use to assess and document property damage?

– Xactimate or similar estimating software – Digital cameras and measuring tools – Property inspection software – Note-taking apps and dictation software – Cloud-based collaboration tools

6. How do you stay up-to-date on industry trends and best practices in property adjusting?

– Attend industry conferences and seminars – Read professional journals and publications – Participate in online forums and discussion groups – Network with other professionals in the field – Obtain industry certifications and designations

7. What is your approach to negotiating settlements with policyholders?

– Understand the policyholder’s needs and concerns. – Be prepared to justify your assessment and support your findings. – Negotiate fairly and ethically, within the parameters of the policy. – Seek compromise and mutually acceptable solutions. – Document the settlement agreement clearly and thoroughly.

8. How do you handle the emotional aspects of dealing with policyholders who have experienced a loss?

– Approach policyholders with empathy and compassion. – Actively listen to their concerns and validate their emotions. – Provide clear and concise information. – Be patient and understanding, recognizing that this is a stressful time for them. – Offer support and guidance throughout the claims process.

9. Describe a challenging situation you faced as a property adjuster and how you resolved it.

– Provide specific details about the situation, including the nature of the loss and the challenges you encountered. – Explain the steps you took to resolve the issue, including any research or collaboration. – Highlight your problem-solving abilities, adaptability, and resilience. – Discuss the outcome of the situation and what you learned from the experience.

10. Why are you interested in this property adjuster position and how do your skills align with our company’s needs?

– Express your enthusiasm for the position and the opportunity to contribute to the team. – Research the company and its values. – Highlight your relevant experience, skills, and qualifications. – Explain how your strengths can benefit the organization and support their objectives.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Property Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Property Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Property Adjuster is responsible for evaluating and settling insurance claims related to property damage. Here are some key job responsibilities:

1. Claim Investigation

Investigating and determining the cause and extent of property damage, which may involve visiting the property, interviewing witnesses, and reviewing documents.

- Obtaining photographs and evidence to support the claim.

- Preparing detailed reports documenting the findings and recommendations.

2. Claim Settlement

Negotiating and settling claims with policyholders and claimants, considering policy coverage, liability, and applicable laws.

- Determining the amount of compensation to be paid based on the policy terms.

- Explaining the settlement process and answering questions from policyholders and claimants.

3. Loss Prevention

Providing recommendations to policyholders on ways to prevent or minimize future losses, such as safety measures and risk management strategies.

- Conducting property inspections to identify potential hazards.

- Educating policyholders on safety practices and loss prevention techniques.

4. Customer Service

Providing excellent customer service by responding promptly to inquiries, addressing concerns, and resolving issues in a professional and compassionate manner.

- Maintaining open communication with policyholders and claimants throughout the claim process.

- Building strong relationships with policyholders, claimants, and other stakeholders.

Interview Preparation Tips

To ace the interview for a Property Adjuster position, it’s essential to prepare thoroughly. Here are some tips to help you succeed:

1. Research the Company and the Position

Familiarize yourself with the insurance company, its history, products, and market reputation. Learn about the specific Property Adjuster role, its responsibilities, and the company’s expectations.

- Visit the company website, read industry publications, and connect with current or former employees on LinkedIn.

- Refer to the job description carefully to understand the key qualifications and areas of focus.

2. Highlight Your Relevant Skills and Experience

Emphasize your skills and experience that are relevant to the Property Adjuster role. Focus on your ability to investigate and settle claims, your knowledge of insurance policies and procedures, and your customer service skills.

- Quantify your accomplishments whenever possible, using specific examples and metrics to demonstrate your impact.

- Be prepared to discuss how your previous experience has equipped you with the necessary skills for the position.

3. Practice Common Interview Questions

Anticipate common interview questions and prepare your answers in advance. Practice presenting your responses in a clear, concise, and engaging manner.

- Questions related to your claim investigation and settlement experience.

- Questions about your knowledge of insurance policies, loss prevention, and customer service.

4. Show Enthusiasm and Confidence

During the interview, demonstrate your enthusiasm for the role and your confidence in your abilities. Express your passion for helping policyholders and your commitment to providing excellent customer service.

- Be yourself and let your personality shine through, while maintaining a professional and respectful demeanor.

- Ask thoughtful questions that show your interest in the company and the position.

5. Dress Professionally and Arrive on Time

First impressions matter, so dress professionally and arrive for your interview on time. This shows that you respect the interviewer and the opportunity.

- Choose appropriate attire, such as a suit or business dress, that is clean and well-pressed.

- Be punctual and arrive at the interview location well in advance to avoid any unexpected delays.

Next Step:

Now that you’re armed with the knowledge of Property Adjuster interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Property Adjuster positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini