Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Proprietary Trader position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

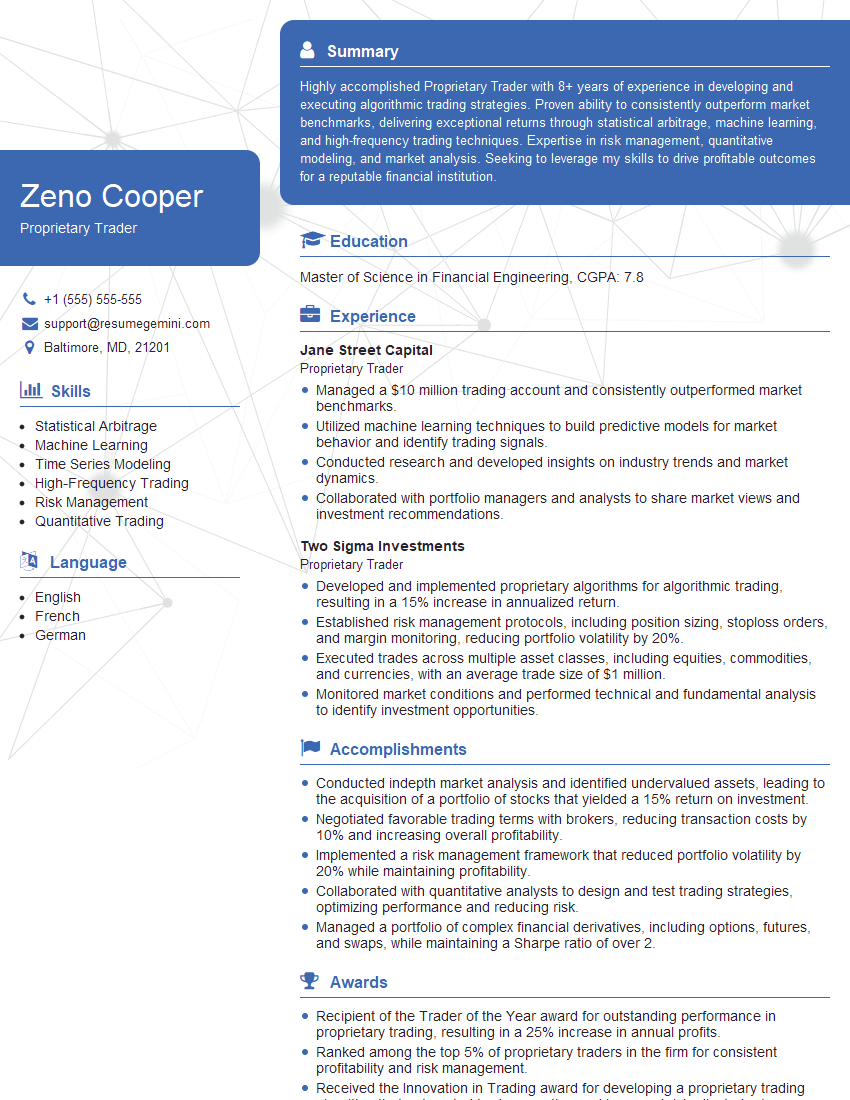

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Proprietary Trader

1. What are the key factors you consider when developing a trading strategy?

In developing a trading strategy, I focus on several key factors:

- Market Analysis: I conduct thorough research on the target market, identifying trends, market conditions, and potential opportunities.

- Risk Management: Establishing clear risk parameters is crucial. I define acceptable levels of risk, implement stop-loss orders, and manage position sizing to mitigate potential losses.

- Technical Analysis: I utilize technical indicators and chart patterns to identify market trends, reversals, and potential entry and exit points.

- Economic Data and News Events: I closely monitor macroeconomic data releases, central bank announcements, and geopolitical events that may impact market movements.

- Behavioral Finance: I acknowledge and consider the influence of psychology and cognitive biases on market behavior, which can provide insights into market sentiment and price fluctuations.

2. Describe your approach to backtesting and optimizing trading strategies.

Backtesting

- I utilize historical market data to simulate trading strategies, evaluating their performance under various market conditions.

- I focus on metrics such as profitability, maximum drawdown, and Sharpe ratio to assess the robustness and consistency of the strategy.

- I conduct sensitivity analysis to determine the impact of different parameters and assumptions on strategy performance.

Optimization

- After backtesting, I refine the strategy by adjusting parameters such as entry and exit signals, risk management rules, and position sizing.

- I utilize optimization algorithms or manual iteration to identify the optimal combination of parameters that maximize performance metrics.

3. How do you manage risk in your trading strategies?

Risk management is a cornerstone of my trading approach:

- Risk Tolerance: I establish a clear risk tolerance level and adhere to it strictly.

- Position Sizing: I calculate optimal position sizes based on risk tolerance, account balance, and market volatility.

- Stop-Loss Orders: I implement stop-loss orders to limit potential losses and protect capital.

- Trailing Stops: I utilize trailing stops to lock in profits and protect gains as the market moves favorably.

- Diversification: I diversify my portfolio across different asset classes and markets to reduce overall risk exposure.

4. Discuss your experience in using quantitative models for trading.

I have extensive experience developing and using quantitative models for trading:

- Statistical Models: I employ statistical techniques such as regression analysis, time series analysis, and machine learning to identify trading opportunities.

- Algorithmic Trading: I have built and deployed automated trading algorithms that execute trades based on predefined criteria and models.

- Optimization Techniques: I utilize optimization methods to fine-tune model parameters and maximize performance metrics.

- Python and R: I am proficient in programming languages like Python and R, which are widely used for quantitative trading.

5. How do you stay updated on the latest market developments and trends?

I employ several strategies to stay informed about market developments and trends:

- Financial News and Media: I regularly read financial news outlets, industry publications, and research reports to track market events and insights.

- Economic Data and Indicators: I monitor key economic data releases, such as GDP, inflation, and employment reports, to gauge economic health and market sentiment.

- Market Analysis Platforms: I utilize platforms that provide real-time market data, charts, and analysis tools to stay on top of market movements.

- Conferences and Webinars: I attend industry conferences and webinars to learn from experts, exchange ideas, and gain fresh perspectives.

6. What are your strengths and weaknesses as a Proprietary Trader?

Strengths

- Strong analytical and quantitative skills

- Proven ability to develop and implement trading strategies

- Excellent risk management and capital preservation mindset

- Experience using quantitative models and algorithmic trading

- Up-to-date knowledge of financial markets and trends

Weaknesses

- Limited experience in managing large portfolios

- Still developing emotional resilience under market pressure

7. Describe a challenging trading situation you encountered and how you handled it.

During a period of market volatility, I encountered a substantial drawdown in my trading portfolio. I remained calm and composed, adhering to my risk management principles:

- Review and Reassessment: I thoroughly reviewed my trading strategy and risk parameters to identify any weaknesses or areas for improvement.

- Risk Reduction: I reduced my position sizes and implemented stricter stop-loss orders to mitigate further potential losses.

- Focus on Fundamentals: I reaffirmed my belief in the long-term fundamentals of the markets and maintained my conviction in my strategy.

- Patience and Discipline: I avoided making impulsive decisions and stuck to my trading plan, waiting for the market to recover.

8. How do you handle the psychological pressures of trading?

I recognize the importance of managing the psychological aspects of trading:

- Mindfulness and Self-Awareness: I practice mindfulness techniques to stay present and aware of my emotions and biases.

- Trading Journal: I maintain a trading journal to track my trades, analyze performance, and identify areas for improvement.

- Stress Management: I engage in regular exercise, meditation, or other stress-reducing activities to maintain emotional equilibrium.

- Support System: I have a network of mentors, colleagues, and friends who provide support and encouragement.

9. What sets you apart from other Proprietary Traders?

My unique combination of skills and experience sets me apart from other Proprietary Traders:

- Quantitative Expertise: My strong foundation in statistics and machine learning enables me to develop and implement sophisticated trading models.

- Risk Management Focus: I prioritize risk management and capital preservation, ensuring the longevity and sustainability of my trading strategies.

- Adaptability and Innovation: I am constantly learning and adapting to evolving market conditions, refining my strategies and seeking new opportunities.

- Analytical Mindset: My analytical approach allows me to make informed decisions based on data and market insights.

10. How do you see the future of Proprietary Trading?

I believe the future of Proprietary Trading will be shaped by several key trends:

- Technological Advancements: AI, machine learning, and big data will continue to revolutionize trading strategies and risk management.

- Increased Regulation: Regulatory oversight will likely become more stringent, requiring traders to adhere to higher compliance standards.

- Global Market Integration: The connectedness of global markets will provide both opportunities and challenges for traders.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Proprietary Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Proprietary Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A proprietary trader makes trades on behalf of their firm, using the firm’s capital. They are responsible for developing and executing trading strategies, and for managing the risk associated with their trades. Key job responsibilities of a proprietary trader include:

1. Developing and executing trading strategies

Proprietary traders develop trading strategies based on their analysis of market data. They use technical analysis, fundamental analysis, or a combination of both, to identify trading opportunities. Once they have identified a trading opportunity, they develop a trading strategy that outlines the parameters of the trade, including the entry and exit points, the risk-reward ratio, and the position size.

- Analyze market data to identify trading opportunities.

- Develop trading strategies based on technical and fundamental analysis.

- Execute trades according to the trading strategies.

2. Managing risk

Proprietary traders are responsible for managing the risk associated with their trades. They use risk management techniques, such as stop-loss orders and position sizing, to limit their losses. They also monitor their trades closely and make adjustments as needed.

- Identify and assess risks associated with trades.

- Develop and implement risk management strategies.

- Monitor trades and make adjustments as needed.

3. Monitoring market conditions

Proprietary traders must be constantly monitoring market conditions. They need to be aware of the latest news and events that could affect the markets. They also need to be able to interpret market data and identify trends.

- Monitor market conditions and identify trends.

- Stay up-to-date on news and events that could affect the markets.

- Interpret market data and make informed trading decisions.

4. Communicating with clients

Proprietary traders may need to communicate with clients to discuss their trading strategies and performance. They need to be able to clearly and concisely explain their investment decisions. They also need to be able to answer questions from clients.

- Communicate trading strategies and performance to clients.

- Answer questions from clients and provide them with updates on market conditions.

- Maintain relationships with clients.

Interview Tips

A well prepared candidate for an interview makes an exceptional impression on the interviewer and increases their chances of securing their desired position. Here are a few tips to help you ace your proprietary trader interview:

1. Research the firm and the position

Before you go on an interview, it’s important to do your research. Learn as much as you can about the firm you’re interviewing with and the position you’re applying for. This will help you answer questions intelligently and show the interviewer that you’re genuinely interested in the opportunity.

- Visit the firm’s website and read about their history, culture, and investment philosophy.

- Read news articles and press releases about the firm.

- Talk to people in your network who know about the firm or the position.

2. Practice answering common interview questions

There are a number of common interview questions that you’re likely to be asked, such as “Why do you want to work for our firm?” and “What are your strengths and weaknesses?” It’s helpful to practice answering these questions in advance so that you can deliver your responses confidently and clearly.

- Brainstorm a list of common interview questions.

- Write out your answers to these questions.

- Practice answering the questions out loud.

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills as a proprietary trader. Be prepared to discuss your trading strategies, your risk management techniques, and your track record. You should also be able to provide examples of your work.

- Highlight your experience in developing and executing trading strategies.

- Discuss your risk management techniques and your track record.

- Provide examples of your work, such as trade logs or performance reports.

4. Be confident and enthusiastic

The interviewer will be looking for someone who is confident and enthusiastic about the opportunity. Be yourself, but be sure to show the interviewer that you’re excited about the prospect of working for the firm.

- Make eye contact with the interviewer.

- Speak clearly and confidently.

- Be enthusiastic about the opportunity.

Next Step:

Now that you’re armed with the knowledge of Proprietary Trader interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Proprietary Trader positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini