Feeling lost in a sea of interview questions? Landed that dream interview for Public Accountant but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Public Accountant interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

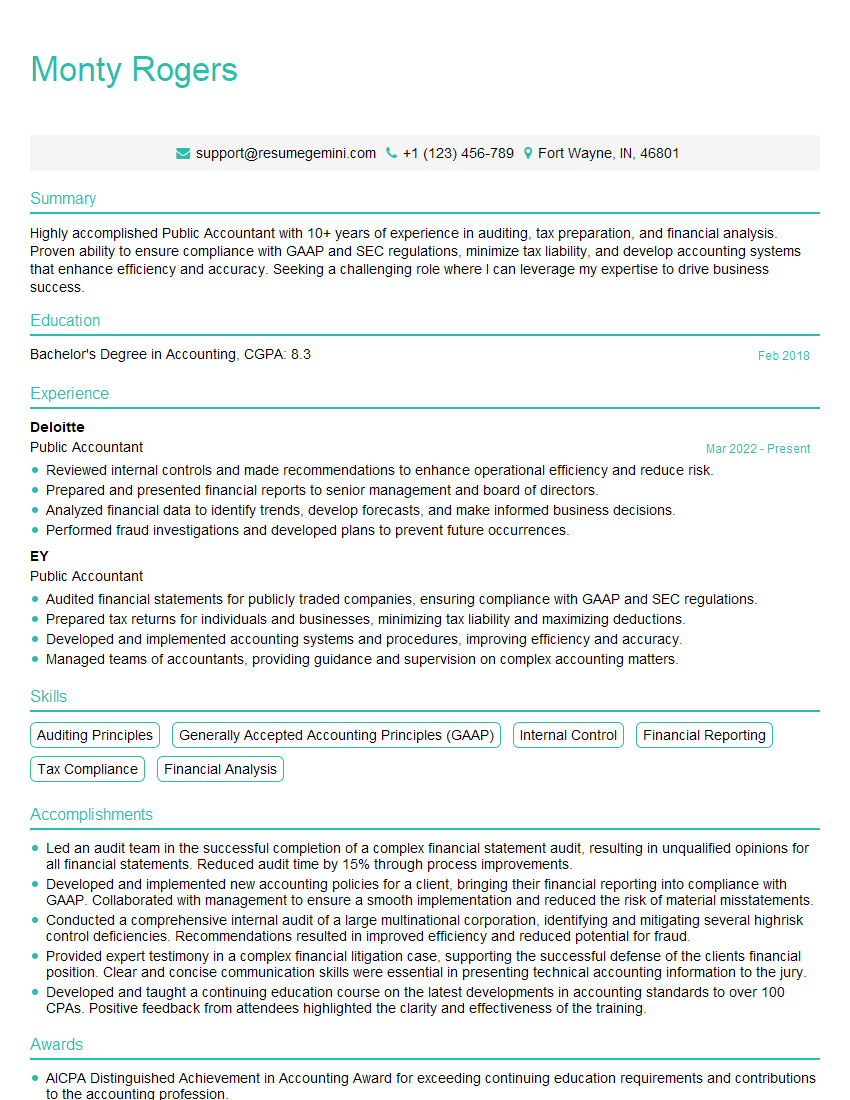

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Public Accountant

1. What are the key differences between IFRS and GAAP?

- IFRS is a principles-based framework, while GAAP is a rules-based framework.

- IFRS is more focused on economic substance, while GAAP is more focused on legal form.

- IFRS is more flexible, while GAAP is more prescriptive.

2. What are the benefits of using a cloud-based accounting system?

subheading of the answer

- Improved data security

- Increased productivity

subheading of the answer

- Reduced costs

- Greater flexibility

3. What are the most common types of audit procedures?

- Risk assessment procedures

- Control testing procedures

- Substantive testing procedures

4. What are the key elements of a financial audit?

- Planning

- Execution

- Reporting

5. What are the ethical responsibilities of a public accountant?

- Independence

- Objectivity

- Due care

- Confidentiality

6. What are the key considerations when performing an audit of internal control?

- The nature of the business

- The size of the business

- The industry in which the business operates

- The risks associated with the business

7. What are the most common types of audit findings?

- Misstatements

- Control deficiencies

- Reportable conditions

- Other matters

8. What are the key elements of an audit report?

- Auditor’s opinion

- Management’s responsibility for the financial statements

- Auditor’s responsibility

- Basis for opinion

- Auditor’s report on other matters

9. What are the key differences between an audit, a review, and a compilation?

- An audit is the most comprehensive level of assurance, while a review is a moderate level of assurance, and a compilation is the least comprehensive level of assurance.

- An audit requires the auditor to obtain reasonable assurance that the financial statements are free from material misstatement, while a review requires the auditor to obtain limited assurance that the financial statements are free from material misstatement, and a compilation does not require the auditor to obtain any assurance that the financial statements are free from material misstatement.

10. Describe your experience with the Sarbanes-Oxley Act of 2002.

- I have a deep understanding of the Sarbanes-Oxley Act of 2002, and I have experience implementing and testing SOX controls.

- I have experience working with both public and private companies to help them comply with SOX requirements.

- I am up to date on the latest changes to the Sarbanes-Oxley Act of 2002, and I am committed to staying abreast of the latest developments in this area.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Public Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Public Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Public accountants play a vital role in the financial reporting and compliance of organizations. They are responsible for providing independent assurance on the accuracy and fairness of financial statements, preparing tax returns, and advising clients on accounting and financial matters.

1. Prepare Financial Statements

Public accountants are responsible for preparing financial statements, such as balance sheets, income statements, and cash flow statements.

- Prepare and review financial statements to ensure accuracy and compliance with GAAP or other applicable financial reporting frameworks.

- Participate in the audit process, including planning, fieldwork, and reporting.

2. Conduct Audits

Public accountants conduct audits to examine and evaluate the financial statements of organizations.

- Conduct audits to ensure the accuracy and fairness of financial information, including financial statements, internal control systems, and compliance with laws and regulations.

- Evaluate internal controls to ensure they are effective and efficient.

3. Prepare Tax Returns

Public accountants prepare tax returns for individuals, businesses, and other organizations.

- Prepare tax returns and assist clients with tax planning and compliance.

- Stay up-to-date on tax laws and regulations to ensure clients are compliant.

4. Advise Clients

Public accountants advise clients on accounting and financial matters.

- Provide consulting services to clients on a variety of accounting and financial matters, such as business planning, financial forecasting, and risk management.

- Represent clients before tax authorities and other regulatory bodies.

Interview Tips

Preparation is key for a successful interview. Here are some tips to help you ace your public accountant interview:

1. Research the Firm

Before the interview, research the public accounting firm you are applying to.

- Visit the firm’s website to learn about its history, services, and culture.

- Read the company’s financial statements to get an idea of its financial health and performance.

2. Prepare for Common Interview Questions

There are some common interview questions that you can prepare for.

- Why are you interested in working for this firm?

- What are your strengths and weaknesses as a public accountant?

- What is your understanding of the role of a public accountant?

3. Practice Answering Behavioral Interview Questions

Behavioral interview questions ask you to provide specific examples of how you have handled past situations.

- Use the STAR method to answer behavioral interview questions. STAR stands for Situation, Task, Action, and Result.

- For example, you could be asked, “Tell me about a time when you had to deal with a difficult client.” Using the STAR method, you would describe the Situation, Task, Action, and Result of that experience.

4. Be Professional

Dress appropriately for the interview and arrive on time.

- Make eye contact with the interviewer and speak clearly and confidently.

- Be prepared to ask the interviewer questions about the firm and the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Public Accountant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.