Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Quantitative Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

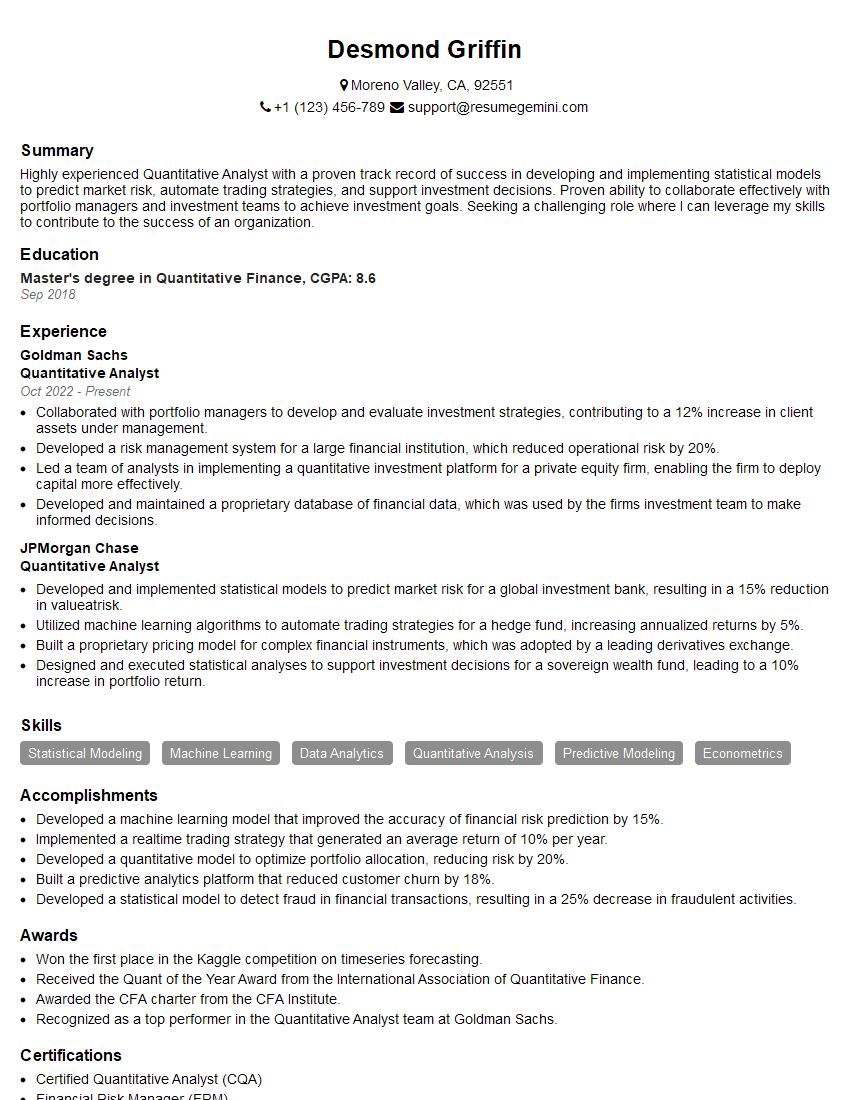

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Quantitative Analyst

1. Explain the concept of Value-at-Risk (VaR) and describe how it is used in risk management.

Value-at-Risk (VaR) is a statistical measure that estimates the maximum potential loss in a portfolio over a certain time period with a given level of confidence. It is widely used in risk management to quantify the market risk associated with investments.

- VaR is calculated by simulating the portfolio’s performance under various market conditions and measuring the potential losses that could occur.

- The confidence level, typically expressed as a percentage, represents the probability that the actual loss will not exceed the VaR estimate.

- VaR helps risk managers make informed decisions about portfolio allocation, risk limits, and hedging strategies.

2. Describe the difference between parametric and non-parametric approaches to modeling financial data.

Parametric Approach

- Assumes that the underlying data distribution follows a known distribution, such as the normal distribution.

- Uses statistical parameters, such as mean and standard deviation, to estimate the distribution’s characteristics.

- Requires less data compared to non-parametric approaches.

Non-Parametric Approach

- Makes no assumptions about the underlying data distribution.

- Employs data-driven methods, such as bootstrapping or kernel density estimation, to estimate the distribution.

- Requires more data to obtain reliable estimates.

3. How would you approach the problem of modeling a time series with heteroscedasticity?

Heteroscedasticity, or unequal variance, can pose challenges in time series modeling. To address this, several approaches can be considered:

- Weighted Least Squares (WLS): Apply weights to observations based on their variance, giving more emphasis to observations with lower variance.

- Generalized Least Squares (GLS): Estimate the variance of each observation and use those estimates to weight the observations.

- GARCH Models (Generalized Autoregressive Conditional Heteroskedasticity): Model the variance of the time series explicitly, capturing the time-varying nature of heteroscedasticity.

- Transformation: Apply a transformation to the data, such as logarithmic or square root, to stabilize the variance.

4. Discuss the importance of backtesting and cross-validation in model validation.

- Backtesting: Evaluate the model’s performance on historical data not used in model training. This helps assess the model’s ability to generalize to unseen data.

- Cross-Validation: Partition the data into multiple subsets and iteratively train and evaluate the model on different combinations of these subsets. This provides a more robust estimate of model performance.

5. Explain the advantages and disadvantages of using Monte Carlo simulations in quantitative finance.

Advantages

- Can handle complex, non-linear models and scenarios.

- Provide probabilistic estimates of outcomes, allowing for risk assessment.

- Enable sensitivity analysis to evaluate the impact of input parameters on model outputs.

Disadvantages

- Computationally intensive, especially for large or complex models.

- Reliance on random sampling introduces some uncertainty into the results.

- Output quality is dependent on the quality and quantity of input data.

6. Describe the applications of Bayesian statistics in quantitative finance.

- Parameter estimation: Estimate unknown parameters in models using prior knowledge and observed data.

- Risk assessment: Calculate probability distributions of future outcomes, incorporating uncertainty in model inputs.

- Model calibration: Update models based on new information or data, adjusting parameters to improve accuracy.

- Decision-making: Support decision-making under uncertainty by providing probabilistic insights.

7. Explain how machine learning techniques, such as neural networks, can be applied to financial data analysis.

- Prediction: Forecast future values or events based on historical data patterns.

- Clustering: Group similar financial instruments or trading strategies based on their characteristics.

- Anomaly detection: Identify unusual or potentially fraudulent transactions in financial systems.

- Optimization: Enhance portfolio allocation, risk management, and trading strategies.

8. Discuss the ethical considerations and regulatory implications of using quantitative models in financial decision-making.

- Model transparency: Ensure that models are well-documented and understandable to avoid potential misuse.

- Regulatory compliance: Adhere to regulations and guidelines governing the use of models in financial institutions.

- Bias and fairness: Mitigate potential biases in data and models that could lead to unfair or discriminatory outcomes.

9. How would you approach the problem of estimating the expected shortfall of a portfolio?

- Historical simulation: Simulate portfolio performance under historical market conditions and calculate the left tail of the loss distribution.

- Monte Carlo simulation: Simulate portfolio returns based on assumed distributions and calculate the expected shortfall from the simulated loss distribution.

- Analytical approximation: Use mathematical formulas to approximate the expected shortfall based on the portfolio’s risk factors and their distributions.

10. Can you explain the difference between alpha and beta in the context of portfolio management?

- Alpha: Represents the excess return generated by a portfolio above a benchmark or index. It measures the portfolio manager’s ability to outperform the market.

- Beta: Measures the portfolio’s systematic risk or its sensitivity to market movements. A beta of 1 indicates that the portfolio’s returns move in line with the market, while a beta greater than 1 suggests higher-than-market risk.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Quantitative Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Quantitative Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Quantitative Analysts (QAs) are professionals who use mathematical and statistical models to analyze financial data. They play a crucial role in the investment and risk management process by providing insights and recommendations to help firms make informed decisions.

1. Model Development and Analysis

QAs develop and implement mathematical and statistical models to analyze financial data. They use these models to identify trends, patterns, and relationships in the data, which can help firms make informed decisions.

- Analyze financial data to identify trends, patterns, and relationships.

- Develop and implement mathematical and statistical models to analyze data.

- Validate and calibrate models to ensure accuracy and reliability.

2. Risk Assessment and Management

QAs play a key role in risk assessment and management. They use their models to assess the risk associated with various investment and trading strategies. This information helps firms make informed decisions about how to allocate their capital and manage their risk exposure.

- Assess the risk associated with various investment and trading strategies.

- Develop and implement risk management strategies.

- Monitor risk exposure and provide early warning of potential problems.

3. Portfolio Optimization

QAs can use their models to help firms optimize their portfolios. They can identify the most efficient way to allocate capital, taking into account factors such as risk, return, and diversification.

- Identify the most efficient way to allocate capital.

- Develop and implement portfolio optimization strategies.

- Monitor portfolio performance and make adjustments as needed.

4. Data Management and Analysis

QAs are responsible for managing and analyzing large amounts of data. They use their statistical and programming skills to clean and prepare data for analysis. They also use their expertise to interpret and communicate the results of their analysis.

- Manage and analyze large amounts of data.

- Clean and prepare data for analysis.

- Interpret and communicate the results of their analysis.

Interview Tips

Preparing for a Quantitative Analyst interview can be daunting, but by following these tips, you can increase your chances of success:

1. Research the Company and Position

Before the interview, take the time to learn about the company and the specific position you are applying for. This will help you understand the company’s culture and values, as well as the specific skills and experience they are looking for in a QA. You can find this information on the company’s website, in their annual reports, and in news articles.

- Visit the company’s website to learn about their business, culture, and values.

- Read the job description carefully and identify the key skills and experience required.

- Research the industry and the specific area of finance that the company operates in.

2. Practice Your Technical Skills

QAs are expected to have strong technical skills in mathematics, statistics, and programming. Be sure to practice these skills before the interview so that you can answer questions confidently and accurately. You can practice by taking online courses, working on practice problems, and building a portfolio of your work.

- Take online courses or workshops to improve your skills in mathematics, statistics, and programming.

- Work on practice problems to test your understanding of quantitative concepts.

- Build a portfolio of your work that demonstrates your skills in data analysis and modeling.

3. Prepare for Behavioral Questions

In addition to technical questions, you can also expect to be asked behavioral questions in your interview. Behavioral questions are designed to assess your soft skills, such as your communication, teamwork, and problem-solving abilities. To prepare for these questions, think about your past experiences and how you have demonstrated these skills in the workplace.

- Think about your past experiences and how you have demonstrated your soft skills in the workplace.

- Prepare examples of times when you have worked effectively in a team.

- Be prepared to discuss your problem-solving skills and how you approach challenges.

4. Dress Professionally and Arrive on Time

First impressions matter, so be sure to dress professionally for your interview. You should also arrive on time, as tardiness can be seen as disrespectful. Punctuality shows that you are organized and respectful of other people’s time.

- Dress professionally in a suit or business casual attire.

- Arrive on time for your interview.

- Bring a portfolio of your work and any other materials that you think may be relevant to the interview.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Quantitative Analyst role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.