Are you gearing up for a career in Rate Clerk? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Rate Clerk and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

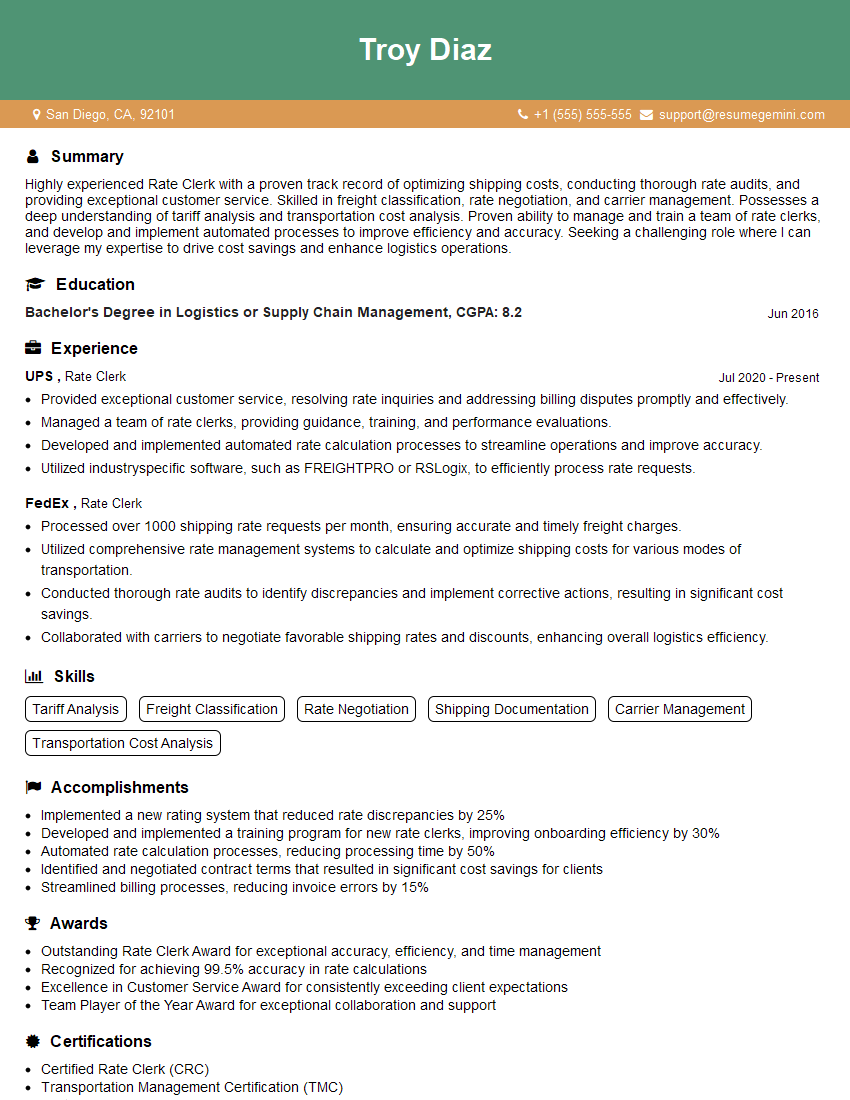

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Rate Clerk

1. Explain the process of rate calculation for a specific type of insurance policy, such as auto or homeowner’s insurance?

The process of rate calculation for auto insurance involves several steps:

- Data Collection: Gather information about the applicant, vehicle, and driving history.

- Risk Assessment: Evaluate factors such as age, driving record, vehicle type, and location to determine the level of risk.

- Base Rate Determination: Use industry data and actuarial models to establish a base rate for the policy.

- Rating Factors Application: Apply various rating factors, such as territory, deductible, and coverages, to adjust the base rate.

- Premium Calculation: Multiply the adjusted rate by the policy’s coverage limits to determine the final premium.

2. Describe the different types of rating plans used in insurance and their advantages and disadvantages?

Flat Rating Plan:

- Pros: Simple to administer, fair for low-risk drivers.

- Cons: May be unfair to high-risk drivers.

Experience Rating Plan:

- Pros: Rewards safe drivers, discourages risky behavior.

- Cons: May penalize drivers who have experienced accidents or violations.

Territory Rating Plan:

- Pros: Reflects geographic variations in risk.

- Cons: May not be fair to drivers in less risky areas.

3. How do you handle rate audits for policyholders?

Rate Audit Process:

- Review Policy and Records: Examine the policyholder’s insurance contract and relevant documents.

- Verify Declarations: Ensure the policyholder’s declarations match their actual business operations.

- Calculate Premium: Apply the appropriate rating factors to determine the correct premium.

- Compare to Paid Premium: Reconcile the calculated premium with the premium paid by the policyholder.

- Issue Refund or Invoice: Request a refund if the policyholder overpaid or send an invoice if they underpaid.

4. Explain how you stay up-to-date on changes in insurance regulations and industry best practices?

Methods for Staying Up-to-Date:

- Attend industry conferences and webinars.

- Read trade publications and newsletters.

- Participate in professional organizations.

- Consult with legal and regulatory experts.

- Follow industry news sources.

5. Describe your experience in using technology to support the rate calculation process?

Technology in Rate Calculation:

- Rating Software: Utilize specialized software to automate rate calculations and streamline the process.

- Data Analytics Tools: Employ data analytics to identify trends and improve rate accuracy.

- Customer Portals: Provide online platforms for policyholders to access their rate information and make payments.

6. Provide an example of a time when you successfully resolved a complex rating issue?

Complex Rating Issue Resolution:

- Identification: Recognized and diagnosed a discrepancy in a policyholder’s rate calculation.

- Investigation: Analyzed policy details, records, and industry regulations to determine the root cause.

- Solution: Implemented a correction to the rating formula and recalculated the premium.

- Communication: Clearly explained the issue and resolution to the policyholder.

7. Explain how you ensure the accuracy and consistency of rate calculations across multiple policies and products?

Accuracy and Consistency Measures:

- Standardized Processes: Implement clear and consistent rate calculation procedures.

- Regular Audits: Conduct periodic audits to verify the accuracy of calculations.

- Collaboration with Underwriters: Consult with underwriters to ensure that rating factors are applied correctly.

8. How do you handle customer inquiries and disputes related to rate calculations?

Customer Inquiry and Dispute Handling:

- Active Listening: Listen attentively to understand the customer’s concerns.

- Review and Verification: Examine policy details and rate calculations to identify the issue.

- Explanation and Resolution: Clearly and patiently explain the rate calculation and any adjustments made.

- Documentation: Maintain detailed records of customer interactions and resolutions.

9. What are your thoughts on the potential impact of artificial intelligence (AI) on the insurance rating process?

AI in Insurance Rating:

- Pros: Increased efficiency, improved accuracy, personalized rates.

- Cons: Bias and discrimination concerns, potential job displacement.

- Cautious Approach: Embrace AI while addressing ethical considerations and ensuring fairness.

10. Describe how you would approach the task of developing a new rating plan for a commercial insurance product?

New Rating Plan Development:

- Market Research: Analyze industry trends and competitor offerings.

- Data Analysis: Utilize historical data to identify key risk factors and pricing drivers.

- Actuarial Modeling: Employ actuarial principles to determine appropriate rate levels.

- Regulatory Compliance: Ensure compliance with all applicable laws and regulations.

- Stakeholder Consultation: Engage with underwriters, brokers, and policyholders for feedback.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Rate Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Rate Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Rate Clerks play crucial roles in ensuring accurate and consistent pricing for products and services within organizations. Their key responsibilities encompass:

1. Rate Calculation and Analysis

Calculate and analyze freight rates, tariffs, discounts, and other pricing components using established formulas and guidelines.

- Apply industry regulations and customer-specific agreements to determine appropriate rates.

- Monitor rate changes and market trends to ensure competitive pricing.

2. Rate Management and Maintenance

Maintain and update rate tables, databases, and systems to ensure accuracy and accessibility.

- Process and manage rate changes, including implementation and communication with clients.

- Collaborate with sales and operations teams to establish and maintain rate agreements.

3. Rate Auditing and Reconciliation

Audit freight invoices and bills of lading to verify accuracy of rates and charges.

- Investigate discrepancies and resolve billing issues with carriers and customers.

- Maintain accurate records and documentation for auditing purposes.

4. Customer Support and Communication

Provide rate information and support to internal and external customers.

- Respond to inquiries, resolve rate-related issues, and provide rate advice.

- Maintain strong relationships with clients to understand their needs and ensure satisfaction.

Interview Tips

To ace the Rate Clerk interview, it is essential to prepare thoroughly and showcase your relevant skills and experience. Consider the following tips:

1. Research the Company and Industry

Familiarize yourself with the organization’s business model, industry trends, and specific rate-related practices. This demonstrates your interest and understanding of the field.

- Visit the company’s website and LinkedIn page.

- Read industry publications and articles to stay updated on market dynamics.

2. Highlight Your Rate Calculation and Analysis Skills

Emphasize your ability to calculate rates accurately and efficiently using industry formulas and guidelines. Provide specific examples of your experience in rate analysis and freight bill auditing.

- Quantify your accomplishments, such as reducing billing errors or improving rate accuracy.

- Use the STAR method (Situation, Task, Action, Result) to describe your experiences.

3. Showcase Your Rate Management Expertise

Demonstrate your proficiency in managing and maintaining rate tables and databases. Explain how you ensure rate consistency and handle rate changes effectively.

- Describe your experience in implementing and communicating rate changes.

- Highlight your knowledge of industry regulations and customer-specific agreements.

4. Emphasize Your Customer Service Skills

Rate Clerks often interact with customers to provide rate information and resolve issues. Showcase your ability to communicate effectively, handle inquiries, and maintain positive customer relationships.

- Share examples of your experience in providing excellent customer service.

- Describe how you build and maintain relationships with clients.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Rate Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!