Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Rate Setter interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Rate Setter so you can tailor your answers to impress potential employers.

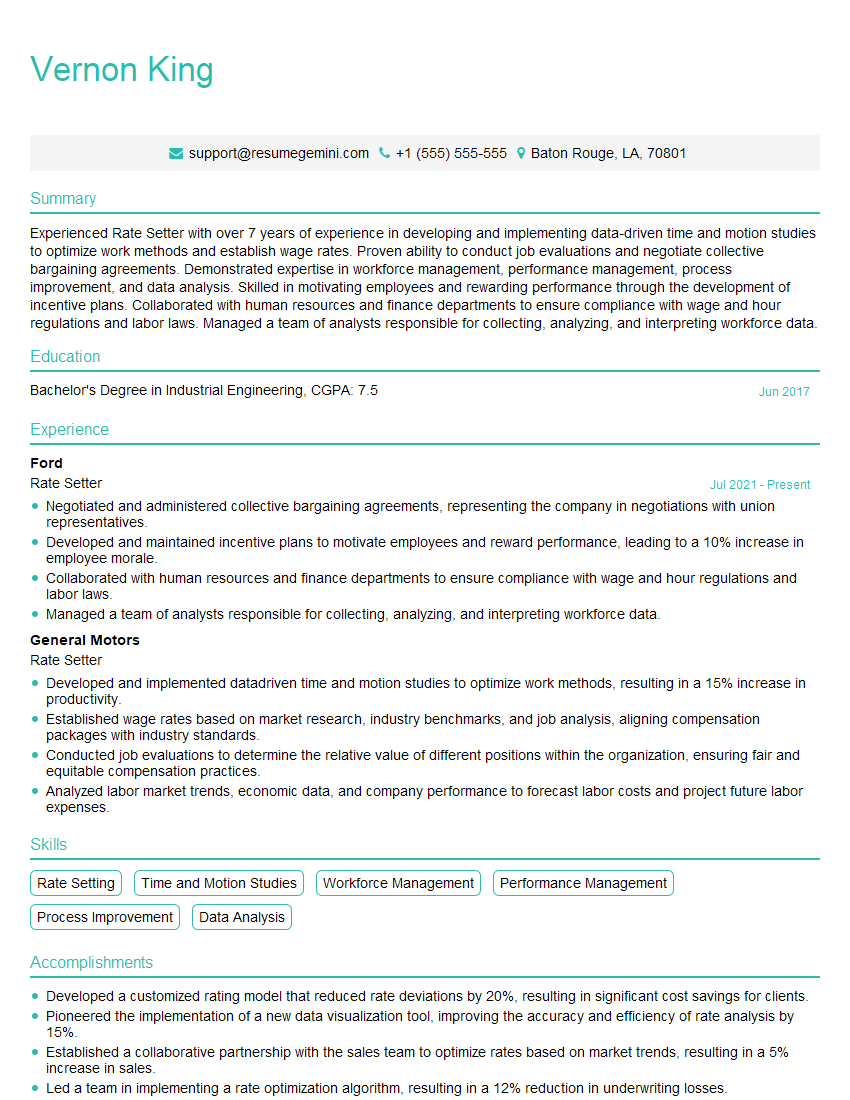

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Rate Setter

1. How do you determine the appropriate interest rates for different types of loans, considering factors such as risk, inflation, and market conditions?

To determine appropriate interest rates for different types of loans, I consider the following factors:

- Risk: I assess the risk associated with each type of loan, considering factors such as loan-to-value ratios, credit scores, and debt-to-income ratios.

- Inflation: I consider the current and projected inflation rate to ensure that interest rates are adjusted accordingly to maintain the real value of loans.

- Market conditions: I monitor market conditions, including supply and demand for loans, competitive rates, and economic indicators, to make informed decisions about interest rates.

2. What are the key performance indicators (KPIs) that you track and monitor to measure the effectiveness of your rate-setting strategy?

KPIs related to loan performance

- Default rates

- Delinquency rates

- Loan-to-value ratios

KPIs related to financial performance

- Net interest margin

- Return on equity

- Risk-adjusted return on capital

3. How do you balance the need to attract new borrowers with the need to maintain profitability for the organization?

I balance the need to attract new borrowers with the need to maintain profitability by:

- Conducting thorough market research: Understanding the market demands, competitive rates, and borrower profiles helps me set attractive rates while ensuring profitability.

- Implementing risk-based pricing: I adjust interest rates based on the risk assessment of each borrower, allowing me to attract lower-risk borrowers while maintaining profitability on higher-risk loans.

- Offering differentiated products: I develop a range of loan products with varying interest rates and features, catering to the diverse needs of borrowers while optimizing profitability.

4. What are the ethical considerations that you take into account when setting interest rates?

When setting interest rates, I consider the following ethical considerations:

- Fairness: I ensure that interest rates are fair and reasonable for borrowers, considering their financial situation and risk profile.

- Transparency: I communicate interest rates clearly and transparently to borrowers, allowing them to make informed decisions.

- Responsible lending: I assess borrowers’ ability to repay loans before approving them, ensuring that they do not take on excessive debt.

5. How do you stay up-to-date with industry best practices and regulatory changes that impact rate-setting?

- Attending industry conferences and workshops: I participate in industry events to learn about best practices, regulatory updates, and emerging trends.

- Reading industry publications and white papers: I stay informed by reviewing research and analysis from reputable sources.

- Networking with peers: I connect with other rate setters and industry professionals to exchange knowledge and insights.

6. How do you handle situations where there is significant market volatility or economic uncertainty?

In situations of market volatility or economic uncertainty, I take the following steps:

- Monitor market conditions closely: I track key economic indicators and market data to assess the impact on interest rates.

- Adjust rate-setting strategy: I consider adjusting interest rates to mitigate risk and maintain financial stability, while ensuring fairness to borrowers.

- Communicate with stakeholders: I keep borrowers and other stakeholders informed about changes to interest rates and the rationale behind them.

7. What are your strengths and weaknesses as a Rate Setter?

Strengths

- Strong analytical and quantitative skills

- Deep understanding of financial markets and lending principles

- Proven ability to balance risk and profitability

Weaknesses

- Limited experience in setting rates for specific industries or asset classes

- Still developing expertise in managing interest rate risk in complex market environments

8. How do you approach the task of setting interest rates for different types of loans, such as personal loans, mortgages, and business loans?

- Personal loans: I consider factors such as credit scores, debt-to-income ratios, and loan purposes to determine appropriate interest rates.

- Mortgages: I assess loan-to-value ratios, credit scores, property type, and market conditions to set mortgage rates.

- Business loans: I evaluate business risk, financial performance, industry trends, and collateral to determine interest rates for business loans.

9. What is your approach to setting interest rates in a competitive market environment?

In a competitive market environment, I take the following steps to set interest rates:

- Monitor competitor rates: I regularly track interest rates offered by competitors to ensure we remain competitive.

- Differentiate products and services: I develop unique loan products and services to differentiate our offerings and justify competitive rates.

- Focus on customer value: I prioritize providing excellent customer service and building long-term relationships to retain borrowers even in competitive markets.

10. How do you incorporate data analysis and modeling into your rate-setting process?

- Data analysis: I analyze historical data on loan performance, market trends, and economic indicators to identify patterns and make informed decisions.

- Modeling: I develop financial models to simulate different rate scenarios and assess the potential impact on loan demand, profitability, and risk.

- Optimization: I use optimization techniques to find the optimal interest rates that balance multiple objectives, such as profitability, risk management, and customer acquisition.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Rate Setter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Rate Setter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Rate Setter is responsible for setting the standard rates for direct labor employees in a manufacturing or industrial setting. The primary objective is to ensure that the rates are fair and equitable while meeting productivity and cost objectives. The key job responsibilities include:

1. Standard Rate Determination

Analyzes and evaluates job descriptions, work methods, and production data to determine the appropriate standard rates for each job or task.

- Conducts time and motion studies, observes employees, and collects data on production output and time.

- Uses industrial engineering principles and statistical analysis to establish standard rates that ensure efficient and fair output.

2. Rate Maintenance and Adjustment

Reviews and adjusts the standard rates regularly to ensure they remain accurate and appropriate for changing conditions.

- Monitors production performance, labor costs, and other relevant metrics to identify potential areas for improvement.

- Makes adjustments to the rates based on factors such as technological advancements, process improvements, or changes in labor market conditions.

3. Labor Cost Control

Assists in developing and implementing labor cost control systems to manage direct labor expenses.

- Participates in budget planning and cost reduction initiatives by providing data and analysis on labor costs.

- Works with supervisors and managers to identify and address areas of inefficiency or excessive labor costs.

4. Training and Development

Provides training and guidance to employees on standard rates and production methods.

- Develops and delivers training materials to explain the rationale behind the standard rates and how to achieve them.

- Coaches and mentors employees to improve their productivity and meet the established standards.

Interview Tips

To ace the Rate Setter interview, candidates should prepare thoroughly and demonstrate their knowledge, skills, and enthusiasm for the role. Here are some tips to help prepare:

1. Research the Company and Industry

Familiarize yourself with the company’s products, services, industry trends, and recent developments. This will help you understand the context of the role and demonstrate your interest in the industry.

- Visit the company website, read industry publications, and attend conferences to stay informed.

- Research the specific industry in which the company operates to gain insights into its challenges and opportunities.

2. Prepare for Technical Questions

Review your knowledge of industrial engineering principles, time and motion studies, and statistical analysis. You should be prepared to discuss how you would determine standard rates and adjust them based on changing conditions.

- Practice solving sample problems related to standard rate determination and labor cost control.

- Review case studies to demonstrate your analytical skills and problem-solving abilities in real-world scenarios.

3. Highlight Your Analytical and Communication Skills

Emphasize your ability to analyze data, draw conclusions, and communicate your findings effectively. Rate Setters often collaborate with supervisors, managers, and employees, so strong communication skills are essential.

- Provide examples of how you have successfully analyzed complex data to identify trends and develop solutions.

- Showcase your ability to present your findings clearly and persuasively, both verbally and in writing.

4. Demonstrate Your Commitment to Continuous Improvement

Rate Setters play a crucial role in improving productivity and minimizing costs. Highlight your commitment to continuous improvement and your willingness to explore new methods and technologies.

- Share examples of how you have contributed to process improvements or cost reductions in previous roles.

- Express your enthusiasm for learning about new industrial engineering techniques and technologies.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Rate Setter interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!