Are you gearing up for a career in Rating Clerk? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Rating Clerk and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

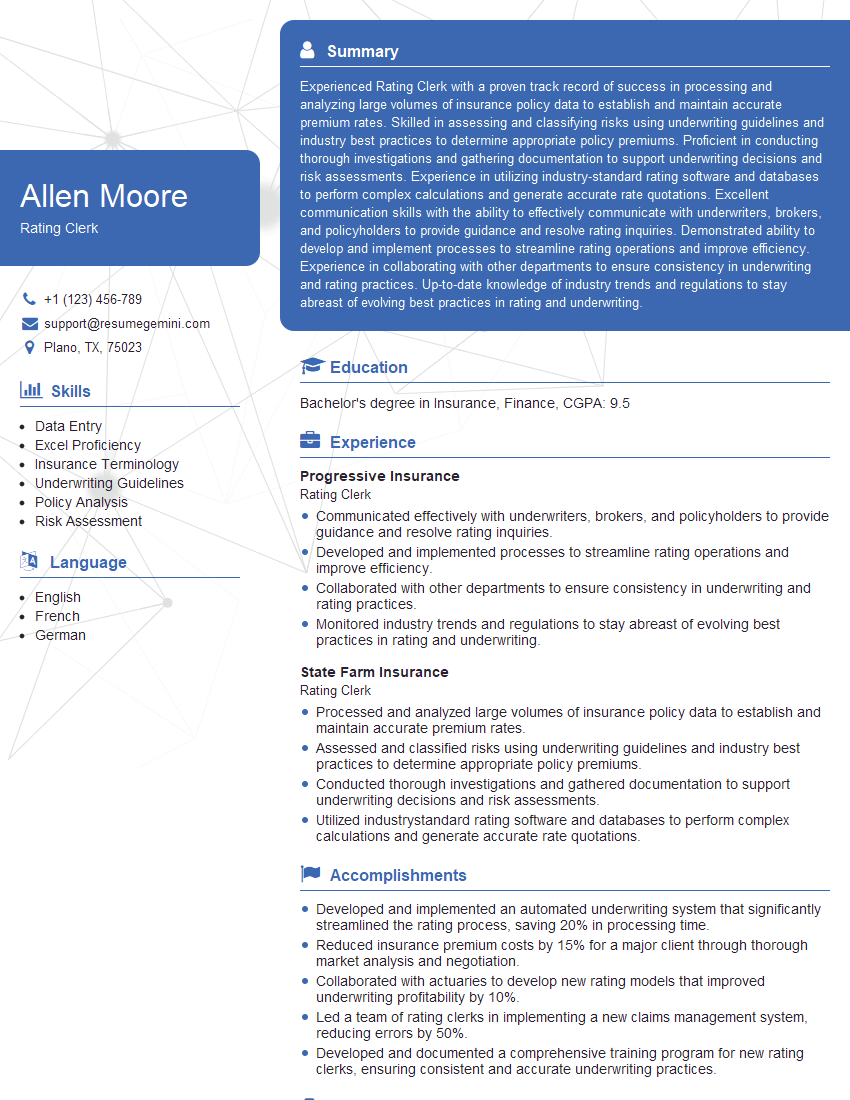

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Rating Clerk

1. Describe the process of rating a risk for a property and business insurance policy?

The process of rating a risk for a property and business insurance policy typically involves the following steps:

- Gather information: This includes collecting data about the property, such as its location, construction, and use. It also includes information about the business, such as its industry, revenue, and number of employees.

- Analyze the risk: This involves identifying and evaluating the potential hazards that could cause damage to the property or business. These hazards can include natural disasters, fires, theft, and vandalism.

- Determine the premium: The premium is the amount of money that the policyholder will pay for the insurance policy. The premium is based on the risk analysis, as well as other factors such as the policyholder’s deductible and coverage limits.

2. What are the different types of rating plans used in property and business insurance?

Flat rating

- A flat rating is a simple rating plan in which all policyholders in a given class pay the same premium.

- This type of rating is often used for personal lines of insurance, such as auto and homeowners insurance.

Experience rating

- Experience rating is a rating plan that takes into account the policyholder’s claims history.

- Policyholders with a good claims history will pay lower premiums than those with a poor claims history.

- This type of rating is often used for commercial lines of insurance, such as property and liability insurance.

Schedule rating

- Schedule rating is a rating plan that is used to rate risks that are not standard.

- This type of rating is often used for large or complex risks, such as manufacturing plants and warehouses.

3. What are the factors that can affect the premium for a property and business insurance policy?

- The type of property or business

- The location of the property or business

- The construction of the property

- The use of the property or business

- The policyholder’s claims history

- The policyholder’s deductible

- The policyholder’s coverage limits

4. What are the different types of endorsements that can be added to a property and business insurance policy?

- Named perils endorsements: These endorsements add coverage for specific perils, such as fire, theft, or vandalism.

- Extended perils endorsements: These endorsements add coverage for a broader range of perils, such as wind, hail, and earthquakes.

- Inland marine endorsements: These endorsements add coverage for property that is in transit.

- Business income endorsements: These endorsements add coverage for the loss of income that a business suffers as a result of a covered peril.

5. What are the duties and responsibilities of a rating clerk?

- Calculate and issue insurance premiums

- Analyze and interpret insurance policies

- Maintain and update insurance rate manuals

- Provide customer service to policyholders

- Keep up-to-date on changes in insurance laws and regulations

6. What are the qualifications for a rating clerk?

- High school diploma or equivalent

- 1-3 years of experience in the insurance industry

- Strong knowledge of insurance policies and rating procedures

- Excellent math and communication skills

- Proficient in the use of insurance software

7. What is the difference between a rate and a premium?

8. What is the purpose of a deductible?

9. What is the difference between a property insurance policy and a liability insurance policy?

10. What are the most common types of property insurance claims?

- Fire

- Theft

- Vandalism

- Wind

- Hail

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Rating Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Rating Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Rating clerks perform the crucial task of assigning credit ratings to individuals and businesses seeking loans or other financial assistance.

1. Credit Analysis

Reviewing financial statements, credit history, and other relevant data to assess the creditworthiness of applicants

- Analyzing income, assets, and debts to determine repayment capacity

- Evaluating collateral and other security offered by the borrowers

2. Credit Rating Assignment

Assigning credit ratings based on the analysis of the applicant’s financial health and risk profile

- Using rating scales established by credit agencies or internal guidelines

- Considering factors such as credit history, debt-to-income ratio, and industry trends

3. Report Writing and Communication

Preparing detailed credit reports and recommendations for loan officers, underwriters, and other decision-makers

- Documenting the analysis performed and the rationale for the assigned credit rating

- Communicating with applicants and other stakeholders to clarify information or gather additional data

4. Staying Updated with Industry Regulations

Maintaining knowledge of industry regulations and best practices for credit rating

- Monitoring changes in credit scoring models and rating methodologies

- Attending conferences and training sessions to enhance professional development

Interview Tips

To ace the interview for a Rating Clerk position, it is essential to prepare thoroughly and showcase your skills and knowledge.

1. Research the Company and Industry

Thoroughly research the company you are applying to, its products or services, and the industry it operates in.

- Visit the company website and read industry publications to gain insights

- Understand the company’s credit rating criteria and methodologies

2. Highlight Your Analytical and Financial Skills

Emphasize your strong analytical and financial skills that are essential for credit rating.

- Describe specific experiences where you analyzed complex financial data and drew insights

- Discuss your understanding of financial ratios, credit scoring models, and risk assessment techniques

3. Showcase Your Attention to Detail and Accuracy

Stress your meticulous attention to detail and accuracy in your work.

- Highlight your experience in reviewing and interpreting large volumes of financial information

- Emphasize your ability to identify errors or inconsistencies in data

4. Prepare for Behavioral Questions

Prepare for common behavioral questions that may assess your teamwork, communication skills, and problem-solving abilities.

- Describe an instance where you had to work effectively in a team to complete a challenging task

- Explain how you handle situations when you encounter conflicting information or perspectives

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Rating Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.