Are you gearing up for an interview for a Rating Examiner position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Rating Examiner and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

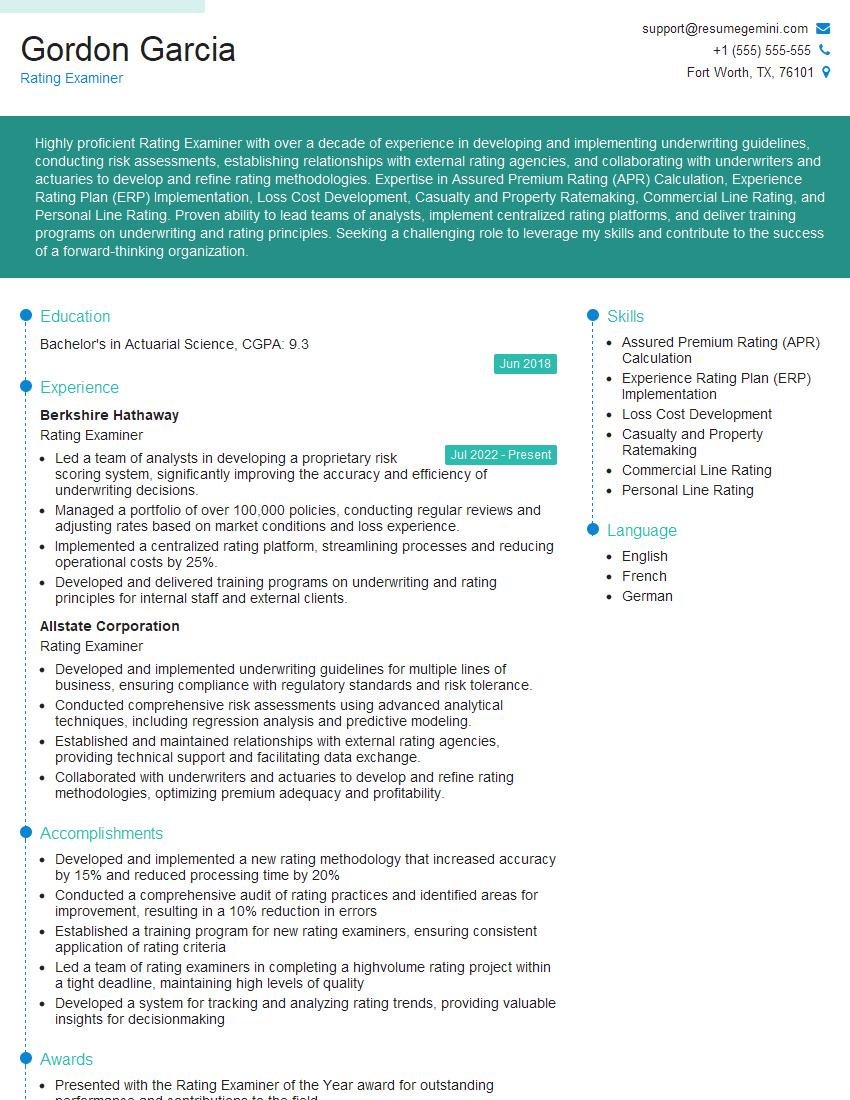

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Rating Examiner

1. Explain the different types of rating scales used in employee performance reviews and their advantages and disadvantages?

- Graphic Rating Scale: Simple and easy to use, allows for direct comparison between employees, but can be subjective and lead to rater bias.

- Likert Scale: Uses a series of statements with varying degrees of agreement, providing more nuanced feedback, but can be time-consuming to complete.

- Behavioral Observation Scale (BOS): Focuses on specific behaviors and incidents, reducing subjectivity but requiring significant observation and documentation.

- 360-Degree Feedback: Collects feedback from multiple sources (supervisors, peers, subordinates), providing a comprehensive view but can be challenging to manage logistically.

- Forced Choice: Presents a set of statements and requires the rater to choose the most (or least) applicable, reducing rater bias but limiting the range of feedback.

2. What are the key principles and ethical considerations in conducting employee performance reviews?

Objectivity

- Base evaluations on observable behaviors and data, avoiding personal biases and assumptions.

- Use standardized rating scales and criteria to ensure fairness and consistency.

Transparency

- Communicate clear expectations and performance standards to employees before the review process.

- Provide detailed feedback on strengths and areas for improvement.

Constructive Feedback

- Focus on providing actionable feedback that helps employees identify and address performance gaps.

- Use specific examples and avoid generalizations or vague language.

3. How do you handle difficult conversations with employees who perform poorly or are resistant to feedback?

- Prepare thoroughly: Gather data and evidence to support your evaluation and identify specific areas for improvement.

- Choose the right time and place: Schedule a private meeting in a neutral setting where you can have an open and confidential discussion.

- Start with positives: Acknowledge the employee’s contributions and strengths before discussing areas for improvement.

- Be direct and specific: Clearly communicate the performance concerns, providing specific examples and avoiding generalizations.

- Listen actively: Allow the employee to express their perspective and provide explanations.

- Collaborate on solutions: Engage the employee in developing an action plan to address performance gaps.

4. What is the role of a Rating Examiner in ensuring the accuracy and fairness of performance reviews?

- Develop clear and consistent rating criteria: Establish objective performance standards and rating scales that all raters use.

- Train raters: Provide training on rating techniques, ethical considerations, and the use of rating scales to reduce bias and ensure inter-rater reliability.

- Review and calibrate ratings: Regularly review and compare ratings across raters to identify and address any inconsistencies or biases.

- Monitor rating trends: Track ratings over time to identify potential issues or systemic biases in the performance review process.

- Resolve disputes: Handle disputes or appeals from employees regarding their performance reviews fairly and objectively.

5. Describe a situation where you successfully resolved a conflict or dispute related to employee performance reviews.

- Identify the issue: Clearly understand the nature of the conflict or dispute, including the perspectives of both the employee and the rater.

- Gather evidence: Collect relevant data, such as performance records, feedback, and observations, to support your analysis.

- Facilitate a discussion: Bring together the parties involved and facilitate a respectful and productive conversation to discuss the concerns.

- Mediate a resolution: Help the parties identify common ground and develop a mutually acceptable solution that addresses the performance issues.

- Document the outcome: Clearly document the resolution and any agreed-upon action plan to ensure accountability and follow-up.

6. How do you stay updated on best practices and legal requirements related to employee performance reviews?

- Attend conferences and workshops: Participate in industry events and educational programs to learn about current trends and legal updates.

- Read professional publications: Stay informed through journals, books, and articles on performance management.

- Consult with HR experts: Seek guidance from qualified HR professionals or legal counsel to ensure compliance with relevant laws and regulations.

- Monitor industry news: Keep abreast of industry news and research to identify emerging best practices and legal developments.

7. Describe how you use technology to enhance the performance review process.

- Automated rating systems: Use software or online platforms to streamline rating processes, reduce errors, and improve efficiency.

- Performance management dashboards: Leverage dashboards to provide real-time insights into performance metrics and trends for data-driven decision-making.

- Employee self-assessment tools: Utilize tools that allow employees to provide self-feedback and reflections on their performance.

- Feedback collection systems: Implement tools to collect 360-degree feedback from supervisors, peers, and subordinates.

8. How do you ensure that performance reviews are used to support employee development and goal setting?

- Connect to career goals: Align performance evaluations with employee career aspirations and goals, providing feedback that supports their growth and development.

- Action planning: Develop specific and measurable action plans based on performance feedback, setting clear expectations for improvement.

- Regular check-ins: Schedule follow-up meetings to track progress on action plans and provide ongoing support and guidance.

- Coaching and mentoring: Offer opportunities for coaching and mentoring to help employees develop skills and improve their performance.

9. How do you handle cases where an employee’s performance significantly exceeds or falls below expectations?

Exceptional performance

- Recognition and reward: Acknowledge and reward outstanding performance to motivate employees and promote a culture of excellence.

- Challenge assignments: Provide opportunities for growth and development by assigning challenging projects or roles.

- Encourage mentorship: Support exceptional performers in mentoring or coaching others to share their knowledge and skills.

Below-expectations performance

- Provide constructive feedback: Clearly communicate performance concerns, providing specific examples and identifying areas for improvement.

- Develop an action plan: Collaborate with the employee to develop a plan to address performance gaps and set clear expectations for improvement.

- Monitor progress: Regularly track the employee’s progress and provide support and guidance as needed.

10. What are the key qualities and skills that make an effective Rating Examiner?

- Objectivity and fairness: Maintain impartiality and avoid bias when evaluating performance.

- Communication skills: Effectively communicate performance feedback and engage in constructive conversations.

- Analytical thinking: Analyze performance data and identify trends and patterns.

- Interpersonal skills: Build rapport and establish positive relationships with employees.

- Continuous learning: Stay updated on best practices and legal requirements related to performance management.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Rating Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Rating Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Rating Examiners are highly trained, certified professionals who hold a pivotal role in the mortgage industry. Their expertise lies in reviewing, analyzing, and evaluating residential mortgage applications to determine the creditworthiness of borrowers and assign appropriate credit ratings. These ratings play a crucial role in determining the loan terms, including interest rates, loan amounts, and repayment periods. By ensuring accuracy and consistency in the rating process, Rating Examiners contribute significantly to the stability and integrity of the housing market.

1. Application Assessment

Rating Examiners meticulously scrutinize mortgage applications, verifying borrowers’ financial information, such as income, assets, debts, and liabilities. They assess credit histories, employment records, and property details to gain a comprehensive understanding of the borrower’s financial situation.

- Examining loan applications for completeness and accuracy

- Verifying income, assets, debts, and other financial information

2. Credit Analysis

Rating Examiners leverage their expertise in credit analysis to evaluate borrowers’ credit scores and credit histories. They assess the borrower’s ability to repay the loan by considering factors such as payment history, credit utilization, and any derogatory marks.

- Analyzing credit reports to assess creditworthiness

- Calculating debt-to-income ratios and other credit metrics

3. Risk Assessment

Rating Examiners meticulously assess the risks associated with each loan application. They evaluate factors such as property value, loan-to-value ratio, and borrowers’ financial stability to determine the likelihood of default. This assessment helps lenders make informed decisions regarding loan approvals and interest rates.

- Evaluating property values and loan-to-value ratios

- Assessing borrower’s financial stability and risk of default

4. Rating Assignment

Based on their comprehensive analysis, Rating Examiners assign credit ratings to loan applications. These ratings, typically ranging from AAA to D, indicate the level of risk associated with the loan and serve as a crucial factor in determining loan terms and interest rates.

- Assigning credit ratings based on risk assessment

- Communicating ratings decisions to lenders and borrowers

Interview Tips

To maximize your chances of acing the Rating Examiner interview, consider the following tips:

1. Research the Company and Position

Thoroughly research the company’s culture, values, and specific requirements for the Rating Examiner role. This knowledge will enable you to tailor your responses and demonstrate your alignment with the organization’s objectives.

- Visit the company’s website and social media pages

- Read industry publications and news articles

2. Quantify Your Accomplishments

When describing your previous experiences, focus on quantifying your accomplishments whenever possible. Using specific metrics and data points adds credibility to your claims and helps the interviewer understand the impact of your work.

- Example: “In my previous role, I increased loan application approval rates by 15% by implementing new risk assessment techniques.”

3. Highlight Your Analytical Skills

Emphasize your strong analytical and problem-solving abilities. Rating Examiners are expected to meticulously analyze complex financial information and make sound judgments. Showcase your expertise in identifying patterns, interpreting data, and drawing logical conclusions.

- Example: “I have a proven track record of using data analysis to identify high-risk loans and prevent potential losses.”

4. Demonstrate Your Attention to Detail

Rating Examiners must exhibit meticulous attention to detail. During the interview, highlight your ability to carefully review and verify information, ensuring accuracy and completeness. Mention specific examples where you identified errors or discrepancies that might have otherwise been overlooked.

- Example: “In my last position, I implemented a rigorous quality control process that reduced errors in loan applications by 20%.”

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Rating Examiner role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.