Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Real Estate Assessor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

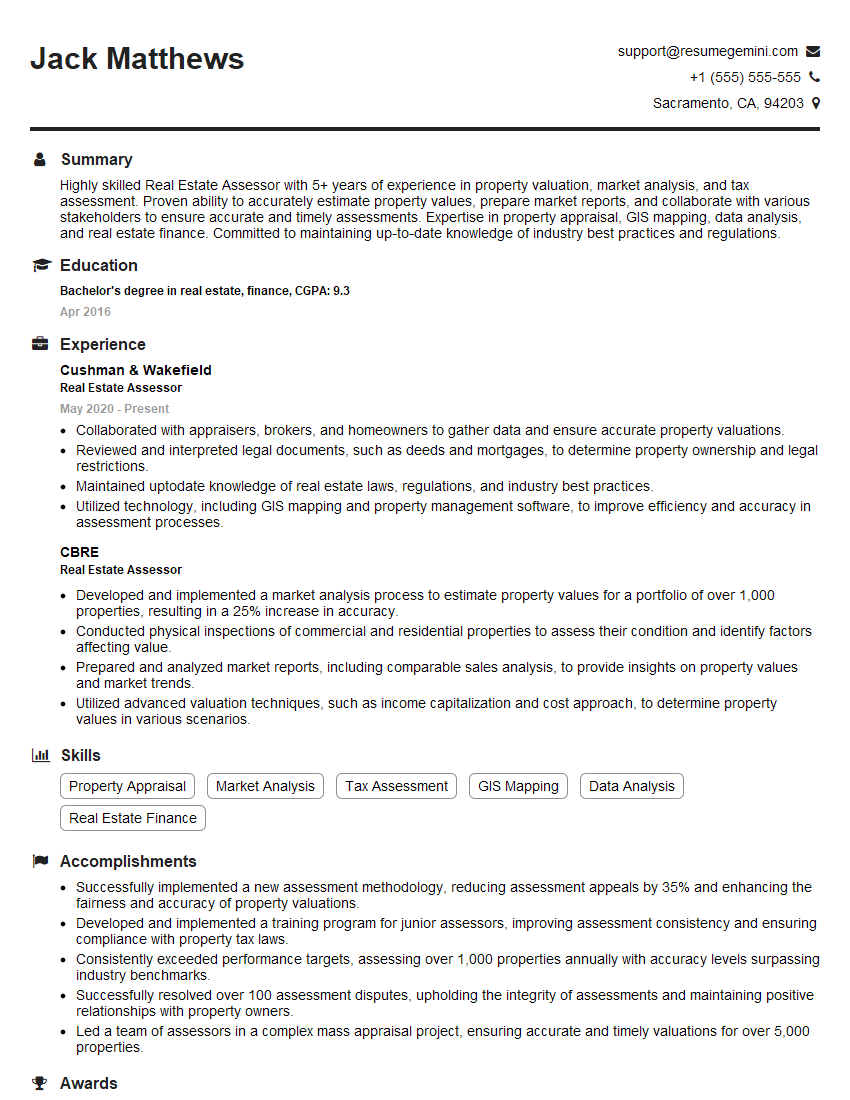

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Real Estate Assessor

1. What are the key factors you consider when assessing the value of a residential property?

- Location: The neighborhood, proximity to amenities, and access to transportation.

- Building characteristics: Size, age, number of bedrooms and bathrooms, and overall condition.

- Market conditions: Recent sales of comparable properties, economic indicators, and interest rates.

- Owner-occupied vs. investment property: Different factors may be considered for owner-occupied properties, such as personal preferences and emotional attachment.

- Legal and environmental factors: Zoning restrictions, easements, environmental hazards, and property boundaries.

2. What methods do you use to value commercial properties, and how do they differ from residential property valuations?

Sales Comparison Approach

- Analyze sales data of similar commercial properties in the area.

- Adjust for differences in size, location, and other relevant factors.

Income Capitalization Approach

- Estimate the potential income and expenses of the property.

- Capitalize the income stream using an appropriate rate to determine the property’s value.

Cost Approach

- Estimate the cost to replace or recreate the property.

- Deduct depreciation for the age and condition of the property.

3. How do you handle situations where there is limited or no comparable data available for a particular property?

- Use non-comparable sales data and adjust for differences.

- Interview local real estate professionals for market insights.

- Apply theoretical valuation models, such as hypothetical scenarios or regression analysis.

- Consider income and expense data, if available.

- Consult with other assessors or industry experts for guidance.

4. What are the ethical guidelines you follow in your work as a Real Estate Assessor?

- Adhere to the Uniform Standards of Professional Appraisal Practice (USPAP).

- Maintain independence and impartiality.

- Disclose any potential conflicts of interest.

- Use only reliable data and methods.

- Provide clear and unbiased reports.

5. How do you stay up-to-date on changes in the real estate market and appraisal regulations?

- Attend industry conferences and workshops.

- Subscribe to real estate publications and newsletters.

- Participate in continuing education programs.

- Network with other real estate professionals.

- Monitor government websites and agencies for regulatory updates.

6. What software and tools do you use in your day-to-day work as a Real Estate Assessor?

- Computer-assisted mass appraisal (CAMA) software.

- Property data management systems.

- Calculators and spreadsheets for data analysis.

- Geographic information systems (GIS) for spatial analysis.

- Online research tools for property information and market data.

7. What is the difference between a market value appraisal and an assessed value?

- Market value appraisal: Estimates the property’s value based on current market conditions and comparable sales, typically used for mortgage financing or property transactions.

- Assessed value: A government-determined value used for property tax purposes, often based on a percentage of the market value or a specific formula.

8. How do you handle appeals from property owners who disagree with their property assessments?

- Review the property record and assessment data.

- Meet with the property owner to discuss their concerns.

- Consider additional information provided by the owner, such as comparable sales or property improvements.

- Make an independent determination based on the available evidence.

- Communicate the decision to the owner clearly and professionally.

9. What are the potential consequences of inaccurate property assessments?

- Unfair property taxes for property owners.

- Reduced tax revenue for local governments.

- Distorted real estate market values.

- Legal challenges from property owners.

- Erosion of public trust in the assessment system.

10. What do you see as the future of real estate assessment?

- Increased use of technology and automation for data collection and analysis.

- Adoption of more sophisticated valuation models and techniques.

- Greater focus on data transparency and accessibility.

- Enhanced collaboration between assessors and other stakeholders.

- Continued emphasis on ethical and professional standards.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Real Estate Assessor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Real Estate Assessor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Real Estate Assessors play a crucial role in the property tax system. Their primary duty is evaluating and appraising properties for tax purposes. This involves analyzing market trends, conducting property inspections, and determining the fair market value of real estate to ensure equitable tax assessments.

1. Property Appraisal and Valuation

Assessors determine the value of land and properties, considering factors such as location, size, condition, and recent sales data. They estimate the fair market value to establish a foundation for property taxes.

2. Inspection and Analysis

Assessors visit properties to inspect their physical condition, including structural integrity, amenities, and any improvements. They also analyze comparable sales in the area to support their valuations.

3. Data Collection and Research

Assessors gather data from various sources, such as deeds, building permits, and neighborhood surveys. They conduct thorough research to assess market conditions, property trends, and economic factors that influence property values.

4. Tax Assessment and Administration

Based on their valuations, assessors calculate and issue tax assessments to property owners. They may also assist in resolving assessment disputes and provide guidance on property tax matters.

Interview Tips

Preparing thoroughly for a Real Estate Assessor interview can significantly increase your chances of success. Consider these tips to present yourself confidently and effectively during the interview.

1. Research the Company and Position

Familiarize yourself with the organization you’re applying to and the specific responsibilities of the Real Estate Assessor role. Understanding the company’s values and objectives will help you tailor your answers to the interviewer’s questions.

2. Highlight Your Technical Expertise

Emphasize your technical skills in property appraisal, valuation, and market analysis. Provide specific examples of complex assessments you’ve handled. Quantify your accomplishments whenever possible to demonstrate the impact of your work.

3. Communicate Your Analytical Skills

Assessors must possess strong analytical abilities. Showcase your experience in gathering and interpreting data, identifying trends, and making informed decisions based on thorough analysis. Provide examples of how you’ve used your analytical skills to solve problems.

4. Demonstrate Your Communication Abilities

Effective communication is essential for Real Estate Assessors. Highlight your ability to convey complex financial and technical concepts clearly and persuasively to a diverse audience. Describe situations where you effectively communicated your assessments to property owners or stakeholders.

5. Emphasize Your Attention to Detail

Accuracy and attention to detail are paramount in this role. Provide examples of your meticulous approach to property inspections, data analysis, and report preparation. Explain how your accuracy ensures fair and equitable property tax assessments.

6. Prepare for Common Interview Questions

Practice answering common interview questions tailored to the Real Estate Assessor role. Prepare for questions about your experience, technical skills, and understanding of property tax laws and regulations. Also, be prepared to discuss your qualifications and how you align with the company’s needs.

7. Ask Insightful Questions

Asking thoughtful questions at the end of the interview demonstrates your engagement and interest in the position. Prepare questions about the company’s goals, the team you’d be joining, or the specific projects you’d be involved in. This shows that you’re genuinely interested in the role and the organization.

8. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally, arrive on time for your interview, and maintain a positive and enthusiastic attitude throughout the process. These details convey respect and professionalism.

9. Follow Up Appropriately

After the interview, send a thank-you note to the interviewer, reiterating your interest in the position and expressing your appreciation for their time. This demonstrates your continued enthusiasm and leaves a lasting positive impression.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Real Estate Assessor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.