Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Real Estate Investor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Real Estate Investor so you can tailor your answers to impress potential employers.

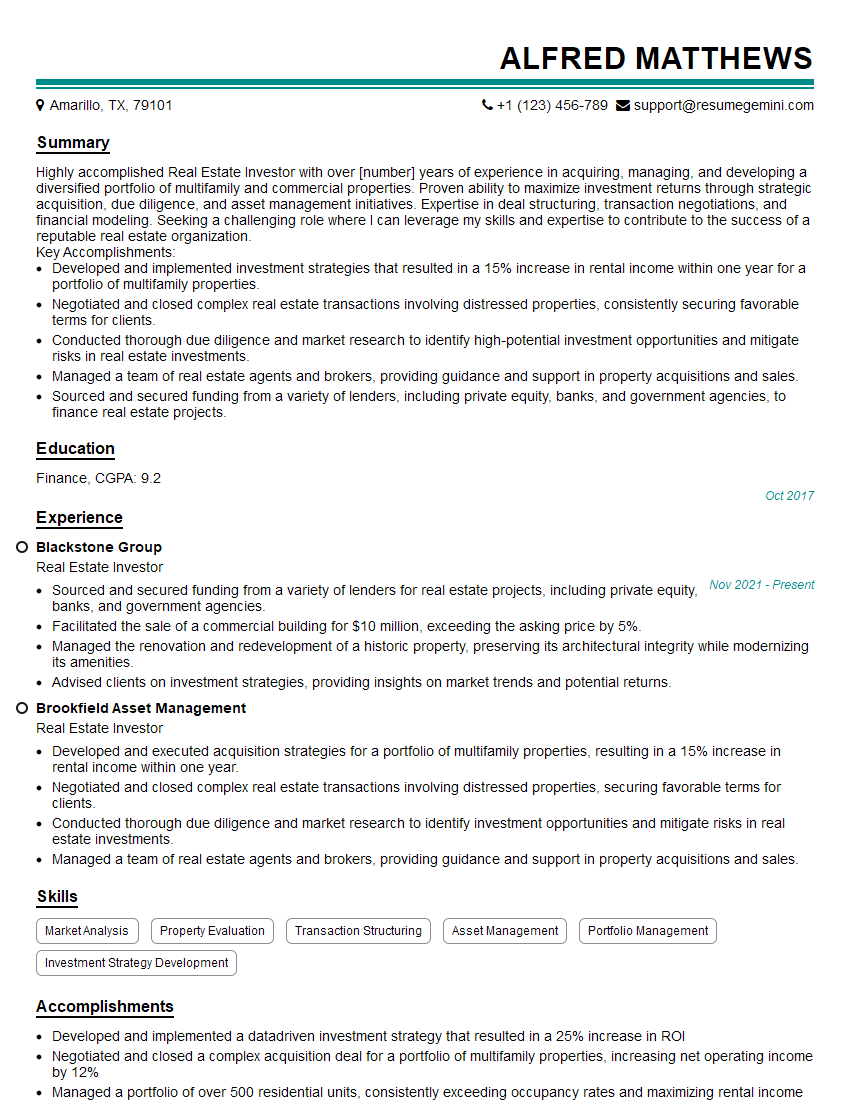

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Real Estate Investor

1. what is cash flow? How does positive cash flow benefit a real estate investor?

Cash flow is the difference between a property’s income and expenses. Positive cash flow benefits a real estate investor by providing them with a steady stream of income that can be used to cover expenses, make improvements, or reinvest in other properties.

- Provides a steady stream of income

- Can be used to cover expenses

- Can be used to make improvements

- Can be used to reinvest in other properties

2. What is due diligence? What are the key elements of due diligence for a real estate investor?

Key Elements of Due Diligence

- Reviewing the property’s title

- Inspecting the property

- Reviewing the property’s financial statements

- Interviewing the property’s tenants

- Talking to the property’s neighbors

Benefits of Due Diligence

- Helps to identify potential problems

- Helps to make informed investment decisions

- Can help to avoid costly mistakes

3. What are the different types of real estate investments?

There are many different types of real estate investments, including:

- Residential properties

- Commercial properties

- Industrial properties

- Land

- REITs

4. What are the risks associated with real estate investing?

There are a number of risks associated with real estate investing, including:

- Vacancy risk

- Default risk

- Interest rate risk

- Property value risk

- Environmental risk

5. How do you evaluate a real estate investment?

I evaluate a real estate investment by considering the following factors:

- The property’s location

- The property’s condition

- The property’s income potential

- The property’s expenses

- The property’s potential for appreciation

6. What are some of the strategies you use to increase the value of a real estate investment?

Some of the strategies I use to increase the value of a real estate investment include:

- Making improvements to the property

- Increasing the property’s income

- Reducing the property’s expenses

- Holding the property for appreciation

7. What are some of the challenges you have faced as a real estate investor?

Some of the challenges I have faced as a real estate investor include:

- Finding good deals

- Financing properties

- Managing tenants

- Dealing with repairs and maintenance

- Keeping up with the latest real estate trends

8. What are your goals as a real estate investor?

My goals as a real estate investor are to:

- Generate passive income

- Build wealth

- Help others achieve their real estate goals

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed with your company’s reputation for excellence in the real estate industry. I am also excited about the opportunity to work with a team of experienced professionals who share my passion for real estate.

10. Do you have any questions for me?

Yes, I have a few questions for you:

- What is the company’s culture like?

- What are the company’s growth plans?

- What are the company’s expectations for a real estate investor?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Real Estate Investor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Real Estate Investor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Real Estate Investor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!