Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Real Time Trader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Real Time Trader so you can tailor your answers to impress potential employers.

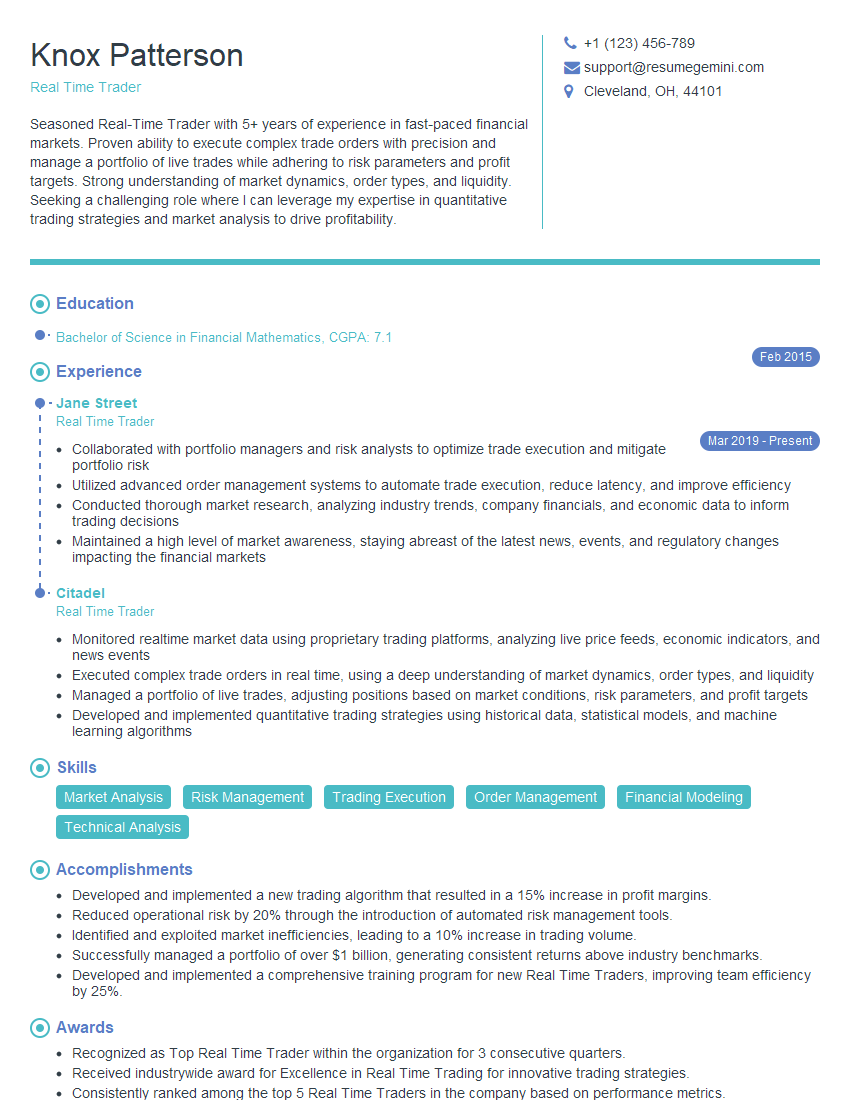

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Real Time Trader

1. Describe the steps involved in executing a trade in real time.

- Identify the trading opportunity and determine the appropriate trade strategy.

- Send an order to the broker or exchange, specifying the type of order (market, limit, stop, etc.), the quantity, and the desired price.

- Monitor the order status and make adjustments as needed (e.g., cancel or modify the order).

- Execute the trade at the desired price or accept the best available price.

- Confirm the trade execution and record the details (e.g., price, quantity, timestamp).

2. How do you manage risk in real-time trading?

By implementing various risk management techniques such as:

Risk Assessment

- Identify potential risks associated with different trading strategies and market conditions.

- Calculate potential losses and determine acceptable levels of risk.

Position Sizing

- Determine the appropriate trade size based on risk tolerance, account balance, and market volatility.

- Adjust position sizes as risk parameters or market conditions change.

Stop-Loss Orders

- Place stop-loss orders to automatically exit trades when predetermined price levels are reached.

- Protect against excessive losses and limit downside risk.

Diversification

- Spread trades across different instruments, sectors, or markets.

- Reduce overall portfolio risk by mitigating concentrated exposure to any single asset.

3. What are the different types of trading strategies used in real-time trading?

- Scalping: Taking small, frequent profits from short-term price movements.

- Day Trading: Opening and closing trades within a single trading day.

- Swing Trading: Holding trades for several days or weeks, targeting larger price swings.

- Trend Following: Trading in the direction of the prevailing market trend.

- News Trading: Reacting to market-moving news events and trading the resulting price fluctuations.

4. How do you analyze market data and make trading decisions in real time?

By utilizing a combination of technical analysis and fundamental analysis:

Technical Analysis

- Study price charts and patterns to identify trading opportunities.

- Use technical indicators (e.g., moving averages, oscillators) to gauge market momentum, trend strength, and support/resistance levels.

Fundamental Analysis

- Evaluate economic data, company earnings reports, and industry trends.

- Assess the intrinsic value of assets and identify potential mispricings in the market.

Combining Technical and Fundamental Analysis

- Use technical analysis to identify trading signals and entry/exit points.

- Supplement with fundamental analysis to confirm trading decisions and assess the overall market outlook.

5. What tools and resources do you use to monitor and trade the markets in real time?

- Trading platforms (e.g., MetaTrader, cTrader)

- Market data feeds (e.g., Reuters, Bloomberg)

- News and analysis services (e.g., CNBC, Seeking Alpha)

- Charting software (e.g., TradingView, Thinkorswim)

- Risk management tools (e.g., position sizing calculators, stop-loss orders)

6. How do you stay up-to-date with the latest market trends and news?

- Monitor financial news websites and social media platforms (e.g., Twitter, StockTwits)

- Attend industry conferences and webinars

- Read industry publications and research reports

- Network with other traders and market professionals

7. What are the ethical considerations and regulations that you adhere to as a real-time trader?

- Uphold the highest standards of integrity and transparency.

- Comply with all applicable laws and regulations (e.g., insider trading laws, market manipulation regulations).

- Avoid conflicts of interest and disclose any potential conflicts promptly.

- Act in the best interests of clients or employers.

8. How do you measure and evaluate your trading performance?

By tracking key metrics such as:

- Profitability (e.g., return on investment, profit factor)

- Risk management (e.g., maximum drawdown, Sharpe ratio)

- Trading frequency (e.g., average number of trades per day)

- Win rate (percentage of profitable trades)

- Consistency (ability to achieve positive returns over multiple time periods)

9. What are the challenges you have faced and how did you overcome them?

By employing strategies such as:

- Emotional Discipline: Implementing risk management rules and sticking to them regardless of emotions.

- Continuous Learning: Staying up-to-date with market trends, trading techniques, and risk management strategies.

- Adaptability: Adjusting trading strategies and risk parameters as market conditions evolve.

- Persistence: Overcoming setbacks and maintaining a positive mindset even during challenging times.

10. Why are you interested in this real-time trading position and what makes you qualified for it?

By highlighting your passion for trading, relevant skills, and experience:

- Emphasize your enthusiasm for navigating fast-paced markets and making quick decisions.

- Showcase your proficiency in technical analysis, risk management, and trading strategy implementation.

- Quantify your trading experience and provide examples of successful trades or strategies.

- Demonstrate your commitment to continuous learning and staying abreast of market developments.

- Express your alignment with the company’s trading philosophy and goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Real Time Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Real Time Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Real-time traders are responsible for executing trades in the financial markets in a timely and efficient manner. They work closely with traders on the trading floor and analysts to develop and implement trading strategies. They also monitor market conditions and data to identify trading opportunities. Some of the key job responsibilities of a real-time trader include:

1. Execute Trades

Real-time traders are responsible for executing trades in the financial markets. This involves buying and selling stocks, bonds, currencies, and other financial instruments. They must be able to execute trades quickly and efficiently in order to capitalize on market opportunities.

2. Monitor Market Conditions

Real-time traders must constantly monitor market conditions in order to identify trading opportunities. They use a variety of tools to track market data, including charts, news feeds, and trading platforms. They must be able to identify trends and patterns in the market in order to make informed trading decisions.

3. Develop Trading Strategies

Real-time traders work closely with traders on the trading floor and analysts to develop and implement trading strategies. They must be able to understand and interpret market data in order to identify trading opportunities. They must also be able to develop and implement trading strategies that align with the risk tolerance and investment goals of their clients.

4. Manage Risk

Real-time traders must be able to manage risk in order to protect their clients’ capital. They must be able to identify and assess risks and take appropriate measures to mitigate those risks. They must also be able to monitor their trades closely and adjust their positions as needed.

Interview Tips

To ace your real time trader interview, it is important to prepare thoroughly and practice your answers to questions that you are likely to be asked. Here are a few tips to help you prepare for your interview:

1. Research the Company and the Position

Before your interview, take some time to research the company and the position you are applying for. This will help you to understand the company’s culture and values, as well as the specific requirements of the position. You can find information about the company on their website, in news articles, and on social media. You can also learn more about the position by reading the job posting and speaking to people who work in the industry.

2. Practice your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and clearly during your interview.

3. Be Prepared to Discuss Your Experience

The interviewer will likely ask you about your experience in the financial markets. Be prepared to discuss your trading experience, as well as your knowledge of the markets. You should also be able to provide examples of your successes and failures.

4. Be Professional and Enthusiastic

It is important to be professional and enthusiastic during your interview. This will demonstrate to the interviewer that you are serious about the position and that you are confident in your abilities. You should dress appropriately for the interview and arrive on time. You should also be prepared to answer questions about yourself and your experience in a clear and concise manner.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Real Time Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!