Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Realty Loan Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

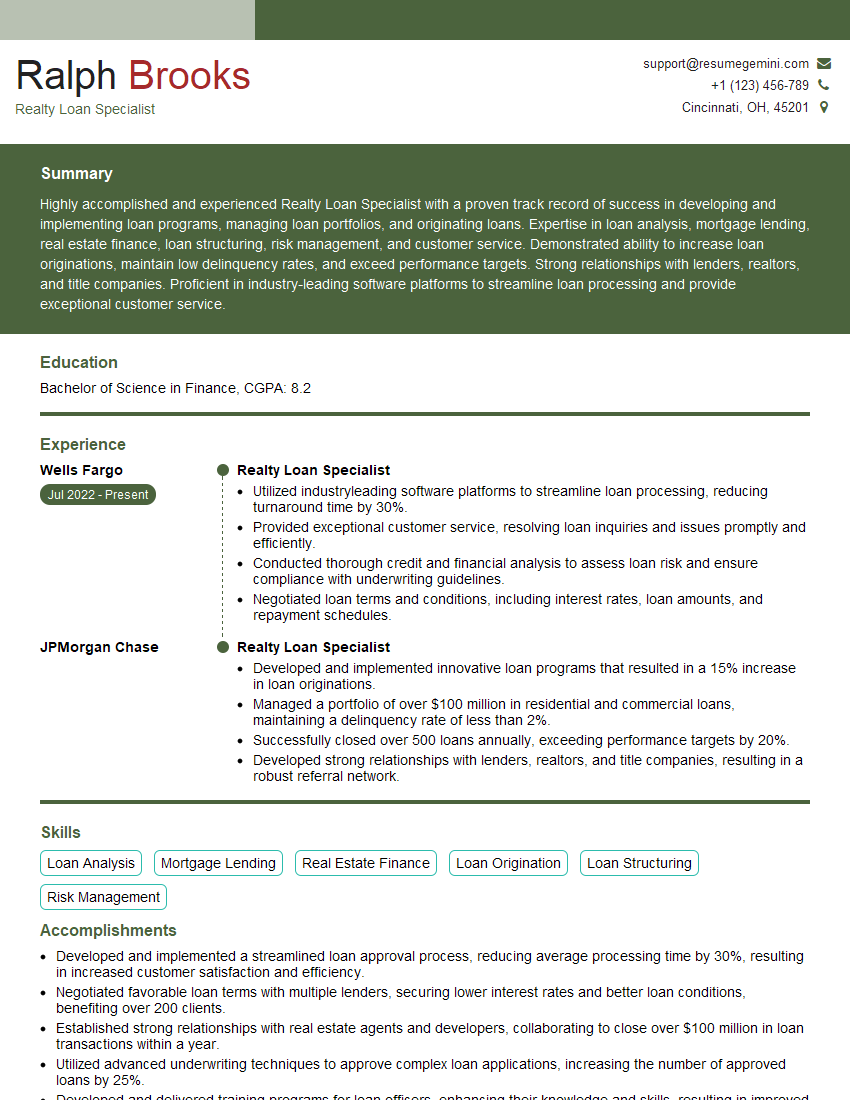

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Realty Loan Specialist

1. Describe the process of underwriting a mortgage loan.

- Review borrower’s financial history and creditworthiness.

- Verify income, assets, and liabilities.

- Assess the property’s value and condition.

- Determine the loan amount, interest rate, and loan term.

- Issue a loan commitment.

2. What are the different types of mortgage loans available?

- Conventional loans: Backed by Fannie Mae or Freddie Mac, require private mortgage insurance (PMI) for low down payments.

- Government-backed loans: Mortgages insured or guaranteed by the government (e.g., FHA, VA, USDA), with lower down payments and more flexible credit requirements.

3. How do you determine a borrower’s debt-to-income ratio (DTI)?

- Calculate monthly gross income (excluding irregular or seasonal income).

- Add monthly housing expenses (mortgage or rent, property taxes, insurance).

- Add other monthly debt payments (e.g., car loans, student loans, credit cards).

- Divide total debt payments by gross income.

4. What are some common reasons for loan denials?

- Insufficient income or assets

- Low credit score or negative credit history

- High DTI ratio

- Property-related issues

- Incomplete or inaccurate loan application

5. How do you handle difficult customers or borrowers?

- Stay calm and professional.

- Listen carefully to their concerns.

- Explain the underwriting process and requirements clearly.

- Be patient and empathetic, but also firm in upholding the lender’s policies.

- If necessary, refer the borrower to a supervisor or manager.

6. What are the key factors that influence mortgage interest rates?

- Economic conditions (e.g., inflation, recession)

- Demand for mortgages

- Federal Reserve policies

- Risk profile of the borrower

- Type of mortgage loan

7. How do you stay up-to-date on industry trends and regulatory changes in mortgage lending?

- Attend industry events and conferences.

- Read trade publications and industry blogs.

- Participate in professional development courses.

- Stay informed about updates to the Home Mortgage Disclosure Act (HMDA) and other regulations.

8. What are the ethical considerations in mortgage lending?

- Treating borrowers fairly and respectfully.

- Protecting borrower financial interests

- Avoiding conflicts of interest

- Complying with all applicable laws and regulations

- Maintaining confidentiality

9. How do you prioritize and manage a heavy workload?

- Use a task management system to track progress.

- Delegate tasks to colleagues as appropriate.

- Break down large tasks into smaller, manageable chunks.

- Set realistic deadlines and stick to them.

- Identify bottlenecks and seek ways to improve efficiency.

10. Why are you interested in this position and how do your skills make you a suitable candidate?

- Tailor to the specific role: Highlight experiences and skills that align with the job description.

- Demonstrate enthusiasm: Express your interest in the company and the industry.

- Showcase expertise: Quantify your accomplishments and provide specific examples of your success in underwriting real estate loans.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Realty Loan Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Realty Loan Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Realty Loan Specialists play a crucial role in the financial industry, serving as intermediaries between borrowers and lenders. Their primary responsibilities include:

1. Loan Origination and Processing

Initiate and process loan applications by gathering and verifying financial and personal information from potential borrowers.

- Conduct credit checks and analyze financial statements.

- Determine loan eligibility and recommend loan products.

2. Loan Underwriting

Assess the risk associated with each loan application.

- Evaluate borrower’s income, assets, debts, and credit history.

- Recommend loan approval or denial.

3. Loan Closing

Facilitate the finalization of loan agreements.

- Prepare and review loan documents.

- Attend loan signings with borrowers.

4. Customer Relationship Management

Establish and maintain positive relationships with borrowers.

- Provide loan status updates and answer customer inquiries.

- Recommend additional products and services to meet customer needs.

Interview Tips

Preparing for a Realty Loan Specialist interview requires a combination of technical knowledge and interpersonal skills. Here are some helpful tips:

1. Research the Company and Industry

Demonstrate your interest and understanding of the company’s products, services, and industry trends.

- Visit the company website and social media pages.

- Read articles and news about the company and industry.

2. Practice Common Interview Questions

Prepare for questions that focus on your qualifications, experience, and motivations.

- Describe your experience in loan origination, underwriting, or closing.

- Explain your understanding of mortgage products and processes.

3. Showcase Your Technical Skills

Highlight your proficiency in loan processing software, credit analysis tools, and industry regulations.

- Quantify your accomplishments with specific metrics.

- Discuss your knowledge of current lending guidelines.

4. Emphasize Customer Service Skills

Convey your ability to build rapport with clients and provide excellent support.

- Share examples of how you have handled difficult customer interactions.

- Explain your philosophy on customer care.

5. Prepare Questions for the Interviewer

Asking thoughtful questions shows your engagement and interest in the role.

- Inquire about the company’s growth plans.

- Ask about specific aspects of the loan origination process.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Realty Loan Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.