Are you gearing up for a career in Receivables Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Receivables Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

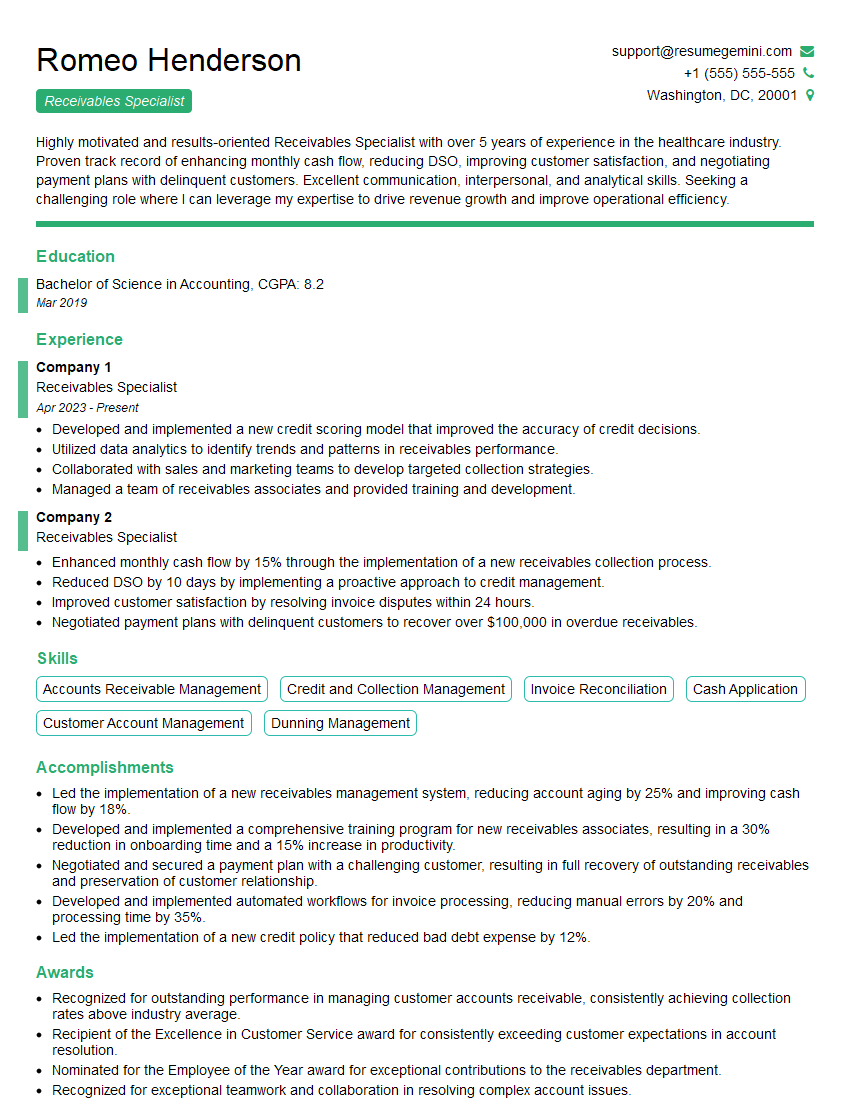

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Receivables Specialist

1. Describe the key responsibilities of a Receivables Specialist.

The key responsibilities of a Receivables Specialist include:

- Maintaining accurate and up-to-date customer accounts receivable records

- Processing customer payments and reconciling bank statements

- Investigating and resolving customer disputes

- Managing the collection process and recovering overdue payments

- Providing excellent customer service

2. What are the key skills and qualifications required for a Receivables Specialist?

Education and Experience

- Bachelor’s degree in accounting or finance, or equivalent work experience

- 2-3 years of experience in a receivables or collections role

Skills

- Strong understanding of accounting principles and GAAP

- Proficient in Microsoft Office Suite

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Detail-oriented and highly organized

3. What are the most important qualities of a successful Receivables Specialist?

The most important qualities of a successful Receivables Specialist include:

- Accuracy and attention to detail

- Strong work ethic and dedication

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Positive attitude and willingness to go the extra mile

4. What are the biggest challenges facing Receivables Specialists today?

The biggest challenges facing Receivables Specialists today include:

- The increasing complexity of the global economy

- The growing use of electronic payments

- The need to comply with increasingly complex regulations

- The rising cost of doing business

5. What are the trends that are shaping the future of the receivables management industry?

The trends that are shaping the future of the receivables management industry include:

- The increasing use of automation and technology

- The growing importance of data analytics

- The need for greater collaboration between receivables specialists and other departments

- The rising demand for specialized skills and knowledge

6. How do you stay up-to-date on the latest trends and developments in the receivables management industry?

I stay up-to-date on the latest trends and developments in the receivables management industry by:

- Attending industry conferences and webinars

- Reading industry publications and blogs

- Networking with other receivables professionals

- Taking advantage of training and development opportunities

7. What is your favorite part of being a Receivables Specialist?

My favorite part of being a Receivables Specialist is the opportunity to help customers resolve their financial issues and improve their cash flow.

8. What is the most challenging part of being a Receivables Specialist?

The most challenging part of being a Receivables Specialist is dealing with customers who are struggling financially and may be difficult to collect from.

9. What is your proudest accomplishment as a Receivables Specialist?

My proudest accomplishment as a Receivables Specialist was helping a customer who was struggling financially to get back on their feet and repay their debt.

10. What are your career goals as a Receivables Specialist?

My career goals as a Receivables Specialist are to continue to develop my skills and knowledge and to eventually become a manager in the receivables management field.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Receivables Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Receivables Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Receivables Specialists play a crucial role in ensuring the timely collection of payments and maintaining healthy cash flow for organizations. Key job responsibilities include:

1. Accounts Receivable Management

Monitoring and maintaining accounts receivable records, ensuring accuracy and completeness.

- Processing invoices, payments, and credit memos.

- Reconciling bank statements and customer accounts.

2. Invoice Tracking

Tracking and monitoring the progress of invoices, identifying overdue or delinquent accounts.

- Issuing invoices, payment reminders, and collection letters.

- Investigating discrepancies and resolving disputes.

3. Cash Application

Applying customer payments to the appropriate accounts, ensuring timely and accurate posting.

- Matching invoices to payments.

- Investigating and resolving discrepancies.

4. Customer Communication

Communicating with customers regarding outstanding payments, inquiries, and disputes.

- Negotiating payment plans and resolving conflicts.

- Providing excellent customer service and resolving complaints.

Interview Tips

To ace the Receivables Specialist interview, follow these preparation tips and techniques:

1. Research the Company and Role

Thoroughly research the company’s industry, size, and financial performance. Understand the specific responsibilities of the Receivables Specialist role within the organization.

2. Prepare for Common Interview Questions

Anticipate and prepare for common interview questions related to accounts receivable, cash application, collection techniques, and customer communication. Practice answering these questions using the STAR method (Situation, Task, Action, Result).

- Example Outline: Describe a situation where you had to resolve a dispute with a customer.

3. Showcase Relevant Skills and Experience

Highlight your relevant skills and experience, including proficiency in accounts receivable software, knowledge of financial reporting, and strong communication and customer service abilities.

4. Demonstrate Your Attention to Detail

Receivables Specialists must have a keen eye for detail and accuracy. Emphasize your ability to meticulously review and reconcile accounts, identify errors, and maintain organized records.

5. Be Enthusiastic and Professional

Convey your enthusiasm for the role and the company. Dress professionally and arrive for the interview on time. Show confidence and a positive attitude throughout the interview process.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Receivables Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.