Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Reconcilement Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Reconcilement Clerk so you can tailor your answers to impress potential employers.

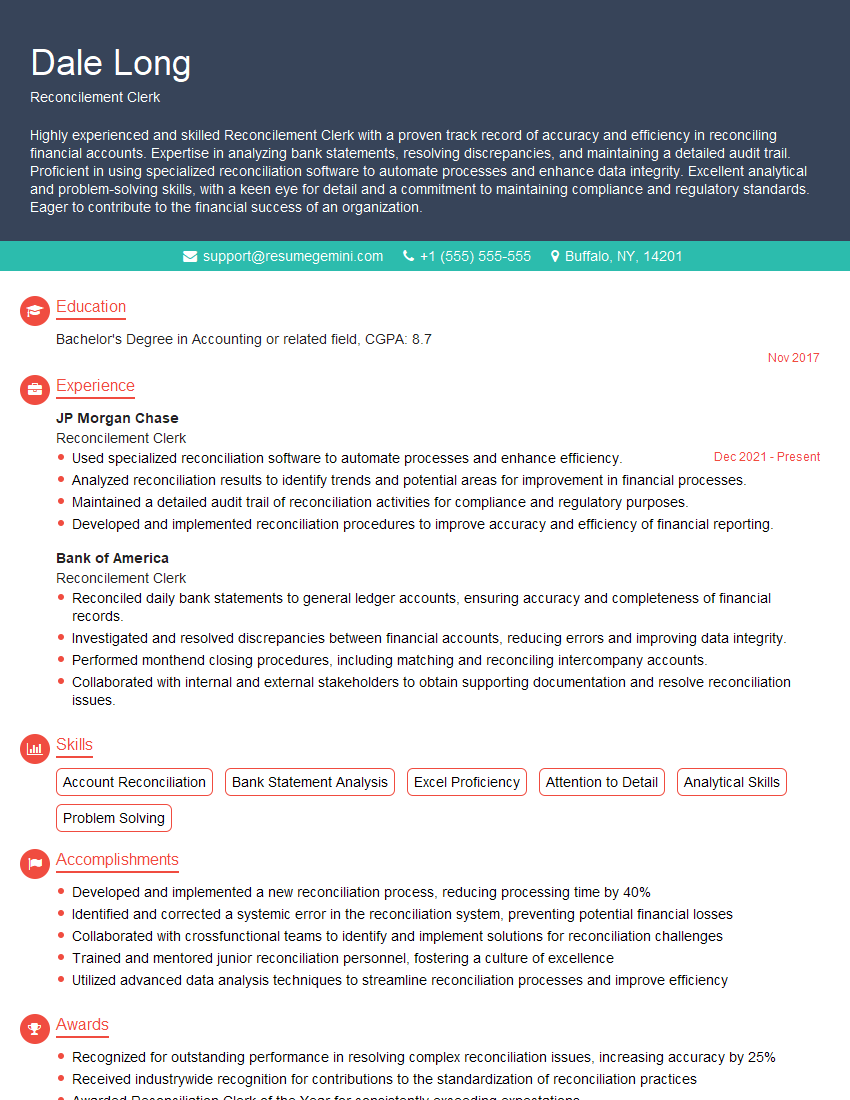

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Reconcilement Clerk

1. Explain the process of bank reconciliation step by step?

- Gather all necessary bank statements, checkbooks, and other relevant documents.

- Compare the bank statement with the check register, noting any discrepancies.

- Investigate any discrepancies and make necessary adjustments to the check register.

- Record any outstanding checks or deposits.

- Balance the check register with the bank statement.

2. What are the common errors that can occur during reconciliation and how to prevent them?

Errors

- Incorrect data entry

- Omission of transactions

- Duplication of transactions

Preventing Errors

- Use a checklist to ensure that all transactions are recorded.

- Double-check all data entry for accuracy.

- Review the reconciliation process regularly to identify any areas where errors may occur.

3. What is the purpose of a reconciliation report, and what information does it typically include?

- To provide a summary of the reconciliation process and its results.

- To identify any discrepancies or adjustments made during reconciliation.

- To serve as a record of the reconciliation process.

- Typically includes the following information:

- Beginning balance

- Ending balance

- Deposits

- Withdrawals

- Outstanding checks

- Discrepancies

- Adjustments

4. Explain how you would handle a situation where there is a large discrepancy between the bank statement and the check register?

- Review the bank statement and check register carefully to identify any errors.

- Contact the bank to verify the accuracy of the bank statement.

- Contact customers or vendors to confirm the accuracy of transactions.

- Make necessary adjustments to the check register and bank statement.

- Document the discrepancy and the steps taken to resolve it.

5. What are the key qualities and skills required to be an effective Reconcilement Clerk?

- Attention to detail

- Accuracy

- Analytical skills

- Problem-solving skills

- Communication skills

- Time management skills

6. How do you stay up-to-date with the latest changes and best practices in reconciliation?

- Attend industry conferences and workshops.

- Read trade publications and online resources.

- Network with other reconciliation professionals.

- Seek opportunities for professional development.

7. What is your experience with using accounting software for reconciliation?

- Describe your experience using accounting software for reconciliation.

- Highlight any specific features or modules that you are familiar with.

- Explain how you have used accounting software to improve the efficiency and accuracy of the reconciliation process.

8. How do you handle high-volume reconciliation tasks?

- Describe your strategies for managing high-volume reconciliation tasks.

- Explain how you prioritize tasks and allocate resources effectively.

- Highlight any tools or techniques that you use to streamline the process.

9. What are the key challenges you have faced in your previous reconciliation roles?

10. Why are you interested in this Reconciliation Clerk position?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Reconcilement Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Reconcilement Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Reconciliation Clerks are responsible for ensuring the accuracy of financial records by identifying and resolving discrepancies between two or more sets of data. Key responsibilities include:

1. Data Matching and Reconciliation

Matching and reconciling data from different sources, such as bank statements, invoices, purchase orders, and receipts.

- Identifying and investigating discrepancies between data sets.

- Resolving discrepancies by researching and collecting supporting documentation.

2. Data Analysis and Reporting

Analyzing and interpreting data to identify trends and patterns.

- Preparing reconciliation reports and summaries.

- Presenting findings and recommendations to management.

3. Account Monitoring and Maintenance

Monitoring and maintaining account balances and transactions.

- Identifying and reporting unusual or suspicious activity.

- Assisting with account closures and transfers.

4. Compliance and Auditing

Ensuring compliance with company policies and procedures, as well as external regulations.

- Participating in internal and external audits.

- Providing documentation and support for audit inquiries.

Interview Tips

To ace the interview for a Reconcilement Clerk position, candidates should prepare thoroughly and demonstrate the following:

1. Technical Skills and Knowledge

Candidates should have a strong foundation in accounting principles, data analysis techniques, and financial reporting.

- Highlight your experience in using reconciliation software.

- Be prepared to discuss your knowledge of GAAP and IFRS.

2. Accuracy and Attention to Detail

Reconciliation Clerks must be meticulous and pay close attention to detail.

- Emphasize your ability to identify and correct errors.

- Provide examples of how you have maintained high levels of accuracy in previous roles.

3. Problem-Solving and Analytical Skills

Candidates should be able to identify and resolve discrepancies in a timely and efficient manner.

- Describe your approach to investigating and resolving complex issues.

- Share examples of how you have used analytical thinking to solve problems.

4. Communication and Teamwork

Reconciliation Clerks often work with other departments and stakeholders.

- Highlight your ability to communicate clearly and effectively.

- Provide examples of how you have worked successfully in a team environment.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Reconcilement Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!