Are you gearing up for an interview for a Reconciliation Analyst position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Reconciliation Analyst and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

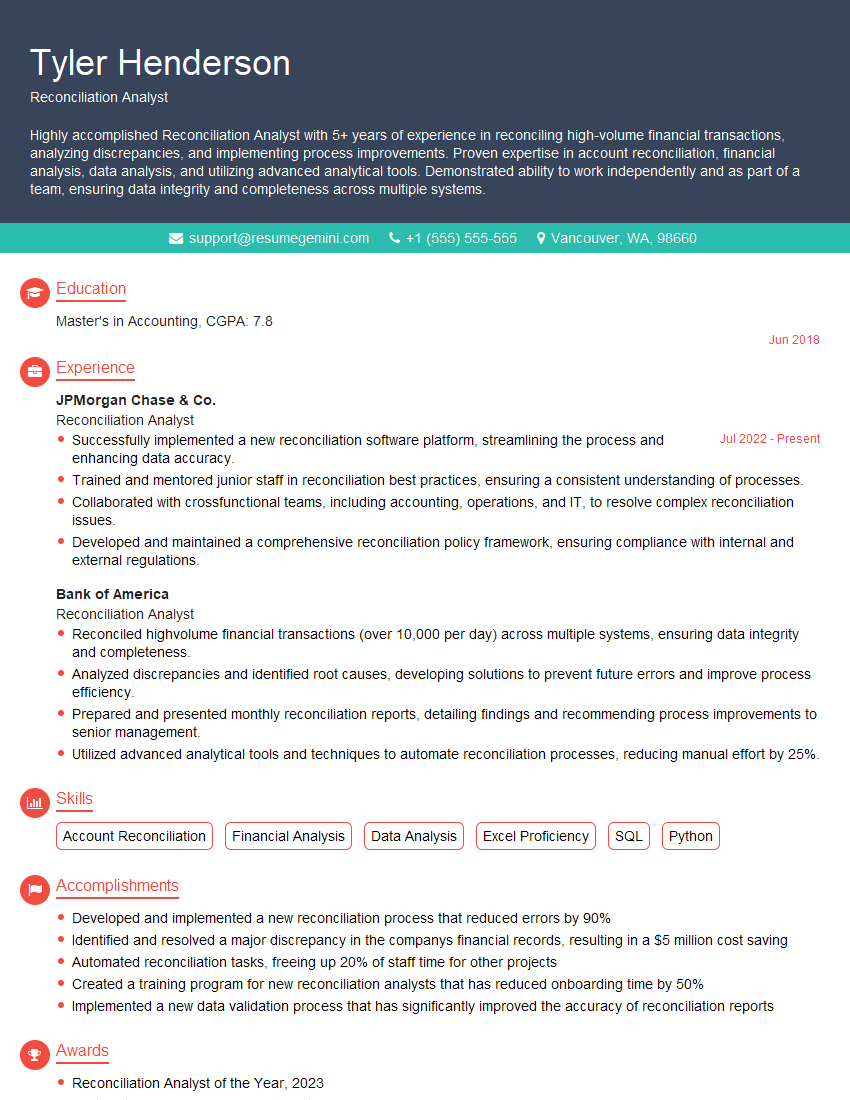

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Reconciliation Analyst

1. Describe the key steps involved in the reconciliation process.

The key steps involved in the reconciliation process typically include:

- Data gathering: Collecting data from various sources, such as bank statements, internal records, and external systems.

- Data cleansing: Verifying and correcting data for accuracy and completeness.

- Matching: Comparing data from different sources to identify discrepancies.

- Investigation: Analyzing discrepancies to determine their root cause and resolving them.

- Documentation: Recording the reconciliation results and any necessary adjustments.

2. What techniques do you use to analyze large volumes of data for reconciliation?

Analytical tools

- Spreadsheets (e.g., Microsoft Excel)

- Data visualization tools (e.g., Tableau, Power BI)

Sampling techniques

- Statistical sampling

- Risk-based sampling

Data mining techniques

- Association analysis

- Cluster analysis

3. How do you prioritize discrepancies for investigation?

I prioritize discrepancies for investigation based on the following factors:

- Materiality: The significance of the discrepancy in relation to the overall financial position.

- Likelihood of error: The probability that the discrepancy represents an actual error.

- Impact on financial reporting: The potential impact of the discrepancy on the accuracy of the financial statements.

- Complexity: The difficulty in resolving the discrepancy.

4. What types of adjustments are commonly made during the reconciliation process?

Common types of adjustments made during the reconciliation process include:

- Accruals: Adjusting for transactions that have occurred but have not yet been recorded.

- Deferrals: Adjusting for transactions that have been recorded but have not yet occurred.

- Cut-off errors: Correcting for transactions that were recorded in the wrong period.

- Rounding differences: Adjusting for minor differences due to rounding.

5. How do you ensure the accuracy and completeness of reconciliation results?

To ensure the accuracy and completeness of reconciliation results, I follow these best practices:

- Independent verification: Having a second person review the reconciliation results.

- Documentation: Maintaining detailed records of the reconciliation process and any adjustments made.

- Regular monitoring: Periodically reviewing reconciliations to identify any trends or areas for improvement.

6. What are the challenges of working with multiple data sources for reconciliation?

Challenges of working with multiple data sources for reconciliation include:

- Data inconsistencies: Differences in data formats, definitions, and time periods.

- Data availability: Ensuring that all necessary data is available for reconciliation.

- Data volume: Managing and processing large volumes of data from disparate sources.

- Data security: Protecting sensitive financial data from unauthorized access.

7. How do you stay updated on best practices and regulatory changes in reconciliation?

To stay updated on best practices and regulatory changes in reconciliation, I:

- Attend industry conferences and webinars.

- Read professional journals and publications.

- Network with other reconciliation professionals.

- Review guidance from regulatory bodies (e.g., SEC, FASB).

8. Describe your experience in automating reconciliation processes.

In my previous role, I was responsible for automating the reconciliation process for bank accounts. I used a robotic process automation (RPA) tool to extract data from bank statements, compare it to internal records, and identify discrepancies. The RPA tool significantly reduced the time and effort required to perform reconciliations, allowing us to focus on more complex tasks.

9. How do you handle exceptions during the reconciliation process?

When I encounter exceptions during the reconciliation process, I follow these steps:

- Investigate the root cause of the exception.

- Determine the appropriate adjustment or correction.

- Document the exception and the resolution.

- Communicate the exception to relevant stakeholders.

- Monitor the exception to ensure that it does not recur.

10. What are the key qualities of a successful Reconciliation Analyst?

The key qualities of a successful Reconciliation Analyst include:

- Strong analytical skills

- Attention to detail

- Problem-solving abilities

- Excellent communication skills

- Knowledge of accounting principles and best practices

- Proficiency in data analysis tools and techniques

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Reconciliation Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Reconciliation Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Reconciliation Analyst is a highly integral role in the organization, ensuring the accuracy and reliability of financial data. Key responsibilities include:

1. Data Reconciliation

Executing comprehensive reconciliations between various data sources, such as general ledger, bank statements, and vendor invoices, to identify and resolve discrepancies.

- Analyzing variances and conducting root cause investigations.

- Documenting and reporting reconciliation findings, ensuring transparency and accountability.

2. Financial Reporting

Coordinating with Finance and Accounting teams to support the preparation and review of financial statements.

- Assisting with the identification and correction of errors in financial data.

- Providing support in the analysis of financial trends and performance metrics.

3. Process Improvement

Working collaboratively with stakeholders to enhance reconciliation processes and controls.

- Automating reconciliation tasks to improve efficiency and reduce the risk of errors.

- Identifying and implementing solutions to address recurring discrepancies and streamline operations.

4. Compliance and Risk Management

Ensuring compliance with regulatory requirements and internal controls related to financial reporting and reconciliation.

- Monitoring and evaluating the effectiveness of reconciliation procedures.

- Participating in internal audits and providing support to auditors.

Interview Tips

To prepare effectively for your Reconciliation Analyst interview, consider the following tips:

1. Research the Company and Industry

Demonstrate your interest and knowledge of the company’s financial operations, industry trends, and regulatory environment.

- Visit the company’s website to gather information about their financial performance, recent news, and company culture.

- Read industry publications and articles to stay abreast of key trends and challenges.

2. Review Key Concepts and Technical Skills

Refresh your understanding of accounting principles, reconciliation techniques, and relevant software applications (e.g., Excel, data analytics tools).

- Review textbooks or online resources to solidify your grasp of core concepts.

- Practice solving reconciliation problems or completing mock exercises to demonstrate your proficiency.

3. Highlight Your Analytical and Problem-Solving Abilities

In your answers, emphasize your ability to analyze complex data, identify discrepancies, and develop solutions.

- Use the STAR method to provide specific examples of how you have successfully resolved reconciliation issues in the past.

- Discuss your approach to problem-solving and your ability to work independently and as part of a team.

4. Showcase Your Attention to Detail and Accuracy

Reconciliation requires meticulous attention to detail. Highlight your ability to consistently deliver accurate and reliable work.

- Emphasize your experience in handling large volumes of data and your commitment to maintaining high standards of accuracy.

- Provide examples of how you have proactively identified and corrected errors in financial records.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Reconciliation Analyst role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.