Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Reconciliation Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

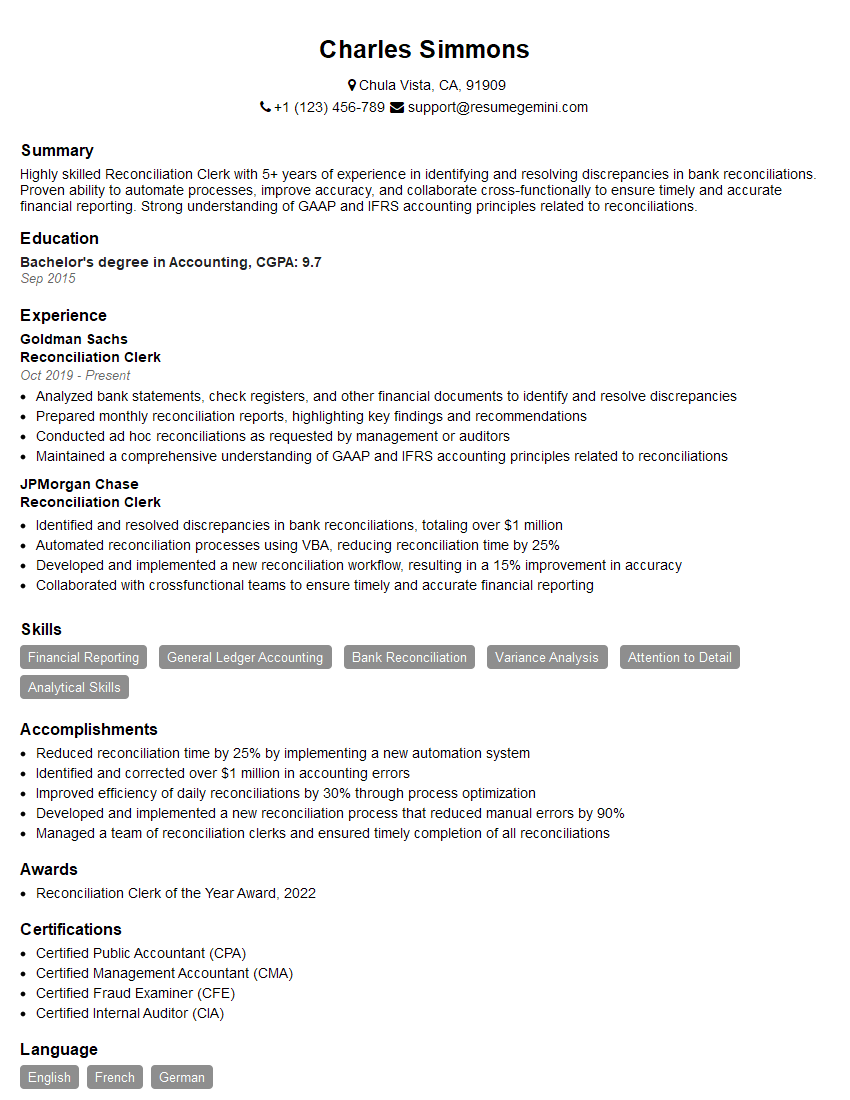

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Reconciliation Clerk

1. Explain the key responsibilities of a Reconciliation Clerk?

As a Reconciliation Clerk, I would be responsible for:

- Matching and reconciling financial transactions from various sources, such as bank statements, invoices, and purchase orders.

- Identifying and investigating discrepancies and errors in the data.

- Documenting and resolving discrepancies in a timely and accurate manner.

- Preparing and reviewing reconciliation reports for management review.

- Adhering to established accounting principles and procedures.

2. What are the common challenges faced by Reconciliation Clerks?

Understanding and interpreting complex financial data

- Reconciling large volumes of transactions efficiently.

- Managing multiple reconciliations simultaneously.

- Handling sensitive financial information with confidentiality.

- Meeting tight deadlines and working under pressure.

Staying up-to-date with accounting standards

- Adapting to changes in accounting policies and regulations.

- Using technology effectively to streamline reconciliation processes.

- Communicating effectively with stakeholders, including auditors and management.

3. How do you handle discrepancies and errors during the reconciliation process?

When I encounter discrepancies or errors during the reconciliation process, I follow a systematic approach to resolve them:

- Identify the discrepancy: Determine the nature and source of the error.

- Investigate the cause: Analyze the supporting documentation to find the root cause of the error.

- Resolve the discrepancy: Correct the error in the accounting records and document the resolution.

- Communicate the resolution: Inform the appropriate stakeholders, such as the account holder or management, about the error and its resolution.

4. Explain your experience with using accounting software for reconciliation.

I have extensive experience using various accounting software for reconciliation purposes, including:

- Oracle NetSuite

- SAP Accounting

- QuickBooks

- Sage Intacct

I am proficient in utilizing these software tools to automate reconciliation tasks, such as importing transactions, matching data, and generating reconciliation reports.

5. How do you prioritize and manage multiple reconciliation tasks effectively?

To prioritize and manage multiple reconciliation tasks effectively, I utilize the following strategies:

- Establish a clear schedule: Create a plan that outlines the deadlines for each reconciliation task.

- Set priorities: Determine which reconciliations are most critical and need to be completed first.

- Delegate tasks: If necessary, delegate tasks to other team members to ensure timely completion.

- Use technology: Leverage automated reconciliation tools to streamline the process and save time.

- Communicate regularly: Keep stakeholders informed about the progress of reconciliation tasks and any potential delays.

6. Describe your experience with internal control procedures related to reconciliation.

I am well-versed in internal control procedures related to reconciliation, including:

- Separation of duties: Ensuring that different individuals are responsible for recording transactions and performing reconciliations.

- Independent review: Having reconciliations reviewed by a supervisor or auditor to ensure accuracy.

- Documentation and approval: Maintaining proper documentation of reconciliation procedures and obtaining approvals from authorized personnel.

- Regular monitoring: Implementing procedures to monitor reconciliation activities and identify any weaknesses or control gaps.

I am committed to adhering to established internal control procedures to ensure the accuracy and reliability of financial reporting.

7. How do you stay up-to-date with changes in accounting standards and best practices?

To stay up-to-date with changes in accounting standards and best practices, I engage in the following activities:

- Attend industry conferences: Participate in conferences and seminars to learn about new accounting standards and industry trends.

- Read professional publications: Subscribe to accounting journals and magazines to stay informed about the latest developments.

- Take continuing education courses: Complete online or in-person courses to enhance my knowledge and skills.

- Network with other professionals: Connect with accountants and auditors to exchange ideas and stay abreast of industry best practices.

8. Explain how you communicate reconciliation findings and recommendations to management and other stakeholders.

I effectively communicate reconciliation findings and recommendations to management and other stakeholders through the following channels:

- Written reports: Prepare clear and concise written reports that summarize reconciliation results, identify any discrepancies, and provide recommendations for improvement.

- Verbal presentations: Present reconciliation findings and recommendations in meetings, using visual aids to illustrate key points.

- Email communication: Send regular email updates to stakeholders, providing them with timely information about the status of reconciliations and any significant findings.

- Follow-up meetings: Schedule follow-up meetings to discuss reconciliation results in more detail and address any questions or concerns raised by stakeholders.

I tailor my communication approach to the specific audience and situation, ensuring that the message is clearly understood and actionable.

9. Describe your experience with using data analytics tools for reconciliation.

I have experience using data analytics tools to enhance the efficiency and accuracy of reconciliation processes, including:

- Data extraction and cleansing: Extracting data from various sources and preparing it for analysis.

- Data matching and reconciliation: Utilizing data analytics tools to automate the matching and reconciliation of transactions.

- Trend analysis: Identifying patterns and trends in reconciliation data to improve future processes.

- Exception reporting: Generating reports that highlight exceptions and potential errors for further investigation.

By leveraging data analytics, I can streamline reconciliations, reduce manual errors, and gain valuable insights into financial data.

10. Explain how you ensure the confidentiality and security of sensitive financial information during reconciliation processes.

I take the confidentiality and security of sensitive financial information very seriously and adhere to the following practices:

- Restricted access: Only authorized personnel have access to confidential financial information.

- Encryption and secure storage: Sensitive data is encrypted and stored securely using industry-standard protocols.

- Regular security updates: Software and systems are regularly updated to patch any potential vulnerabilities.

- Employee training: Employees are trained on confidentiality protocols and best practices for handling sensitive information.

- Incident response plan: In case of a security breach, an incident response plan is in place to mitigate risks and protect data.

By implementing these measures, I ensure that sensitive financial information remains confidential and secure throughout the reconciliation process.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Reconciliation Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Reconciliation Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Reconciliation Clerks are responsible for ensuring that the company’s financial records are accurate and up-to-date. They do this by comparing different sets of financial data, such as bank statements, invoices, and purchase orders, to identify any discrepancies.

1. Compare and analyze financial data

Reconciliation Clerks compare and analyze different sets of financial data to identify any discrepancies.

- Bank statements

- Invoices

- Purchase orders

2. Research and resolve discrepancies

Reconciliation Clerks research and resolve any discrepancies that they identify. They may contact vendors or customers to obtain additional information. And may also work with the accounting department to correct any errors.

- Contact vendors or customers

- Work with the accounting department

3. Prepare and maintain financial reports

Reconciliation Clerks prepare and maintain financial reports that summarize their findings. These reports are used by management to make informed decisions about the company’s financial performance.

- Summarize their findings

- Inform management

4. Maintain a high level of accuracy and attention to detail

Reconciliation Clerks must maintain a high level of accuracy and attention to detail in their work. This is because any errors that they make could have a negative impact on the company’s financial performance.

- High level of accuracy

- Attention to detail

Interview Tips

Preparing for an interview can be daunting, but with a little planning and effort, you can ace your interview for a Reconciliation Clerk position. Here are a few tips to help you get started.

1. Research the company and the position

The more you know about the company and the position you’re applying for, the better prepared you’ll be to answer questions and make a good impression. Read the company’s website, look at their social media pages, and check out Glassdoor to learn more about the company culture and what it’s like to work there.

- Company’s website

- Social media pages

- Glassdoor

2. Practice answering common interview questions

There are a few common interview questions that you’re likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Take some time to practice answering these questions so that you can deliver your responses confidently and concisely.

- “Why are you interested in this position?”

- “What are your strengths and weaknesses?”

3. Be prepared to talk about your experience

The interviewer will want to know about your relevant experience and skills. Be prepared to talk about your experience in reconciling financial data, resolving discrepancies, and preparing financial reports. If you don’t have any direct experience in these areas, be sure to highlight any transferable skills that you have, such as attention to detail, problem-solving, and analytical thinking.

- Reconciling financial data

- Resolving discrepancies

- Preparing financial reports

4. Ask questions

Asking questions at the end of the interview shows that you’re interested in the position and the company. It also gives you an opportunity to learn more about the role and the company culture. Be sure to ask questions that are specific to the position and the company, such as “What are the biggest challenges facing the company right now?” and “What is the company culture like?”.

- “What are the biggest challenges facing the company right now?”

- “What is the company culture like?”

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Reconciliation Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Reconciliation Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.