Are you gearing up for an interview for a Remittance Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Remittance Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

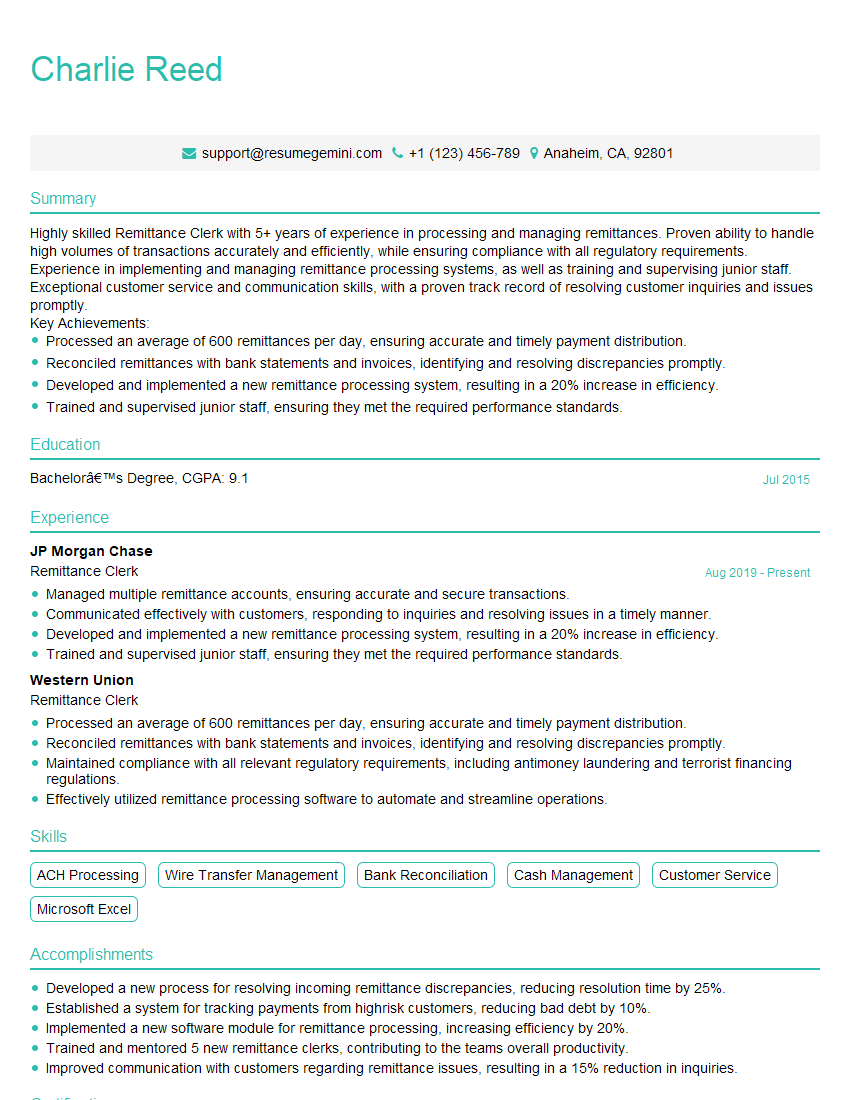

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Remittance Clerk

1. What is the role of a Remittance Clerk?

The primary responsibility of a Remittance Clerk is to process and handle financial transactions related to remittances, ensuring accuracy and compliance with regulations. This involves receiving and disbursing funds, maintaining records, and providing customer service.

2. Can you describe the process of receiving and disbursing remittances?

Receiving Remittances

- Verifying customer identification and authenticity of remittance instructions

- Recording remittance details, including amount, currency, and beneficiary information

- Updating system records and issuing receipts or confirmation slips

Disbursing Remittances

- Executing wire transfers, issuing checks, or disbursing cash in accordance with customer instructions

- Confirming beneficiary details and verifying authorized signatories

- Maintaining records of disbursed remittances and providing receipts or remittance advices

3. What are the key regulations that a Remittance Clerk must be aware of?

Remittance Clerks must adhere to various regulations to ensure compliance and prevent fraud, including:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations

- International financial reporting standards (IFRS)

- Foreign Exchange Control regulations

- Specific industry or company guidelines

4. How do you handle discrepancies or errors in remittances?

In the event of a discrepancy or error, I would:

- Review the remittance instructions and customer documentation carefully to identify the issue

- Contact the sender or beneficiary to gather additional information or resolve discrepancies

- Document all communication and keep a record of the resolution process

- Escalate complex or unresolved issues to a supervisor or compliance officer

5. What is your experience with remittance software or systems?

I have experience working with various remittance software and systems, including [list of software or systems]. I am proficient in using these applications to process remittances, manage customer accounts, and generate reports. I am also familiar with the security protocols and compliance requirements for these systems.

6. How do you ensure the accuracy and completeness of remittance transactions?

I employ several methods to ensure accuracy and completeness:

- Double-checking all remittance details before processing

- Verifying customer identification and beneficiary information against authorized records

- Reconciling remittances with daily summaries and reports

- Adhering to established policies and procedures for remittance handling

7. What is your understanding of foreign exchange rates and their impact on remittances?

I have a basic understanding of foreign exchange rates and their impact on remittances. I am aware that exchange rates fluctuate constantly and can affect the amount received by beneficiaries. I stay informed about currency exchange markets and use reliable sources to obtain accurate rates.

8. Can you describe your experience with customer service and conflict resolution?

As a Remittance Clerk, I understand the importance of providing excellent customer service. I am patient, empathetic, and skilled in resolving customer queries or complaints. I actively listen to customer concerns, provide clear explanations, and find solutions to meet their needs. In the case of conflicts, I remain calm and professional, seeking to de-escalate the situation and find a mutually acceptable resolution.

9. What are your strengths and weaknesses as a Remittance Clerk?

Strengths

- Accuracy and attention to detail

- Strong understanding of remittance regulations

- Proficiency in remittance software and systems

- Excellent customer service skills

Weaknesses

- Limited experience with high-value or complex remittances

- Still developing knowledge of foreign exchange markets

10. How do you stay updated with the latest industry regulations and best practices for Remittance Clerks?

To stay updated on industry regulations and best practices, I:

- Attend industry conferences and workshops

- Subscribe to industry publications and newsletters

- Participate in online forums and discussion groups

- Consult with colleagues and experts in the field

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Remittance Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Remittance Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Remittance Clerk is responsible for handling and processing financial transactions, primarily focusing on remittances. Key job responsibilities include:

1. Transaction Processing

Process remittances, including wire transfers, demand drafts, and other payment methods.

- Verify and validate remittance details, such as sender and receiver information, amounts, and currency.

- Input transaction data accurately and efficiently into the designated systems.

2. Customer Service

Provide excellent customer service to both senders and receivers.

- Answer inquiries and provide information related to remittances.

- Resolve customer issues promptly and professionally.

- Maintain positive relationships with customers and build trust.

3. Compliance and Reporting

Ensure compliance with regulatory requirements and internal policies.

- Monitor and report suspicious transactions according to anti-money laundering and terrorism financing regulations.

- Follow KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures.

4. Reconciliation and Settlement

Reconcile remittance records and ensure settlement of transactions.

- Compare transactions with account balances and identify discrepancies.

- Resolve discrepancies and ensure accurate reconciliation of funds.

Interview Tips

Preparing for an interview as a Remittance Clerk is crucial to showcase your skills and confidence. Here are some effective tips:

1. Research the Company and Position

- Glean information about the company’s history, values, and financial performance.

- Understand the specific responsibilities and requirements of the Remittance Clerk position.

2. Highlight Relevant Skills and Experience

- Emphasize your transaction processing experience, including familiarity with remittance platforms and financial regulations.

- Demonstrate your customer service skills and ability to handle inquiries and resolve issues effectively.

3. Prepare for Common Interview Questions

- Practice answering questions about your understanding of the remittance process, compliance requirements, and your ability to work under pressure.

- Research common interview questions for Remittance Clerks and prepare thoughtful responses.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples.

4. Be Professional and Punctual

- Dress appropriately and arrive on time for your interview.

- Maintain eye contact, be polite, and demonstrate a positive attitude.

- Bring copies of your resume and relevant certifications to the interview.

5. Ask Questions

- At the end of the interview, ask insightful questions about the company, the position, or the industry.

- This shows your interest and engagement, and it provides you with additional information to make an informed decision.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Remittance Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!