Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Renewable Energy System Finance Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

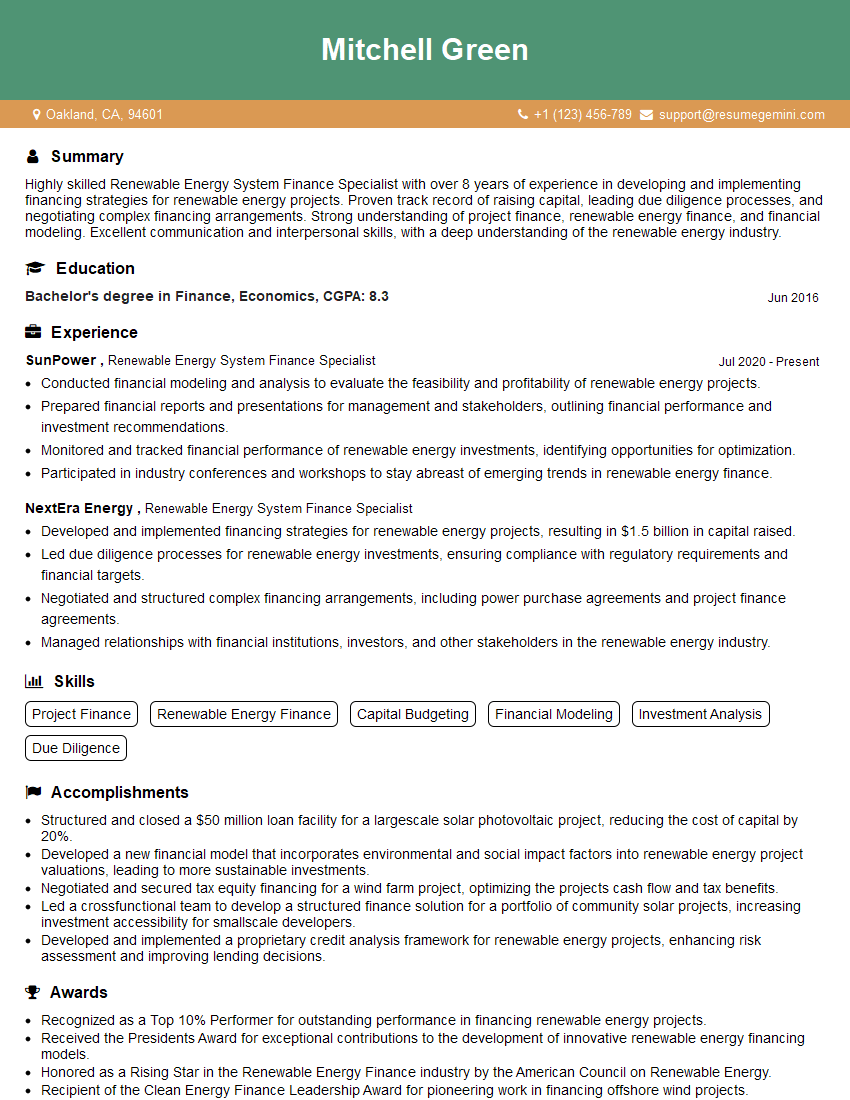

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Renewable Energy System Finance Specialist

1. Can you provide an overview of the process for financing a large-scale renewable energy project?

In the process of financing a large-scale renewable energy project, I would typically:

- Assess the project’s financial feasibility, including the cost of development, operation, and maintenance.

- Identify and secure funding sources, such as government grants, loans from financial institutions, or equity investments from private investors.

- Negotiate the terms of the financing, including the interest rate, loan term, and repayment schedule.

- Monitor the project’s financial performance and ensure compliance with all applicable regulations.

2. What are the key factors that you consider when evaluating the financial viability of a renewable energy project?

Project costs

- Capital costs, including the cost of land, equipment, and construction

- Operating costs, such as labor, maintenance, and insurance

- Decommissioning costs, which are the costs associated with dismantling and removing the project at the end of its useful life

Project revenues

- Electricity sales revenue, which is based on the amount of electricity generated by the project and the price at which it is sold

- Government incentives, such as tax credits or grants

- Other revenue streams, such as carbon credits or ancillary services

Project risks

- Technology risk, which is the risk that the project will not perform as expected

- Market risk, which is the risk that the price of electricity or other factors will change

- Regulatory risk, which is the risk that changes in government policies or regulations will impact the project

3. What are the different types of financing structures that are available for renewable energy projects?

There are a variety of financing structures that can be used for renewable energy projects, including:

- Project finance, which is a non-recourse financing structure in which the lender relies solely on the project’s cash flow to repay the loan.

- Corporate finance, which is a financing structure in which the borrower uses its own balance sheet to secure the loan.

- Public-private partnerships (PPPs), which are partnerships between government entities and private companies to develop and operate renewable energy projects.

4. What are the advantages and disadvantages of each type of financing structure?

Project finance

Advantages:- Non-recourse, which means that the lender has no recourse to the borrower’s other assets in the event of a default.

- Attractive to lenders, as they can pool multiple projects together to reduce risk.

- Can be more expensive than other financing structures due to the higher risk.

- Requires a strong track record and financial performance from the borrower.

Corporate finance

Advantages:- Less expensive than project finance due to the lower risk.

- More flexible than project finance, as the borrower can use its own balance sheet to secure the loan.

- Recourse, which means that the lender has recourse to the borrower’s other assets in the event of a default.

- May not be available to borrowers with a weak track record or financial performance.

Public-private partnerships (PPPs)

Advantages:- Can provide access to government funding and support.

- Can help to share the risk between the public and private sectors.

- Can be complex and time-consuming to structure and negotiate.

- May involve a loss of control for the private sector partner.

5. What are the key factors that you consider when negotiating the terms of a financing agreement?

- The interest rate

- The loan term

- The repayment schedule

- The covenants and restrictions

- The security

6. What are the common challenges that you have faced in financing renewable energy projects?

- The high cost of capital

- The lack of long-term financing

- The regulatory uncertainty

- The lack of understanding of renewable energy finance among lenders

7. How have you overcome these challenges?

- I have worked with lenders to develop innovative financing structures that reduce the cost of capital.

- I have helped to secure long-term financing from a variety of sources, including government agencies, banks, and private investors.

- I have worked with policymakers to advocate for regulatory changes that support renewable energy development.

- I have educated lenders about the risks and rewards of renewable energy finance.

8. What are the trends that you are seeing in the renewable energy finance market?

- The increasing popularity of renewable energy projects

- The decreasing cost of renewable energy technology

- The growing number of government incentives for renewable energy

- The increasing availability of long-term financing for renewable energy projects

9. What are your thoughts on the future of renewable energy finance?

I believe that the future of renewable energy finance is bright. As the cost of renewable energy technology continues to decrease and the demand for renewable energy increases, the market for renewable energy finance will continue to grow. I am excited to be a part of this growing market and to help to finance the transition to a clean energy future.

10. What are your strengths and weaknesses as a Renewable Energy System Finance Specialist?

Strengths

- Strong understanding of renewable energy technology and finance

- Excellent analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

Weaknesses

- Limited experience in project finance

- Limited experience in working with international clients

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Renewable Energy System Finance Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Renewable Energy System Finance Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Renewable Energy System Finance Specialists play a crucial role in the development and implementation of renewable energy projects. Their key responsibilities include:

1. Project Financing

Secure funding for renewable energy projects through various sources, including banks, investors, and government grants.

- Conduct financial analysis and develop business plans to demonstrate project viability.

- Negotiate loan terms, interest rates, and other financing arrangements.

2. Investment Analysis

Evaluate potential investments in renewable energy projects and make recommendations to clients.

- Assess project risks and returns, conducting due diligence and market research.

- Develop financial models and projections to forecast project performance.

3. Financial Management

Manage the financial aspects of renewable energy projects, ensuring compliance and optimizing performance.

- Monitor project expenses, revenues, and cash flow.

- Prepare financial reports and provide regular updates to stakeholders.

4. Regulatory Compliance

Stay updated on regulatory requirements related to renewable energy financing and ensure projects adhere to them.

- Interpret complex regulations and guidelines.

- Advise clients on compliance strategies and assist with permitting processes.

Interview Preparation Tips

To ace an interview for a Renewable Energy System Finance Specialist position, candidates should follow these preparation tips:

1. Research the Company and Industry

Familiarize yourself with the company’s mission, values, and recent projects. Understand the latest trends and developments in renewable energy financing.

2. Prepare Technical Answers

Practice answering technical questions related to financial analysis, project financing, and regulatory compliance. Use specific examples and demonstrate your understanding of complex financial concepts.

3. Showcase Your Experience

Highlight your experience in renewable energy finance, including any relevant projects or transactions you have worked on. Quantify your accomplishments using specific metrics.

4. Emphasize Your Problem-Solving Skills

Explain how you have successfully solved complex financial challenges or overcome obstacles in previous projects. Provide examples that showcase your analytical abilities and creative thinking.

5. Be Passionate and Enthusiastic

Demonstrate your passion for renewable energy and your belief in its potential. Explain why you are excited about working in this field and how you can contribute to the company’s success.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Renewable Energy System Finance Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.