Feeling lost in a sea of interview questions? Landed that dream interview for Renewable Energy Trader but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Renewable Energy Trader interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

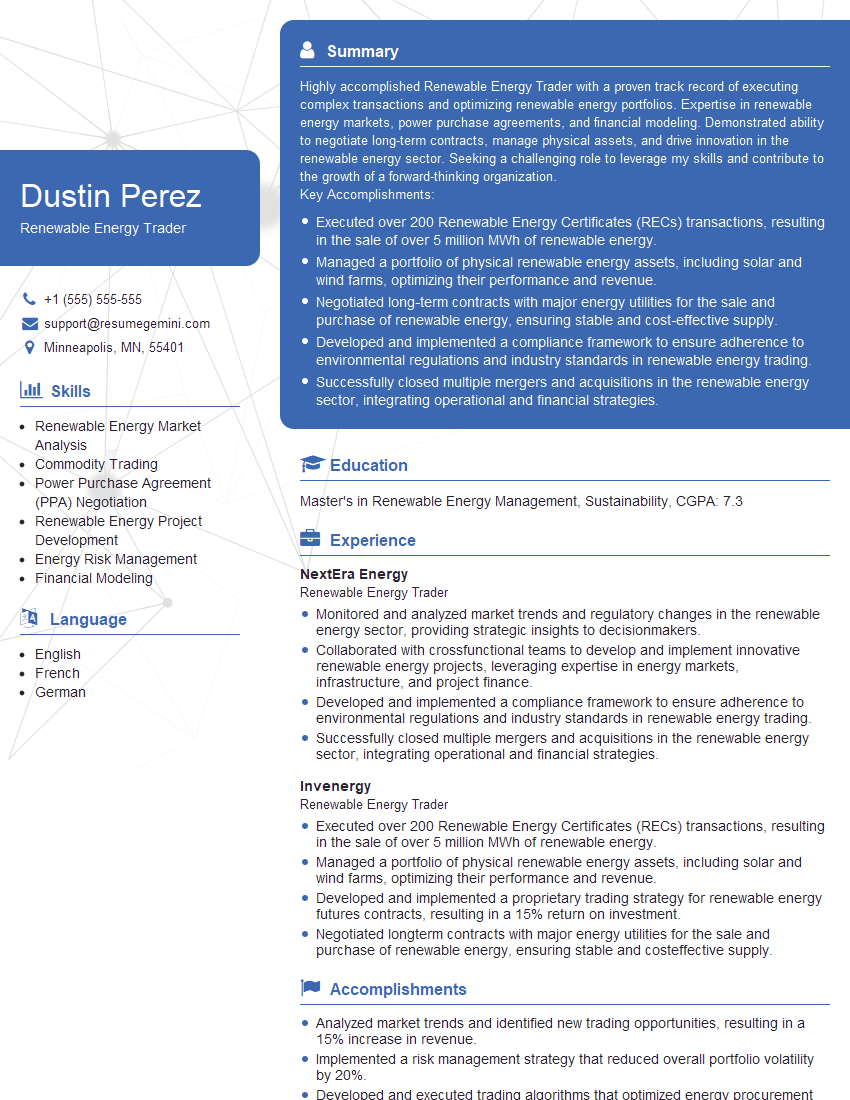

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Renewable Energy Trader

1. Explain the key differences between physical and financial renewable energy trading.

Sure, here are the key differences between physical and financial renewable energy trading:

- Physical trading involves the buying and selling of physical renewable energy assets, such as solar panels, wind turbines, or biomass. Physical traders typically take title to the assets they trade and are responsible for their delivery.

- Financial trading involves the buying and selling of contracts that represent renewable energy assets. Financial traders do not take title to the physical assets themselves, but rather speculate on their future price movements.

2. What are the different types of renewable energy contracts?

There are a variety of different types of renewable energy contracts, including:

- Power purchase agreements (PPAs) are long-term contracts between renewable energy generators and offtakers. PPAs typically specify the price at which the generator will sell its electricity to the offtaker.

- Renewable energy certificates (RECs) are tradable certificates that represent the environmental attributes of renewable energy. RECs can be sold separately from the physical electricity generated by renewable energy projects.

- Green bonds are bonds that are issued to finance renewable energy projects. Green bonds typically offer investors a lower interest rate than traditional bonds, due to the environmental benefits of the projects they finance.

3. What are the key risks associated with renewable energy trading?

There are a number of key risks associated with renewable energy trading, including:

- Price risk: The price of renewable energy can fluctuate significantly, depending on a number of factors, such as the weather, the cost of fossil fuels, and government policies.

- Volume risk: The volume of renewable energy generation can also fluctuate significantly, depending on the weather and other factors. This can make it difficult for traders to accurately forecast their revenue and expenses.

- Regulatory risk: The regulatory landscape for renewable energy is constantly evolving. Changes in regulations can impact the profitability of renewable energy projects and the value of renewable energy contracts.

4. How do you manage the risks associated with renewable energy trading?

There are a number of ways to manage the risks associated with renewable energy trading, including:

- Hedging: Hedging is a strategy used to reduce exposure to price risk. Traders can hedge their positions by buying or selling financial instruments that are correlated to the price of renewable energy.

- Diversification: Diversification is a strategy used to reduce exposure to volume risk. Traders can diversify their portfolios by investing in a variety of different renewable energy projects.

- Scenario analysis: Scenario analysis is a technique used to assess the impact of different regulatory scenarios on the profitability of renewable energy projects. Traders can use scenario analysis to identify and mitigate potential risks.

5. What are the key trends in the renewable energy market?

There are a number of key trends in the renewable energy market, including:

- The increasing cost-competitiveness of renewable energy: The cost of renewable energy has been declining steadily in recent years, making it increasingly competitive with traditional fossil fuels.

- The growing demand for renewable energy: The demand for renewable energy is growing rapidly around the world, as governments and businesses seek to reduce their carbon emissions.

- The development of new renewable energy technologies: New renewable energy technologies are being developed all the time, which is helping to reduce the cost and improve the efficiency of renewable energy generation.

6. What are the challenges facing the renewable energy industry?

The renewable energy industry is facing a number of challenges, including:

- The intermittency of renewable energy: Renewable energy sources, such as solar and wind power, are intermittent, meaning that they are not always available when needed. This can make it difficult to integrate renewable energy into the grid.

- The need for transmission infrastructure: Renewable energy projects are often located in remote areas, which can require the construction of new transmission infrastructure to connect them to the grid. This can be a costly and time-consuming process.

- The lack of a level playing field: Renewable energy projects often compete with fossil fuel projects that receive government subsidies. This can make it difficult for renewable energy projects to compete on a level playing field.

7. What are the opportunities for the renewable energy industry?

The renewable energy industry is facing a number of opportunities, including:

- The growing demand for renewable energy: The demand for renewable energy is growing rapidly around the world, as governments and businesses seek to reduce their carbon emissions. This is creating a significant opportunity for renewable energy companies.

- The development of new renewable energy technologies: New renewable energy technologies are being developed all the time, which is helping to reduce the cost and improve the efficiency of renewable energy generation. This is making renewable energy more attractive to investors and consumers.

- The increasing cost-competitiveness of renewable energy: The cost of renewable energy has been declining steadily in recent years, making it increasingly competitive with traditional fossil fuels. This is making renewable energy a more attractive option for businesses and consumers.

8. How do you stay up to date on the latest trends in the renewable energy market?

I stay up to date on the latest trends in the renewable energy market by:

- Reading industry publications and news articles: I regularly read industry publications and news articles to keep up with the latest developments in the renewable energy market.

- Attending industry conferences and events: I attend industry conferences and events to learn about new technologies and trends, and to network with other professionals in the field.

- Networking with other professionals: I network with other professionals in the field to exchange ideas and learn about new opportunities.

9. What are your strengths and weaknesses as a renewable energy trader?

My strengths as a renewable energy trader include:

- Strong understanding of the renewable energy market: I have a strong understanding of the renewable energy market, including the different types of renewable energy contracts, the key risks involved, and the regulatory landscape.

- Excellent analytical skills: I have excellent analytical skills and am able to quickly and accurately assess the risks and rewards of different renewable energy trading opportunities.

- Strong negotiation skills: I have strong negotiation skills and am able to effectively negotiate contracts with renewable energy generators and offtakers.

My weaknesses as a renewable energy trader include:

- Lack of experience in physical renewable energy trading: I have limited experience in physical renewable energy trading.

- Lack of experience in trading in emerging renewable energy markets: I have limited experience in trading in emerging renewable energy markets.

10. Why are you interested in this role?

I am interested in this role because I am passionate about renewable energy and I believe that I have the skills and experience necessary to be successful in this role. I am eager to learn more about the renewable energy market and to contribute to the growth of the industry. I am also excited about the opportunity to work with a team of talented professionals and to make a positive impact on the world.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Renewable Energy Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Renewable Energy Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Renewable Energy Traders play a crucial role in the energy industry, facilitating the buying and selling of renewable energy sources. Their responsibilities encompass a wide range of tasks, including:

1. Market Analysis and Forecasting

Conduct thorough market research and analysis to stay abreast of the latest industry trends and developments. Utilize market data and predictive models to forecast future energy prices and demand, ensuring informed decision-making.

- Monitor market fluctuations and identify opportunities for profitable trading.

- Develop strategies to mitigate risks and maximize returns.

2. Trading Execution

Execute trades on various trading platforms, optimizing the sale and purchase of renewable energy sources. Negotiate contracts with generators and buyers, ensuring favorable terms and conditions.

- Stay up-to-date with trading strategies and best practices.

- Leverage data analytics to make informed trading decisions.

3. Risk Management

Evaluate and mitigate financial and operational risks associated with trading activities. Implement risk management strategies and monitor market positions to minimize potential losses.

- Analyze market volatility and identify potential threats.

- Create contingency plans to manage unforeseen circumstances.

4. Client Relationship Management

Establish and maintain strong relationships with generators, buyers, and other industry stakeholders. Provide excellent customer service, building trust and fostering long-term partnerships.

- Understand customer needs and develop tailored solutions.

- Network with industry professionals to stay informed and expand business opportunities.

Interview Tips

Preparing thoroughly for your interview can significantly increase your chances of success. Consider the following tips to ace the interview for a Renewable Energy Trader position:

1. Research the Company and Industry

Gain a deep understanding of the company and the renewable energy industry. This will demonstrate your interest and enthusiasm for the role, and allow you to ask insightful questions during the interview.

- Review the company’s website, annual reports, and recent news articles.

- Stay up-to-date on industry trends and key players.

2. Highlight Your Skills and Experience

Emphasize your skills and experience that are relevant to the job requirements. Quantify your accomplishments and provide specific examples of your success in trading, risk management, and client relationship building.

- Use the STAR method to structure your answers (Situation, Task, Action, Result).

- Explain how your previous experience has prepared you for this role.

3. Demonstrate Your Market Knowledge

Show your understanding of the renewable energy market and your ability to make informed trading decisions. Discuss your analysis of market trends, forecasting methods, and risk management strategies.

- Share examples of how you have successfully executed trades and managed risk.

- Discuss your knowledge of renewable energy technologies and their impact on the market.

4. Ask Thoughtful Questions

Prepare insightful questions to ask the interviewer. This shows your engagement and interest in the position and the company. Questions could focus on the company’s sustainability goals, market outlook, or trading strategies.

- Avoid asking generic or superficial questions.

- Tailor your questions to the specific job and company.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Renewable Energy Trader role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.