Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Repossessor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

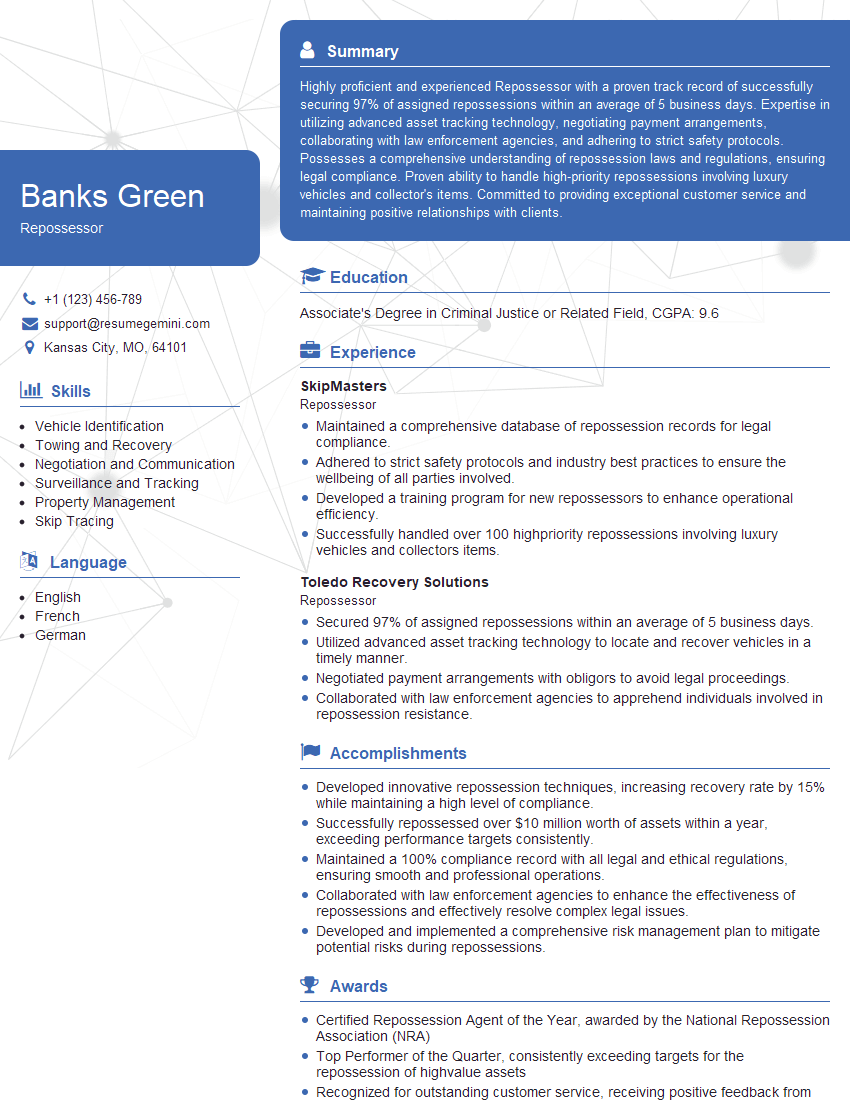

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Repossessor

1. Describe the steps you would take when repossessing a vehicle?

- Verify the identity of the borrower and the vehicle

- Confirm the default on the loan

- Obtain a court order or other legal authority to repossess the vehicle

- Peacefully remove the vehicle from the borrower’s property

- Secure the vehicle in a safe and secure location

- Notify the borrower of the repossession and their rights

- Prepare the vehicle for sale

- Sell the vehicle at auction or through other means

2. What are the most common challenges you face when repossessing vehicles?

Dealing with uncooperative borrowers

- Borrowers who refuse to surrender the vehicle

- Borrowers who hide or damage the vehicle

- Borrowers who make threats or become violent

Overcoming legal obstacles

- Vehicles that are parked on private property

- Vehicles that are subject to liens or other legal claims

- Vehicles that are in a dangerous or inaccessible location

3. How do you stay safe when repossessing vehicles?

- Never approach a vehicle alone

- Always be aware of your surroundings and the people around you

- Carry a personal safety device such as a pepper spray or stun gun

- If you feel threatened, do not hesitate to call the police

4. What are the ethical considerations involved in repossessing vehicles?

- Respecting the privacy of the borrower

- Avoiding unnecessary damage to the vehicle

- Being fair and impartial in all dealings with the borrower

- Following all applicable laws and regulations

5. How do you keep up with the latest changes in repossession laws and regulations?

- Reading industry publications

- Attending conferences and seminars

- Consulting with legal counsel

6. What are your strengths as a repossessor?

- I am a highly motivated and results-oriented individual

- I have a strong work ethic and am willing to go the extra mile

- I am a quick learner and am able to adapt to new situations quickly

- I am physically fit and able to handle the physical demands of the job

- I am a good communicator and am able to build rapport with people from all walks of life

7. What are your weaknesses as a repossessor?

- I can be impatient at times, especially when dealing with uncooperative borrowers

- I am not always the most organized person, and I can sometimes lose track of things

- I am not always comfortable with confrontation, and I can sometimes avoid dealing with difficult situations

8. What are your salary expectations?

- My salary expectations are in line with the industry average for repossessors with my experience and qualifications

- I am also willing to negotiate based on the company’s budget and the specific responsibilities of the position

9. What are your career goals?

- My long-term career goal is to become a manager in the repossession industry

- I believe that my skills and experience would make me a valuable asset to any management team

- In the short-term, I am focused on developing my skills and knowledge as a repossessor

10. Why should we hire you as our Repossessor?

- I am a highly qualified and experienced repossessor

- I have a proven track record of success in the field

- I am a hard worker and I am always willing to go the extra mile

- I am a team player and I am always willing to help out my colleagues

- I am confident that I have the skills and experience necessary to be a successful repossessor for your company

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Repossessor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Repossessor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Repossessor, you will be responsible for the safe and lawful recovery of collateral that has been defaulted on by borrowers. This role requires a combination of physical fitness, legal knowledge, and customer service skills.

1. Collateral Recovery

Your primary duty will be to locate and recover collateral, such as vehicles, equipment, or other assets, that have not been repaid as agreed upon in the loan contract.

- Conduct skip tracing to locate and contact borrowers who have defaulted.

- Negotiate with borrowers to arrange for voluntary surrender of collateral.

- Peacefully repossess collateral if voluntary surrender is not possible.

2. Legal Compliance

You must ensure that all repossessions are carried out in accordance with applicable laws and regulations.

- Obtain proper legal documentation, such as court orders or repossession affidavits.

- Serve legal notices and communicate with borrowers in a professional and respectful manner.

- Follow company policies and procedures for repossessions.

3. Customer Service

Even during stressful situations, you will be expected to interact with borrowers and other parties in a courteous and professional manner.

- Explain the repossession process and answer borrowers’ questions.

- Coordinate with towing companies and storage facilities.

- Maintain a positive image of the company and the repossession industry.

4. Safety and Security

You may encounter potentially dangerous situations during repossessions. It is crucial to prioritize safety and follow proper security measures.

- Assess risks and take appropriate precautions before approaching vehicles or borrowers.

- Wear protective gear and carry safety equipment.

- Never use force or violence during repossessions.

Interview Tips

To prepare for your Repossessor interview, consider the following tips:

1. Research the Company and Industry

Familiarize yourself with the company you are applying to, its policies, and the repossession industry as a whole. This knowledge will help you demonstrate your interest and understanding during the interview.

- Visit the company’s website and social media pages.

- Read industry publications and news articles.

- Attend industry events or meet with professionals in the field.

2. Highlight Relevant Skills and Experience

Emphasize your skills and experience that are directly relevant to the role of Repossessor. These may include:

- Physical fitness and ability to handle physically demanding tasks.

- Strong communication and negotiation skills.

- Knowledge of repossession laws and procedures.

- Experience in law enforcement, security, or collections.

3. Prepare for Common Interview Questions

Practice answering common interview questions, such as:

- Why are you interested in becoming a Repossessor?

- What is your experience in recovering collateral or working with defaulted borrowers?

- How do you ensure that repossessions are carried out legally and safely?

4. Dress Professionally and Arrive on Time

Make a good first impression by dressing professionally and arriving for your interview on time. This shows respect for the interviewer and the company.

- Choose clothing that is appropriate for the office environment and the role you are applying for.

- Be punctual and allow ample time to arrive at the interview location without rushing.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Repossessor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.