Are you gearing up for an interview for a Residential Collections position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Residential Collections and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

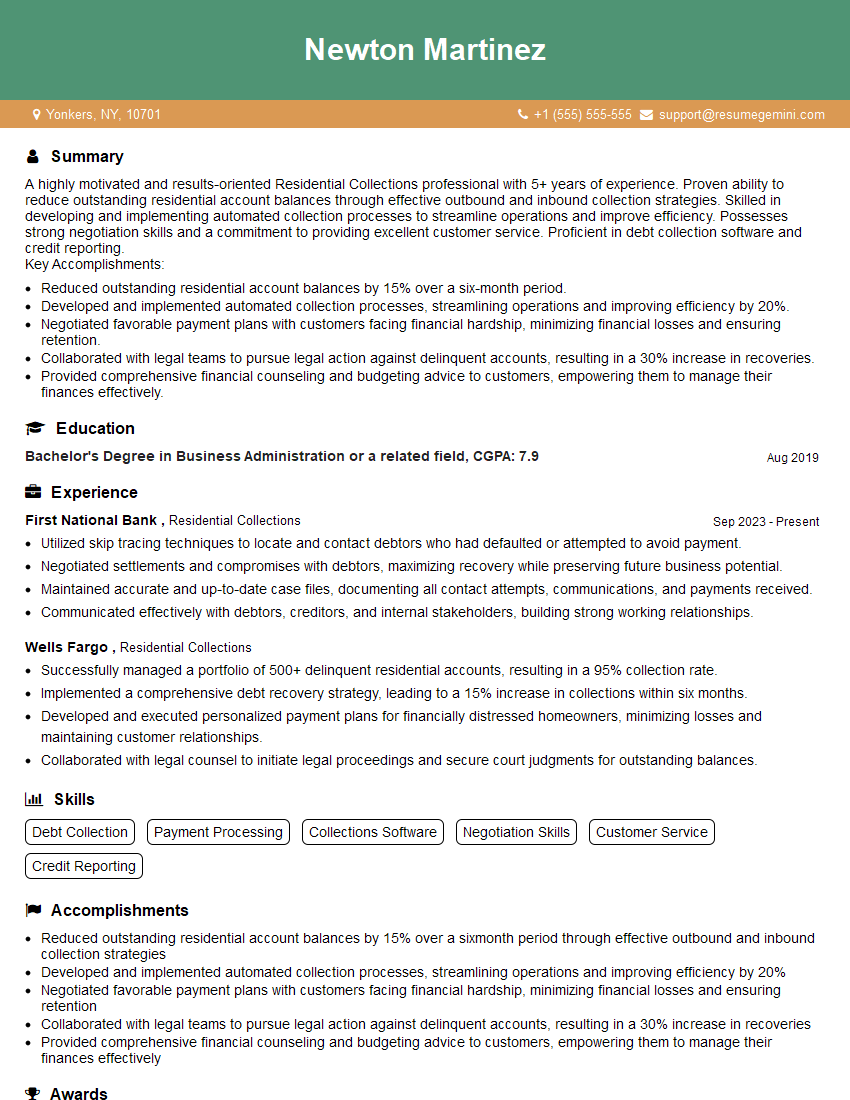

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Residential Collections

1. How would you approach a customer who is delinquent on their account and has been ignoring your calls and emails?

The first step is to try to contact the customer by phone or email to understand their situation. If they do not respond, send them a letter outlining their account status and the consequences of not making a payment. If they still do not respond, you may need to consider taking legal action.

2. What are the different types of payment plans that you can offer customers?

Flexible payment plans

- Extended payment plans

- Installment plans

- Seasonal payment plans

Deferred payment plans

- Hardship programs

- Forbearance agreements

- Deferment programs

3. How do you handle customers who are angry or upset?

When dealing with an angry or upset customer, it is important to remain calm and professional. Listen to their concerns and try to understand their perspective. Once you have a better understanding of the situation, you can work with them to find a solution.

4. What do you do when you are unable to collect a debt?

If you are unable to collect a debt, you may need to consider taking legal action. However, it is important to weigh the costs and benefits of doing so. You should also consider the customer’s financial situation and ability to repay the debt.

5. What are the ethical considerations that you must be aware of when working as a debt collector?

Debt collectors are subject to a number of ethical considerations, including:

- Treat customers with respect and dignity

- Follow the law

- Be honest and truthful

- Avoid using abusive or harassing tactics

- Protect customer privacy

6. How do you stay motivated when working in a challenging environment?

Working in a challenging environment can be difficult, but there are a few things that can help you stay motivated:

- Set realistic goals

- Break down large tasks into smaller ones

- Reward yourself for your accomplishments

- Build a strong support system

- Stay positive

7. What are your strengths and weaknesses as a debt collector?

Strengths

- Excellent communication skills

- Strong negotiation skills

- Ability to handle difficult customers

- Knowledge of the law

- Experience in the collections industry

Weaknesses

- Can be difficult to deal with angry or upset customers

- Can be stressful at times

- Can be difficult to collect debts from people who are financially struggling

8. What are your career goals?

My career goals are to continue to develop my skills as a debt collector and to eventually move into a management position. I am also interested in learning more about the legal side of collections.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to customer service and ethical collections practices. I am also confident that my skills and experience would be a valuable asset to your team.

10. Do you have any questions for me?

I do have a few questions for you:

- What is the average caseload for a debt collector in your company?

- What are the training and development opportunities available for debt collectors?

- What is the company culture like?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Residential Collections.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Residential Collections‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Residential Collections personnel play a crucial role in the financial recovery process. Their primary responsibilities include:

1. Collections Management

Effectively follow up on delinquent accounts, initiate contact with customers, and negotiate payment arrangements.

2. Investigating Customer Accounts

Accurately review financial records, identify reasons for non-payment, and assess the financial situation of customers.

3. Legal Actions

In cases where other collection methods fail, prepare and submit documentation for legal action, including filing lawsuits and garnishing wages.

4. Customer Service and Communications

Maintain positive relationships with customers, provide clear and accurate information, and resolve inquiries related to debt collection.

5. Data Entry and Reporting

Accurately document and record collection activities, maintain customer profiles, and generate reports as required.

Interview Tips

To prepare for a Residential Collections interview, consider the following tips:

1. Research the Company and Industry

Understand the organization’s debt collection practices, regulations, and the latest trends in the industry.

2. Highlight Experience and Skills

Emphasize relevant work experience, communication and negotiation skills, understanding of collection laws, and customer service acumen.

3. Share Examples of Success

Provide concrete examples of successful collection strategies, resolutions, and how you exceeded expectations in previous roles.

4. Demonstrate Empathy and Sensitivity

Convey your ability to deal with customers who are under financial stress with empathy and professionalism.

5. Be Ready to Discuss Ethical Challenges

Be prepared to discuss ethical considerations in debt collection and demonstrate your commitment to fair and responsible practices.

6. Prepare Questions for the Interviewer

Asking thoughtful questions shows your interest in the role and the organization, such as their approach to customer-centric collections.

Next Step:

Now that you’re armed with the knowledge of Residential Collections interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Residential Collections positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini