Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Residential Insurance Inspector position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

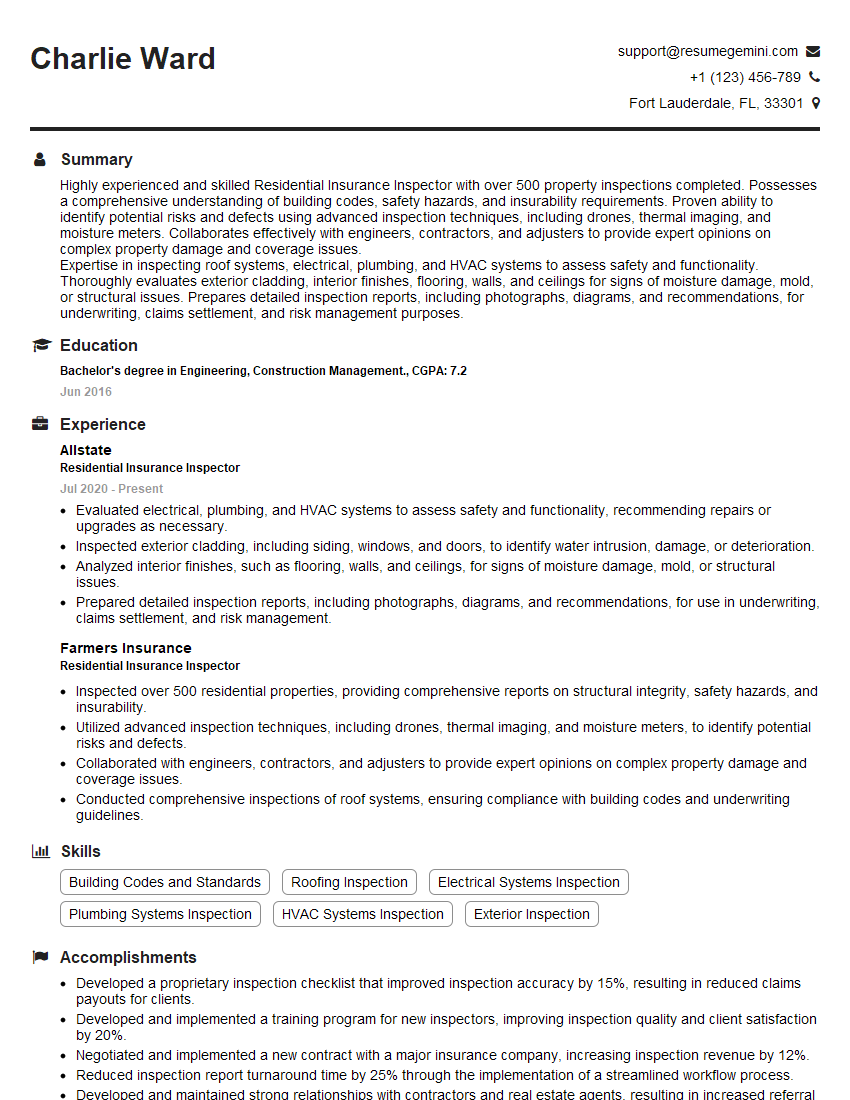

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Residential Insurance Inspector

1. Describe the key elements you would assess when performing a residential insurance inspection?

As a Residential Insurance Inspector, I would meticulously assess several key elements during an inspection. These include:

- Exterior: Roof condition, siding, windows, doors, and landscaping.

- Interior: Flooring, walls, ceilings, electrical system, plumbing system, and HVAC system.

- Structure: Foundation, framing, and any visible signs of damage or deterioration.

- Safety Features: Smoke detectors, carbon monoxide detectors, fire extinguishers, and security systems.

2. Explain the different types of roofing materials and their advantages and disadvantages.

Asphalt Shingles

- Advantages: Affordable, easy to install, and widely available.

- Disadvantages: Shorter lifespan (15-25 years) and vulnerable to wind damage.

Metal Roofing

- Advantages: Durable, long-lasting (50+ years), and fire-resistant.

- Disadvantages: Can be more expensive than other materials and may be noisy during rain.

Tile Roofing

- Advantages: Elegant, durable (50+ years), and fire-resistant.

- Disadvantages: Heavy, expensive, and can be prone to cracking.

Wood Shingles

- Advantages: Natural and aesthetically pleasing.

- Disadvantages: Require regular maintenance, vulnerable to fire, and can attract insects.

3. How do you assess the condition of a plumbing system during an inspection?

I assess the plumbing system by performing several key checks:

- Inspecting pipes: Checking for leaks, corrosion, and proper connections.

- Testing fixtures: Flushing toilets, running faucets, and checking showerheads for proper operation.

- Examining water pressure: Measuring the water pressure and identifying any potential issues.

- Inspecting water heater: Checking for leaks, sediment buildup, and proper functionality.

4. What are the most common electrical hazards to look for during an inspection?

The most common electrical hazards I look for include:

- Exposed wires: Wires that are not properly insulated or covered.

- Overloaded circuits: Too many appliances or devices plugged into a single circuit.

- Faulty wiring: Improperly installed or damaged wiring.

- Improper grounding: Electrical components not properly connected to the grounding system.

- Arc faults: Electrical sparks that can ignite fires.

5. Describe your experience in using specialized inspection equipment, such as drones or thermal imaging cameras.

I have extensive experience using specialized inspection equipment, including:

- Drones: I utilize drones to capture aerial footage and images of rooftops, inaccessible areas, and other difficult-to-reach parts of the property.

- Thermal imaging cameras: I use thermal imaging cameras to detect areas of heat loss, moisture intrusion, and electrical anomalies.

6. How do you handle situations where you discover significant damage or safety hazards during an inspection?

When I discover significant damage or safety hazards during an inspection, I follow these steps:

- Document the findings: Take clear photographs and detailed notes of the damage or hazard.

- Communicate with the client: Inform the client about my findings and discuss the necessary repairs or actions.

- Recommend repairs: Provide specific recommendations for addressing the damage or hazard and ensure it meets all applicable codes and standards.

- Follow up: Schedule a follow-up inspection to verify that the repairs have been completed satisfactorily.

7. What are the ethical considerations you keep in mind when conducting inspections?

As a Residential Insurance Inspector, I adhere to strict ethical considerations:

- Objectivity: I maintain impartiality and avoid any conflicts of interest that could compromise my inspections.

- Confidentiality: I keep all information obtained during inspections confidential and secure.

- Professionalism: I conduct myself in a courteous and respectful manner, regardless of the circumstances.

- Accuracy and Integrity: I provide honest, unbiased, and thorough reports based on my findings.

8. Explain how you stay up-to-date with the latest building codes and industry best practices.

To stay current with the latest building codes and industry best practices, I:

- Attend conferences and seminars: I regularly participate in industry events to learn about new regulations and technological advancements.

- Read industry publications: I subscribe to industry journals and magazines to stay informed about emerging trends and best practices.

- Network with other inspectors: I connect with other inspectors to exchange knowledge and discuss new developments in the field.

9. Describe your experience in identifying and assessing building envelope issues.

I have extensive experience in identifying and assessing building envelope issues, including:

- Water infiltration: I inspect roofing, siding, windows, and doors for any signs of moisture intrusion.

- Air leakage: I use blower door testing or infrared cameras to identify areas where air is leaking from the building.

- Thermal bridging: I examine insulation and framing to detect areas where heat is escaping from the building.

10. How do you communicate your findings and recommendations effectively to clients and insurance companies?

I communicate my findings and recommendations to clients and insurance companies in a clear and concise manner:

- Detailed reports: I provide comprehensive inspection reports that include detailed descriptions of my findings, photographs, and recommendations.

- Verbal presentations: I present my findings to clients and insurance company representatives verbally, highlighting key points and answering any questions.

- Electronic communication: I also use email and cloud-based platforms to share inspection reports and communicate with clients and insurance companies remotely.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Residential Insurance Inspector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Residential Insurance Inspector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Residential Insurance Inspectors are responsible for evaluating and assessing the condition of residential properties to determine their insurability and risk. They play a crucial role in determining the premium rates and coverage limits for homeowners’ insurance policies.

1. Property Inspections

Conduct thorough inspections of residential properties, including the exterior, interior, roof, and surrounding grounds.

- Identify and document any defects, damages, or potential hazards.

- Assess the overall condition of the property and its components, including structural integrity, roofing, electrical systems, plumbing, and HVAC.

2. Risk Assessment

Evaluate the property’s susceptibility to various risks, such as fire, theft, water damage, and natural disasters.

- Identify potential hazards and vulnerabilities that could increase the likelihood of claims.

- Recommend safety measures and loss prevention techniques to reduce the risk of damage.

3. Report Writing

Prepare detailed inspection reports that document the property’s condition, identified risks, and recommendations.

- Clearly and accurately summarize the findings of the inspection.

- Provide photographic evidence and supporting documentation to support the findings.

4. Customer Service

Communicate effectively with homeowners, insurance companies, and other stakeholders.

- Explain the inspection process and findings to property owners.

- Answer questions and provide guidance to ensure a smooth and professional experience.

Interview Tips

To prepare effectively for your Residential Insurance Inspector interview, consider these tips:

1. Research the Company and Role

Thoroughly research the insurance company and the specific role you are applying for. Understand their underwriting guidelines, products, and claims history.

- Familiarize yourself with the company’s website, annual reports, and social media pages.

- Connect with current or former employees on LinkedIn to gain insights into the company culture and job expectations.

2. Highlight Your Inspection Skills

Emphasize your technical skills in conducting thorough property inspections. Showcase your ability to identify and document property defects, hazards, and risk factors.

- Provide examples of complex inspections you have completed and the recommendations you made.

- Highlight any certifications or training you have obtained to demonstrate your expertise.

3. Demonstrate Your Risk Assessment Expertise

Explain your understanding of risk assessment and loss prevention techniques. Discuss how you evaluate properties for potential hazards and vulnerabilities.

- Share examples of how you have identified and mitigated risks on past inspections.

- Explain your knowledge of building codes, safety standards, and best practices for residential properties.

4. Prepare for Common Interview Questions

Practice answering common interview questions related to your skills, experience, and motivations.

- Why are you interested in a Residential Insurance Inspector role?

- Describe your experience in property inspections and risk assessment.

- How do you stay up-to-date with industry best practices and regulations?

5. Ask Thoughtful Questions

Prepare thoughtful questions to ask the interviewer. This shows your engagement and interest in the role and company.

- Inquire about the company’s underwriting criteria and claim settlement process.

- Ask about opportunities for professional development and career growth within the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Residential Insurance Inspector role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.