Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Retirement Assistant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

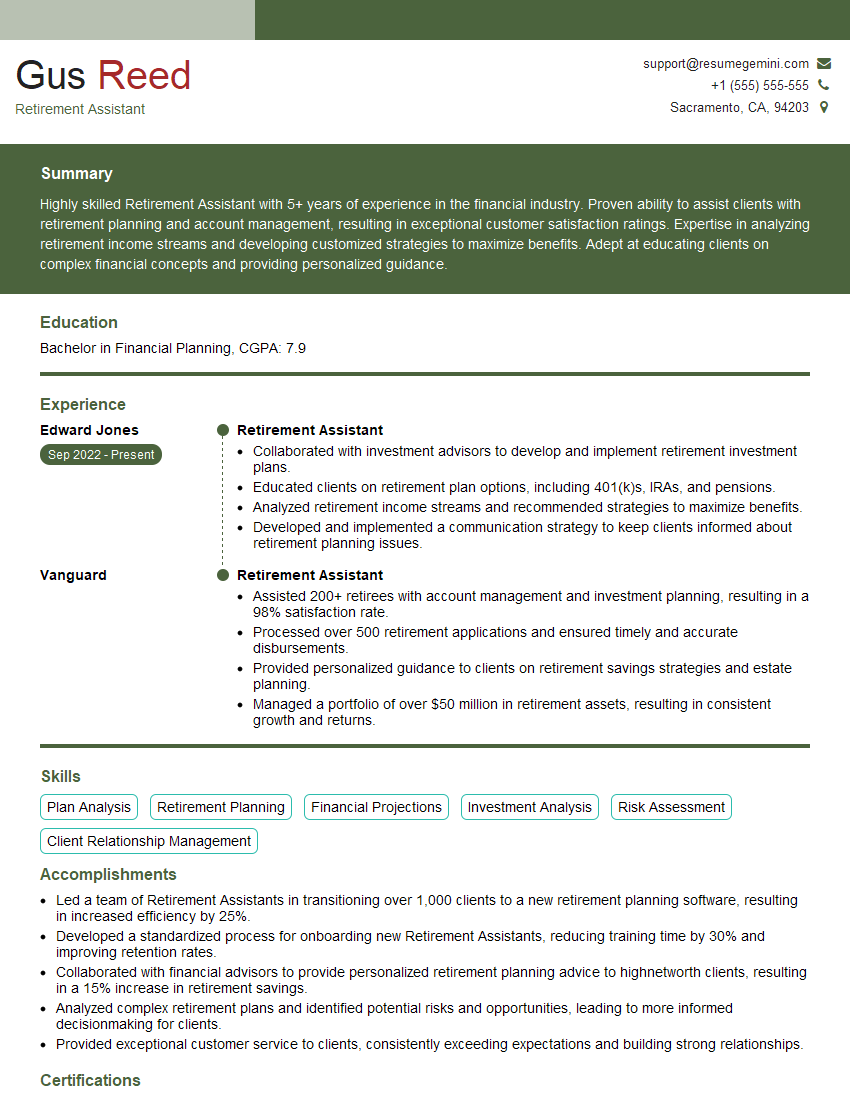

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Retirement Assistant

1. What are the key duties and responsibilities of a Retirement Assistant?

- Provide administrative and clerical support to retirement plan participants and beneficiaries

- Process and maintain retirement plan documents, such as applications, forms, and elections

- Calculate and communicate retirement benefits to participants and beneficiaries

- Answer questions and provide guidance on retirement plan rules and regulations

- Maintain accurate records and files related to retirement plans

2. What are the qualifications and experience required for a Retirement Assistant?

Education

- High school diploma or equivalent

- Associate’s degree or higher in a related field preferred

Experience

- 1-3 years of experience in a retirement plan administration or customer service setting preferred

- Strong understanding of retirement plan rules and regulations

- Excellent written and verbal communication skills

- Proficient in Microsoft Office Suite

3. What are the key challenges facing Retirement Assistants today?

- The increasing complexity of retirement plans

- The need to provide personalized and timely service to participants and beneficiaries

- The need to stay up-to-date on the latest retirement plan rules and regulations

- The need to maintain a high level of confidentiality and security

4. What are the key trends that will impact the role of Retirement Assistants in the future?

- The use of technology to automate and streamline retirement plan processes

- The increased focus on participant education and financial literacy

- The need for Retirement Assistants to be more proactive and consultative

- The need for Retirement Assistants to have a broader understanding of financial planning

5. How do you stay up-to-date on the latest retirement plan rules and regulations?

- Attend industry conferences and webinars

- Read trade publications and articles

- Participate in online forums and discussion groups

- Consult with legal and financial professionals

6. Tell me about a time when you had to deal with a difficult participant or beneficiary.

In my previous role, I had to deal with a participant who was very angry and upset about the distribution of his retirement benefits. He was convinced that he was being treated unfairly and that the plan was not following the rules. I listened to his concerns and tried to explain the rules to him in a clear and concise way. I also offered to help him file an appeal if he was still not satisfied with the outcome. Eventually, he calmed down and agreed to file an appeal.

7. What is your favorite part of being a Retirement Assistant?

My favorite part of being a Retirement Assistant is helping people plan for their financial future. I enjoy educating participants and beneficiaries about their retirement plan options and helping them make informed decisions about their retirement savings.

8. What are your career goals?

My career goal is to become a Retirement Plan Administrator. I am passionate about helping people plan for their financial future and I believe that this is the best way to do it.

9. Why are you interested in working for our company?

I am interested in working for your company because of your commitment to providing excellent customer service. I am also impressed by your company’s culture and values.

10. What are your salary expectations?

My salary expectations are commensurate with my experience and qualifications. I am confident that I can be a valuable asset to your team and I am willing to negotiate a salary that is fair to both of us.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Retirement Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Retirement Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Retirement Assistant plays a pivotal role in supporting individuals as they plan for and transition into retirement. Key job responsibilities include:

1. Retirement Planning Support

Collaborating with individuals to assess their retirement goals, risk tolerance, and financial situation.

- Providing personalized retirement planning guidance and recommendations.

- Developing and implementing comprehensive retirement plans.

2. Investment Management Assistance

Understanding and explaining investment options and strategies to clients.

- Monitoring and managing client investments in accordance with their retirement plans.

- Offering ongoing portfolio reviews and adjustments to optimize returns.

3. Income Stream Management

Advising clients on generating sustainable income streams during retirement.

- Exploring options such as pensions, annuities, and drawdowns from investment accounts.

- Developing strategies to maximize income while minimizing tax implications.

4. Estate Planning Coordination

Collaborating with estate planning professionals to ensure alignment between retirement plans and estate goals.

- Providing guidance on trusts, wills, and power of attorney documents.

- Coordinating with attorneys and financial advisors to develop comprehensive estate plans.

Interview Tips

Preparing for a Retirement Assistant interview requires a combination of technical knowledge and interpersonal skills. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Understand the company’s culture, values, and retirement planning offerings. Research industry trends and regulations to demonstrate your knowledge.

2. Highlight Your Retirement Planning Expertise

Emphasize your understanding of retirement planning principles, investment strategies, and estate planning concepts. Share specific examples of how you have helped clients achieve their retirement goals.

3. Demonstrate Strong Communication and Interpersonal Skills

Retirement Assistants interact with clients from diverse backgrounds. Showcase your ability to communicate complex financial concepts clearly and compassionately. Emphasize your empathy and ability to build strong relationships.

4. Prepare Questions for the Interviewer

Asking thoughtful questions shows genuine interest in the role and company. Prepare questions about the company’s retirement planning philosophy, client base, and opportunities for professional development.

5. Practice Common Interview Questions

Anticipate common interview questions such as “Why are you interested in this role?” and “What are your strengths and weaknesses?” Practice your answers to demonstrate your preparation and enthusiasm.

6. Dress Professionally and Be Punctual

First impressions matter. Dress professionally for the interview, arrive on time, and maintain a positive attitude throughout the process.

Next Step:

Now that you’re armed with the knowledge of Retirement Assistant interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Retirement Assistant positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini