Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Revenue Stamp Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

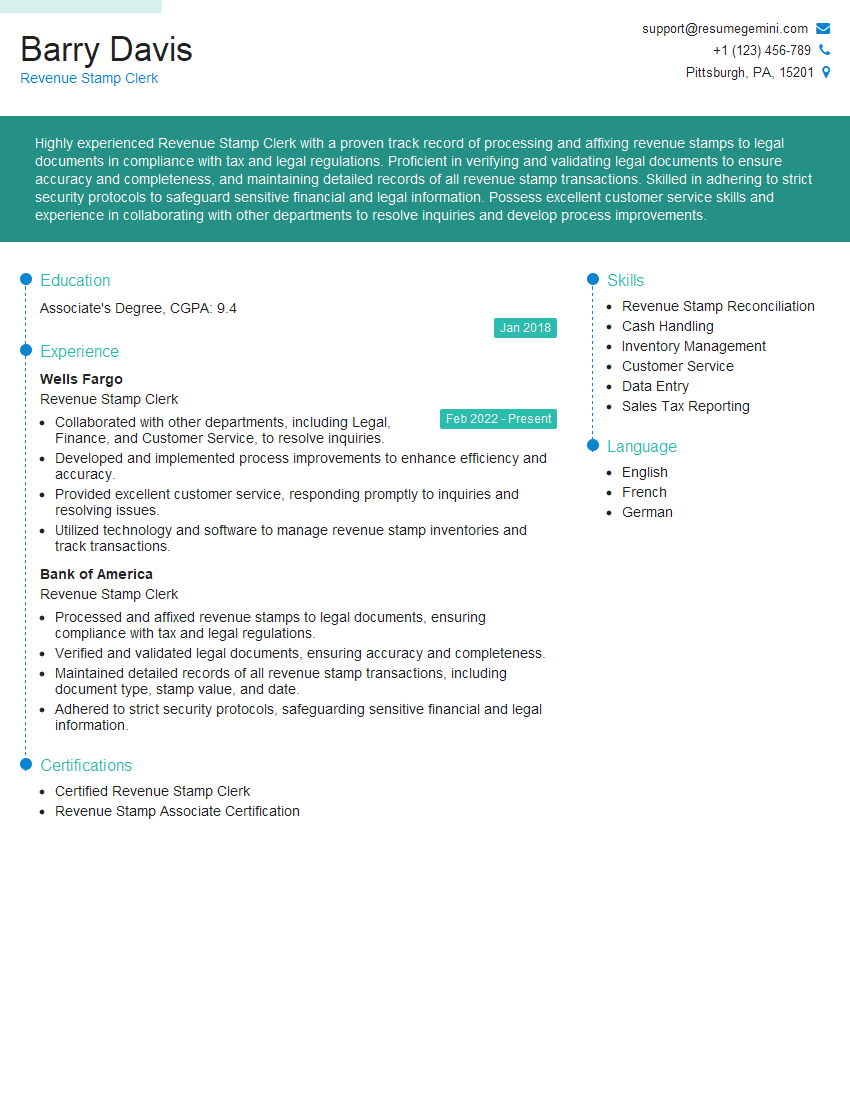

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Revenue Stamp Clerk

1. Explain the process of issuing revenue stamps.

The process of issuing revenue stamps involves several key steps:

- Document Review: Review the document presented to determine the appropriate stamp duty or fee required.

- Calculation: Calculate the exact amount of revenue stamp duty or fee based on the document’s value or purpose.

- Stamp Selection: Select the correct denomination of revenue stamps to meet the calculated amount.

- Stamp Affixation: Affix the revenue stamps securely to the document in the designated area.

- Cancellation: Cancel the revenue stamps to prevent their reuse by marking them with an official stamp or other means.

- Record Keeping: Maintain accurate records of all revenue stamps issued, including their denomination, serial numbers, and dates.

2. What are the different types of revenue stamps and their uses?

Revenue Stamps for Documents

- Contract Stamps: Used on contracts and agreements to indicate payment of stamp duty.

- Deed Stamps: Applied to deeds and property transfers to denote payment of stamp duty.

- Court Stamps: Required on legal documents filed with courts, such as petitions and affidavits.

Revenue Stamps for Commodities

- Tobacco Stamps: Used to tax tobacco products.

- Alcohol Stamps: Applied to alcoholic beverages to indicate payment of excise duty.

- Fuel Stamps: Affixed to fuel products to denote payment of fuel taxes.

3. How do you handle discrepancies or errors in revenue stamp issuance?

- Identify the Error: Determine the nature and extent of the error, such as incorrect denomination or missing stamps.

- Corrective Action: Take appropriate steps to correct the error, including recalling or issuing additional stamps as necessary.

- Documentation: Maintain a record of all errors and corrective actions taken.

- Reporting: Inform relevant authorities or supervisors about significant discrepancies or errors.

4. What are the security features incorporated into revenue stamps to prevent fraud?

- Special Paper: Use of specialized paper with unique security features, such as watermarks or security fibers.

- Holograms: Incorporation of holographic images to deter counterfeiting.

- Serial Numbers: Each stamp carries a unique serial number to prevent duplication.

- Ultraviolet Inks: Use of invisible inks that can only be detected under UV light.

- Perforations: Stamps are often perforated in a specific pattern to prevent alteration or reuse.

5. How do you ensure the accuracy and integrity of revenue stamp records?

- Regular Audits: Conduct regular audits of revenue stamp inventory and records to identify any discrepancies.

- Reconciliation: Reconcile revenue stamp issuance records with financial records to ensure proper accounting.

- Secure Storage: Store revenue stamps securely to prevent unauthorized access or theft.

- Limited Access: Restrict access to revenue stamps and records to authorized personnel only.

6. What are the legal implications and consequences of mishandling revenue stamps?

- Penalties: Mishandling revenue stamps, such as counterfeiting or unauthorized use, can result in severe penalties, including fines and imprisonment.

- Breach of Trust: Revenue stamp clerks are entrusted with the responsibility of handling valuable government property. Mishandling can constitute a breach of trust.

- Damage to Revenue: Improper issuance or cancellation of revenue stamps can lead to loss of revenue for the government.

7. Describe your experience in handling high-volume transactions involving revenue stamps.

- Efficient Processing: Demonstrated ability to process a large number of transactions accurately and efficiently.

- Attention to Detail: Meticulous in verifying documents, calculating stamp duty, and affixing stamps.

- Time Management: Ability to manage time effectively to meet high-volume demands.

- Customer Service: Provided courteous and helpful assistance to customers while handling large transaction volumes.

8. How do you stay updated with changes in revenue stamp regulations and procedures?

- Regulatory Bulletins: Monitor official government publications and bulletins for any updates or revisions to revenue stamp regulations.

- Training Programs: Participate in training programs offered by the government or industry organizations to stay informed about new procedures.

- Networking: Connect with other revenue stamp clerks or professionals to exchange knowledge and insights.

9. What are some common challenges faced by revenue stamp clerks and how do you overcome them?

- High Workload: Manage high-volume transactions by prioritizing tasks, utilizing efficient systems, and seeking support when necessary.

- Document Irregularities: Handle irregular or incomplete documents by contacting the customer for clarification or seeking guidance from supervisors.

- Public Pressure: Deal with customers who may be impatient or frustrated by providing clear explanations and resolving their issues professionally.

10. Why are you interested in this revenue stamp clerk position?

- Passion for Revenue Management: Express enthusiasm for the role of revenue stamp clerks in contributing to government revenue collection.

- Attention to Detail: Highlight your meticulous nature and ability to handle sensitive financial transactions with accuracy.

- Customer Service: Emphasize your commitment to providing excellent customer service in a demanding environment.

- Career Growth: Indicate your aspirations to grow professionally within the organization and take on additional responsibilities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Revenue Stamp Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Revenue Stamp Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Revenue Stamp Clerk is responsible for performing various tasks related to revenue stamps, which are adhesive stamps used to indicate that a tax has been paid. Key responsibilities of this role include:

1. Revenue Stamp Issuance and Sales:

Issuing and selling revenue stamps to customers over the counter

- Calculating the correct amount of stamps needed

- Counting and verifying cash and ensuring receipt accuracy

2. Stamp Inventory Management:

Maintaining an accurate inventory of revenue stamps

- Storing stamps securely to prevent theft or damage

- Tracking inventory levels and coordinating replenishment orders

3. Customer Service:

Providing excellent customer service to individuals inquiring about revenue stamps

- Handling inquiries regarding stamp availability, pricing, and usage

- Resolving customer concerns and complaints

4. Record-Keeping:

Maintaining accurate records of stamp sales and transactions

- Keeping track of revenue stamp inventory and sales

- Preparing reports and reconciling daily transactions

Interview Tips

To ace the interview for a Revenue Stamp Clerk position, follow these key tips:

1. Research the Role and Organization:

Familiarize yourself with the job description and the organization’s activities related to revenue stamps. Researching will enable you to articulate how your skills and experience align with the position’s requirements.

- Review the organization’s website and social media platforms to gain insights into their services and operations.

- Learn about the laws and regulations governing revenue stamps in your jurisdiction.

2. Highlight Relevant Skills and Experience:

Emphasize your experience in customer service, cash handling, and inventory management. If you have any prior experience with revenue stamps, be sure to highlight it.

- Quantify your experience whenever possible. For example, “Increased customer satisfaction by 20% through effective complaint resolution.”

- Showcase your attention to detail and accuracy, as these are crucial qualities for a Revenue Stamp Clerk.

3. Demonstrate Excellent Communication and Interpersonal Skills:

Revenue Stamp Clerks interact with a diverse range of customers. Highlight your strong communication skills and ability to build rapport with individuals from different backgrounds.

- Emphasize your active listening skills and ability to convey information clearly and professionally.

- Share examples of how you have effectively resolved conflicts or navigated challenging customer interactions.

4. Prepare for Common Interview Questions:

Anticipate common interview questions and prepare thoughtful responses. Some questions you may encounter include:

- “Tell us about your experience in customer service and cash handling.”

- “How do you ensure the accurate inventory management of revenue stamps?”

- “How do you handle inquiries or complaints from customers?”

5. Dress Professionally and Arrive Punctually:

First impressions matter, so dress professionally and arrive for your interview on time. Being punctual demonstrates your respect for the interviewer and the organization.

- Choose attire that is business casual or formal, depending on the organization’s dress code.

- Arrive for your interview with ample time to park, check in, and prepare yourself before the scheduled start time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Revenue Stamp Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!