Are you gearing up for an interview for a Risk Control Product Liability Director position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Risk Control Product Liability Director and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

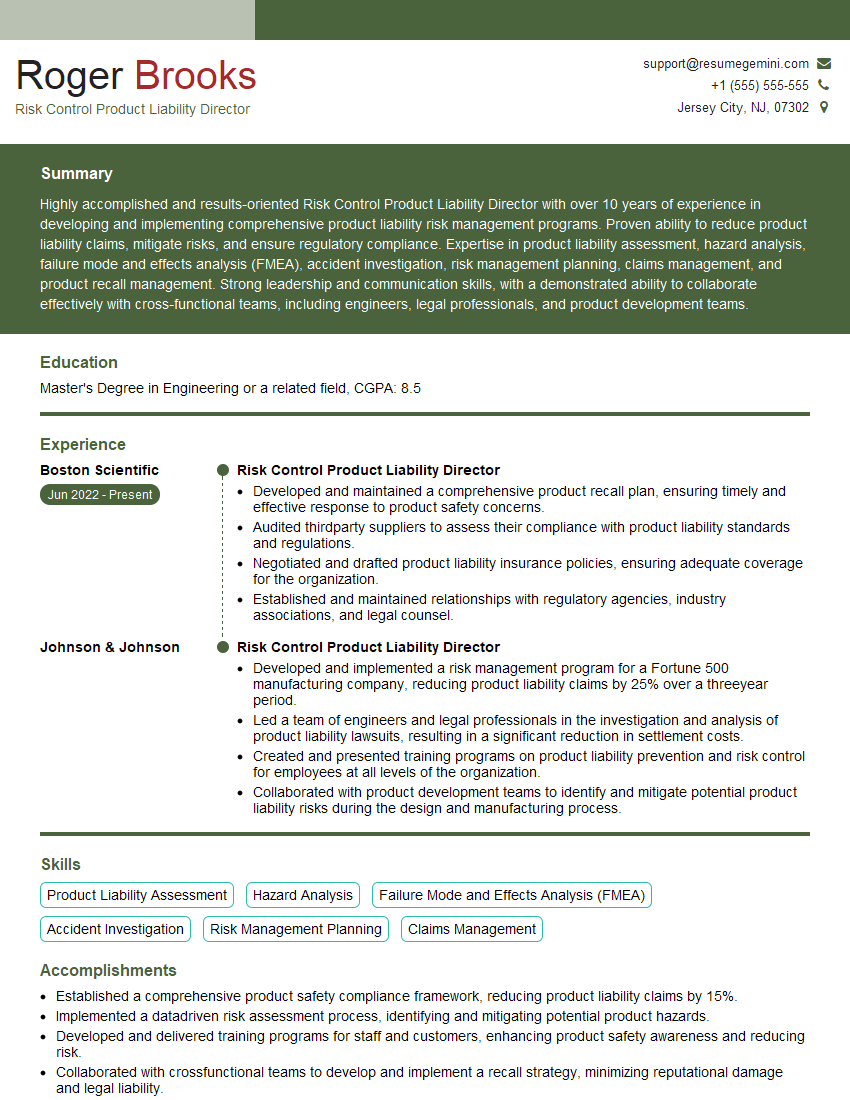

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Risk Control Product Liability Director

1. Describe the key elements of a comprehensive product liability risk control program?

A comprehensive product liability risk control program should include the following key elements:

- Risk assessment: Identifying potential product hazards and assessing the likelihood and severity of potential losses.

- Hazard control: Implementing measures to eliminate or reduce product hazards.

- Quality control: Establishing and maintaining processes to ensure product quality and safety.

- Training and education: Providing training to employees on product safety and risk management.

- Claims management: Developing and implementing procedures for handling product liability claims.

- Insurance: Obtaining adequate product liability insurance to protect against financial losses.

- Auditing and review: Regularly auditing and reviewing the risk control program to ensure its effectiveness.

2. What are the most important factors to consider when developing a product liability risk control strategy?

Risk assessment

- Identifying potential product hazards

- Assessing the likelihood and severity of potential losses

- Considering the company’s risk tolerance

Hazard control

- Implementing measures to eliminate or reduce product hazards

- Considering the cost-effectiveness of hazard control measures

- Ensuring that hazard control measures are implemented effectively

Quality control

- Establishing and maintaining processes to ensure product quality and safety

- Monitoring product quality and safety

- Taking corrective action when product quality or safety issues are identified

3. How do you stay up-to-date on the latest product liability trends and developments?

I stay up-to-date on the latest product liability trends and developments by:

- Reading industry publications and journals

- Attending industry conferences and seminars

- Networking with other product liability professionals

- Taking continuing education courses

- Monitoring regulatory agency websites and announcements

4. What are the most common product liability claims?

The most common product liability claims are:

- Defective design: Claims that a product was designed with a defect that caused an injury or damage.

- Defective manufacturing: Claims that a product was manufactured with a defect that caused an injury or damage.

- Failure to warn: Claims that a product did not contain adequate warnings or instructions, which resulted in an injury or damage.

- Breach of warranty: Claims that a product did not perform as promised, which resulted in an injury or damage.

5. What are the key challenges facing product liability risk managers today?

The key challenges facing product liability risk managers today include:

- Increasing product complexity: Products are becoming increasingly complex, which makes it more difficult to identify and assess potential hazards.

- Global supply chains: Products are often manufactured in multiple countries, which can make it difficult to control product quality and safety.

- E-commerce: The growth of e-commerce has made it easier for consumers to purchase products from anywhere in the world, which can increase the risk of product liability claims.

- Social media: Social media can be used to spread information about product defects and injuries, which can quickly damage a company’s reputation.

- Increasing regulatory scrutiny: Regulatory agencies are becoming more active in enforcing product safety laws, which can increase the cost of compliance for businesses.

6. What are the best practices for product liability risk management?

The best practices for product liability risk management include:

- Conducting thorough product testing and risk assessments

- Implementing strict quality control measures

- Providing clear and adequate warnings and instructions

- Obtaining adequate product liability insurance

- Establishing a product recall plan

- Training employees on product safety and risk management

- Monitoring product safety issues and trends

7. What are the different types of product liability insurance?

The different types of product liability insurance include:

- Occurrence-based insurance: Covers claims that are made during the policy period, regardless of when the injury or damage occurred.

- Claims-made insurance: Covers claims that are made and reported to the insurer during the policy period, regardless of when the injury or damage occurred.

- Retrospective rating insurance: The premium is based on the claims experience of the insured during the policy period.

8. What are the key provisions of a product liability insurance policy?

The key provisions of a product liability insurance policy include:

- Insuring agreement: The insuring agreement states the types of claims that are covered by the policy.

- Exclusions: The exclusions state the types of claims that are not covered by the policy.

- Limits of liability: The limits of liability state the maximum amount that the insurer will pay for a claim.

- Deductible: The deductible is the amount that the insured must pay before the insurer will begin to pay for a claim.

- Reporting requirements: The reporting requirements state the time period within which the insured must report a claim to the insurer.

9. What are the advantages and disadvantages of self-insuring for product liability?

Advantages

- Lower cost

- Greater control over claims handling

- Increased flexibility

Disadvantages

- Higher risk

- Potential for catastrophic losses

- Need for specialized expertise

10. What are the key trends in product liability litigation?

The key trends in product liability litigation include:

- Increasing number of class action lawsuits

- Expanding liability for non-manufacturers

- Increased use of social media in product liability cases

- Greater focus on punitive damages

- Increasingly complex and expensive litigation

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Risk Control Product Liability Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Risk Control Product Liability Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Risk Control Product Liability Directors are responsible for developing and implementing risk control strategies that minimize the likelihood and severity of product liability claims. They also work to improve product safety and regulatory compliance. Key job responsibilities include:

1. Product Safety

Assess product safety and develop strategies to mitigate risks. Conduct product testing and evaluate product quality. Work with engineering and manufacturing teams to identify and correct product defects.

2. Risk Control

Identify and evaluate potential product liability risks. Develop and implement risk control measures to minimize the likelihood and severity of claims. Monitor risk control programs and make adjustments as needed.

3. Regulatory Compliance

Stay up-to-date on relevant product safety and regulatory requirements. Ensure that products comply with applicable laws and regulations. Work with regulatory agencies to resolve compliance issues.

4. Claims Management

Review and analyze product liability claims. Negotiate and settle claims on behalf of the company. Manage reserves and oversee litigation.

Interview Tips

To ace an interview for a Risk Control Product Liability Director position, it is important to prepare thoroughly and highlight your relevant skills and experience. Here are some tips:

1. Research the Company and Position

Learn about the company’s products, risk profile, and regulatory environment. Understand the specific responsibilities of the Risk Control Product Liability Director role.

2. Highlight Your Expertise

Emphasize your experience in product safety, risk control, regulatory compliance, and claims management. Provide specific examples of your successes in these areas.

3. Demonstrate Your Understanding of the Industry

Show that you are familiar with the latest trends and best practices in product liability risk management. Discuss your insights on emerging risks and how you would address them.

4. Be Prepared to Discuss Your Approach

Outline your approach to risk control and product liability management. Explain how you would identify, evaluate, and mitigate risks. Share examples of innovative risk control solutions you have implemented.

5. Practice Your Communication Skills

Prepare clear and concise answers to common interview questions. Practice articulating your ideas and responding to questions from multiple perspectives.

6. Ask Thoughtful Questions

Ask questions at the end of the interview to demonstrate your interest and engagement. This shows that you are eager to learn more about the role and the company.

Example Interview Questions

- Tell me about your experience in product safety and risk control.

- How do you stay up-to-date on changes in product liability laws and regulations?

- Describe a successful risk control program that you implemented.

- How do you manage product liability claims?

- What are your thoughts on the emerging risks in product liability?

Next Step:

Now that you’re armed with the knowledge of Risk Control Product Liability Director interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Risk Control Product Liability Director positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini