Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Risk Management Director position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

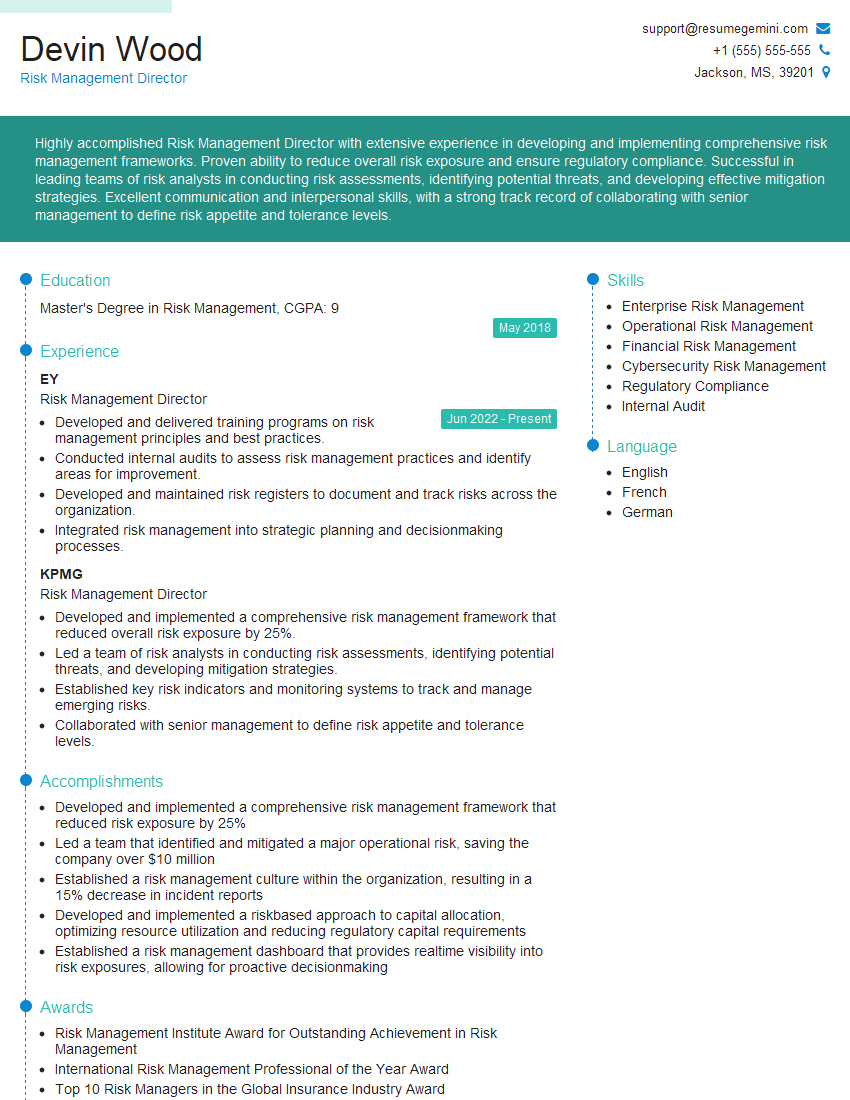

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Risk Management Director

1. What are the key risk management challenges facing the financial industry today?

- Economic instability and geopolitical risks

- Cybersecurity threats and data breaches

- Regulatory changes and compliance requirements

- Climate change and sustainability risks

- Operational risks, such as fraud and IT failures

2. What is your approach to risk assessment?

Risk Identification

- Brainstorming and scenario planning

- Data analysis and risk modeling

- Regulatory reviews and industry best practices

Risk Assessment

- Quantitative analysis using risk metrics and models

- Qualitative analysis considering expert opinions and judgments

- Combining quantitative and qualitative results for comprehensive assessment

3. How do you communicate risk to stakeholders?

- Regular risk reports and presentations

- Customized risk briefings for different audiences

- Interactive workshops and simulations

- Online risk dashboards and portals

- Clear and concise communication using non-technical language

4. What are the key elements of a successful risk management program?

- Strong leadership and commitment

- Comprehensive risk assessment and monitoring

- Effective risk mitigation strategies

- Regular review and improvement

- Integration with business strategy and operations

5. How do you stay up-to-date on the latest risk management trends and best practices?

- Attending industry conferences and workshops

- Reading professional journals and publications

- Participating in professional organizations and networks

- Seeking advice and insights from experts and peers

- Continuously pursuing professional development opportunities

6. What are your thoughts on the use of technology in risk management?

- Technology can automate tasks and improve efficiency

- It can provide real-time data and insights for better decision-making

- AI and machine learning can enhance risk modeling and prediction

- However, it’s important to balance technology with human expertise

- Technology should support risk management, not replace it

7. How do you manage risks that are difficult to quantify?

- Use qualitative analysis techniques, such as risk matrices and scenario planning

- Seek expert opinions and consult with stakeholders

- Conduct sensitivity analysis to assess the impact of different assumptions

- Develop contingency plans and mitigation strategies

- Monitor risks closely and adjust plans as needed

8. What is your experience in managing regulatory compliance?

- Understanding regulatory requirements and their implications

- Developing and implementing compliance programs

- Conducting internal audits and assessments

- Working with regulators and external auditors

- Staying up-to-date on regulatory changes

9. How do you approach risk management in a rapidly changing business environment?

- Continuously monitor the business environment for emerging risks

- Adapt risk management strategies to changing conditions

- Communicate risks and implications to stakeholders

- Be proactive in identifying and mitigating potential risks

- Foster a culture of risk awareness and resilience

10. What is your experience in managing enterprise-wide risk management programs?

- Developing and implementing risk management frameworks

- Assessing and managing risks across all business units

- Coordinating with cross-functional teams

- Reporting to senior management and the board

- Ensuring alignment with organizational strategy and objectives

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Risk Management Director.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Risk Management Director‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Risk Management Director plays a crucial role in safeguarding an organization from potential risks and ensuring its smooth operation. The key job responsibilities of a Risk Management Director typically encompass the following:

1. Risk Assessment and Identification

Thorough assessment and identification of potential risks that may impact the organization’s operations, reputation, and financial stability. Conducting comprehensive risk assessments to evaluate the likelihood and impact of various risks, including both internal and external factors.

2. Risk Mitigation and Management

Developing and implementing robust risk mitigation strategies to minimize the impact of identified risks. Establishing risk management frameworks and policies to guide decision-making and ensure adherence to regulatory requirements. Monitoring and reviewing risk management initiatives to assess their effectiveness.

3. Risk Reporting and Communication

Regularly reporting on risk management activities to senior management and the board of directors. Effectively communicating risk assessment findings, mitigation strategies, and overall risk appetite to key stakeholders. Ensuring transparency and open dialogue on risk-related matters.

4. Compliance and Regulatory Oversight

Maintaining compliance with relevant laws, regulations, and industry best practices related to risk management. Monitoring regulatory changes and advising on their potential impact. Ensuring that the organization’s risk management practices align with regulatory requirements and industry standards.

Interview Tips

To ace an interview for a Risk Management Director role, candidates should employ effective preparation strategies and demonstrate a deep understanding of risk management principles and practices:

1. Research and Preparation

- Thoroughly research the organization, its industry, and the specific risk management challenges it faces.

- Review the job description and identify the key responsibilities and qualifications required for the role.

- Prepare examples and case studies that demonstrate your expertise in risk assessment, mitigation, and management.

2. Communicating Your Expertise

- Clearly articulate your understanding of risk management concepts and frameworks.

- Highlight your ability to identify and prioritize risks effectively.

- Explain your approach to developing and implementing risk mitigation strategies.

- Emphasize your communication and stakeholder management skills, especially in conveying risk information to non-technical audiences.

3. Industry Knowledge and Adaptability

- Demonstrate a solid understanding of the regulatory environment and industry best practices related to risk management.

- Discuss your experience in managing risks specific to the organization’s industry.

- Highlight your ability to adapt to changing risk landscapes and emerging threats.

4. Leadership and Strategic Thinking

- Exhibit strong leadership skills and the ability to motivate and guide a team of risk management professionals.

- Explain how you align risk management strategies with the organization’s overall business objectives.

- Discuss your experience in developing and implementing enterprise-wide risk management programs.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Risk Management Director interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!