Are you gearing up for a career in Roving Teller? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Roving Teller and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

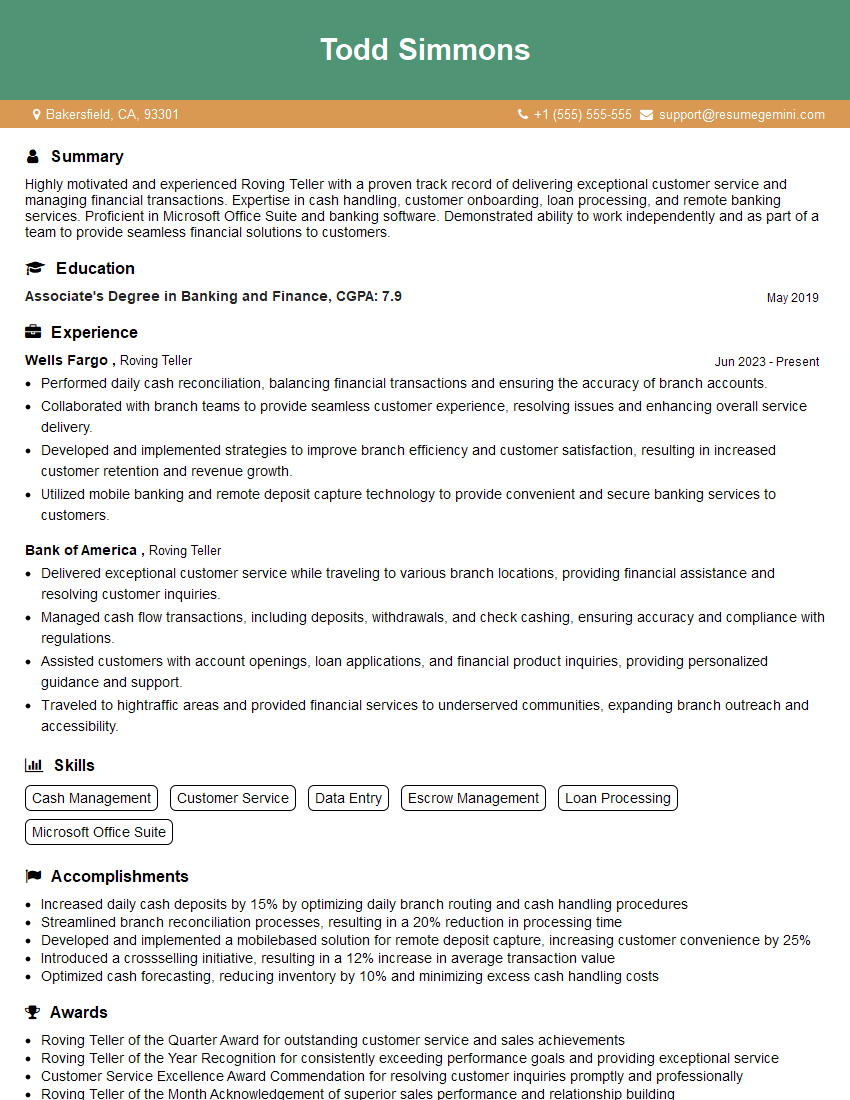

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Roving Teller

1. What are the key responsibilities of a Roving Teller?

- Provide excellent customer service to members and non-members

- Process financial transactions accurately and efficiently

- Maintain a clean and organized work area

- Follow all company policies and procedures

2. What experience and qualifications do you have that make you a good fit for this role?

- Previous experience as a teller or in a similar customer service role

- Strong math skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

3. How would you handle a difficult customer?

- Stay calm and professional

- Listen to the customer’s concerns

- Try to resolve the issue to the customer’s satisfaction

- If necessary, escalate the issue to a supervisor

4. What would you do if you noticed a discrepancy in a customer’s account?

- Notify the customer immediately

- Investigate the discrepancy

- Take steps to correct the error

- Document the incident

5. What is your understanding of the Bank Secrecy Act?

- The Bank Secrecy Act (BSA) is a federal law that requires financial institutions to help the government fight money laundering and terrorist financing

- BSA regulations require financial institutions to collect and report information about their customers’ financial transactions

- Failure to comply with BSA regulations can result in civil and criminal penalties

6. What are some of the challenges you anticipate facing in this role?

- Dealing with difficult customers

- Processing transactions quickly and accurately

- Maintaining a clean and organized work area

- Following all company policies and procedures

7. What are your strengths and weaknesses?

- Strengths: Customer service skills, math skills, attention to detail, ability to work independently and as part of a team

- Weaknesses: Limited experience with certain types of transactions, such as large wire transfers

8. Why are you interested in this role?

- I am interested in this role because I enjoy providing excellent customer service and helping people with their financial needs

- I believe that my skills and experience make me a good fit for this role

- I am excited about the opportunity to learn more about the financial industry and grow my career

9. What are your salary expectations?

- My salary expectations are in line with the market rate for this role and my experience

- I am willing to negotiate a salary that is fair and commensurate with my value to the company

10. Do you have any questions for me?

- I am wondering about the company’s culture and values

- I am also curious about the training and development opportunities that the company offers

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Roving Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Roving Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Roving Tellers are responsible for providing a variety of financial services to customers in a convenient and efficient manner. They typically work in a mobile unit that travels to different locations throughout a designated area.

1. Customer Service

Roving Tellers must be able to provide excellent customer service. They should be friendly, courteous, and helpful. They should also be able to communicate effectively with customers from all walks of life.

- Greet customers and answer their questions.

- Process transactions accurately and efficiently.

- Resolve customer issues and complaints.

- Maintain a clean and organized work area.

2. Cash Handling

Roving Tellers are responsible for handling large amounts of cash. They must be able to count money accurately and quickly. They must also be able to follow strict security procedures to prevent theft and fraud.

- Count and verify cash.

- Dispense cash to customers.

- Make change for customers.

- Balance cash drawers at the end of each day.

3. Transaction Processing

Roving Tellers are responsible for processing a variety of transactions, including deposits, withdrawals, transfers, and loan payments. They must be able to use a variety of banking equipment, including ATMs, point-of-sale systems, and cash registers.

- Process deposits and withdrawals.

- Process transfers and loan payments.

- Issue money orders and cashier’s checks.

- Balance accounts at the end of each day.

4. Sales and Marketing

Roving Tellers may also be responsible for sales and marketing activities. They may promote bank products and services to customers. They may also cross-sell products and services to existing customers.

- Promote bank products and services.

- Cross-sell products and services to existing customers.

- Build relationships with customers.

- Generate leads for new customers.

Interview Tips

Preparing thoroughly for an interview is crucial to ace it. Here are some tips to help you prepare:

1. Research the Company and the Position

Take the time to learn about the financial institution and the specific role of a Roving Teller. This will help you understand the company’s culture and the expectations for the position. Visit the company’s website, read any available job descriptions, and research the industry. This will give you a solid foundation for answering questions about the company and the position.

- Visit the company’s website.

- Read job descriptions.

- Research the industry.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” Practice answering these questions in advance so that you can deliver your answers confidently and concisely.

- Practice answering common interview questions.

- Deliver your answers confidently and concisely.

3. Prepare Questions to Ask the Interviewer

Asking thoughtful questions at the end of an interview shows that you are engaged and interested in the position. It also gives you an opportunity to learn more about the company and the role. Prepare a few questions in advance, such as “What are the biggest challenges facing the company right now?” or “What is the company culture like?”

- Prepare thoughtful questions to ask the interviewer.

- Show that you are engaged and interested in the position.

- Learn more about the company and the role.

4. Dress Professionally and Arrive on Time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time, or even a few minutes early. This shows that you are respectful of the interviewer’s time and that you are serious about the position.

- Dress professionally.

- Arrive on time.

- Show that you are serious about the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Roving Teller interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.