Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Safe Deposit Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Safe Deposit Clerk so you can tailor your answers to impress potential employers.

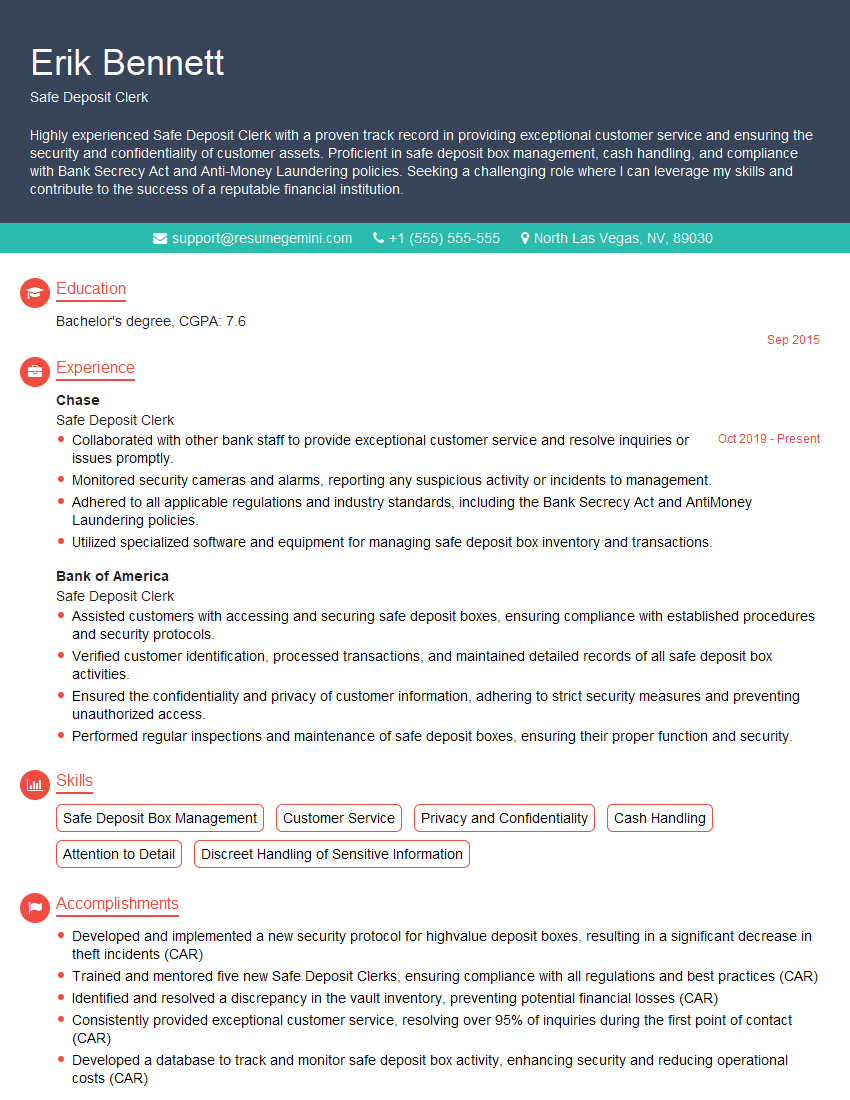

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Safe Deposit Clerk

1. Describe the key responsibilities of a Safe Deposit Clerk?

- Receiving and handling deposits and withdrawals securely

- Maintaining accurate records of safe deposit transactions

- Adhering to strict security procedures to prevent theft and unauthorized access

- Inspecting and verifying contents of safe deposit boxes as part of annual audits

- Providing exceptional customer service to clients with confidentiality and discretion

2. What security measures are employed to protect the contents of safe deposit boxes?

Physical Security

- Multiple locks and alarm systems

- Reinforced concrete walls and vaults

- Surveillance cameras and motion sensors

Procedural Security

- Two-person access for box openings and closings

- Detailed record-keeping of box entries

- Restricted employee access and background checks

3. How do you handle requests from customers to access their safe deposit boxes?

I would first verify the customer’s identity and ensure that they are authorized to access the box. I would then check the box’s records to ensure that there are no outstanding payments or holds. If everything is in order, I would retrieve the box and open it in the presence of the customer. I would also maintain confidentiality and discretion throughout the process.

4. What steps do you take to ensure the accuracy of safe deposit transactions?

- Double-checking all deposits and withdrawals

- Reconciling daily transactions with the bank’s records

- Maintaining detailed and organized records

- Utilizing a secure tracking system to monitor box activity

5. How do you handle discrepancies or unusual activity related to safe deposit boxes?

I would promptly report any discrepancies or unusual activity to my supervisor. I would also document the incident and initiate an investigation. I would follow the bank’s established protocols for handling such situations and cooperate with the authorities as necessary.

6. What are the common challenges faced by Safe Deposit Clerks and how do you overcome them?

Some common challenges include dealing with difficult customers, handling high-value items, and maintaining confidentiality. I overcome these challenges by remaining calm and professional, following established procedures, and seeking support from my colleagues when necessary.

7. How do you stay up-to-date with industry best practices and regulations related to safe deposit operations?

- Attending industry conferences and webinars

- Reading professional publications and research

- Participating in training programs offered by the bank

8. What is the most important aspect of providing excellent customer service as a Safe Deposit Clerk?

The most important aspect is to treat each customer with respect and confidentiality. I also strive to provide clear and concise information, respond promptly to inquiries, and create a welcoming and professional environment for customers.

9. How do you maintain a high level of ethical conduct and integrity in your role as a Safe Deposit Clerk?

- Adhering to all bank policies and procedures

- Maintaining confidentiality of customer information

- Avoiding any conflicts of interest

- Reporting any suspicious activity or unethical behavior

10. What are your career goals and how does this role fit into your long-term aspirations?

My career goal is to become a Branch Manager. I believe that this role as a Safe Deposit Clerk will provide me with a strong foundation in banking operations and customer service. It will also allow me to develop the skills and experience necessary to advance my career within the financial industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Safe Deposit Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Safe Deposit Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Safe Deposit Clerks are responsible for the safekeeping and management of valuable items stored in safe deposit boxes at financial institutions.

1. Customer Service

Provide excellent customer service to individuals renting safe deposit boxes, including answering questions, resolving issues, and ensuring customer satisfaction.

- Greet customers, verify their identity, and assist them with opening and closing safe deposit boxes.

- Maintain confidentiality and discretion regarding customers’ valuables.

2. Safe Deposit Box Management

Manage the inventory and occupancy of safe deposit boxes, including issuing and retrieving keys or access cards.

- Process requests for new box rentals, renewals, and closures.

- Maintain accurate records of box assignments, access history, and customer information.

3. Security Procedures

Enforce security protocols to protect the contents of safe deposit boxes, including access control and surveillance.

- Monitor and control access to the safe deposit area.

- Conduct regular inspections of boxes and the surrounding area.

4. Compliance and Reporting

Adhere to all applicable regulations and policies governing the management of safe deposit boxes.

- Maintain accurate and detailed records of all transactions.

- Report any suspicious activities or irregularities to the appropriate authorities.

Interview Tips

Preparing for an interview for a Safe Deposit Clerk position requires a combination of research, practice, and confidence. Here are some tips to help you ace the interview:

1. Research the Company and Position

Thoroughly research the financial institution and the specific responsibilities of the Safe Deposit Clerk position. This will help you understand the company’s culture, values, and expectations.

- Visit the company’s website and social media pages.

- Read industry news and articles about safe deposit box management.

2. Practice Your Answers

Prepare thoughtful and concise answers to common interview questions. Practice delivering your answers clearly and confidently.

- Review the job description and identify key responsibilities.

- Prepare examples of your customer service, problem-solving, and security-related experience.

3. Dress Professionally

First impressions matter, so dress professionally for the interview. Choose conservative attire that conveys respect and attention to detail.

- Wear a suit or dress pants and a button-down shirt.

- Make sure your clothes are clean, pressed, and fit well.

4. Arrive on Time

Punctuality is essential. Arrive on time for your interview, allowing yourself extra time for parking and finding the interview location.

- Plan your route and traffic conditions in advance.

- Give yourself a buffer of 15-20 minutes to account for unexpected delays.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Safe Deposit Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Safe Deposit Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.