Feeling lost in a sea of interview questions? Landed that dream interview for Safety Deposit Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Safety Deposit Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

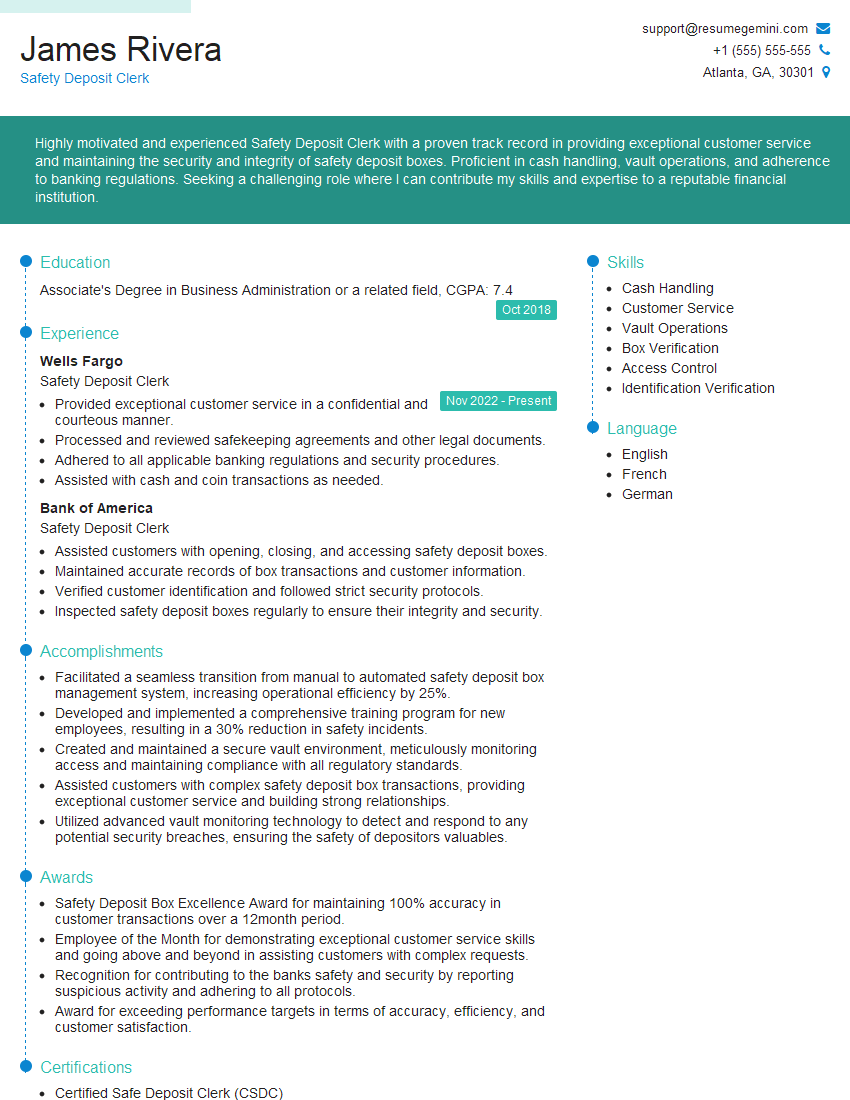

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Safety Deposit Clerk

1. What are the key responsibilities of a Safety Deposit Clerk?

As a Safety Deposit Clerk, my primary responsibilities include:

- Managing the safety deposit box inventory, including issuing and returning boxes to customers

- Verifying customer identification and ensuring proper documentation for box access

- Maintaining the security and confidentiality of customer records and box contents

- Processing transactions, such as new box rentals, box upgrades, and closures

- Assisting customers with inquiries and providing exceptional customer service

- Following established policies and procedures to ensure compliance and security

- Maintaining a clean and organized vault area

2. What are the essential qualities and skills required for a Safety Deposit Clerk?

Technical Skills

- Proficient in handling and maintaining safety deposit boxes

- Expertise in verifying customer identification and documentation

- Knowledge of safety deposit box regulations and policies

Soft Skills

- Excellent customer service skills

- Attention to detail and accuracy

- Strong integrity and confidentiality

3. How do you ensure the confidentiality and security of customer information and box contents?

Confidentiality and security are paramount in my role. I adhere to the following measures:

- Strictly following established security protocols and authentication procedures

- Maintaining strict physical security by controlling access to the vault

- Limiting access to customer information only to authorized personnel

- Maintaining accurate and secure records of all transactions and activities

4. Describe a situation where you had to handle a difficult customer and how you resolved it.

In my previous role, a customer became agitated when they discovered they had misplaced their key. I remained calm and professional, assuring them that we would work together to resolve the issue. I provided options for replacing the key, and we ultimately determined that a lock change was the best course of action. Throughout the process, I maintained transparency and empathy, building rapport and resolving the situation amicably.

5. How do you handle discrepancies or irregularities in box inventory or customer accounts?

I follow established discrepancy procedures to ensure proper investigation and resolution:

- Immediately reporting the discrepancy to a supervisor

- Conducting a thorough investigation to identify the cause

- Taking corrective actions to prevent recurrence

- Documenting all findings and actions taken

6. What are your strategies for mitigating risks and ensuring compliance in your role?

I prioritize risk mitigation and compliance through the following strategies:

- Adhering strictly to safety deposit box regulations and policies

- Regularly reviewing and updating security procedures

- Participating in ongoing training and professional development

- Maintaining open communication with management and colleagues

- Reporting any suspicious activities or concerns promptly

7. How do you stay up-to-date with industry best practices and technological advancements in safety deposit management?

I actively stay informed through the following methods:

- Attending industry conferences and webinars

- Reading relevant publications and research

- Participating in professional organizations and networking

- Consulting with security experts and vendors

8. What is your experience with cash management procedures for safety deposit boxes?

In my previous role, I was responsible for managing cash transactions related to safety deposit boxes. My duties included:

- Accepting and counting cash payments

- Issuing receipts and maintaining accurate records

- Balancing cash drawers and reconciling transactions

9. How do you handle situations where a customer is unable to access their safety deposit box?

I prioritize customer satisfaction and follow these steps in such situations:

- Verifying the customer’s identity and authorization

- Attempting to locate a spare key or assist the customer in retrieving theirs

- Contacting the branch manager or supervisor for guidance

- Following established protocols for emergency access

10. What is your understanding of the importance of maintaining a clean and organized safety deposit vault?

A clean and organized vault is essential for security, efficiency, and customer confidence:

- Ensures easy access to boxes and prevents mix-ups

- Reduces the risk of damage or loss to customer belongings

- Maintains a professional and trustworthy environment

- Facilitates regular inspections and audits

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Safety Deposit Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Safety Deposit Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Safety Deposit Clerks are responsible for the safekeeping of valuable items in a bank or other financial institution. They must be meticulous and accurate in their work, as they are entrusted with the responsibility of protecting customers’ valuables.

1. Receiving and Issuing Safety Deposit Boxes

Safety Deposit Clerks receive and issue safety deposit boxes to customers. They must verify the customer’s identity and ensure that the customer has the proper documentation to access the box.

- Verifying customer identification

- Issuing and receiving safety deposit boxes

2. Maintaining Records

Safety Deposit Clerks maintain records of all safety deposit box transactions. They must keep track of who has access to each box and when the box was accessed.

- Keeping track of safety deposit box transactions

- Maintaining records of who has access to each box

3. Inspecting Safety Deposit Boxes

Safety Deposit Clerks inspect safety deposit boxes on a regular basis to ensure that they are in good condition and that the contents are secure.

- Inspecting safety deposit boxes for damage

- Ensuring that the contents of the boxes are secure

4. Providing Customer Service

Safety Deposit Clerks provide customer service to customers who are using safety deposit boxes. They must be able to answer questions about the safety deposit box service and help customers with any problems they may have.

- Answering questions about the safety deposit box service

- Helping customers with any problems they may have

Interview Tips

Preparing for an interview for a Safety Deposit Clerk position can be daunting, but there are a few things you can do to increase your chances of success.

1. Research the Company and the Position

Before you go on an interview, it’s important to do your research on the company and the position you’re applying for. This will help you understand the company’s culture and values, and it will also help you answer questions about the position in a way that shows you’re truly interested in the job.

- Visit the company website

- Read the job description

- Look up the company on Glassdoor or LinkedIn

2. Practice Answering Common Interview Questions

There are a few common interview questions that you’re likely to be asked in an interview for a Safety Deposit Clerk position. It’s helpful to practice answering these questions in advance so that you can feel confident and prepared during the interview.

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

3. Dress Professionally

The way you dress for an interview can make a big impression on the interviewer. It’s important to dress professionally for an interview for a Safety Deposit Clerk position. This means wearing a suit or dress pants and a button-down shirt or blouse.

- Wear a suit or dress pants

- Wear a button-down shirt or blouse

- Make sure your clothes are clean and pressed

4. Be Punctual

Punctuality is important for any interview, but it’s especially important for an interview for a Safety Deposit Clerk position. This is because banks and other financial institutions are typically very busy, and the interviewer may not have time to wait for you if you’re late.

- Arrive on time for your interview

- If you’re running late, call the interviewer and let them know

Next Step:

Now that you’re armed with the knowledge of Safety Deposit Clerk interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Safety Deposit Clerk positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini