Are you gearing up for a career in Safety Deposit Supervisor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Safety Deposit Supervisor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

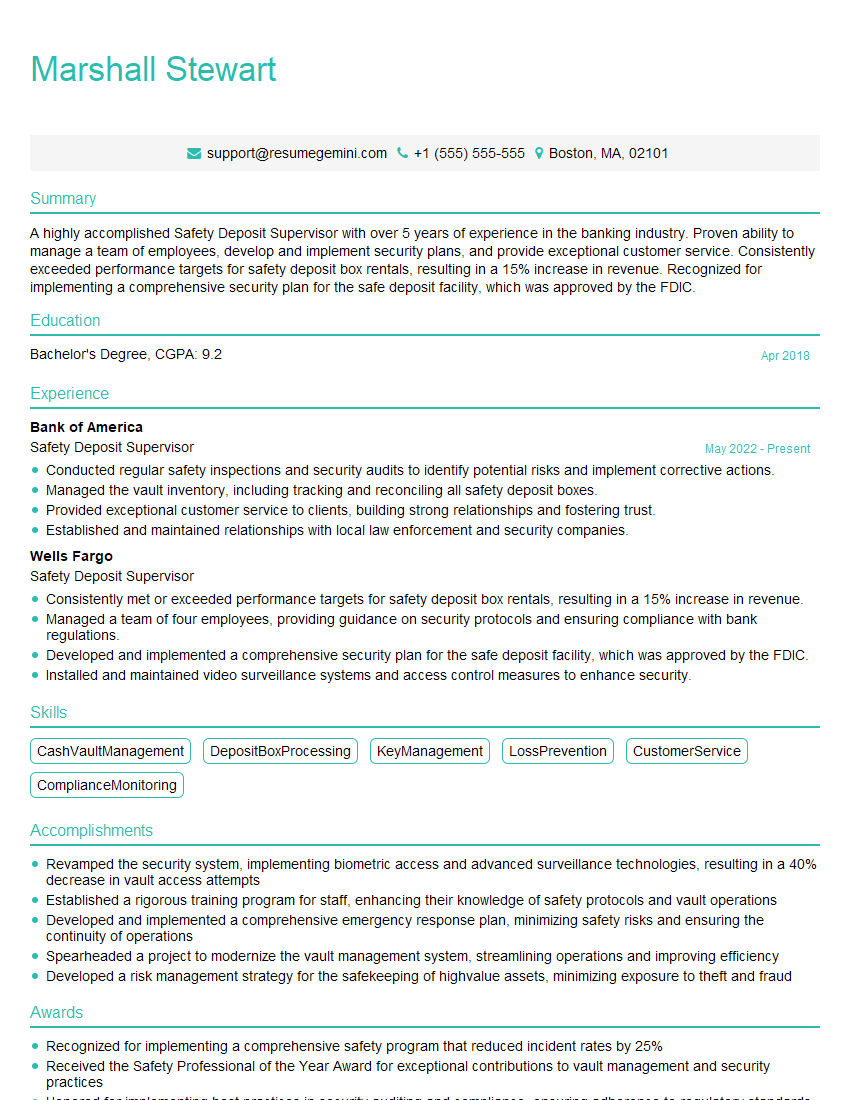

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Safety Deposit Supervisor

1. What are the different types of security measures you have implemented to protect the safety deposit boxes?

In my previous role as Safety Deposit Supervisor, I implemented a comprehensive suite of security measures to ensure the protection of safety deposit boxes and their contents. These measures included:

- Multi-layer access control system with biometrics and dual-factor authentication

- 24/7 video surveillance and motion detection technology

- Reinforced walls, doors, and customized locking mechanisms

- Regular security audits and drills with local law enforcement

- Customer education and awareness programs on security best practices

2. How do you handle customer requests for access to their safety deposit boxes outside of regular business hours?

Emergency Access Procedure

- Verify customer identity through multiple channels

- Obtain written authorization from the branch manager or designated authority

- Escort customer to the vault and strictly supervise access

- Document the access and notify relevant parties

After-Hours Access Service (if applicable)

- Offer scheduled appointments outside of regular hours

- Implement additional security protocols, such as enhanced authentication

- Charge a fee for this service to cover additional costs

3. What is your experience with conducting regular inspections and audits of the safety deposit area?

I have extensive experience in conducting thorough and detailed inspections and audits of the safety deposit area. My responsibilities include:

- Daily inspections of the vault, locks, and access control systems

- Weekly audits of customer records and box inventories

- Monthly reviews of security protocols and risk assessments

- Quarterly inspections by external auditors or compliance officers

- Preparation of comprehensive reports and recommendations

4. How do you manage customer disputes or concerns regarding their safety deposit boxes or contents?

I approach customer disputes or concerns with empathy, professionalism, and a commitment to resolution. My steps include:

- Listen attentively to the customer’s concerns and gather all relevant information

- Review records and documentation to verify the facts

- Consult with management or legal counsel as needed

- Provide clear and thorough explanations to the customer

- Work collaboratively to find a mutually acceptable solution

- Document all interactions and follow up promptly

5. What are the key regulations and compliance requirements that apply to safety deposit operations?

I am well-versed in the applicable regulations and compliance requirements governing safety deposit operations, including:

- Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) laws

- Federal Reserve Regulations E and U

- FINCEN guidance on suspicious activity reporting

- State laws and regulations on safe deposit rentals and access

- Industry best practices and standards

6. What is your experience with training and supervising staff on safety deposit procedures and policies?

I have developed and conducted comprehensive training programs for staff on all aspects of safety deposit operations. My training includes:

- Security protocols and emergency procedures

- Customer service and communication skills

- Compliance with regulations and legal requirements

- Vault operations and box management

- Regular performance evaluations and feedback

7. How do you ensure the confidentiality of customer information and prevent unauthorized access to safety deposit boxes?

Maintaining confidentiality and preventing unauthorized access are paramount. My measures include:

- Strict adherence to privacy policies and data protection laws

- Limited access to customer records and vault operations

- Enforced non-disclosure agreements for all staff

- Regular monitoring and audits of access logs and records

- Customer education on security best practices and access procedures

8. What is your experience with managing insurance claims related to safety deposit boxes?

I have handled insurance claims related to safety deposit boxes with professionalism and efficiency. My responsibilities include:

- Reviewing claim documentation and assessing damages

- Negotiating with insurance companies and customers

- Preparing detailed reports and recommendations

- Maintaining records and ensuring compliance with insurance policies

9. What are the key challenges you have faced in your previous role as Safety Deposit Supervisor?

In my previous role, I encountered various challenges that allowed me to grow and enhance my skills. These challenges included:

- Upgrading security systems while ensuring minimal disruption to customers

- Implementing new compliance requirements and training staff effectively

- Managing customer disputes and maintaining positive relationships

- Optimizing vault space and box utilization

- Staying abreast of industry best practices and emerging technologies

10. How do you stay updated on the latest security trends and best practices in safety deposit operations?

I am committed to continuous learning and staying informed about the latest security trends and best practices. I actively engage in:

- Attending industry conferences and webinars

- Subscribing to trade publications and security journals

- Networking with other safety deposit professionals

- Conducting research and staying abreast of regulatory updates

- Participating in training programs and workshops

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Safety Deposit Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Safety Deposit Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Safety Deposit Supervisor is responsible for managing and supervising the safety deposit vault, ensuring the security and confidentiality of customers’ valuables. This role requires a comprehensive understanding of vault operations, security procedures, and customer service.

1. Vault Management

Directly supervise the vault’s daily operations, including opening, closing, and maintaining the vault’s physical security.

- Ensure the vault is appropriately staffed and secure at all times.

- Establish and enforce security protocols for vault access and usage.

2. Customer Service

Provide excellent customer service to depositors, assisting them with accessing their safety deposit boxes and addressing their inquiries in a timely and professional manner.

- Verify customer identification and follow established procedures.

- Process requests for box rentals, terminations, and other related services.

3. Security and Compliance

Maintain the highest levels of security and compliance in the vault, adhering to all internal policies and external regulations.

- Conduct regular security audits and inspections to identify and address potential risks.

- Update and enforce security procedures in line with industry best practices and regulatory requirements.

4. Vault Inventory and Maintenance

Manage the inventory of safety deposit boxes, ensuring their proper maintenance and availability.

- Maintain accurate records of all safety deposit boxes and their contents.

- Supervise the cleaning and maintenance of the vault and its equipment.

Interview Tips

Preparing for an interview for a Safety Deposit Supervisor position requires research, understanding the job responsibilities, and practicing your answers. Here are some tips to help you ace the interview:

1. Research the Company and Position

Read the company’s website, annual reports, and any available information about the specific branch where you are applying. This will give you insights into the company’s culture, values, and its security protocols.

2. Highlight Your Experience and Skills

Tailor your resume and cover letter to the job description, emphasizing your relevant experience and skills. Quantify your accomplishments whenever possible, using specific metrics and examples to demonstrate your impact. Showcase your understanding of vault operations, security measures, and customer service principles.

3. Practice Common Interview Questions

Prepare for common interview questions such as:

- Tell me about your experience in managing a safety deposit vault.

- How do you ensure the security and confidentiality of customers’ valuables?

- Describe how you would handle a situation where a customer lost their safety deposit box key.

4. Be Enthusiastic and Professional

Arrive on time for your interview, dress appropriately, and maintain a positive and professional demeanor throughout the process. Show your enthusiasm for the role and demonstrate your commitment to providing exceptional customer service and maintaining the highest levels of security

5. Follow Up

Within 24 hours of your interview, send a thank-you note to the interviewer. Restate your interest in the position, reiterate your qualifications, and express your appreciation for their time.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Safety Deposit Supervisor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Safety Deposit Supervisor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.