Are you gearing up for an interview for a Securities Adviser position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Securities Adviser and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

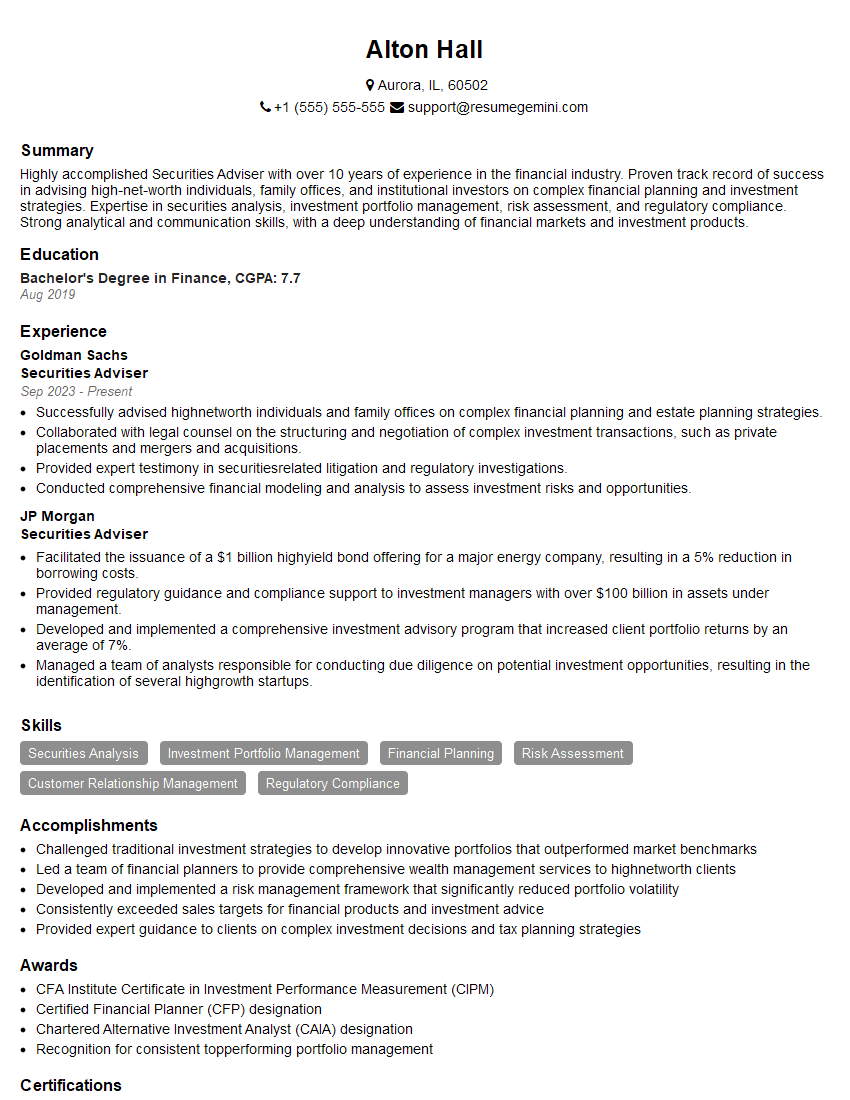

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Adviser

1. Talk about the recent trends you have seen in the securities market and how you have used these insights to advise your clients?

- I have been closely following the recent trends in the securities market, particularly the rise of sustainable investing and the growing demand for ESG-compliant investments.

- I have used these insights to advise my clients on how to align their portfolios with their values while also achieving their financial goals.

- For example, I recently worked with a client who wanted to invest in companies that are committed to environmental sustainability. I researched and identified a number of companies that meet these criteria and developed a portfolio that met his investment objectives.

2. How do you stay up to date on the latest developments in the securities industry?

Continuing Education

- I regularly attend industry conferences and webinars to learn about the latest trends and developments.

- I also read industry publications and online resources to stay informed about the latest news and developments.

Networking

- I network with other professionals in the industry to exchange ideas and learn about new products and services.

- I am also a member of several industry organizations, which provides me with access to resources and networking opportunities.

3. What are some of the challenges you have faced as a Securities Adviser and how have you overcome them?

- One of the challenges I have faced is helping clients understand the complex and ever-changing regulatory environment.

- To overcome this, I make sure to stay up-to-date on the latest regulations and changes, and I clearly explain the implications of these changes to my clients.

- Another challenge I have faced is helping clients manage their emotions during market volatility.

- To overcome this, I focus on educating my clients about the risks and rewards of investing, and I help them develop a long-term investment plan that meets their individual goals and risk tolerance.

4. What are your strengths and weaknesses as a Securities Adviser?

Strengths

- I have a deep understanding of the securities market and the financial planning process.

- I am able to clearly explain complex financial concepts to clients in a way that they can understand.

- I am passionate about helping my clients achieve their financial goals.

Weaknesses

- I am relatively new to the industry, so I do not have as much experience as some of my peers.

- I sometimes find it difficult to say no to clients, even when I know that their requests are not in their best interests.

5. How do you build rapport with your clients and earn their trust?

- I take the time to get to know my clients and understand their individual needs and goals.

- I am always honest and transparent with my clients, and I never make promises that I cannot keep.

- I am always available to answer my clients’ questions and address their concerns.

- I regularly communicate with my clients to keep them updated on their investments and the market.

6. What is your investment philosophy?

- I believe that investing should be a long-term process, and I focus on helping my clients develop portfolios that meet their individual goals and risk tolerance.

- I believe that diversification is key to reducing risk, and I recommend that my clients invest in a variety of asset classes, including stocks, bonds, and real estate.

- I also believe that it is important to rebalance portfolios regularly to ensure that they remain aligned with clients’ goals and risk tolerance.

7. How do you measure your success as a Securities Adviser?

- I measure my success by the satisfaction of my clients and the achievement of their financial goals.

- I also measure my success by the growth of my business and the positive feedback I receive from my clients.

- I am constantly looking for ways to improve my services and provide my clients with the best possible experience.

8. What are your career goals?

- My career goal is to become a trusted and respected Securities Adviser who helps clients achieve their financial goals.

- I want to continue to learn and grow in my career, and I am always looking for ways to improve my services.

- I am also interested in giving back to the community, and I am involved in several volunteer organizations that provide financial education to underserved populations.

9. Why are you interested in working for our firm?

- I am interested in working for your firm because I am impressed by your commitment to providing clients with personalized and comprehensive financial advice.

- I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to the success of your firm.

- I am also excited about the opportunity to work with a team of experienced and dedicated professionals who share my passion for helping clients achieve their financial goals.

10. Do you have any questions for me?

- I am very interested in the firm’s commitment to sustainable investing. Can you tell me more about how you incorporate ESG factors into your investment process?

- I am also interested in the firm’s culture. Can you tell me what it is like to work here?

- Finally, I am curious about the firm’s growth plans. Do you have any plans to expand into new markets or offer new services in the future?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Adviser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Adviser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Advisers work directly with clients to provide customized investment advice and develop tailored investment portfolios.

1. Client Relationship Management

Establish and maintain relationships with clients, understand their financial goals, risk tolerance, and investment objectives.

- Conduct comprehensive financial assessments.

- Develop personalized investment strategies.

2. Investment Research and Analysis

Conduct thorough research and analysis of financial markets, economic trends, and investment opportunities.

- Analyze industry reports, company financials, and economic data.

- Identify potential investment opportunities and assess their risk-return profiles.

3. Portfolio Management

Construct, manage, and monitor investment portfolios that align with clients’ goals and objectives.

- Select and allocate investments based on research and analysis.

- Monitor portfolio performance and make adjustments as needed.

4. Compliance and Regulation

Adhere to all applicable laws, regulations, and ethical standards governing securities advisers.

- Maintain accurate and up-to-date records of all client transactions.

- Provide timely and transparent disclosures to clients.

Interview Preparation Tips

To perform well in your Securities Adviser interview, consider the following tips:

1. Research the Firm and Industry

Demonstrate your knowledge of the firm’s business and the securities industry as a whole.

- Visit the firm’s website and review their values, mission, and services.

- Read industry publications and articles to stay informed about current trends and practices.

2. Highlight Your Skills and Experience

Articulate your relevant skills and experience that align with the key job responsibilities.

- Emphasize your analytical abilities, research skills, and portfolio management experience.

- Quantify your results whenever possible using specific metrics.

3. Prepare for Technical Questions

Expect technical questions about investment analysis, portfolio management, and regulatory compliance.

- Review basic financial concepts and valuation models.

- Practice analyzing financial statements and company profiles.

4. Showcase Your Communication and Interpersonal Skills

Securities Advisers must have excellent communication and interpersonal skills.

- Prepare to discuss your ability to build rapport with clients and effectively convey complex financial concepts.

- Be prepared to demonstrate your active listening and empathy skills.

5. Prepare Questions for the Interviewer

Ask thoughtful questions that demonstrate your interest in the position and firm.

- Inquire about the firm’s investment philosophy and approach to client service.

- Ask about opportunities for professional development and growth within the company.

Next Step:

Now that you’re armed with the knowledge of Securities Adviser interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Securities Adviser positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini